- APAC stocks saw mixed price action as participants reflected on last Friday's NFP print and President Trump's latest tariff remarks.

- US President Trump said he will announce 25% tariffs on all steel and aluminium coming into the US on Monday and unveil reciprocal tariffs on Tuesday or Wednesday which will go into effect almost immediately.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 future up 0.3% after the cash market closed with losses of 0.6% on Friday.

- USD is mixed vs. peers, EUR/USD briefly dipped below 1.03, Cable is pivoting around the 1.24 mark, USD/JPY is sub-152.

- Looking ahead, highlights include Norwegian CPI, EZ Sentix Index, US Employment Trends, NY Fed SCE, Chinese M2 Money Supply, BoC Market Participants Survey, ECB’s Schnabel & BoE’s Mann, Earnings from McDonalds, UniCredit, Generali & Mediobanca.

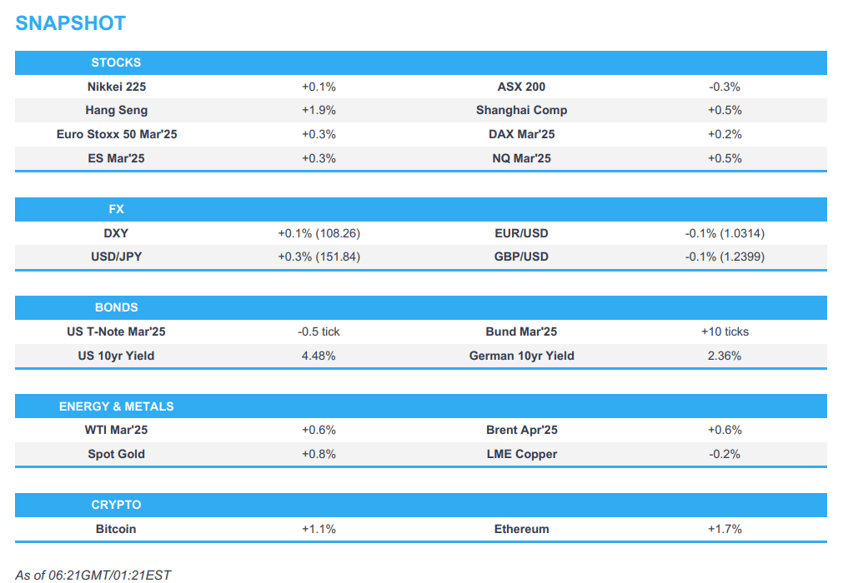

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed in the red on Friday in which they initially saw two-way action on the US jobs report, before the move lower began in the wake of the UoM metrics whereby all the three main measures printed below consensus and outside the forecast range, with inflation expectations for both the short term and longer-term horizon lifting. The move was then notably accentuated, along with Dollar and Treasury strength accompanied by oil weakness upon Reuters source reports noting US President Trump told Republican lawmakers he plans to issue reciprocal tariffs as early as Friday, while Trump later confirmed they will meet on reciprocal tariffs on Monday or Tuesday, and have an announcement, but lacked any further details.

- SPX -0.95% at 6,026, NDX -1.30% at 21,491, DJIA -0.99% at 44,303, RUT -1.19% at 2,280.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they will be announcing on Monday 25% tariffs on all steel and aluminium coming into the US and he will announce reciprocal tariffs on Tuesday or Wednesday which will go into effect almost immediately, while he added that no one can have a majority stake in US Steel (X).

- US President Trump said on Friday that he will make an announcement in the week ahead on reciprocal trade with many countries, while he added that tariffs are an option to address deficit and auto tariffs are always on the table. Furthermore, Trump said they will meet on reciprocal tariffs on Monday or Tuesday and have an announcement.

- Chinese officials may target Broadcom (AVGO) and Synopsys (SNPS) with probes and are building a list of US tech firms for potential probes, according to WSJ.

- Japanese PM Ishiba expressed optimism on Sunday that Japan could avoid higher US tariffs as noted that President Trump had "recognised" Japan's huge investment in the US and the American jobs that it creates.

- Australian PM Albanese said Australia will urge the US to give Australia exemption over steel tariffs.

- Indian PM Modi is prepared to discuss reducing import tariffs and buying more energy and defence equipment from the US when he meets with US President Trump next week, according to Indian officials cited by Bloomberg.

- EU is set to offer lower tariffs on US cars as part of a deal to avoid a trade war with US President Trump, according to a report in the FT on Friday citing sources.

- German Chancellor Scholz said the EU could act in an hour when asked in a pre-election debate if the EU was prepared for possible US tariffs.

