As DB's Henry Allen writes, markets had a rough start to Q2 last week, with the S&P 500 (-0.95%) posting its worst weekly performance in 3 months, whilst the US 30yr yield (+21.0bps) saw its biggest weekly rise since October, with yields extending gains again this morning. Several factors were driving the selloff, but geopolitical tensions played a key role, as fears mounted about some sort of escalation in the Middle East. That meant Brent crude oil prices rose for a 4th consecutive week, surpassing $90/bbl for the first time since October. That in turn led to growing concern about inflation, with investors continuing to price out the chance of rate cuts from the Fed. Indeed, as of this morning, just 62bps of rate cuts are priced in by the December meeting, which is a long way from the 158bps expected at the start of the year.

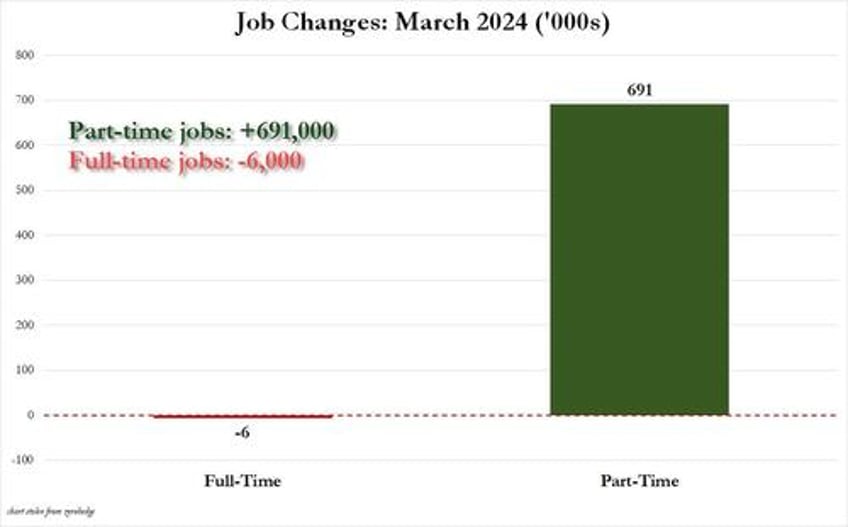

Those questions about rate cuts gathered pace on Friday, as the US jobs report showed nonfarm payrolls grew by +303k in March (vs. +214k expected), although as we showed, all the gain was thanks to low-quality and low-paid part-time jobs.

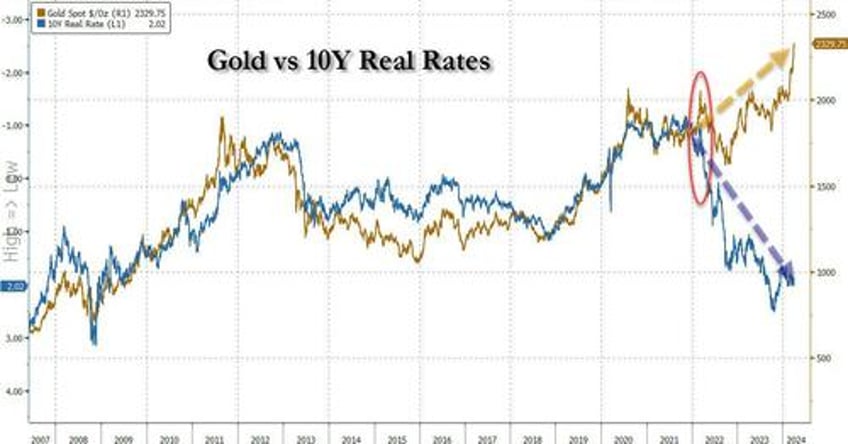

Unlike the previous month, the upside surprise didn’t come with sharp downward revisions. In fact, the January and February prints were revised up by a total of +22k. So even though futures are still pricing a rate cut by June as the most likely outcome, it was down to just a 54% chance by the close on Friday. That also meant that Treasury yields have reached new highs for the year, with the 10yr yield trading this morning as high as 4.46%, and the 10yr real yield rising to 2.08%, a staggering disconnect with the price of gold, something BofA's Mike Hartnett says is a harbinger of major pain.

