After a relatively quiet week on the data front, things start to pick up again even as earnings season comes to a close.

In terms of key events, DB's Jim Reid writes that it’s hard to look too far beyond the latest core PCE print on Thursday after the recent strong CPI report and the strong relevant sub-components in the PPI. DB economists believe the MoM core print will be at 0.36% vs. 0.17% last time. This would make it the highest since last January. The fact that last January was 0.51% means that rolling out base effects should help the YoY rate edge down a tenth to 2.8%. However it's the monthly print that will be all important. Staying with inflation, preliminary CPI prints are also due from Germany and France (Thursday) and for the Eurozone (Friday).

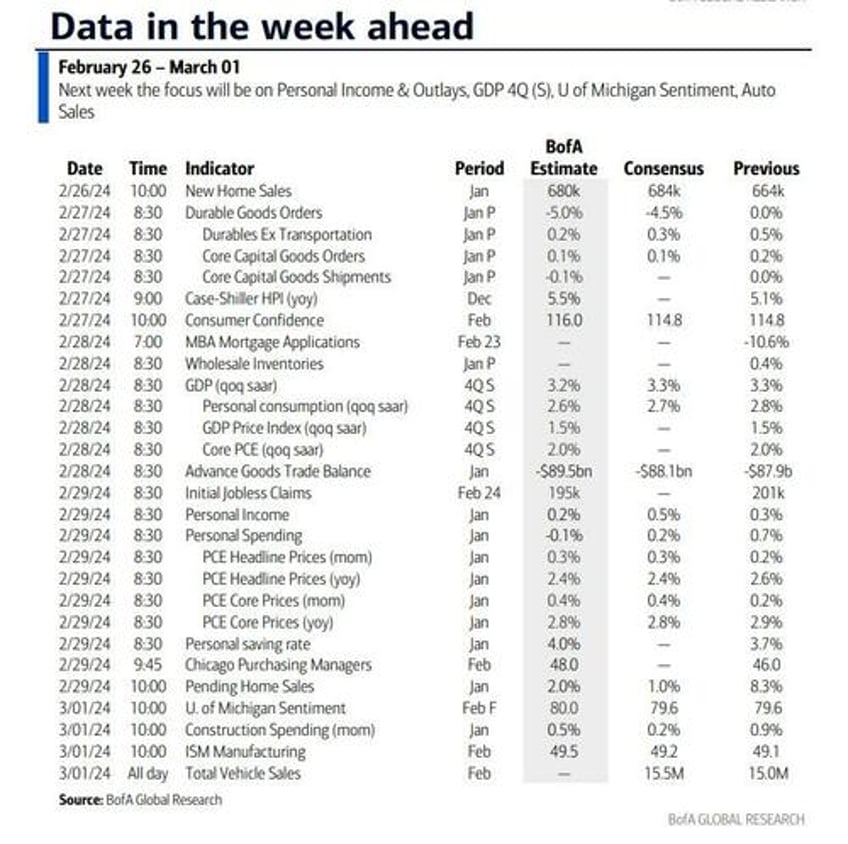

Back to the US, we have new (today) and pending (Thursday) home sales with the focus on whether higher mortgage rates and bad weather in January has had a big impact. Then we have durable goods and consumer confidence (tomorrow), the second reading of Q4 GDP on Wednesday, the personal income and spending data (Thursday), and the ISM manufacturing data as well as unit auto sales as we close out the week by welcoming in a new month on Friday.

Friday is also the day that we could see a partial government shutdown if Congress fails to pass the 2024 budget that has already been agreed to. DB's economists think that it's possible we get a short-term continuing resolution for an extra week which would push it past the "Super Tuesday" primaries on the 5th and coincide with the deadline for the second tranche annual funding bills.

There is also a fair degree of Fed speak which you can see in the calendar at the end as usual alongside all the other data. Chinese PMIs on Friday might be the most interesting non-US data, and should include the lunar new year holidays in the sample period, so one to watch.

