With the Fed on their media blackout ahead of next week's FOMC, things will be slightly quieter this week in terms of scheduled Fed talking heads and macro events after a hectic round of Fed speak last week including a market rollercoaster sparked by Powell's contradictory comments last Thursday which had a big impact on rates and the curve even if they haven't said much that adds to the debate as to whether the Fed is done and if so, how long they'll stay at these levels. The 2s10s and 2s30s both bear steepened more than 30bps last week (the most since post-SVB) even though 2yr yields were up +1.8bps, and as DB's Jim Reid notes overnight, "although we are fully bought in to the steepener trade I’m struggling to explain why it moved so much last week. Perhaps the long end continues to be hit by supply, US fiscal fears (maybe including extra funding for Israel), and concerns over where the oil price might go whereas the front end is receiving the (relative) flight to quality trade that few want to put on at the long-end." Perhaps the recent back-end moves and the Middle-East tensions are also making the market more comfortable that central banks won’t move again at the front-end even as oil goes higher (for a lenghtier discussion of what is moving yields, see "Morgan Stanley Explains The "Real Drivers" Behind The Rout In Treasuries").

As an aside, Reid cautions that he remains concerned "as to how markets will cope with such high yields at the back end of markets, especially those in the US. We spent 10-15 years with yields and rates low/zero/negative across the DM world, helped by QE as this was seen as the only way we could finance the enormous global debt load. If this synopsis is correct, then surely one of the biggest 2-3 year yield sell-offs in history risks causing a lot of pain beyond any seen so far."

If yields stay elevated, the only way I think I’ll be wrong is if we actually didn’t need those levels of rates and yields in the 2010s, or if central banks and governments have taken on enough of the risk just in time to avoid pain from higher yields. That argument is harder to buy in to with QT and strong government supply combining at the moment. On the risk of accidents it was interesting that the US Regional Bank index fell -3.53% on Friday and is down around -20% since the local peak in August and is less than 10% away from the crisis lows in Q2.

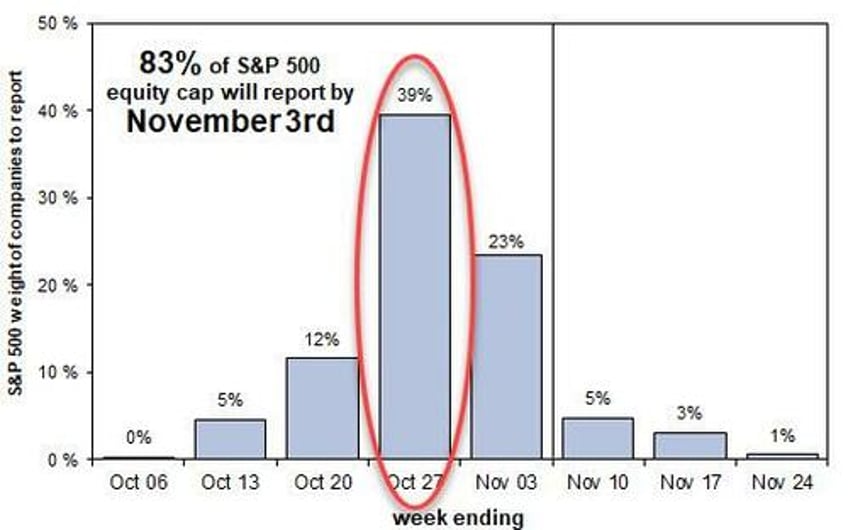

So going back to the calendar, it isn't the busiest week for data but there are a few important signposts which we'll go through below but such is the way of the world it wouldn't be a surprise if the big-tech results have as much impact as the data. This week we get 39% of SPX mkt cap reporting...

... including most of the giga-cap tech names such as Microsoft and Alphabet tomorrow, Meta on Wednesday and Amazon on Thursday, which together make up over $6tn in market cap, and nearly 17% of the S&P 500. Note that the 7th largest in the index Tesla fell -15.58% last week which was a bit of a blow for the mega caps but AI related stocks like Microsoft may fair better.