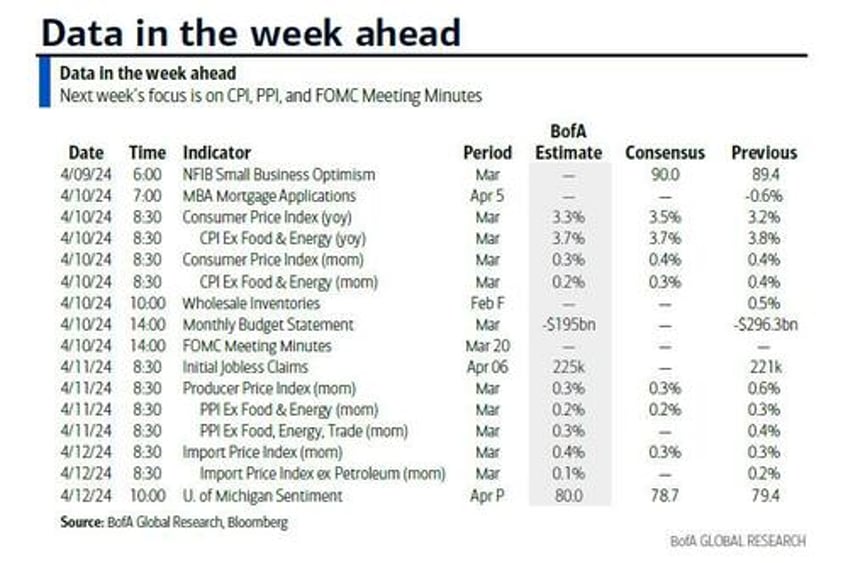

Looking forward, that question on the timing of rate cuts will be on the agenda this week, as the US CPI release for March is out on Wednesday. So far this year, core CPI has proven stronger than expected, with the January and February prints both at a monthly +0.4%. But for now at least, the Fed hasn’t been too alarmed, and Chair Powell said last week that “ it is too soon to say whether the recent readings represent more than just a bump.” So this week’s releases will be in focus, as a third month of stronger inflation would make it harder to dismiss as a temporary move higher.

In terms of what to expect, DB's US economists think that monthly headline CPI will be at +0.27%, in line with consensus, which would see the year-on-year measure pick up two-tenths to +3.4%. But for core CPI, they see the monthly number slowing down to +0.24%, which would push the year-on-year measure down a tenth to +3.7%. In the meantime, it’s clear that markets are becoming more concerned about the issue, and last week saw the US 2yr inflation swap close at its highest since October, at 2.54%.

Over in Europe, the main event this week is likely to be the ECB’s policy decision on Thursday. It’s widely expected they’ll leave rates unchanged at this meeting, including by market pricing and the consensus of economists. So the big question is likely to be what they signal about the subsequent meeting in June, which investors are pricing in as a very strong probability for an initial rate cut. Indeed, we found out last week that Euro Area core inflation fell to a two-year low in March of +2.9%, and the account of the last ECB meeting said that “the case for considering rate cuts was strengthening.” DB's European economists think that the ECB needs additional data over the next couple of months to underpin its confidence in price stability and open the door for a June rate cut. But they think it should be clear that a June cut is the working assumption, barring a significant shock.

This week ahead also marks the start of the Q1 earnings season, with several US financials reporting on Friday, before the number of releases starts to pick up over the subsequent couple of weeks. Friday’s reports include JPMorgan, Citigroup, Wells Fargo and BlackRock.

Rounding up the week ahead, there are monetary policy decisions from both the Bank of Canada and the Reserve Bank of New Zealand on Wednesday, along with the Bank of Korea on Friday. Separately on Wednesday, there’s the release of the FOMC minutes from the March meeting. And on Friday, the Bank of England will publish the Bernanke Review into its forecasts. When it comes to data, we’ll also get China’s CPI and PPI reading for March on Thursday, and on Friday’s there’s the UK’s monthly GDP reading for February.

