It's not like it ever gets quiet any more, but this week will be especially busy week for central bank watchers with decisions due from the Fed, the BoJ (both Wednesday) and the BoE (Thursday), amongst others. Economic data highlights include retail sales in the US (today, which came in mixed), various US housing data, labor market stats in the UK (tomorrow) and inflation in Japan (Friday) and Canada (tomorrow).

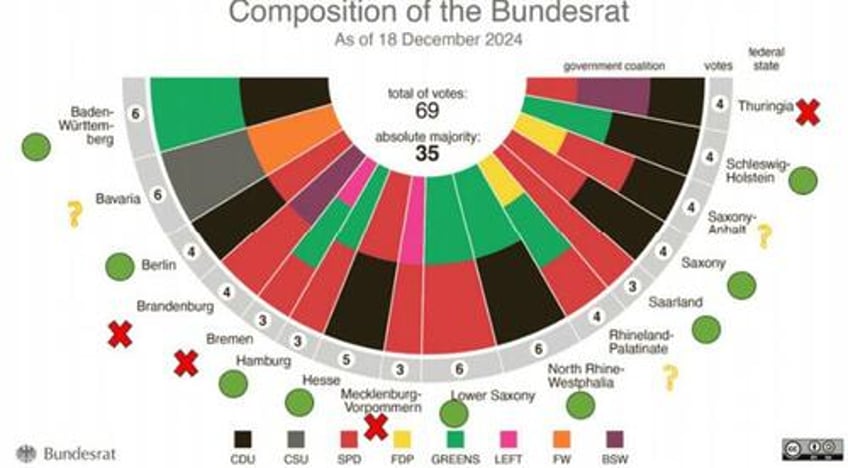

After we had the white smoke of a deal on Friday, the spotlight will be on the vote around the huge proposed fiscal expansion in Germany. The Bundestag and the Bundesrat are expected to hold votes tomorrow and Friday, respectively, before the new Bundestag sits from March 25. We'll preview these below. Note that overnight Trump has said he'll speak to Putin tomorrow so that's another thing to watch

The full day by day week ahead is at the end as usual but let's preview a few of the key events.

First, the Fed is widely expected to stay on hold on Wednesday. In their preview, DB economists still expect limited guidance about the policy path ahead given all the extreme uncertainty. The statement is likely to announce a pause in QT beginning in April, and forward guidance indicating that QT is expected to resume once the debt ceiling is resolved and the liability composition of the balance sheet normalizes. There are risks that a slowing is announced rather than a pause. The economists also expect the SEP to maintain two rate cut dots this year but with an upward drift in individual dots that could push the median dot to one cut as a risk. The economic projections will likely show higher inflation, somewhat weaker growth, and an unchanged forecast for the unemployment rate this year. Last week's inflation data looked softer on the surface but still point towards another strong core PCE print. Today’s retail sales are the last piece of data influencing the Fed, although printing inconclusive (miss on headline, big beat on control group), they won't be a huge help to markets.

According to Goldman, rates will not be the focus during the FOMC meeting as consensus/market pricing are firmly on no rate change with Fed indicating no hurry to cut until policy changes under the new administration become less volatile and uncertain and the outlook becomes clearer. Goldman economists believe that the Fed leadership would prefer for the median 2025 dot to continue to show two cuts this year to avoid adding to recent market turbulence but also see 2026 and 2027 median dots to remain unchanged, implying a path of 3.875% / 3.375% / 3.125% over 2025 / 2026 / 2027, though with higher means each year than last time. Finally, Goldman expects the FOMC’s median economic projections to show a 0.3% upward revision to 2025 core PCE inflation to 2.8% and a 0.3% downgrade to 2025 GDP growth to 1.8%, mainly reflecting the tariff news.

In terms of Germany, this week will be a landmark one with votes on the deal in the Bundestag tomorrow and the Bundesrat on Friday. With the deal agreed on Friday the bulk of the execution risk has been averted. Assuming it goes through, which must be now over 95% probability-wise according to DB's Jim Reid, this could lead to a fiscal stimulus of 3-4% of GDP by 2027 at the latest. So as DB says, don’t underestimate how huge this package is. That said there are still risks both in terms of the vote and the constitutional court ruling around whether not enough time was provided to scrutinize the deal. However the legislation is covered by less than 20 pages of text, so the legal risk here is low. Reid notes that in his view markets have fully caught up to how much of a game changer this will be for Germany over the next few years. Longer-term, Germany should use this period to embark on significant structural reform. Hopefully the comfort of higher growth towards the latter part of this decade won’t reduce the likelihood of this.

