We're currently in-between US payrolls from last Friday and US CPI this Thursday which will be the highlight of this week.

As DB's Jim Reid reminds us this morning, the first of these was a knockout report with the headline number up +254k as against expectations of +150k and with the unemployment rate falling a tenth to 4.1% (4.05% unrounded), which however was due to a record surge in 785,000 government jobs. Still, even though the monthly payrolls report is better known as a "random number generator", even with that caveat it was an impressive report and completely against recent fears, sending the dollar and yields soaring. The main impact was a +21.6bps increase in 2yr US yields on Friday and the probability of a 50bps cut next month declining from around 33% to effectively zero in the process. Reid's own view was always that the amount of rate cuts priced in since mid to late summer was only likely if we had a recession, and if we didn't, then the rates market overall was too pessimistic. He would still say that today.

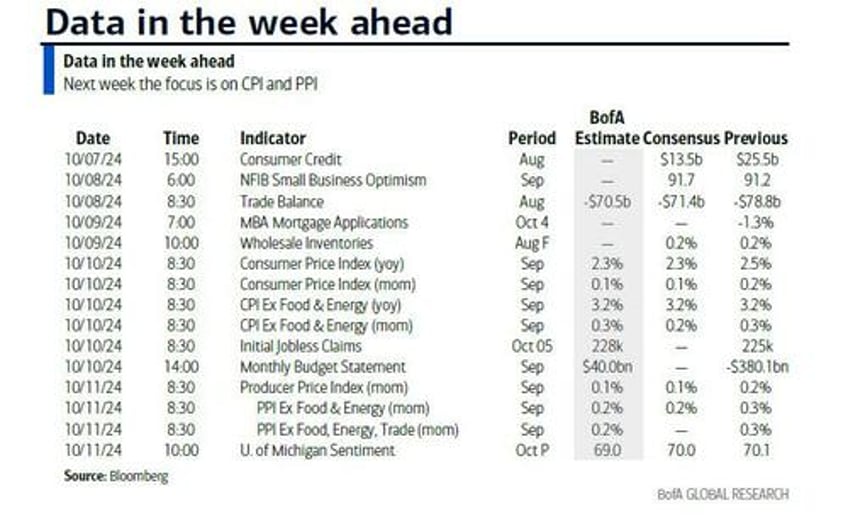

In terms of moving this argument on, it's a relatively quiet week in the US apart from Thursday's CPI but in terms of the main global day-by-day highlights we have the following. Today sees Germany factory orders - which cratered - and Eurozone retail sales, tomorrow sees German Industrial Production, and Swedish CPI, Wednesday sees the last FOMC minutes and a 10yr UST auction, Thursday sees the release of the account of the last ECB meeting, France present its budget proposal, Japanese PPI, German retail sales, Italian industrial production, Norway and Denmark CPI, and a 30yr UST auction, with Friday home to US PPI, the US University of Michigan survey, UK August monthly GDP and US Earnings season kicking off with JPMorgan, Wells Fargo, BlackRock, Bank of New York Mellon all reporting.

In terms of this week's US CPI, consensus expects headline CPI of +0.1% vs. +0.19% previously, to come in tame with core +0.2% (down from +0.28%) edging lower but more elevated than headline. Headline YoY CPI would dip a couple of tenths to 2.3%, with core staying around the same level at 3.2%. However, the six-month annualized core rate would fall from 2.7% to 2.4%. Rents will again take center stage after recent strength. As for PPI on Friday, DB and consensus expect headline (+0.1% vs. +0.2% last month) and core (+0.2% vs. 0.3% last month) to be directionally similar to CPI. The market will as ever pay closest attention to the categories that feed into the core PCE deflator – namely, health care services, airfares and portfolio management. Staying with inflation, Friday's preliminary University of Michigan consumer sentiment survey will have inflation expectations which last month picked up a tenth to 3.1% for the long-run measure but fell the same amount to 2.7% for the 1yr measure.

