We start what DB's Jim Reid says should be another relatively quiet week ahead with Thanksgiving Day on Thursday, which is why he expects whatever action we have this week to be packed into the early part of it. On that front US core PCE on Wednesday will be the highlight with durable goods the same day. The minutes of the last FOMC come out the night before so that will also be interesting given the meeting started the day after the election with the result known. On the same day November US consumer confidence will also be interesting given the election. It is expected to climb but the UoM consumer sentiment reading on Friday dipped a little although the headline stat from the report was that 5-yr inflation expectations hit 3.2%, only matched in one month since the pandemic (November 2023), and before that you'd need to go back to 2011 to see the last time we were at 3.2%. The other main global highlights are the flash November CPIs in Europe on Thursday/Friday and the Tokyo CPI in Japan the day before.

Looking at more detail into the core US PCE deflator, DB expects +0.29% vs. +0.25% last month which if correct would take the YoY rate from 2.65% to 2.81%. The second print of Q3 GDP (no change at 2.8% expected) on the same day could risk some revisions to PCE inflation, so there is some uncertainty. Clearly this release will have implications for what is proving to be a tight decision in December as to whether the Fed will cut. At the moment the market is pricing in a 60% probability.

Linked into Fed pricing, the market is reacting constructively to the nomination of Scott Bessent for Treasury secretary. This was announced late on Friday (after the US close) and basically takes us back to the direction of travel just over a week ago before various other candidates skipped ahead in the market's pricing. On Polymarket.com he was as high as a 89% probability on November 12th and as low as 11% last Wednesday and still 14% at the lows on Friday. Bessent, a hedge fund CEO, is known to be a fiscal hawk so this should ease some of the more extreme deficit fears as he has advocated a 3% deficit by 2028. In practice that will be extremely tough but for now the market can be a bit relieved. He is also thought to be less extreme on trade policy than some of his rivals for the job. He has recently been quoted in the FT suggesting Trump's tariff policy position could be changed after negotiations with various countries, and he has previously told CNBC that "I would recommend that tariffs be layered in gradually". We will see how influential his views will be on this front. Remember a week ago Elon Musk suggested that appointing Bessent would be a disappointment as it would amount to "business-as-usual". The market will probably be more appreciative of this trait for now. This morning yields on the 10yr US Treasuries are 10bps lower, while the S&P is +0.5%higher. The dollar is around -0.6% lower and base metals are generally higher although gold (-1.6%) has lost some of its risk premium after a good rebound last week.

Reverting back to the other highlights this week. For the flash European inflation prints for November, which start on Thursday with Germany, with the French, Italian and Eurozone-level print following on Friday, our European economists detail their expectations and recent trends in data here. They see Euro Area HICP accelerating to 2.27% YoY (2.0% in October), with country-level forecasts including 2.63% for Germany, 1.66% for France and 1.27% for Italy. Other notable data in key Eurozone economies includes the Ifo survey (today) and retail sales in Germany (Friday) as well as consumer confidence in Germany and France on Wednesday. Q3 GDP numbers are also due in Canada, Sweden and Switzerland on Friday. In Asia, indicators to watch include industrial profits in China and October CPI in Australia (DB forecast 2.4% YoY vs 2.1% in September) on Wednesday. The rest of the day-by-day calendar is at the end as usual.

