In terms of the holiday-shortened week ahead, the main data highlights are US retail sales tomorrow, UK CPI on Wednesday, and Japanese inflation and the global flash PMIs on Friday. For central banks, we have meetings concluding in Australia (tomorrow), UK, Switzerland and Norway (Thursday) with a few additional EM meetings spread through the week. There is also a fair degree of Fed and ECB speak to throw into the mix.

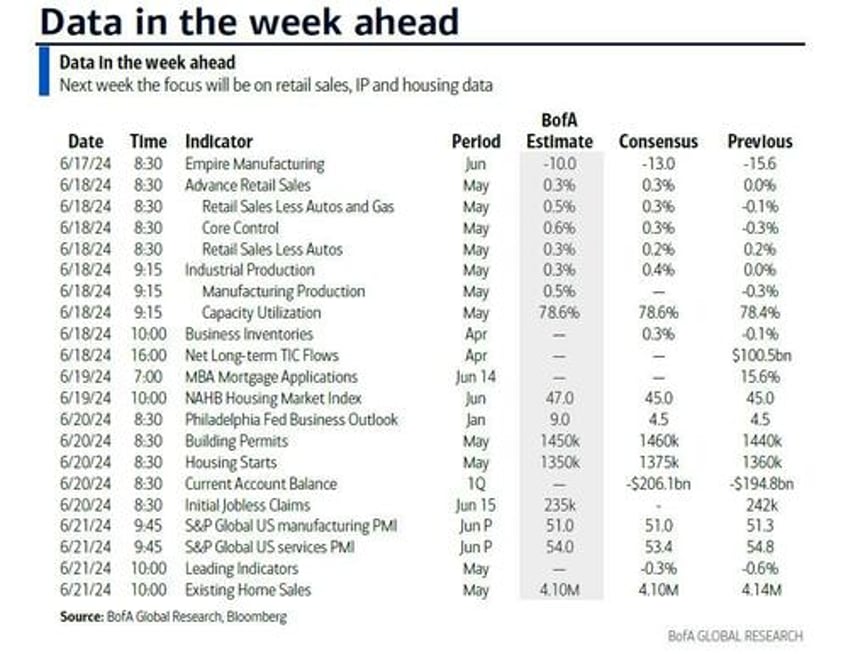

Tomorrow's US retail sales will likely be the focal point in the US and even with a pretty poor UoM consumer sentiment figure from Friday, most economists think we'll see a decent tick up in retail control (+0.3% consensus vs. -0.3% last month) which would equate to around 3% annualized for Q2 (vs. 1.5% in Q1). There have been some signs recently that the US consumer is starting to show some fatigue so this will be an important data point. Also keep a watchful eye on initial jobless claims on Thursday. While consensus expects a modest drop from 242K to 235K, DB's economists see a further rise from 242k to 250k but so far it seems the rise is concentrated in similar states to that seen last year and is likely to be due to difficulties seasonally adjusting to the end of the school year. For more on the week ahead, the full day-by-day week ahead calendar is at the end as usual.

This morning, Asian equity markets are struggling at the start of the week with majority of the region’s markets trading lower this morning. As DB's Jim Reid notes, across the region, the Nikkei (-1.82%) is the biggest underperformer dragged down by energy and real estate stocks while the KOSPI (-0.40%), the Shanghai Composite (-0.56%) and the CSI (-0.13%) also trading trade in negative territory. However, the Hang Seng (+0.50%) is the notable exception, having reversed its opening losses. In overnight trading, US equity futures are struggling to gain momentum with those on the S&P 500 (-0.05%) just below flat and those tied to the NASDAQ 100 (+0.06%) just above flickering near the flatline. Meanwhile, yields on the 10yr USTs (+2.32 bps) have moved upwards to trade at 4.24%.