As you'll see in the day-by-day calendar of events, it's also a busy week of Fed speakers. So it'll be interesting to see how they all react to the bumper payrolls print. The last FOMC meeting minutes on Wednesday will be a bit stale but may give us a better understanding as to how policy might evolve under various scenarios.

As noted above, Friday will mark the start of the Q3 earnings season with several US banks releasing results. Samsung, PepsiCo and BlackRock also report throughout the week.

DB strategists expect S&P 500 earnings growth to slow from 11.8% in Q2 to 9% in Q3, driven by a narrow group of sectors such as energy and mega cap growth & tech, with growth for the others staying steady in the mid-single digits.

Day-by-day calendar of events courtesy of DB:

Monday October 7

- Data: US August consumer credit, China September foreign reserves, Japan August leading index, coincident index, Germany August factory orders, Eurozone August retail sales

- Central banks: Fed's Kashkari, Bowman, Bostic and Musalem speak, ECB's Cipollone, Lane, Nagel and Escriva speak

Tuesday October 8

- Data: US September NFIB small business optimism, August trade balance, Japan August labor cash earnings, household spending, BoP current account and trade balance, September Economy Watchers survey, Germany August industrial production, France August current account balance, trade balance, Canada August international merchandise trade, Sweden September CPI

- Central banks: Fed's Kugler, Bostic and Collins speak, ECB's Nagel speaks

- Earnings: Samsung Electronics, PepsiCo

- Auctions: US 3-yr Notes ($58bn)

Wednesday October 9

- Data: US August wholesale trade sales, Japan September machine tool orders, Germany August trade balance

- Central banks: Fed FOMC meeting minutes, Jefferson, Bostic, Logan, Goolsbee, Collins and Daly speak, ECB's Villeroy and Elderson speak, RBNZ decision

- Auctions: US 10-yr Notes ($39bn, reopening)

Thursday October 10

- Data: US September CPI, initial jobless claims, UK September RICS house price balance, Japan September PPI, bank lending, Germany August retail sales, Italy August industrial production, Norway and Denmark September CPI, Sweden August GDP indicator

- Central banks: Fed's Barkin and Williams speak, ECB account of the September meeting

- Earnings: Domino's Pizza, Fast Retailing, Seven & I

- Auctions: US 30-yr Bonds ($22bn, reopening)

Friday October 11

- Data: US September PPI, October University of Michigan survey, UK August monthly GDP, Japan September M2, M3, Germany August current account balance, Canada September jobs report, August building permits

- Central banks: Fed's Goolsbee and Logan speak, BoC's business outlook

- Earning: JPMorgan, Wells Fargo, BlackRock, Bank of New York Mellon

* * *

Finally, looking at just the US, Goldman writes that the key economic data release this week is the CPI report on Thursday. There are many speaking engagements from Fed officials this week, including remarks by Vice Chair Philip Jefferson on Tuesday and Wednesday and by New York Fed President John Williams on Thursday.

Monday, October 7

- 01:00 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak at the Independent Bankers Association of Texas’s annual convention. Moderated Q&A is expected. Bowman dissented from the FOMC’s decision to lower the fed funds rate by 50bp in September, preferring a 25bp cut instead. On September 30th, Bowman said that “the US economy remains strong and core inflation remains uncomfortably above our 2% target.” As a result, she argued, the FOMC should be “moving at a measured pace toward a more neutral policy stance.”

- 01:50 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a moderated Q&A at an event hosted by the Bank Holding Company Association. On September 23rd, Kashkari noted that he expects the FOMC to “take smaller steps” in lowering the fed funds rate going forward “unless the data changes materially.” Kashkari said he had forecast two more 25bp cuts before the end of the year in his submission to the September Summary of Economic Projections. Kashkari also noted that he estimates the neutral rate to be around 2.9%, above the 2.5% he estimated in March, and said that “the longer this economic resilience continues, the more signal I take that the temporary elevation of the neutral rate might in fact be more structural.”