Back to central banks, the BoJ is expected to keep rates steady and the current monetary policy framework maintained on Wednesday. For the BoE, our UK economist expects the BoE to keep the Bank Rate unchanged at 4.5%.

In geopolitics, the Trump/Putin call on Tuesday could be a prelude to a ceasefire accord.

In micro, the NVDA GTC event will be a focus this week with the Jensen's Keynote late on Tuesday. Also have earnings from FDX, NKE and MU on Thursday.

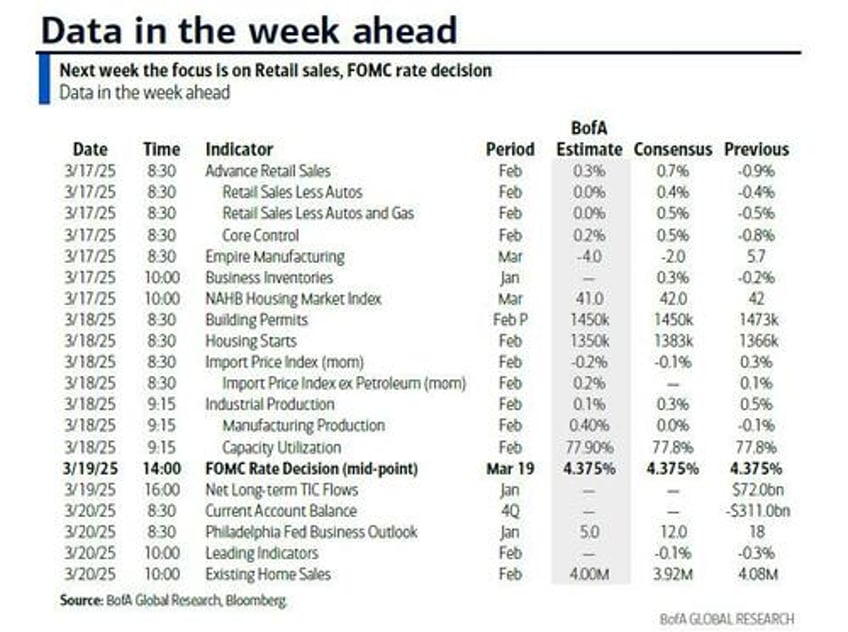

Courtesy of DB, here is a day-by-day calendar of events

Monday March 17

- Data: US February retail sales, March Empire manufacturing index, NAHB housing market index, January business inventories, China February home prices, industrial production, property investment, retail sales, Canada February existing home sales, housing starts, January international securities transactions

Tuesday March 18

- Data: US February industrial production, capacity utilisation, building permits, housing starts, import and export price index, March New York Fed services business activity, Japan January core machine orders, Tertiary industry index, February trade balance, Germany March Zew survey, Italy January trade balance, Eurozone March Zew survey, January trade balance, Canada February CPI

- Central banks: ECB’s Rehn and Escriva speak

- Earnings: Xiaomi, XPeng

- Auctions: US 20-yr Bond (reopening, $13bn)

Wednesday March 19

- Data: US January total net TIC flows, Japan January capacity utilisation, Eurozone Q4 labour costs, New Zealand Q4 GDP

- Central banks: Fed’s decision, BoJ’s decision, ECB’s Villeroy, Centeno, Guindos and Elderson speak

- Earnings: Vonovia, Tencent, Ping An Insurance, General Mills

Thursday March 20

- Data: US Q4 current account balance, March Philadelphia Fed business outlook, February leading index, existing home sales, initial jobless claims, China 1-yr and 5-yr loan prime rates, UK January average weekly earnings, unemployment rate, February jobless claims change, Japan February national CPI, Germany February PPI, Eurozone January construction output, Canada February industrial product price index, raw materials price index, Australia February labour force survey

- Central banks: BoE’s decision, Riskbank decision, SNB decision, ECB published economic bulletin, Lagarde, Lane and Villeroy speak

- Earnings: Nike, FedEx, Micron, Lennar, RWE, Accenture, PDD Holdings

- Auctions: US 10-yr TIPS (reopening, $18bn)

- Other: European Council meeting, through March 21

Friday March 21

- Data: UK March GfK consumer confidence, February public finances, France March manufacturing confidence, February retail sales, Italy January current account balance, ECB January current account, Eurozone March consumer confidence, Canada January retail sales

- Central banks: Fed’s Williams speaks, ECB’s Escriva speaks

- Earnings : Meituan, Carnival, Nio

* * *

Finally, looking at just the US, key economic data releases this week are the retail sales report on Monday and the Philadelphia Fed manufacturing index on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. New York Fed President Williams will deliver a speech on Friday.