Courtesy of DB, here is a day-by-day calendar of events

Monday February 26

- Data: US January new home sales, February Dallas Fed manufacturing activity, Japan January national CPI

- Central banks: ECB's Stournaras and Vujcic speak, BoE's Breeden and Pill speak

- Earnings: Workday, Zoom

- Auctions: US 2-y Notes ($63bn), 5-y Notes ($64bn)

Tuesday February 27

- Data: US January durable goods orders, February Conference Board consumer confidence, Richmond Fed manufacturing index, business conditions, Dallas fed services activity, Q4 house price purchase index, December FHFA house price index, Germany March GfK consumer confidence, France February consumer confidence, Eurozone January M3

- Central banks: Fed's Schmid and Barr speak, BoE's Ramsden speaks

- Earnings: Lowe's, American Tower, AutoZone, Ferrovial, Puma, Macy's

- Auctions: US 7-y Notes ($42bn)

Wednesday February 28

- Data: US January retail inventories, advance goods trade balance, Japan January industrial production, retail sales, Italy February manufacturing confidence, economic sentiment, consumer confidence, Eurozone February services, industrial, economic confidence, Canada Q4 current account balance

- Central banks: Fed's Bostic, Collins and Williams speak, ECB's Muller speaks, BoE's Mann speaks

- Earnings: Salesforce, Snowflake, Universal Music Group, Holcim, Baidu, Okta, SQM, Endeavor Group, Paramount Global

Thursday February 29

- Data: US January PCE, personal income and spending, pending home sales, February MNI Chicago PMI, Kansas City Fed manufacturing activity, initial jobless claims, UK January net consumer credit, mortgage approvals, M4, February Lloyds business barometer, Japan January job-to-applicant ratio, jobless rate, housing starts, Italy December industrial sales, Germany February unemployment claims rate, CPI, France February CPI, January PPI, consumer spending, Canada Q4 GDP

- Central banks: Fed's Bostic, Goolsbee and Mester speak, BoJ's Takata speaks

- Earnings: AB InBev, Dell, Autodesk, Haleon, Leonardo, Covestro

Friday March 1

- Data: US February ISM manufacturing index, Kansas City Fed services activity, total vehicle sales, January construction spending, China February official PMIs, Caixin manufacturing PMI, Japan February consumer confidence, Italy January unemployment rate, February CPI, manufacturing PMI, budget balance, new car registrations, 2023 GDP, Eurozone February CPI, January unemployment rate, Canada February manufacturing PMI

- Central banks: Fed's Williams, Waller, Bostic, Daly and Kugler speak, ECB's Holzmann speaks, BoE's Pill speaks

* * *

The key economic data releases this week are the durable goods report on Tuesday, the core PCE report on Thursday, and the ISM manufacturing report on Friday. There are many speaking engagements from Fed officials this week, including governors Barr, Waller, and Kugler, as well as presidents Schmid, Bostic, Collins, Williams, Goolsbee, Mester, and Daly.

Monday, February 26

- 10:00 AM New home sales, January (GS +3.5%, consensus +3.0%, last +8.0%)

- 10:30 AM Dallas Fed manufacturing activity, February (consensus -14.0, last -27.4)

- 07:40 PM Kansas City Fed President Schmid (FOMC non-voter) speaks: Kansas City Fed President Jeff Schmid will give a speech on the economic and monetary policy outlook at an event in Oklahoma City, OK. Text, Q&A, and livestream are expected.

Tuesday, February 27

- 08:30 AM Durable goods orders, January preliminary (GS -6.0%, consensus -5.0%, last flat); Durable goods orders ex-transportation, January preliminary (GS flat, consensus +0.2%, last +0.5%); Core capital goods orders, January preliminary (GS -0.1%, consensus +0.1%, last +0.2%) ;Core capital goods shipments, January preliminary (GS +0.1%, consensus +0.2%, last flat): We estimate that durable goods orders fell 6.0% in the preliminary January report (mom sa), reflecting a lull in commercial aircraft orders that more than offsets a rebound in the defense category. We forecast soft details as well, including a 0.1% decline in core capital goods orders reflecting an end-of-year lull in global manufacturing activity and scope for order cancellations at the start of the year.

- 09:00 AM FHFA house price index, December (consensus +0.3%, last +0.3%)

- 09:00 AM S&P Case-Shiller 20-city home price index, December (GS +0.1%, consensus +0.2%, last +0.15%)

- 09:05 AM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr speaks at the Conference on Counterparty Credit Risk Management. Speech text and livestream are expected. On February 14, Barr said, “As Chair Powell indicated in his most recent press conference, my FOMC colleagues and I are confident we are on a path to 2% inflation, but we need to see continued good data before we can begin the process of reducing the federal funds rate. I fully support what he called a careful approach to considering policy normalization given current conditions…Given the limited historical experience with the growth and inflation dynamics we currently face, and no modern experience of emerging from a global pandemic, we have yet another reason to proceed carefully, as we have been doing.”

