The week after payrolls is usually quiet but as DB's Jim Reid notes, because the first Friday of the month being the latest it could possibly be this month, we go straight into US CPI (Wednesday) week, with PPI (Thursday) for an added bit of inflationary sparkle. Outside of this the main highlight will be Powell's semi-annual monetary policy testimony before the Senate Banking Committee (tomorrow) and the House Financial Services Committee (Wednesday). The latter comes after CPI which will possibly spread the interest level over the two appearances rather than most of the focus being on the first as per usual. Elsewhere in the US, watch out for the NY Fed inflation expectations series today after a stronger equivalent from the University of Michighan survey just before the weekend on Friday. After that we wait until this Friday for the other important US data, namely retail sales and industrial production.

In Europe we have the UK Q4 GDP reading on Thursday following last week's BoE meeting (our UK economist's recap is here). Elsewhere in the region, January CPIs are due in Denmark and Norway today, and Switzerland on Thursday. In terms of earnings we have 75 S&P 500 companies and 79 Stoxx 600 companies reporting.

The tariff news will clearly continue to dominate the agenda all week, especially after Mr Trump announced on Friday that he'd be holding a press conference early this week on the US plans for equalizing tariffs on "reciprocal trade" with an added mention for autos. Then on Air Force One last night Mr Trump said he would put 25% tariffs on steel and aluminium imports later today. Canada, Mexico and Latin America would be the most impacted given that's where the US imports most of these goods from.

Looking forward now and in terms of Powell's testimonies this week, the overarching message is likely that the Fed is not in a hurry to cut rates at the moment, with Friday's payrolls and to a lesser extent the UoM inflation expectations series the latest support to that message. Even though headline (+143k) and private (+111k) payroll gains were below expectations, net upward revisions of 100k over the prior two months, a decline in the unemployment rate to 4.0% (4.1% expected), and average hourly earnings +0.5% on the month (vs. +0.3% expected), made it a hawkish report.On top of that, the annual benchmark revision to the level of March 2024 nonfarm payrolls (-598k final vs. -818k preliminary) was not as large as the BLS had previously projected. See our economists' US employment chart book here for everything you wanted to know about the labour market post this release.

For those inflation expectations last Friday the 1yr level was up to 4.3% (expected 3.3%) and the more important 5-10yr one at 3.3% (expected 3.2%). If confirmed in the final reading the longer-term expectations have only been higher for one month (June 2008) since 1995. This series continues to be ridiculously partisan post the election though with the 1-yr number seen around 5% from Democrat supporters and around zero for Republicans. So how reliable this number is at the moment is open is debatable.

Finally, talking of inflation, strong seasonally adjusted gains in food and energy prices should keep headline CPI (+0.31% forecast vs. +0.39% previously) above core (+0.28% vs. +0.23%). YoY headline CPI should remain roughly steady at 2.9%, while that for core would just round down to 3.1%. OER will continue to be a big focus. For PPI it‘s as ever the components that go into core PCE that will gain all the attention.

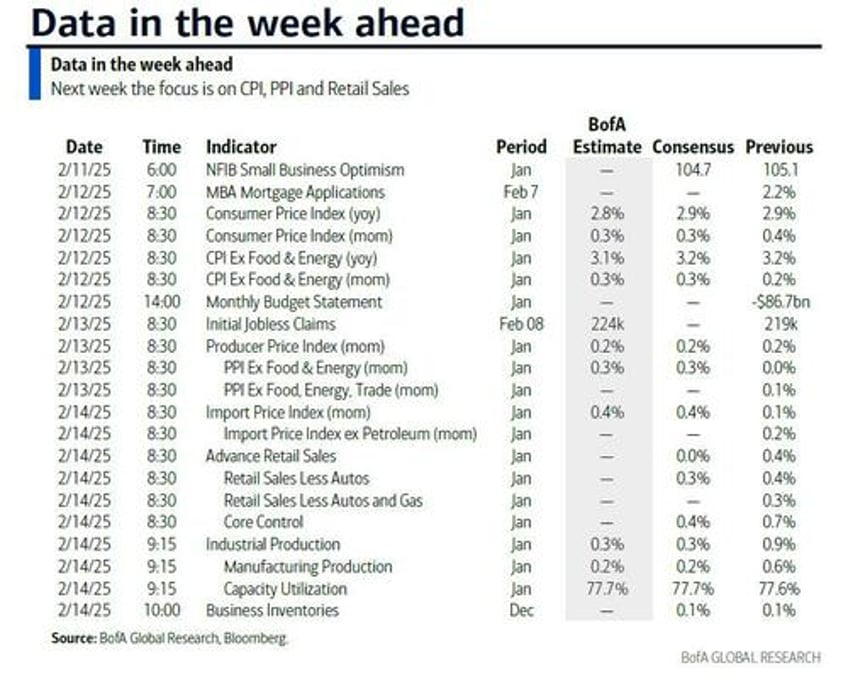

Courtesy of DB, here is a day-by-day calendar of events

Monday February 10

- Data: US January NY Fed 1-yr inflation expectations, Japan January Economy Watchers survey, Denmark and Norway January CPI