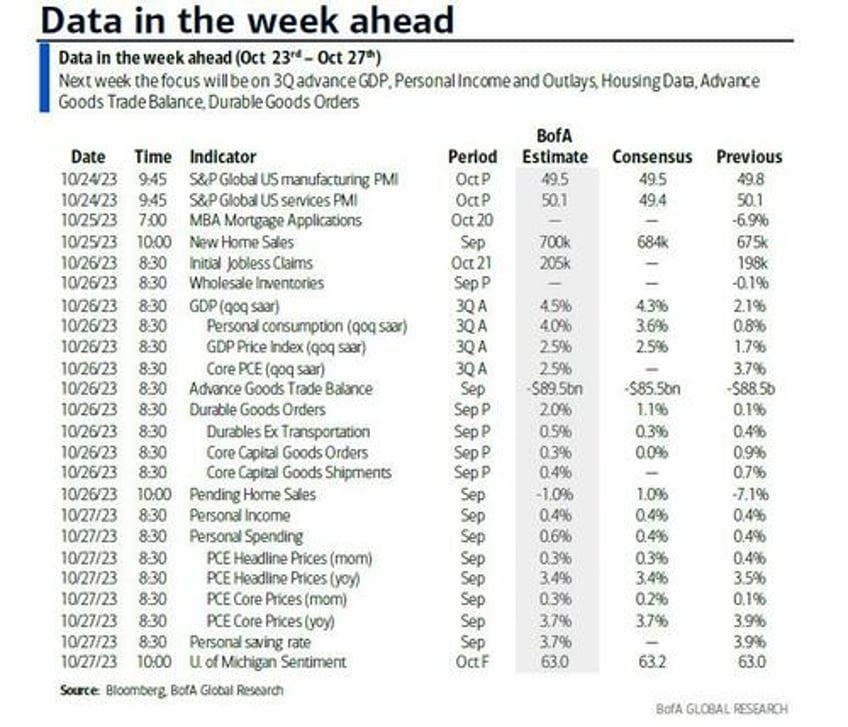

In the US, the data highlight might be the latest US core PCE reading as part of Friday’s consumer income and spending data. Investors will also keep an eye on the preliminary Q3 GDP report in the US where economists expect a 4.3% annualized number (vs. 2.1% in Q2) in what was a quarter that surprised almost everyone with its strength.

Elsewhere in the US we have durable goods orders (DB forecast -0.5% MoM vs +0.1% in August) and advance goods trade balance on Thursday, new home sales on Wednesday, and the final UoM consumer confidence numbers on Friday with the final inflation expectations reading.

In terms of macro events the ECB meeting on Thursday might be a little more dull than it has been for the last 15 months but there could be discussion as to how they will further reduce their balance sheet going forward (see our economists’ preview here). Tomorrow sees the latest quarterly ECB bank lending survey where the recent reports have suggested very tight lending standards but with expectations that this should loosen in the subsequent quarter. This optimism has reduced the concerns over current conditions so we will see if that improvement has materialised and whether it’s expected to continue.

The Bank of Canada will also decide on rates on Wednesday with markets only pricing in around a 10% probability of a hike.

The global flash PMIs tomorrow will also be important, especially to see if manufacturing and Germany can pick up from what are very low levels historically.

There will be more indicators of economic sentiment on the continent next week. This includes consumer confidence for the Eurozone today as well as a gauge for Germany (tomorrow) and France (Friday). Germany will also be in focus when it comes to business sentiment, with the Ifo survey due on Wednesday. In the UK, the focus will be on labour market data tomorrow with unemployment rate already 0.8pp above the lows, the most in the DM world. Moving on to Asia, key data releases in Japan include the Tokyo CPI on Friday and the services PPI on Thursday. This follows news from the Nikkei last night that the BoJ are looking at another tweak to its YCC policy. Our economist continues to believe they'll make changes at their meeting next week.

In terms of earnings, in addition to the US tech earnings mentioned at the top, we have a busy week with the key highlights mentioned in the day-by-day calendar at the end which also includes all the main data and other events.

Day-by-day calendar of events courtesy of DB

Monday October 23

- Data: US September Chicago Fed national activity index, Eurozone October consumer confidence

- Earnings: Cadence Design Systems

Tuesday October 24

- Data: US, UK, Japan, Germany, France and Eurozone October PMIs, US October Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, UK September jobless claims change, August unemployment rate, Japan September nationwide and Tokyo department store sales, Germany November GfK consumer confidence

- Central banks: Euro Area Bank Lending Survey

- Earnings: Microsoft, Alphabet, Visa, Coca-Cola, Novartis, Danaher, Texas Instruments, Verizon, General Electric, NextEra Energy, Fiserv, HCA Healthcare, UniCredit, General Motors, Halliburton, Dow Inc, Spotify, Norsk Hydro, Puma

Wednesday October 25

- Data: US September new home sales, Germany October Ifo survey, France Q3 total jobseekers, Eurozone September M3

- Central banks: Fed's Powell speaks, BoC decision

- Earnings: Meta, Thermo Fisher Scientific, T-Mobile, IBM, Boeing, Porsche AG, KLA, Heineken, Hilton, EQT

Thursday October 26

- Data: US Q3 GDP, personal consumption, core PCE, October Kansas City Fed manufacturing activity, September durable goods orders, advance goods trade balance, retail and wholesale inventories, pending home sales, initial jobless claims, Japan September services PPI

- Central banks: ECB decision, Fed's Waller speaks, BoE's Cunliffe speaks

- Earnings: Amazon, Mastercard, Merck & Co, Linde, Comcast, TotalEnergies, Intel, UPS, Honeywell, Bristol-Myers Squibb, American Tower, Altria, Northrop Grumman, Mercedes-Benz, SK Hynix, Boston Scientific, Iberdrola, Volkswagen, Vale, Chipotle, Ford Motor, STMicroelectronics, Keurig Dr Pepper, Hershey, Kenvue, Newmont, Neste Oyj, Royal Caribbean Cruises, Repsol, Novozymes, HelloFresh, Ubisoft, Hertz