Here is a day-by-day calendar of events courtesy of DB

Monday April 8

- Data: US March NY Fed 1-yr inflation expectations, Japan March Economy Watchers survey, February trade balance, current account balance, labor cash earnings, Germany February trade balance, industrial production

- Central banks: ECB's Stournaras speaks, BoE's Breeden speaks

Tuesday April 9

- Data: US March NFIB small business optimism, Japan March machine tool orders, consumer confidence index, France February trade balance, current account balance

- Central banks: Fed's Kashkari speaks, ECB's bank lending survey

- Auctions: US 3-yr Notes

Wednesday April 10

- Data: US March CPI, monthly budget statement, February wholesale trade sales, Japan March PPI, bank lending, Italy February retail sales, Canada February building permits, Denmark March CPI , Norway March CPI, PPI , Sweden February GDP

- Central banks: March FOMC meeting minutes, Fed's Goolsbee and Bowman speak, BoC decision, RBNZ decision

- Earnings: Tesco

- Auctions: US 10-yr Notes

Thursday April 11

- Data: US March PPI, initial jobless claims, UK March RICS house price balance, China March CPI, PPI, Japan March M2, M3, Italy February industrial production, Germany February current account balance, Norway February GDP

- Central banks: Fed's Williams, Bostic and Collins speak, ECB decision, BoE's Greene speaks, BoE's credit conditions survey

- Auctions: US 30-yr Bond

Friday April 12

- Data: US April University of Michigan consumer survey, March export and import price index, UK February monthly GDP, trade balance, industrial production, index of services, construction output, China March trade balance, Japan February capacity utilization, Italy January industrial sales, Canada March existing home sales, Sweden March CPI

- Central banks : Fed's Daly and Bostic speak, ECB's survey of professional forecasters, BoE's Bernanke report

- Earnings: JPMorgan, Citigroup, Wells Fargo, BlackRock

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the CPI report on Wednesday and the University of Michigan report on Friday. The minutes from the March FOMC meeting will also be released on Wednesday. There are several speaking engagements from Fed officials this week, including remarks from governor Bowman and presidents Williams, Goolsbee, Kashkari, Collins, Bostic, and Daly.

Monday, April 8

- 11:00 AM NY Fed 1-year inflation expectations, March (last +3.04%)

- 01:00 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will appear on local Chicago radio station WBEZ-FM. On April 4, Goolsbee said, “The biggest danger to the inflation picture in my view...[is] the continued high inflation in housing services…I have been expecting it to come down more quickly than it has. If it does not come down, we will have a very difficult time getting overall inflation back to the 2% target.” He added, “If we stay restrictive for too long, we will likely see the employment side of the mandate begin to deteriorate.”

- 07:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will join a town hall discussion at the University of Montana in Missoula. A Q&A is expected. On April 4, Kashkari said, “In March I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target. If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.” He added, the January and February inflation data was “a little bit concerning.”

Tuesday, April 9

- 06:00 AM NFIB small business optimism, March (consensus 89.9, last 89.4)

Wednesday, April 10

- 08:30 AM CPI (mom), March (GS +0.29%, consensus +0.3%, last +0.4%); Core CPI (mom), March (GS +0.27%, consensus +0.3%, last +0.4%); CPI (yoy), March (GS +3.37%, consensus +3.4%, last +3.2%); Core CPI (yoy), March (GS +3.70%, consensus +3.7%, last +3.8%); We estimate a 0.27% increase in March core CPI (mom sa), which would lower the year-on-year rate by one tenth to 3.7%. Our forecast reflects a 0.3% pullback in apparel prices, a return to a negative trend for communication prices (-0.3%), and a 3% drop in airfares. We also assume small declines in new (-0.3%) and used (-0.5%) car prices, reflecting higher incentives and declines in auction prices during the winter. We estimate a slowdown in the primary rent measure (+0.37% vs. +0.44% in February) reflecting the continued softness in apartment inflation, and we assume a similar pace for OER (+0.45% vs. +0.44% in February) given continued single-family outperformance. On the positive side, we assume a strong gain in car insurance rates (+1.4%) based on online price data and a boost to hotel lodging (+1.0%) from residual seasonality. We estimate a 0.29% rise in headline CPI, reflecting higher energy (+0.7%) and food (+0.2%) prices.

- 08:45 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will discuss the Basel capital requirements at the European Bank Executive Forum. A Q&A is expected. On April 5, Bowman said, “While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse…Reducing our policy rate too soon or too quickly could result in a rebound in inflation, requiring further future policy rate increases to return inflation to 2% over the longer run.”