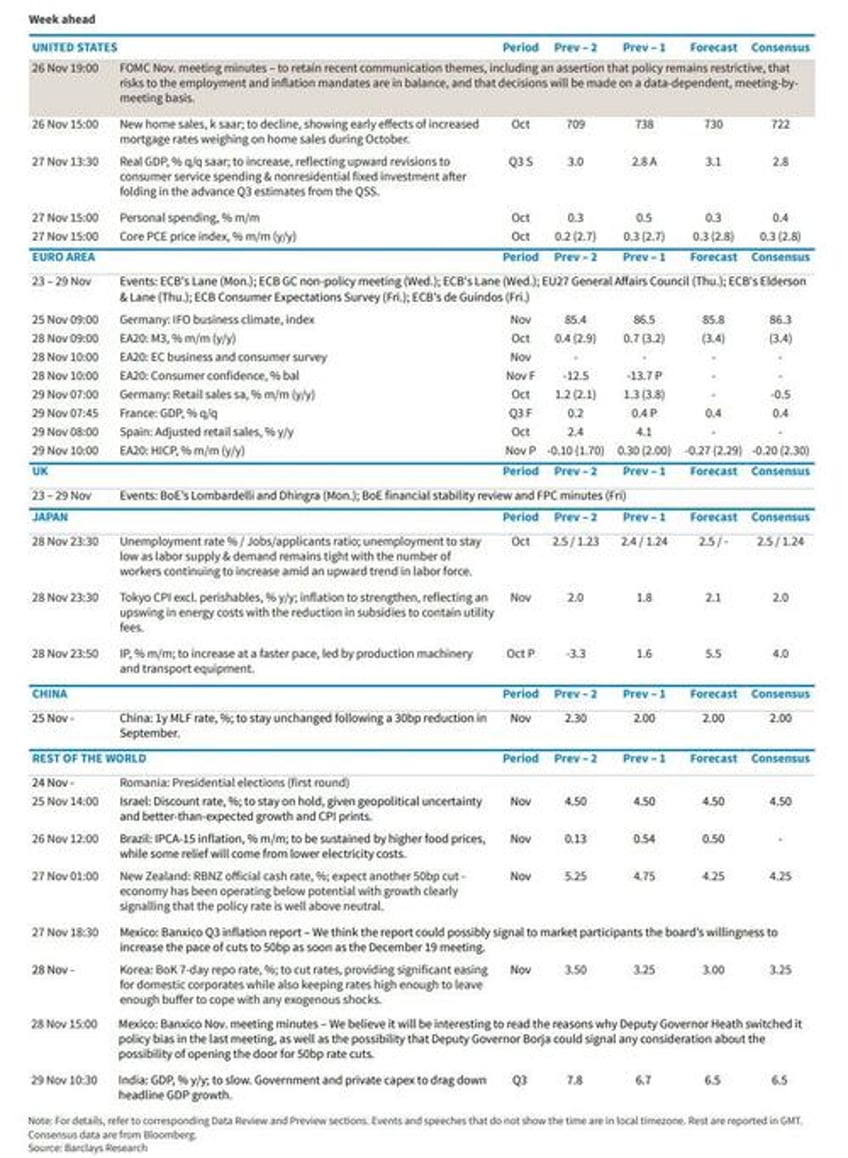

Courtesy of DB, here is a day-by-day calendar of events

Monday November 25

- Data: US October Chicago Fed national activity index, November Dallas Fed manufacturing activity, Japan October PPI services, Germany November Ifo survey

- Central banks: ECB's Lane, Nagel and Makhlouf speak, BoE's Lombardelli and Dhingra speak

- Earnings: Zoom

- Auctions: US 2-yr Notes ($69bn)

Tuesday November 26

- Data: US November Conference Board consumer confidence index, Richmond Fed manufacturing index, Richmond Fed business conditions, Dallas Fed services activity, Philadelphia Fed non-manufacturing activity, October new home sales, September FHFA house price index, Q3 house price purchase index

- Central banks: Fed FOMC meeting minutes, ECB's Villeroy, Centeno and Rehn speak

- Earnings: Dell, Analog Devices, Crowdstrike, HP, Autodesk, Workday, Best Buy, Abercrombie & Fitch

- Auctions: US 2-yr FRN (reopening, $28bn), 5-yr Notes ($70bn)

Wednesday November 27

- Data: US October PCE, personal income, personal spending, durable goods orders, advance goods trade balance, wholesale inventories, pending home sales, November MNI Chicago PMI, initial jobless claims, China October industrial profits, Germany December GfK consumer confidence, France November consumer confidence, Australia October CPI

- Central banks: ECB's Lane speaks, RBNZ decision

- Auctions: US 7-yr Notes ($44bn)

Thursday November 28

- Data: Japan November Tokyo CPI, October jobless rate, job-to-applicant ratio, retail sales, industrial production, Germany November CPI, Italy November consumer confidence index, manufacturing confidence, economic sentiment, October PPI, Eurozone October M3, November services, industrial and economic confidence, Canada Q3 current account balance

- Central banks: ECB's Lane speaks

Friday November 29

- Data: UK November Lloyds Business Barometer, October net consumer credit, M4, Japan October housing starts, November consumer confidence index, Germany November unemployment claims rate, October retail sales, import price index, France November CPI, October consumer spending, PPI, Q3 total payrolls, Italy November CPI, September industrial sales, Eurozone November CPI, Canada, Sweden and Switzerland Q3 GDP

- Central banks: ECB consumer expectations survey, Guindos and Nagel speak, BoE's financial stability review and FPC minutes

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report and core PCE inflation on Wednesday. The minutes from the November FOMC meeting will be released on Tuesday. Fed officials are not expected to speak this week.