- Earnings: McDonald's, Vertex, DBS, Rockwell Automation, Astera Labs, Mediobanca

Tuesday February 11

- Data: US January NFIB small business optimism, Japan January M2, M3, Canada December building permits, Norway Q4 GDP, Canada December building permits

- Central banks: Fed's Chair Powell testifies to the Senate committee, Fed's Hammack and Williams speak, BoE's Bailey and Mann speak

- Earnings: Coca-Cola, S&P Global, Shopify, Gilead Sciences, BP, Welltower, Marriott, DoorDash, UniCredit, Carrier Global, Humana, Kering, Zillow

- Auctions : US 3-yr Notes ($58bn)

Wednesday February 12

- Data: US January CPI, federal budget balance, Japan January PPI, machine tool orders, Germany December current account balance, Italy December industrial production

- Central banks: Fed's Chair Powell testifies to the House Financial Services committee, Fed's Bostic speaks, ECB's Elderson and Nagel speak, BoE's Greene speaks, BoC's summary of deliberations

- Earnings: Cisco, EssilorLuxottica, Equinix, SoftBank, CME, Williams Cos, CVS Health, Vertiv, Dominion Energy, Robinhood, Heineken, Reddit, Barrick Gold, Albemarle, MGM Resorts, Telecom Italia

- Auctions : US 10-yr Notes ($42bn)

Thursday February 13

- Data: US January PPI, initial jobless claims, UK Q4 GDP, January RICS house price balance, Switzerland January CPI

- Central banks: ECB's Nagel speaks, ECB's economic bulletin

- Earnings: Nestle, Siemens, Applied Materials, Unilever, Sony, Deere, Palo Alto Networks, Airbnb, British American Tobacco, Zoetis, Digital Realty Trust, Howmet Aerospace, Barclays, Honda, Adyen, PG&E, Orange, DSM-Firmenich, Legrand, Commerzbank, DraftKings, Moncler, Roku, Nissan, Neste, Crocs, Embracer Group, thyssenkrupp, Altice

- Auctions : US 30-yr Bonds ($25bn)

Friday February 14

- Data: US January retail sales, industrial production, capacity utilisation, import and export price index, December business inventories, Germany January wholesale price index, Italy December general government debt, Eurozone Q4 GDP, Canada December manufacturing sales

- Earnings: Hermes, Safran, NatWest, Moderna

* * *

Finally, according to Goldman, the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Friday. There are several speaking engagements from Fed officials this week, including Chair Powell's semi-annual Congressional testimony on Tuesday and Wednesday.

Monday, February 10

- 11:00 AM New York Fed 1-year inflation expectations, January (last 3.00%): The New York Fed will release its measures of inflation expectations for January. The University of Michigan’s 12-month measure of inflation expectations increased by 0.5pp in January and by an additional 1.0pp in February, partly reflecting the expected impact of tariffs.

Tuesday, February 11

- 06:00 AM NFIB small business optimism, January (consensus 104.7, last 105.1)

- 08:50 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will give a speech on the economic outlook at an event in Kentucky. Speech text and a Q&A are expected.

- 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will testify on the Federal Reserve’s Semi-Annual Monetary Policy Report to the US Senate Committee on Banking, Housing, and Urban Affairs. As discussed in our FOMC recap, in his press conference following the January FOMC meeting, Chair Powell indicated that he still sees the funds rate as “meaningfully restrictive,” the FOMC is not “in a hurry” to cut, and once policy changes from the new administration become clearer, the bar is not high for further inflation progress to justify another rate cut.

- 03:30 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will give remarks on bank regulation at the 2025 Iowa Bankers Association Bank Management and Policy Conference. On January 9, Bowman said "The policy rate is now closer to my estimate of its neutral level, which is higher than before the pandemic." She added that she continues "to be concerned that the current stance of policy may not be as restrictive as others may see it. Given the ongoing strength in the economy, it seems unlikely that the overall level of interest rates and borrowing costs are providing meaningful restraint."

- 03:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks at an event hosted by the Pace University Economics Society. Speech text and a moderated Q&A are expected. On January 15, Williams said "We have seen significant progress and the labor market has come into balance," and "My view [is] that inflation is moving toward our goal of 2 percent." He added that "Because that balance of risks to achieving our goals has now been achieved, our job is to ensure the risks remain in balance."

