As previewed last night, we are now entering the craziest week of the quarter for two reasons: i) over $10 trillion in market cap is reporting earnings and that represents just 5 tech companies (a total of 32% of the S&P is set to report by market cap). and ii) hedges have never been cheaper as complacency hits never before seen levels. And then there is an absolute avalanche of economic and central bank events.

Let's take a closer look.

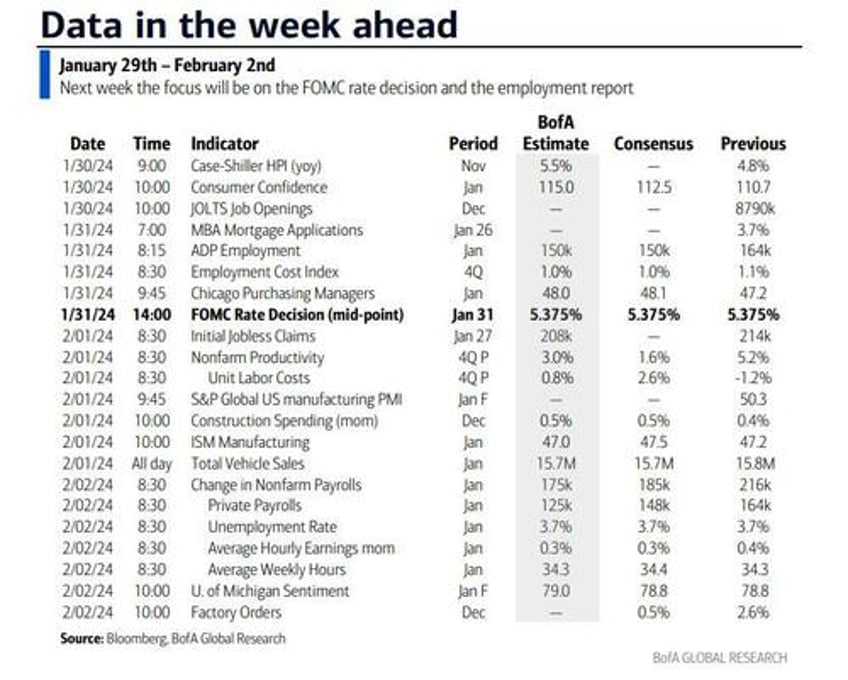

The FOMC ending Wednesday and Payrolls on Friday are the most obvious landmarks, but we also have just five companies accounting for 24% of the S&P 500 (Microsoft, Apple, Alphabet, Amazon and Meta) with $10.5tn of market cap, reporting in a 48-hour window from Tuesday night.

If that's not enough the US Treasury Quarterly Refunding Announcement (QRA) is out on Wednesday. The last two editions have coincided with first a huge sell-off in bonds and then a huge rally. The precursor is today’s Treasury’s borrowing estimate which is out at 3pm EST. As we previewed, this time there probably won't be any major surprises but the report is going to be heavily scrutinised. Other US highlights include the JOLTS data and consumer confidence tomorrow, the ADP report on Wednesday and the ISM manufacturing index (DB forecast 48.1 vs 47.4 in December) on Thursday.

In Europe, the latest CPI prints will start coming in on Wednesday with DB expecting the headline Eurozone index to come in at 2.81% YoY (2.9% in December) and core at 3.27% (3.4%). There will also be the Q4 GDP data across key Eurozone economies tomorrow as well as labour market indicators throughout the week. In the UK we have the BoE and Riksbank meetings on Thursday.

Over in Asia, the BoJ 'summary of opinions' (tomorrow) from the January meeting will be interesting with economists looking for an indication of how widespread an optimistic take on the outlook for wages and inflation is among the policy board as well as any hints of actual policy revision. In China, the highlight will be the official PMIs on Wednesday as well as the Caixin manufacturing PMI on Thursday.

Now, let's go through some of the main highlights in more detail now.

For the FOMC, DB's Jim Reid writes that his bank's US economists believe that their prior tightening bias will be left behind and ensuring a meaningful overhaul of the post-meeting statement. They expect Powell to echo comments from his colleagues that policy is in a good place, that a restrictive stance will have to be maintained for some time, but that officials do expect to cut rates this year. However, the timing and pace of those cuts will be data dependent and determined on a meeting-by-meeting basis. In this way, Powell would leave open the potential for a rate cut in March, but would not intend to add to those probabilities at this time. In addition, look for an update on their view on QT. It is too early for a decision to be made but clues may be given to their latest thoughts on the timing of any changes.