NOTABLE HEADLINES

- Fed Governor Kugler (voter) said on Friday that a stable labour market gives the Fed time to make decisions, while she added they are not at 2% inflation and it makes sense to hold rates steady. Kugler said they want to make sure inflation progress continues and that the economy is resilient, as well as noted that the labour market is stable which gives them a little bit of time to make decisions. Kugler also said the inflation rate has gone sideways and firmed, and that it makes sense to hold the policy rate where it is. Furthermore, she said it is prudent to hold the policy rate steady for some time, citing inflation above 2%, a solid economy, and uncertainties, while she added that they need to see continued slowing of inflation to feel comfortable cutting rates.

- US President Trump announced he is revoking security clearances for former President Biden and stopping his daily intelligence briefings, while he stated that there was no need for Biden to have continued access.

- US President Trump said he instructed the Secretary of the US Treasury to stop producing new pennies which is wasteful, while he suggested tearing the waste out of the US budget, even if it's a penny at a time.

- US President Trump’s acting head of the consumer finance watchdog told staff to stop pending investigations and supervisory activities of banks, according to a Washington Post reporter.

- US House Speaker Johnson said he will push the ‘one big bill’ strategy for passing US President Trump’s tax cut agenda and Republicans will find offsets to pay for Trump’s tax cut plans, according to a Fox interview.

APAC TRADE

EQUITIES

- APAC stocks saw mixed price action as participants reflected on last Friday's NFP print and President Trump's latest tariff remarks in which he stated they will be announcing on Monday 25% tariffs on all steel and aluminium coming into the US and will announce reciprocal tariffs on Tuesday or Wednesday, while China's retaliatory tariffs against the US took effect.

- ASX 200 declined with the index led lower by underperformance in tech and telecoms, while miners also suffered owing to the US tariff threat although Australia will urge the US to give Australia exemption over steel tariffs.

- Nikkei 225 retreated at the open but the clawed back its losses as a weaker currency provided a cushion and with some optimism from Japanese PM Ishiba that Japan could avoid higher US tariffs following his recent meeting with US President Trump.

- Hang Seng and Shanghai Comp were positive following the recent CPI data from China which showed an acceleration and with the outperformance in Hong Kong led by notable strength in tech and telecom stocks. Nonetheless, the gains in the mainland were limited by the tariff and trade frictions after China's retaliatory tariffs against the US took effect and with officials also said to be building a list of US tech firms for potential probes.

- US equity futures (ES +0.3%, NQ +0.6%) were ultimately higher after recovering from the initial tariff-related dip at the reopen.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 future up 0.3% after the cash market closed with losses of 0.6% on Friday.

FX

- DXY was firmer to start the week after President Trump commented that they will be announcing 25% tariffs on all steel and aluminium coming into the US on Monday and will announce reciprocal tariffs on Tuesday or Wednesday. This boosted the dollar against most of its major peers and resulted in the early underperformance of CAD.

- EUR/USD briefly dipped beneath the 1.0300 level owing to the early dollar strength and with headwinds for the single currency amid the lingering US tariff threat against the EU.

- GBP/USD traded indecisively and reverted to the 1.2400 level amid light pertinent catalysts and a quiet calendar for the UK to start the week, although BoE Governor Bailey is scheduled to speak on Tuesday and Q4 GDP data is due on Thursday.

- USD/JPY continued its rebound from last week's trough and was unfazed by the upside in Japanese yields.

- Antipodeans initially retreated amid the tariff concerns with the US set to announce 25% tariffs on all steel and aluminium imports into the US, as well as reciprocal tariffs, as China's retaliatory tariffs took effect. However, antipodeans then staged a recovery as the effects of the tariff headlines waned.

- PBoC set USD/CNY mid-point at 7.1707 vs exp. 7.3050 (prev. 7.1699).

FIXED INCOME

- 10yr UST futures lacked direction with the attention in the US this week on tariffs, Powell's testimony and CPI data.

- Bund futures were uneventful after bouncing off near-term support around the 133.00 level late last week, while there were comments from German Chancellor Scholz that the EU could act in an hour when asked about readiness for possible US tariffs.

- 10yr JGB futures demand was subdued in the absence of tier-1 releases and as Japanese yields edged higher.

COMMODITIES

- Crude futures gradually advanced following US President Trump's tariff rhetoric but with gains capped amid the mixed risk appetite and after Trump commented that he spoke with Russian President Putin regarding ending the Ukraine war although offered very few details including when the call took place.