Friday October 27

- Data: US September personal spending, personal income, PCE deflator, October Kansas City Fed services activity, China September industrial profits, Japan October Tokyo CPI, Italy September hourly wages, October economic sentiment, consumer, manufacturing confidence, August industrial sales, France October consumer confidence

- Central banks: Fed's Barr speaks

- Earnings: Exxon Mobil, Chevron, AbbVie, Sanofi, Equinor, Keyence, Charter Communications, Colgate-Palmolive, Eni, Covestro, Air France-KLM

* * *

Finally, turning to just the US, Goldman writes that the key economic data releases this week are the Q3 GDP advance release and durable goods report on Thursday, and the core PCE inflation report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period in advance of the FOMC meeting October 31-November 1.

Monday, October 23

- No major data releases.

Tuesday, October 24

- 09:45 AM S&P Global US manufacturing PMI, October preliminary (consensus 49.4, last 49.8): S&P Global US services PMI, October preliminary (consensus 49.9, last 50.1)

- 10:00 AM Richmond Fed manufacturing index, October (consensus 3, last 5)

Wednesday, October 25

- 10:00 AM New home sales, September (GS +2.0%, consensus +1.0%, last -8.7%)

- 04:35 PM Fed Chair Powell speaks: Fed Chair Jerome Powell will deliver brief remarks introducing the Moynihan Prize recipient at the 2023 Moynihan Lecture in Social Science and Public Policy. Speech text will be available, but Powell is not expected to comment on monetary policy given the FOMC blackout period.

Thursday, October 26

- 08:30 AM GDP, Q3 advance (GS +4.6%, consensus +4.3%, last +2.1%); Personal consumption, Q3 advance (GS +4.0%, consensus +4.0%, last +0.8%): We estimate that GDP rose 4.6% annualized in the advance reading for Q3, following +2.1% annualized in Q2. Our forecast reflects strong consumption growth (+4.0% qoq ar) and a +1.1pp contribution from net exports but a more modest gain in business fixed investment (+0.7%).

- 08:30 AM Durable goods orders, September preliminary (GS +4.0%, consensus +1.5%, last +0.1%); Durable goods orders ex-transportation, September preliminary (GS +0.2%, consensus +0.3%, last +0.4%);Core capital goods orders, September preliminary (GS -0.1%, consensus flat, last +0.9%); Core capital goods shipments, September preliminary (GS -0.1%, consensus +0.3%, last +0.7%): We estimate that durable goods orders rose 4.0% in the preliminary September report (mom sa), reflecting a jump in commercial aircraft orders. We forecast softer details however, including a 0.1% decline in both core capital goods orders and core capital goods shipments following outsized strength in August. Industrial production of business equipment also declined in the month.

- 08:30 AM Wholesale inventories, September preliminary (consensus +0.1%, last -0.1%)

- 08:30 AM Advance goods trade balance, September (GS -$88.5bn, consensus -$86.0bn, last revised -$84.6bn)

- 08:30 AM Initial jobless claims, week ended October 21 (GS 200k, consensus 208k, last 198k); Continuing jobless claims, week ended October 14 (GS 1,750k, consensus 1,738k, last 1,734k)

- 10:00 AM Pending home sales, September (GS -2.0%, consensus -1.6%, last -7.1%)

- 11:00 AM Kansas City Fed manufacturing index, October (last -8)

- 04:00 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver opening remarks at the Fed's Economics of Payments XII Conference. Speech text will be available, but Waller is not expected to comment on monetary policy.

Friday, October 27

- 08:30 AM Personal income, September (GS +0.6%, consensus +0.4%, last +0.4%); Personal spending, September (GS +0.5%, consensus +0.5%, last +0.4%); PCE price index, September (GS +0.34%, consensus +0.3%, last +0.4%); Core PCE price index, September (GS +0.28%, consensus +0.3%, last +0.1%): Based on the details of the PPI, CPI, and import price reports, we estimate that the core PCE price index rose 0.28% in September, corresponding to a year-over-year rate of +3.69%. Additionally, we expect that the headline PCE price index increased 0.34% in September or increased 3.45% from a year earlier. Our forecast is consistent with core services ex housing inflation of 0.32% and with a 0.26% increase in our trimmed core PCE measure (vs. 0.17% in August and 0.20% in July).

- 09:00 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will deliver opening remarks at the second day of the Fed's Economics of Payments XII Conference. Speech text will be available, but Barr is not expected to comment on monetary policy.

- 10:00 AM University of Michigan consumer sentiment, October final (GS 63.0, consensus 63.2, last 63.0); University of Michigan 5–10-year inflation expectations, October final (GS 2.9%, consensus 3.0%, last 3.0%): We expect the University of Michigan consumer sentiment index to remain at 63.0 and for the report's measure of long-term inflation expectations to be revised down one tenth to 2.9%, reflecting the pullback in gasoline prices.

Source: Deutsche Bank, Goldman, BofA