- 10:00 AM Wholesale inventories, February final (consensus +0.5%, last +0.5%)

- 12:45 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a panel discussion for the Social Finance Institute. A Q&A is expected.

- 02:00 PM FOMC meeting minutes, March 19-20 meeting: At the March FOMC meeting, the median FOMC participant continued to project three rate cuts in 2024 despite a 0.2pp increase in the median 2024 core PCE inflation projection to 2.6%. We saw three takeaways from Chair Powell’s press conference. First, Powell was not concerned by the firmer January and February inflation data. Second, Powell noted that, while the FOMC raised its 2024 GDP growth forecast meaningfully, stronger growth has been made possible recently by faster growth of labor supply and is therefore not an argument against rate cuts. Third, FOMC participants think it will be appropriate to slow the pace of balance sheet runoff “fairly soon.” We continue to expect three 25bp cuts in the Fed funds rate this year, with the first at the June meeting.

Thursday, April 11

- 08:30 AM PPI final demand, March (GS +0.3%, consensus +0.3%, last +0.6%); PPI ex-food and energy, March (GS +0.3%, consensus +0.2%, last +0.3%); PPI ex-food, energy, and trade, March (GS +0.3%, consensus +0.2%, last +0.4%); 08:30 AM Initial jobless claims, week ended April 6 (GS 215k, consensus 215k, last 221k); Continuing jobless claims, week ended March 30 (consensus 1,800k, last 1,791k)

- 08:45 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President Williams will deliver keynote remarks at the FHLBNY 2024 Member Symposium. Speech text and a Q&A are expected. On February 28, Williams said, “While the economy has come a long way toward achieving better balance and reaching our 2% inflation goal, we are not there yet. I am committed to fully restoring price stability in the context of a strong economy and labor market.” He added, “my view is that something like the three-rate-cuts-this-year projection from December is a reasonable kind of starting point” and that rate cuts could come “later this year.”

- 12:00 PM Boston Fed Susan Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will speak at the Economic Club of New York. Speech text and a Q&A are expected. On February 28, Collins said, “I believe it will likely become appropriate to begin easing policy later this year. When this happens, a methodical, forward-looking approach to reducing rates gradually should provide the necessary flexibility to manage risks, while promoting stable prices and maximum employment…If that trajectory slows down, in terms of inflation, then we are going to have to be more patient than I think many had expected.”

- 01:30 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation on leadership in financial services. A Q&A is expected. On April 3, Bostic said, “We've seen inflation kind of become much more bumpy. If the economy evolves as I expect and that's going to be seeing continued robustness in GDP and employment, and a slow decline in inflation over the course of the year, I think it will be appropriate for us to start moving down at the end of this year, the fourth quarter.”

Friday, April 12

- 08:30 AM Import price index, March (consensus +0.3%, last +0.3%): Export price index, March (consensus +0.3%, last +0.8%)

- 10:00 AM University of Michigan consumer sentiment, April preliminary (GS 79.0, consensus 79.0, last 79.4); University of Michigan 5-10-year inflation expectations, April preliminary (GS 3.0%, consensus 2.9%, last 2.8%): We expect the University of Michigan consumer sentiment index decreased to 79.0 in the preliminary April reading. The University of Michigan is transitioning from phone interviews to web-based interviews over the next four months. We have adjusted our estimate of consumer sentiment down slightly since web-based responses tend to be more pessimistic than phone-based responses for the consumer sentiment measure. We estimate the report's measure of long-term inflation expectations rose 0.2pp to 3.0%, reflecting higher gasoline prices and the higher-than-expected price data reported so far in 2024.

- 02:30 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will give a speech and participate in a moderated conversation on housing at the Confronting America's Housing Crisis: Solutions for the 21st Century. Speech text and a Q&A are expected.

- 03:30 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will participate in fireside chat at the 2024 Fintech Conference: The Evolution of Fintech – AI, Payments and Financial Inclusion. A moderated Q&A is expected. On April 2, Daly said, “I think that [three rate cuts this year] is a very reasonable baseline. Growth is going strong, so there’s really no urgency to adjust the rate.” She added “it’s a close call” on whether fewer cuts will be needed.

Source DB, Goldman, BofA