- 06:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will moderate a conversation with Steve Koonin, CEO of the Atlanta Hawks and State Farm Arena, as part of the Atlanta Fed’s Leading Voices series. On September 23rd, Bostic said that his “residual concern about inflation might have led me to settle on a relatively small first move last week — say, 25 basis points. But such a move would belie growing uncertainty about the trajectory of the labor market.” Bostic also noted that “policy remains in the restrictive range, so if my optimism about inflation is unsatisfied, then the Committee can slow or even halt the pace of further reductions. Should labor markets prove substantially less healthy than they appear at the moment, the ½ percentage point reduction puts us in a better position to adjust than a more modest cut would have.”

- 06:30 PM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will deliver a speech on the US economy and monetary policy at an event hosted by the Money Marketeers of New York University. Text and Q&A are expected. On September 27th, Musalem noted that the business sector was in a “good place” with activity overall “solid”, adding that mass lay-offs did not appear “imminent.” As a result, Musalem argued, the Fed should revert to lowering the fed funds rate “gradually,” following the 50bp cut at the September meeting.

Tuesday, October 8

- 03:00 AM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will deliver a speech at the ECB’s Conference on Monetary Policy in Frankfurt. Text and audience and moderated Q&A are expected. On September 25th, Governor Kugler said she “strongly supported” the FOMC’s decision to lower the fed funds rate by 50bp in September. Kugler noted that “the labor market remains resilient, but the FOMC now needs to balance its focus so we can continue making progress on disinflation while avoiding unnecessary pain and weakness in the economy as disinflation continues in the right trajectory.”

- 06:00 AM NFIB small business optimism, September (consensus 92.0, last 91.2)

- 08:30 AM Trade balance, August (GS -$71.7bn, consensus -$70.5bn, last -$78.8bn)

- 12:45 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will deliver remarks on the economic outlook and take part in a moderated discussion at the Atlanta Consular Corps luncheon. Q&A is expected.

- 04:00 PM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will deliver remarks as part of the 23rd annual Regional and Community Bankers Conference. Text and Q&A are expected.

- 07:30 PM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will take part in an event on the discount window at Davidson College in North Carolina. Text and audience Q&A are expected.

Wednesday, October 9

- 08:00 AM Atlanta Fed President Bostic (FOMC voter) speaks; Atlanta Fed President Raphael Bostic will deliver welcoming remarks at the Greater Atlanta Home Builders Association’s monthly meeting.

- 09:15 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver a speech to the Future of Global Energy Conference hosted by the Greater Houston Partnership. Text is expected.

- 10:00 AM Wholesale inventories, August final (consensus +0.2%, last +0.2%)

- 10:30 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will give opening remarks at the Chicago Payments Symposium. On Friday, after the September employment report was released, Goolsbee noted that “this jobs number today, and the whole report, is a superb report,” although he also said that “you don’t want to react too much to one month’s report.” Goolsbee observed that “there are some signs that inflation might undershoot the 2% target, and we want to be mindful of that too."

- 12:30 PM Fed Vice Chair Jefferson speaks: Fed Vice Chair Jefferson will deliver a speech on the discount window at an event hosted by the Charlotte Economics Club. Text and Q&A are expected.

- 02:00 PM FOMC meeting minutes, September 17-18: The FOMC delivered a 50bp cut at its September meeting. The Fed leadership appears to have pushed through a larger cut even though many participants seemed to indicate that they preferred a smaller cut in their submissions to the dot plot. The rationale for the larger cut and the key theme of the meeting was the shift in focus from inflation risks to employment risks in light of softer labor market data at the time. We therefore look for further details on FOMC participants’ views of the appropriate policy stance and their expectations for the policy path going forward. That being said, the September employment report has since reset the labor market narrative, and the FOMC meeting minutes will not reflect updated assessments of labor market risks in light of those data.

- 05:00 PM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will deliver a speech at the Worcester Regional Research Bureau’s 39th annual meeting. Text and Q&A are expected.