Staying on China retail sales rose +3.7% y/y in May, exceeding market expectations for a +3.0% gain and increasing pace from a +2.3% increase in the previous month. However, other economic metrics failed to surpass market forecasts with industrial output growing +5.6% y/y in May (v/s +6.2% expected), down from an increase of +6.7% in April. Meanwhile, the nation’s real estate crisis continued to weigh on investment in fixed assets with the overall YTD investment figures expanding +4.0%, just shy of Bloomberg forecast of +4.2% gain. Additionally, new home prices dropped at the fastest pace since October 2014, falling -0.7% m/m in May (v/s -0.58% in April) and marking the 11th straight decline despite the government’s stimulus to support the property market.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 17

- Data : US June Empire manufacturing index, China May retail sales, industrial production, new home prices, Japan April core machine orders, Canada May housing starts, building permits, April international securities transactions

- Central banks : Fed's Harker speaks, ECB's Lagarde, Lane and Guindos speak, China 1-yr MLF rate

Tuesday June 18

- Data : US May retail sales, industrial production, capacity utilisation, June New York Fed services business activity, April business inventories, total net TIC flows, Germany and Eurozone June Zew survey

- Central banks : Fed's Cook, Barkin, Logan, Kugler, Musalem, Goolsbee and Collins speak, ECB's Knot, Cipollone, Guindos and Villeroy speak, RBA decision

- Auctions : US 20-yr Bond (reopening, $13bn)

Wednesday June 19

- Data : US June NAHB housing market index, UK May CPI, RPI, PPI, April house price index, Japan May trade balance, Italy April current account balance, ECB April current account, Eurozone April construction output, New Zealand Q1 GDP

- Central banks : BoJ minutes of the April meeting, BoC summary of deliberations, ECB's Centeno speaks

Thursday June 20

- Data : US Q1 current account balance, May housing starts, building permits, June Philadelphia Fed business outlook, initial jobless claims, China 1-yr and 5-yr loan prime rates, Germany May PPI, EU27 May new car registrations, Eurozone June consumer confidence

- Central banks : BoE decision, SNB decision, Norges Bank decision, Fed's Barkin speaks, ECB's economic bulletin

- Auctions : US 5-yr TIPS (reopening, $21bn)

Friday June 21

- Data : US, UK, Japan, Germany, France and the Eurozone June PMIs, US May leading index, existing home sales, UK June GfK consumer confidence, May public finances, retail sales, Japan May national CPI, France June manufacturing confidence, Canada April retail sales, May industrial product price index, raw materials price index

- Central banks : ECB's Nagel speaks

Finally, looking at just the US, the key economic data releases this week are the retail sales report on Tuesday and the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials this week.

Monday, June 17

- 08:30 AM Empire State manufacturing survey, June (consensus -12.0, last -15.6)

- 12:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will moderate a discussion with Strauss Zelnick, CEO of Take-Two Interactive, at the Economic Club of New York. On May 30th—before last week’s CPI report and FOMC meeting—President Williams argued that “some of the recent inflation readings [represented] mostly a reversal of the unusually low readings of the second half of last year, rather than a break in the overall downward direction of inflation.” President Williams also said he saw “the current stance of monetary policy as being well positioned to continue the progress we've made toward achieving our objectives.” While he noted that he doesn’t “feel any urgency” to cut the fed funds rate, he also said that the FOMC didn’t “need to be at 2%” inflation to lower rates and would “want to be able to move before that.”

- 01:00 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will deliver a speech on the economic outlook at an event hosted by the Philadelphia Fed. Text and Q&A are expected.

- 09:00 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver acceptance speech for the 2024 Marshall Medal at the 2024 Marshall Forum. Text is expected.

Tuesday, June 18

- 08:30 AM Retail sales, May (GS +0.3%, consensus +0.3%, last flat); Retail sales ex-auto, May (GS +0.2%, consensus +0.2%, last +0.2%); Retail sales ex-auto & gas, May (GS +0.5%, consensus +0.4%, last -0.1%); Core retail sales, May (GS +0.5%, consensus +0.4%, last -0.3%): We estimate core retail sales rebounded 0.5% in May (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects a pick up in credit card spending among retailers. We estimate a 0.3% rise in headline retail sales, reflecting higher auto sales but lower gasoline prices.

- 09:15 AM Industrial production, May (GS +0.2%, consensus +0.3%, last flat); Manufacturing production, May (GS +0.2%, consensus +0.3%, last -0.3%); Capacity utilization, May (GS 78.5%, consensus 78.6%, last 78.4%): We estimate industrial production increased 0.2%, as strong oil and gas and electricity production outweigh weak mining production. We estimate capacity utilization increased to 78.5%.