Monday, November 25

- There are no major economic data releases scheduled.

Tuesday, November 26

- 09:00 AM S&P Case-Shiller 20-city home price index, September (GS +0.2%, consensus +0.3%, last +0.4%)

- 09:00 AM FHFA house price index, September (consensus +0.3%, last +0.3%)

- 10:00 AM New home sales, October (GS -2.0%, consensus -1.8%, last +4.1%)

- 10:00 AM Conference Board consumer confidence, November (GS 111.4, consensus 112.0, last 108.7)

- 02:00 PM Minutes from the November 6 – 7 FOMC meeting: At its November meeting, the FOMC lowered the target range for the fed funds rate by 0.25pp to 4.5-4.75%. Chair Powell made it clear during the post-meeting press conference that the FOMC will not react to possible post-election fiscal policy changes until it has greater clarity about the timing and substance of potential policy changes and their impact on the economy. The Committee made only minor changes to its post-meeting statement, and Chair Powell did not provide guidance about the next meeting in his press conference, so we will look for further details on FOMC participants’ views of the appropriate policy stance and their expectations for the policy path going forward. We tweaked our forecast to include a slower every-other-meeting pace of cuts at the very end of the cutting cycle, when the FOMC might want to move more cautiously to make sure it gets the stopping point right. In our revised forecast, we continue to expect consecutive cuts in December, January, and March but now expect the final two cuts to come in June and September (vs. May and June previously), ultimately reaching the same terminal rate of 3.25-3.5%.

Wednesday, November 27

- 08:30 AM GDP, Q3 second release (GS +2.8%, consensus +2.8%, last +2.8%); Personal consumption, Q3 second release (GS +3.5%, consensus +3.7%, last +3.7%): We estimate no revision on net to Q3 GDP growth at +2.8% (quarter-over-quarter annualized), reflecting downward revisions to consumer spending (-0.2pp to +3.5%) due to softer public transportation and utilities details in the quarterly census survey (QSS), offset by upward revisions to residential investment and inventories.

- 08:30 AM Advance good trade balance, October (GS -$105.0bn, consensus -$101.6bn, last -$108.7bn)

- 10:00 AM Wholesale inventories, October preliminary (consensus -0.1%, last -0.2%)

- 08:30 AM Durable goods orders, October preliminary (GS +1.0%, consensus +0.5%, last -0.7%); Durable goods orders ex-transportation, October preliminary (GS +0.1%, consensus +0.1%, last +0.5%); Core capital goods orders, October preliminary (GS flat, consensus +0.1%, last +0.7%); Core capital goods shipments, October preliminary (GS +0.2%, consensus flat, last -0.1%): We estimate that durable goods orders increased 1.0% in the preliminary October report (month-over-month, seasonally adjusted), reflecting a rebound in commercial aircraft orders. We forecast unchanged core capital goods orders but a 0.2% increase in core capital goods shipments, reflecting mixed global manufacturing data.

- 08:30 AM Initial jobless claims, week ended November 23 (GS 215k, consensus 217k, last 213k): Continuing jobless claims, week ended November 16 (consensus 1,889k, last 1,908k)

- 09:45 AM Chicago PMI, November (GS 45.0, consensus 45.0, last 41.6)

- 10:00 AM Personal income, October (GS +0.3%, consensus +0.3%, last +0.3%): Personal spending, October (GS +0.3%, consensus +0.4%, last +0.5%); Core PCE price index, October (GS +0.27%, consensus +0.3%, last +0.3%); Core PCE price index (YoY), October (GS +2.79%, consensus +2.8%, last +2.7%); PCE price index, October (GS +0.25%, consensus +0.2%, last +0.2%); PCE price index (YoY), October (GS +2.32%, consensus +2.3%, last +2.1%): We estimate personal income and personal spending both increased by 0.3% in October. We estimate that the core PCE price index rose by 0.27%, corresponding to a year-over-year rate of 2.79%. Additionally, we expect that the headline PCE price index increased by 0.25% from the prior month, corresponding to a year-over-year rate of 2.32%. Our forecast is consistent with a 0.27% increase in our trimmed core PCE measure (vs. +0.28% in September).

- 10:00 AM Pending home sales, October (GS +0.9%, consensus -1.8%, last +7.4%)

Thursday, November 28

- Thanksgiving holiday. NYSE closed. SIFMA recommends bond markets also close.

Friday, November 29

- There are no major economic data releases scheduled. NYSE will close early at 1:00 PM. SIFMA recommends an early 2:00 PM close to bond markets.

Source: DB, Goldman,Barclays