- 06:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will take part in a moderated conversation at Boise State University. Q&A is expected.

Thursday, October 10

- 08:30 AM CPI (MoM), September (GS +0.10%, consensus +0.1%, last +0.2%); Core CPI (MoM), September (GS +0.28%, consensus +0.2%, last +0.3%); CPI (YoY), September (GS +2.27%, consensus +2.3%, last +2.5%); Core CPI (YoY), September (GS +3.16%, consensus +3.2%, last +3.2%): We estimate a 0.28% increase in September core CPI (month-over-month SA), which would leave the year-over-year rate unchanged on a rounded basis at 3.2%. Our forecast reflects an increase in used car prices (+1.0%) reflecting a rebound in auction prices, another increase in airfares (+0.5%) reflecting a boost from residual seasonality, and another firm increase in the car insurance category (+0.7%) based on continued—albeit decelerating—increases in premiums in our online dataset. We expect a modest decline in new car prices (-0.1%), reflecting a sequential increase in new vehicle incentives. We expect moderation in the shelter components (OER +0.35%, primary rent +0.31%). We estimate a 0.10% rise in headline CPI, reflecting higher food prices (+0.2%) but lower energy prices (-2.1%). Our forecast is consistent with a 0.22% increase in core PCE in September. We will update our core PCE forecast after the CPI is released and again after the PPI is released.

- 08:30 AM Initial jobless claims, week ended October 5 (GS 235k, consensus 230k, last 225k); Continuing jobless claims, week ended September 28 (consensus 1,832k, last 1,826k): We estimate that initial claims increased by 10k to 235k in the week ended October 5th, reflecting an estimated 15k boost from hurricane-related filings but a 5k drag from residual seasonality.

- 09:15 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver a speech on entrepreneurship and innovation at an event in Charleston, South Carolina. Text and Q&A are expected. On September 26th, Cook said she “wholeheartedly” supported the FOMC’s decision to lower the fed funds rate by 50bp in September, noting that the “decision reflected growing confidence that, with an appropriate recalibration of our policy stance, the solid labor market can be maintained in a context of moderate economic growth and inflation continuing to move sustainably down to our target.”

- 10:30 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Tom Barkin will take part in a fireside chat on the economic outlook at the Virginia Maritime Association’s 2024 International Trade Symposium. Q&A is expected. On October 2nd, Barkin noted that “it remains difficult to say that the inflation battle has yet been won,” and that “while we have made real progress, there remains significant uncertainty on both inflation and employment.”

- 11:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver keynote remarks at an event hosted by Binghamton University. Text and Q&A are expected. On September 6th, Williams said that the recent data had been “consistent with the good labor market that existed in the period before the pandemic” and that the unemployment rate “remains relatively low by historical standards.” Williams said he saw potential downside risks to growth as a result of “significant further weakening in the US labor market” or a “sharp slowdown in global growth” but both “upside and downside” risks to inflation.

Friday, October 11

- 08:30 AM PPI final demand, September (GS +0.1%, consensus +0.1%, last +0.2%); PPI ex-food and energy, September (GS +0.1%, consensus +0.2%, last +0.3%); PPI ex-food, energy, and trade, September (GS +0.2%, consensus +0.2%, last +0.3%);

- 09:00 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver opening remarks at the Community Bankers Symposium, hosted by the Chicago Fed.

- 10:00 AM University of Michigan consumer sentiment, October preliminary (GS 71.2, consensus 70.5, last 70.1); University of Michigan 5-10-year inflation expectations, October preliminary (GS 3.0%, consensus 3.0%, last 3.1%)

- 10:45 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will participate in a panel discussion at the Women in Financial Services Conference, hosted by the Federal Home Loan Bank of Dallas. Q&A is expected.

- 01:10 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will deliver a speech on community banking at the Chicago Fed’s Community Bankers Symposium. Text and Q&A are expected.

Source: DB, Goldman