- Iraq set Basrah medium crude official selling price to Asia at a premium of USD 2.65/bbl vs Oman/Dubai average and to Europe at a discount of USD 1.25/bbl vs Dated Brent, while it set the OSP to North and South America at a discount of USD 0.65/bbl vs ASCI, according to SOMO.

- Estonia, Latvia and Lithuania have completed decoupling from the Russian power grid as planned and successfully synchronised their electricity systems to the European continental power grid.

- Spot gold steadily gained with the precious metal approach closer towards retesting last week's record highs.

- Copper futures were ultimately rangebound amid the mixed risk appetite and with only mild upside seen after President Trump said they will be announcing on Monday 25% tariffs on all steel and aluminium coming into the US.

CRYPTO

- Bitcoin saw two-way price action and rebounded from an earlier dip to test the USD 97,000 level to the upside.

NOTABLE ASIA-PAC HEADLINES

- Shein reportedly asked China suppliers to add production lines in Vietnam, according to Bloomberg.

- India's Finance Minister Sitharaman said a new income tax bill will be introduced in parliament in the week ahead.

DATA RECAP

- Chinese CPI MM (Jan) 0.7% vs. Exp. 0.8% (Prev. 0.0%)

- Chinese CPI YY (Jan) 0.5% vs. Exp. 0.4% (Prev. 0.1%)

- Chinese PPI YY (Jan) -2.3% vs. Exp. -2.1% (Prev. -2.3%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu dispatched a delegation to Qatar’s Doha for the next phase of ceasefire talks.

- Israeli military said operations in the northern West Bank expanded to Nur Shams, while it added that several terrorists were killed and wanted suspects were detained. It was separately reported that Israel’s army confirmed it received three hostages and said it struck a Hamas weapons depot in Syria.

- US President Trump said he is committed to buying and owning Gaza and may give sections to other states in the Middle East to rebuild it, while he added that they will make Gaza into a good site for future development. Trump also said that he will be meeting with Saudi Arabia’s Crown Prince MBS and Egyptian President Sisi, as well as noted that Middle Eastern nations will take Palestinians after those nations speak to him.

- Hamas official condemned US President Trump's remarks on Gaza ownership and said that Palestinians will foil all displacement plans, according to Reuters.

- Turkish President Erdogan said that they have no need to discuss or take seriously US President Trump’s Gaza plan, while he added that no one has the power to remove the people of Gaza.

- Qatar condemned statements by Israeli PM Netanyahu on establishing a Palestinian state inside Saudi territory.

- Iran’s Supreme Leader Khamenei met with visiting top Hamas leaders in Tehran.

- Egypt’s Foreign Minister heads to Washington for talks with US officials, according to AFP.

RUSSIA-UKRAINE

- US President Trump said on Friday that he has spoken to Russian President Putin by phone regarding ending the Ukraine war, according to the New York Post.

- US President Trump said he does not want to talk about his conversation with Russian President Putin but believes they are making progress and expects to have more conversations with Putin. Furthermore, Trump declined to say when they talked and noted that he would meet with Putin in person at the right time, according to Reuters.

- Russia’s Kremlin said it can neither confirm nor deny publications regarding the Putin-Trump conversation, while Russia’s envoy to the UN said Russia awaits appropriate signals from the US regarding contacts with Moscow and that Russia has not yet seen positive steps from the new US administration on disarmament, according to RIA.

- Russian Deputy Foreign Minister said Russia has not received any satisfactory proposals to start talks on Ukraine and statements by the West and Ukraine about an immediate start on talks are nothing but buzz building, according to RIA.

- Russian Defence Ministry said Russian forces captured Orikhovo-Vasylivka in eastern Ukraine, while it was also reported that Russia said its troops repelled three Ukrainian counterattacks in the Kursk region.

- Russia launched a drone attack on Ukraine's capital Kyiv, according to the Mayor.

OTHER

- North Korean leader Kim said the trilateral cooperation among the US, Japan and South Korea is raising a grave security challenge. It was also reported that North Korea noted its nuclear weapons are not a bargaining chip and that its nuclear forces are meant for combat against enemies that threaten global peace, according to KCNA.

EU/UK

NOTABLE HEADLINES

- UK Health Minister Andrew Gwynne was fired by PM Starmer over his WhatsApp messages which insulted constituents, fellow MPs and councillors.

- French President Macron said France will announce during the Paris AI summit opening on Monday EUR 109bln investments in AI over the coming years.

- Germany's election front-runner Merz said he was open to reforming Germany's borrowing rules amid pressure regarding defence spending financing, according to the FT.