- 10:00 AM Conference Board consumer confidence, February (GS 114.6, consensus 115.0, last 114.8)

- 10:00 AM Richmond Fed manufacturing index, February (consensus -8, last -15)

Wednesday, February 28

- 08:30 AM GDP, Q4 second release (GS +3.4%, consensus +3.3%, last +3.3%); Personal consumption, Q4 second release (GS +2.8%, consensus +2.7%, last +2.8%): We estimate a 0.1pp upward revision to Q4 GDP growth to +3.4% (qoq ar), reflecting upward revisions to government spending and healthcare consumption, partially offset by downward revisions to inventory investment, consumer goods spending, and recreation categories.

- 08:30 AM Advance goods trade balance, January (GS -$86.0bn, consensus -$88.3bn, last -$87.9bn)

- 08:30 AM Wholesale inventories, January preliminary (consensus +0.2%, last +0.4%)

- 12:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will answer questions on the economic outlook and monetary policy at a fireside chat in Roswell, GA. Q&A is expected. On February 16, when discussing when to begin cutting the fed funds rate, Bostic said, “A year ago, six months ago, I was in the fourth quarter. So, we’ve seen tremendous progress, and I’m hopeful that that continues. If that continues, I’ll be willing to pull it forward even further.” He added that he could “for sure” see three cuts instead of the two he anticipated in the latest Summary of Economic Projections. On February 15, Bostic said, “The evidence from data, our surveys, and our outreach says that victory is not clearly in hand and leaves me not yet comfortable that inflation is inexorably declining to our 2% objective. That may be true for some time, even if the January CPI report turns out to be an aberration…I require more confidence before declaring victory in this fight for price stability...My expectation is that the rate of inflation will continue to decline, but more slowly than the pace implied by where the markets signal monetary policy should be…Right now, a strong labor market and macroeconomy offer the chance to execute these policy decisions without oppressive urgency.”

- 12:15 PM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will give remarks, participate in a fireside chat, and take audience questions in an event hosted by the Center for Business, Government & Society. Speech text, Q&A, and livestream are expected. On February 7, Collins said, “Seeing sustained, broadening signs of progress should provide the necessary confidence I would need to begin a methodical adjustment to our policy stance…it will likely become appropriate to begin easing policy restraint later this year…a methodical, forward-looking strategy that eases policy gradually will provide the flexibility to manage risks, while promoting stable prices and maximum employment.”

- 12:45 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver keynote remarks at the Long Island Association Regional Economic Briefing. Speech text, Q&A with media, and livestream are expected. On February 23, Williams said, “At some point, I think it will be appropriate to pull back on restrictive monetary policy, likely later this year. But it’s really about reading that data and looking for consistent signs that inflation is not only coming down but is moving towards that 2% longer-run goal.” He added, “Rate hikes are not my base case. But clearly, if fundamentally the economic outlook changes in a material, significant way — either with inflation not showing signs of moving toward the 2% longer-run goal on a sustained basis or other indicators that monetary policy is not having the needed or desired effects in order to achieve that goal — then you have to rethink that.”

Thursday, February 29

- 08:30 AM Personal income, January (GS +0.5%, consensus +0.4%, last +0.3%); Personal spending, January (GS -0.1%, consensus +0.2%, last +0.7%); PCE price index (mom), January (GS +0.36%, consensus +0.3%, last +0.2%); PCE price index (yoy), January (GS +2.39%, consensus +2.4%, last +2.6%); Core PCE price index (mom), January (GS +0.43%, consensus +0.4%, last +0.2%); Core PCE price index (yoy), January (GS +2.85%, consensus +2.8%, last +2.9%): We estimate that personal spending declined 0.1% and that personal income increased 0.5% in January. We estimate that the core PCE price index rose 0.43% in January, corresponding to a year-over-year rate of +2.85%. Additionally, we expect that the headline PCE price index rose 0.36%, or +2.39% from a year earlier. Our forecast is consistent with a 0.22% increase in our trimmed core PCE measure for January (vs. 0.20% in December and 0.12% in November).

- 08:30 AM Initial jobless claims, week ended February 24 (GS 200k, consensus 210k, last 201k); Continuing jobless claims, week ended February 17 (GS 1,860k, consensus 1,874k, last 1,862k)

- 10:00 AM Pending home sales, January (GS +1.0%, consensus +1.1%, last +8.3%)

- 10:50 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a fireside chat at the 2024 Banking Outlook Conference on the economic outlook, monetary policy, and state of the banking industry. Q&A and Livestream are expected.