- 10:00 AM Business inventories, April (consensus +0.3%, last -0.1%)

- 10:00 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will speak at an MNI webcast. Q&A is expected. On May 16th, President Barkin argued that “to get to 2% [inflation] sustainably in the right kind of way, I just think it’s going to take a little bit more time.” He said that he thought there was “just a lot of movement on the services [inflation] side and it’s going to take a little bit of time,” but that he believed the FOMC was “on the right path here.”

- 11:40 AM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will deliver a keynote address at the Lawrence Partnership Annual Meeting and 10th Year Anniversary. Text is expected. On May 21st, President Collins said that she thought “this is a period when patience really matters” because “the data has been very mixed,” and that it would likely “take longer than [she] had previously thought” for the FOMC to start lowering the fed funds rate. President Collins noted that “there are a lot of reasons why special dimensions of this cycle could explain why we’re moderately restrictive and we have perhaps still more in the pipeline.”

- 01:00 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will take part in a moderated Q&A at the Headliners Club in Austin, Texas. Q&A is expected. On May 30th, President Logan noted that “there’s good reasons to think that we’re headed to 2% or we’re still on that path, perhaps a bit slower and a little bit clunkier maybe than we thought at the beginning of the year, but there’s a lot of uncertainty.” She noted that “it also may be that policy is just not as restrictive as we think it might have been relative to the level of interest rates before the pandemic,” and that “it’s really important to keep all options on the table and that we continue to be flexible.” On May 10th, President Logan had said that it was “just too early to think about cutting rates.”

- 01:00 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will speak at a virtual event hosted by the Peterson Institute of International Economics. Text and Q&A are expected. On April 3rd, Governor Kugler said that “if disinflation and labor market conditions proceed as I am currently expecting, then some lowering of the policy rate this year would be appropriate.” Governor Kugler also noted that “with demand growth cooling, given the backdrop of solid supply, my baseline expectation is that further disinflation can be accomplished without a significant rise in unemployment.”

- 01:20 PM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will deliver a speech on the US economy and monetary policy at a luncheon hosted by the CFA Society of St. Louis. Text and moderated Q&A are expected. These will be President Musalem’s first public remarks since becoming President of the St. Louis Fed.

- 02:00 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will speak in a panel discussion at the 2024 Marshall Forum. On June 14th, President Goolsbee noted that the May CPI was a “very good” report but cautioned that it was only one month of data. President Goolsbee said that “if we got a lot of months like this, we would be feeling so much better.” On May 10th, President Goolsbee had stressed that “there isn’t at this time much evidence, in my view, that inflation is stalling out at 3% ... we hit this bump [in Q1] and now I think we wait.”

Wednesday, June 19

- Juneteenth National Independence Day. NYSE will be closed. SIFMA recommends bond markets also remain closed.

- 10:00 AM NAHB housing market index, June (consensus 45, last 45)

Thursday, June 20

- 08:30 AM Initial jobless claims, week ended June 15 (GS 245k, consensus 235k, last 242k); Continuing jobless claims, week ended June 8 (consensus 1,802k, last 1,820k)

- 08:30 AM Housing starts, May (GS -0.8%, consensus +1.1%, last +5.7%); Building permits, May (consensus +0.7%, last -3.0%)

- 08:30 AM Philadelphia Fed manufacturing index, June (GS 5.5, consensus 4.8, last 4.5): We estimate that the Philadelphia Fed manufacturing index edged up by 1pt to 5.5 in June, reflecting the foreign manufacturing rebound but downward convergence to other surveys.

- 08:45 AM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a fireside chat at the Michigan Bankers Association Annual Conference. Q&A is expected. On May 28th, President Kashkari said that he didn’t think that “anybody has totally taken rate increases off the table,” while also noting that “the odds of us raising rates are quite low.” President Kashkari stressed that “wage growth is still quite robust relative to ultimately what we think would be consistent with the 2% inflation target.”

- 04:00 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will take part in an even hosted by the Richmond chapter Risk Management Association. Q&A is expected.

Friday, June 21

- 09:45 AM S&P Global US manufacturing PMI, June preliminary (consensus 51.0, last 51.3); 09:45 AM S&P Global US services PMI, June preliminary (consensus 53.8, last 54.8)

- 10:00 AM Existing home sales, May (GS +1.1%, consensus -1.2%, last -1.9%)

Source: DB, Goldman, BofA