For payrolls DB expect headline (+200k vs. +216k last) and private (+175k vs. +164k last) payrolls to outperform consensus of 180k and 148k and their three-month averages of 165k and 145k, respectively. Last January was strong and there could be some seasonals to consider which is part of the reason for DB's elevated forecast. The BLS will also release its revised seasonal factors for the establishment survey on Friday, which may change the complexion of data trends. DB expect unemployment to rise a tenth to 3.8% but every January brings an update to population controls so we could have a different numerator and denominator to December. Overall last month's report was a bit of a mess so it'll be interesting if we see a clearer picture this time.

Here is a Day-by-day calendar of events courtesy of Deutsche Bank

Monday January 29

- Data: US January Dallas Fed manufacturing activity, Japan December jobless rate, job-to-applicant ratio

- Central banks: ECB's Guindos speaks

- Earnings: Ryanair

Tuesday January 30

- Data: US January Conference Board consumer confidence, Dallas Fed services activity, December JOLTS report, November FHFA house price index, UK December net consumer credit, mortgage approvals, M4, Japan December retail sales, industrial production, Italy Q4 GDP, December PPI, Germany Q4 GDP, France Q4 GDP, December consumer spending, Eurozone Q4 GDP, January services, industrial and economic confidence

- Central banks: BoJ Summary of Opinions January MPM, ECB's Vujcic, Lane, Vasle and Nagel speak

- Earnings: Microsoft, Alphabet, AMD, Danaher, Pfizer, UPS, Stryker, Starbucks, Mondelez, Diageo, General Motors, MSCI, Juniper Networks

Wednesday January 31

- Data: US Q4 employment cost index, January ADP report, MNI Chicago PMI, China January PMIs, UK January Lloyds business barometer, Japan January consumer confidence, December housing starts, Italy December unemployment rate, hourly wages,November industrial sales, Germany January CPI, unemployment claims rate, France January CPI, December PPI, Canada November GDP

- Central banks: Fed's decision

- Earnings: Novo Nordisk, Mastercard, Samsung Electronics, Novartis, Thermo Fisher Scientific, Qualcomm, Boeing, Boston Scientific, GSK, Hitachi, Hess, Rockwell Automation, Corteva, Fujitsu, H&M

- Auctions: US Treasury Quarterly Refunding Announcement

Thursday February 1

- Data: US Q4 unit labor costs, nonfarm productivity, January ISM index, total vehicle sales, December construction spending, initial jobless claims, China January Caixin manufacturing PMI, Japan January monetary base, Italy January CPI, manufacturing PMI, new car registrations, budget balance, Eurozone January CPI, December unemployment rate, Canada January manufacturing PMI

- Central banks: BoE decision, Decision Maker Panel survey, Riksbank decision, ECB's Centeno and Lane speak

- Earnings: Apple, Amazon, Meta, Merck & Co, Roche, Shell, Honeywell, Sanofi, Eaton, Ferrari, Royal Caribbean Cruises, Evolution AB, BT Group, United States Steel, Volvo, Peloton

Friday February 2

- Data: US January jobs report, December factory orders, France December industrial production, budget balance

- Central banks: ECB's Centeno speaks, BoE's Pill speaks

- Earnings: Exxon Mobil, AbbVie, Chevron, Keyence, Regeneron, Bristol-MyersSquibb, Cigna, Charter Communications, Aon

Finally, turning just to the US, the key economic data releases this week are the Employment Cost Index on Wednesday, the ISM manufacturing report on Thursday, and the employment report on Friday. The January FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, January 29

- No major economic data releases scheduled.

Tuesday, January 30

- 09:00 AM FHFA house price index, November (consensus +0.3%, last +0.3%)

- 09:00 AM S&P Case-Shiller 20-city home price index, November (GS +0.5%, consensus +0.45%, last +0.6%)

- 10:00 AM Conference Board consumer confidence, January (GS 114.3, consensus 114.0, last 110.7)

- 10:00 AM JOLTS job openings, December (consensus 8,709k, last 8,790k)

Wednesday, January 31

- 08:15 AM ADP employment change, January (GS +130k, consensus +148k, last +164k): We estimate a 130k rise in ADP payroll employment in Janaury, reflecting the recent slowdown in gross hiring and ADP’s underexposure to the outperforming healthcare and government segments. Unlike nonfarm payrolls, ADP does not generally exhibit large weather effects, and we assume a modest drag of roughly 10k in the January ADP report (mom sa).