- 11:00 AM Kansas City Fed manufacturing index, February (last -9)

- 11:00 AM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will join a virtual event for remarks on “Monetary Policy at an Unusual Time.” Q&A and livestream are expected. On February 14, Goolsbee said, “Let’s not get amped up on one month of CPI that was higher than it was expected to be…If you see inflation go up a little bit that doesn't mean that we're not on the target to get to 2%. We can still be on the path even if we have some increases and some ups and downs…so let's not get too flipped out." On February 5, Goolsbee said, “We’ve had seven months of really quite good inflation reports, right around or even below the Fed’s target. So if we just keep getting more data like what we have gotten, I believe that we should well be on the path to normalization.”

- 01:15 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will speak at the Columbia University School of International and Public Affairs and Bank Policy Institute's 2024 Bank Regulation Research Conference. Text and Q&A are expected. On February 6, Mester said, “It would be a mistake to move rates down too soon or too quickly without sufficient evidence that inflation was on a sustainable and timely path back to 2%. If the economy evolves as expected, I think we will gain that confidence later this year, and then we can begin moving rates down.”

- 08:10 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a moderated discussion at an event hosted by the Citizens Budget Commission. Q&A and livestream are expected.

Friday, March 1

- 09:45 AM S&P Global US manufacturing PMI, February final (consensus 51.5, last 51.5)

- 10:00 AM Construction spending, January (GS +0.6%, consensus +0.2%, last +0.9%)

- 10:00 AM University of Michigan consumer sentiment, February final (GS 79.2, consensus 79.6, last 79.6); University of Michigan 5-10-year inflation expectations, February final (GS 2.9%, consensus 2.9%, last 2.9%): We estimate the University of Michigan consumer sentiment index declined to 79.2 in the final February reading and estimate the report's measure of long-term inflation expectations will be unrevised at 2.9%.

- 10:00 AM ISM manufacturing index, February (GS 49.1, consensus 49.5, last 49.1): We estimate the ISM manufacturing index was unchanged at 49.1 in February, as negative residual seasonality offsets a rebound in global manufacturing activity and in other business surveys. Our GS manufacturing tracker rose 4.2pt to 50.4.

- 10:15 AM Fed Governor Waller and Dallas Fed President Logan (FOMC non-voter) speak: Fed Governor Christopher Waller and Dallas Fed President Lorie Logan will each respond to a paper titled "Quantitative Tightening Around the Globe: What Have We Learned?" at the 2024 US Monetary Policy Forum in New York. Speech text and Q&A are expected. On February 22, Waller said, “The strength of the economy and the recent data we have received on inflation mean it is appropriate to be patient, careful, methodical, deliberative – pick your favorite synonym. Whatever word you pick, they all translate to one idea: What’s the rush?” He added, “I am going to need to see a couple more months of inflation data to be sure that January was a fluke and that we are still on track to price stability…My conjecture is that, in the absence of a major economic shock, delaying rate cuts by a few months should not have a substantial impact on the real economy in the near term. And I think I have shown that acting too soon could squander our progress in inflation and risk considerable harm to the economy.” On January 6, Logan said, “If we don’t maintain sufficiently tight financial conditions, there is a risk that inflation will pick back up and reverse the progress we’ve made…In light of the easing in financial conditions in recent months, we shouldn’t take the possibility of another rate increase off the table just yet.”

- 12:15 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will speak in a moderated conversation on topics including the economic outlook and real estate trends at a conference in Orlando. Q&A is expected.

- 01:30 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will participate in a panel discussion on "AI & the Labor Market" at the 2024 US Monetary Policy Forum, moderated by Kansas City Fed President Jeffrey Schmid. Text and Q&A are expected. On February 16, Daly said, “To finish the job will take fortitude. We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves…Price stability is within sight. But there is more work to do.” Daly added that three 25bps cuts to the fed funds rate was a “reasonable baseline.”

- 03:30 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will speak about pursuing the dual mandate at the 2024 Stanford Institute for Economic Policy Research Economic Summit. Speech text, Q&A, and livestream are expected. On February 7, Kugler said, “At some point, the continued cooling of inflation and labor markets may make it appropriate to reduce the target range for the federal funds rate. On the other hand, if progress on disinflation stalls, it may be appropriate to hold the target range steady at its current level for longer to ensure continued progress on our dual mandate.”

- 05:00 PM Lightweight motor vehicle sales, February (GS 15.3mn, consensus 15.4mn, last 15.0mn)

Source: DB, BofA, Goldman