Monday, March 17

- 08:30 AM Retail sales, February (GS +0.7%, consensus +0.6%, last -0.9%); Retail sales ex-auto, February (GS +0.4%, consensus +0.3%, last -0.4%); Retail sales ex-auto & gas, February (GS +0.5%, consensus +0.4%, last -0.5%); Core retail sales, February (GS +0.5%, consensus +0.3%, last -0.8%): We estimate core retail sales expanded 0.5% in February (ex-autos, gasoline, and building materials; month-over-month SA), reflecting continued growth in measures of card spending and payback for a particularly weak January reading but a slight drag from colder-than-usual weather. We estimate a 0.7% increase in headline retail sales, reflecting higher auto sales and gasoline prices.

- 08:30 AM Empire manufacturing index, March (consensus -2.0, last +5.7)

- 10:00 AM Business inventories, January (consensus +0.3%, last -0.2%)

- 10:00 AM NAHB housing market index, March (consensus 42, last 42)

Tuesday, March 18

- 8:30 AM Housing starts, February (GS +2.0%, consensus +1.1%, last -9.8%); Building permits, February (consensus -1.6%, last -0.6%)

- 08:30 AM Import price index, February (consensus -0.1%, last +0.3%)

- 09:15 AM Industrial production, February (GS +0.2%, consensus +0.2%, last +0.5%); Manufacturing production, February (GS +0.4%, consensus +0.3%, last -0.1%); Capacity utilization, February (GS 77.8%, consensus 77.8%, last 77.8%): We estimate industrial production increased +0.2%, reflecting a rebound in auto manufacturing and another month of strong utilities production due to increased demand for heating as a result of colder-than-usual temperatures. We estimate capacity utilization remained at 77.8%.

Wednesday, March 19

- 02:00 PM FOMC statement, March 18 – March 19 meeting: As discussed in our FOMC preview, we expect the FOMC to reiterate that it is not in a hurry to deliver further interest rate cuts and intends to remain on the sidelines until policy changes under the new administration become less volatile and uncertain and the outlook becomes clearer. While we expect FOMC participants to rethink their projections now that the first tariffs have taken effect and further tariff increases look likely, we suspect that the Fed leadership would nevertheless prefer for the median 2025 dot to continue to show two cuts this year to avoid adding to recent market turbulence. We also expect the 2026 and 2027 median dots to remain unchanged, implying a path of 3.875% / 3.375% / 3.125% over 2025 / 2026 / 2027, though with higher means each year than last time. The longer-run or neutral rate projection might continue to creep higher from 3% to 3.125%. We expect the FOMC’s median economic projections to show a 0.3pp upward revision to 2025 core PCE inflation to 2.8% and a 0.3pp downgrade to 2025 GDP growth to 1.8%, mainly reflecting the tariff news.

Thursday, March 20

- 08:30 AM Current account balance, Q4 (consensus -$330.0bn, last -$310.9bn); 08:30 AM Initial jobless claims, week ended March 15 (GS 215k, consensus 224k, last 220k): Continuing jobless claims, week ended March 8 (consensus 1,888k, last 1,870k)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS flat, consensus 8.0, last 18.1)

- 10:00 AM Existing home sales, February (GS +2.0%, consensus -3.4%, last -3.9%)

Friday, March 21

- There are no major economic data releases scheduled.

- 09:05 AM New York Fed President John Williams (FOMC voter) speaks: New York Fed President John Williams will deliver a keynote address at a conference in Nassau, Bahamas. Text and Q&A are expected. On March 4th, President Williams said he thought “the current stance of policy is good” and that he did not “see any need to change it right away.” Williams also noted that he “factor[s] in some effects of tariffs now on inflation because I think we will see some of those effects later this year,” and that he will “be watching carefully … [how] this is affecting consumer confidence, business confidence, the uncertainty around this and the effects on economic activity, employment, and things like that.”

Source: DB, Goldman