- 08:30 AM Employment cost index, Q4 (GS +0.90%, consensus +1.0%, last +1.1%): We estimate the employment cost index rose by 0.90% in Q4 (qoq sa), which would lower the year-on-year rate by one tenth to 4.2% (nsa yoy). Our forecast reflects a modest sequential slowdown in wage growth indicators in the quarter.

- 09:45 AM Chicago PMI, January (GS 48.5, consensus 48.0, last 47.2): We estimate that the Chicago PMI rose by 1.3pt to 48.5 in January, reflecting a start-of-year rebound in manufacturing activity indicated by US freight data.

- 02:00 PM FOMC statement, January 30-31 meeting: As discussed in our FOMC preview, we expect the Fed to aim to keep a March cut on the table without sending a decisive signal at its January meeting. We expect the Committee to remove the outdating hiking bias from the post-meeting statement and note that future policy changes will depend on upcoming inflation and other data. We continue to expect the FOMC to deliver a first cut in March and 5 cuts in total in 2024, mainly because progress on inflation has already surpassed the threshold the FOMC has given.

Thursday, February 1

- 08:30 AM Nonfarm productivity, Q4 preliminary (GS +2.8%, consensus +2.3%, last 5.2%); Unit labor costs, Q4 preliminary (GS +0.3%, consensus +1.5%, last -1.2%): We expect nonfarm productivity growth of +2.8% (qoq saar) in the Q4 preliminary reading. We expect unit labor costs—compensation per hour divided by output per hour—to grow 0.3% in the Q4 preliminary reading, which would increase the year-over-year rate to +2.4%.

- 08:30 AM Initial jobless claims, week ended January 27 (GS 210k, consensus 210k, last 214k): Continuing jobless claims, week ended January 20 (GS 1,835k, last 1,833k)

- 10:00 AM ISM manufacturing index, January (GS 47.6, consensus 47.4, last 47.4): We estimate the ISM manufacturing index rebounded by 0.2pt to 47.6 in January, reflecting weakness in other business surveys but a start-of-year rebound in manufacturing activity indicated by US freight data. Our GS manufacturing tracker fell 2.3pt to 45.9 driven by a collapse in the volatile Empire Fed survey.

- 10:00 AM Construction spending, December (GS +1.1%, consensus +0.5%, last +0.4%)

- 05:00 PM Lightweight motor vehicle sales, January (GS 15.5mn, consensus 15.7mn, last 15.83mn)

Friday, February 2

- 08:30 AM Nonfarm payroll employment, January (GS +250k, consensus +180k, last +216k); Private payroll employment, January (GS +215k, consensus +148k, last +164k); Average hourly earnings (mom), January (GS +0.20%, consensus +0.30%, last +0.4%) ; Average hourly earnings (yoy), January (GS +3.99%, consensus +4.1%, last +4.1%); Unemployment rate, January (GS 3.7%, consensus 3.8%, last 3.7%); Labor force participation rate, January (GS 62.6%, consensus 62.6%, last 62.5%): We estimate nonfarm payrolls rose by 250k in January (mom sa), reflecting below-normal end-of-year layoff rates—as indicated by our GS layoff tracker—that more than offset a roughly 50k drag from cold, snowy weather during the survey week. We assume this weather headwinds weighs on the leisure and hospitality, other services, and construction categories. Big Data employment indicators were mixed in the month but are also broadly consistent with low layoff rates and a potentially large weather drag. We estimate that the unemployment rate was unchanged at 3.7%, reflecting a sharp rebound in household survey employment offset by a rebound in the labor force participation rate to 62.6%. We estimate a 0.20% increase in average hourly earnings (mom sa) that lowers the year-on-year rate by one tenth to 4.0%, reflecting waning wage pressures and negative calendar effects (the latter worth roughly -5bps).

- 10:00 AM University of Michigan consumer sentiment, January final (GS 80.4, consensus 79.0, last 78.8); University of Michigan 5–10-year inflation expectations, January final (GS 2.8%, consensus 2.8%, last 2.8%): We expect the University of Michigan consumer sentiment index increased to 80.4 in the final January reading and for the report's measure of long-term inflation expectations to be unrevised at 2.8%.

- 10:00 AM Factory orders, December (GS flat, consensus +0.2%, last +2.6%); Durable goods orders, December final (last flat); Durable goods orders ex-transportation, December final (last +0.6%); Core capital goods orders, December final (last +0.3%); Core capital goods shipments, December final (last +0.1%): We estimate that factory orders were unchanged in December following a 2.6% increase in November. Durable goods orders were unchanged in the December advance report, while core capital goods orders increased 0.3%.

Source: DB, Goldman, BofA