Wednesday, February 12

- 08:30 AM CPI (MoM), January (GS +0.36%, consensus +0.3%, last +0.4%); Core CPI (MoM), January (GS +0.34%, consensus +0.3%, last +0.2%); CPI (YoY), January (GS +2.96%, consensus +2.9%, last +2.9%); Core CPI (YoY), January (GS +3.19%, consensus +3.1%, last +3.2%): We estimate a 0.34% increase in January core CPI (month-over-month SA), which would leave the year-over-year rate unchanged on a rounded basis at 3.2%. Our forecast reflects an increase in used car prices (+1.5%) reflecting an increase in auction prices, an increase in new car prices (+0.5%) reflecting a decline in incentives, and an acceleration in the car insurance category (+0.75%) based on premiums in our online dataset. We expect seasonal distortions and a postage price increase to boost the communications category (GS forecast +0.5% vs. flat in December and -1.0% in November). We expect the shelter components to moderate slightly (OER +0.31% vs. +0.33% in December; primary rent +0.27% vs. +0.33% in December). We estimate a 0.36% rise in headline CPI, reflecting higher food (+0.4%) and energy (+0.6%) prices. Our forecast is consistent with a 0.32% increase in core PCE in January. We will update our core PCE forecast after the CPI is released.

- In this month’s report, the BLS will release recalculated seasonal factors that reflect the price movements of 2024—which could reduce the impact of seasonal distortions that explained some of the month-to-month variation in core inflation last year—as well as updated weights. The annual seasonal factor revisions tend to cause monthly inflation readings to be revised toward the annual average. In other words, higher inflation readings for the year tend to be revised lower and lower readings tend to be revised higher. On average over the last decade, about 20% of the relative strength of a month’s initial core inflation vintage has been revised away in its first annual revision. Last year, monthly core CPI inflation was particularly elevated in Q1 (10bp above the 2024 average) and particularly low in May-July (14bp below).

- 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will testify before the House Financial Services Committee. Speech text and a Q&A are expected.

- 12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak in a moderated conversation on the economic outlook at an event at the Atlanta Fed. Q&A is expected. On February 3, Bostic said "I want to see what the 100bps of reduction of the policy rate that we did last year translates to in terms of the economy... I want to be cautious and I don’t want to have our policy lean in a direction, making the assumption that the economy is going to evolve a certain way, and then we have to turn and unwind." He added that his "general outlook is that we’re going to get to target and get [policy] back to neutral. And I think neutral is lower than where we are now, somewhere in the 3-3.5% range."

Thursday, February 13

- 08:30 AM PPI final demand, January (GS +0.4%, consensus +0.3%, last +0.2%); PPI ex-food and energy, January (GS +0.2%, consensus +0.3%, last flat); PPI ex-food, energy, and trade, January (GS +0.2%, consensus +0.2%, last +0.1%);

- 08:30 AM Initial jobless claims, week ended February 8 (GS 215k, consensus 217k, last 219k): Continuing jobless claims, week ended February 1 (consensus 1,888k, last 1,886k)

Friday, February 14

- 08:30 AM Retail sales, January (GS -0.2%, consensus -0.1%, last +0.4%); Retail sales ex-auto, January (GS +0.3%, consensus +0.3%, last +0.4%); Retail sales ex-auto & gas, January (GS +0.4%, consensus +0.4%, last +0.3%); Core retail sales, January (GS +0.2%, consensus +0.3%, last +0.7%): Core estimate core retail sales expanded 0.2% in January (ex-autos, gasoline, and building materials; month-over-month SA), reflecting middling growth in measures of card spending and a potential drag from colder-than-usual weather. We estimate a 0.2% decline in headline retail sales, reflecting higher gasoline prices but lower auto sales.

- 08:30 AM Import price index, January (consensus +0.4%, last +0.1%): Export price index, January (consensus +0.3%, last +0.3%)

- 09:15 AM Industrial production, January (GS +0.1%, consensus +0.3%, last +0.9%): Manufacturing production, January (GS -0.1%, consensus +0.1%, last +0.6%)

- Capacity utilization, January (GS 77.6%, consensus 77.7%, last 77.6%): We estimate industrial production increased +0.1%. We expect colder-than-usual temperatures to contribute to strong utilities production due to increased demand for heating, but softer autos and mining production. We estimate capacity utilization remained unchanged at 77.6%.

- 10:00 AM Business inventories, December (consensus flat, last +0.1%)

Soruce: BofA, Goldman