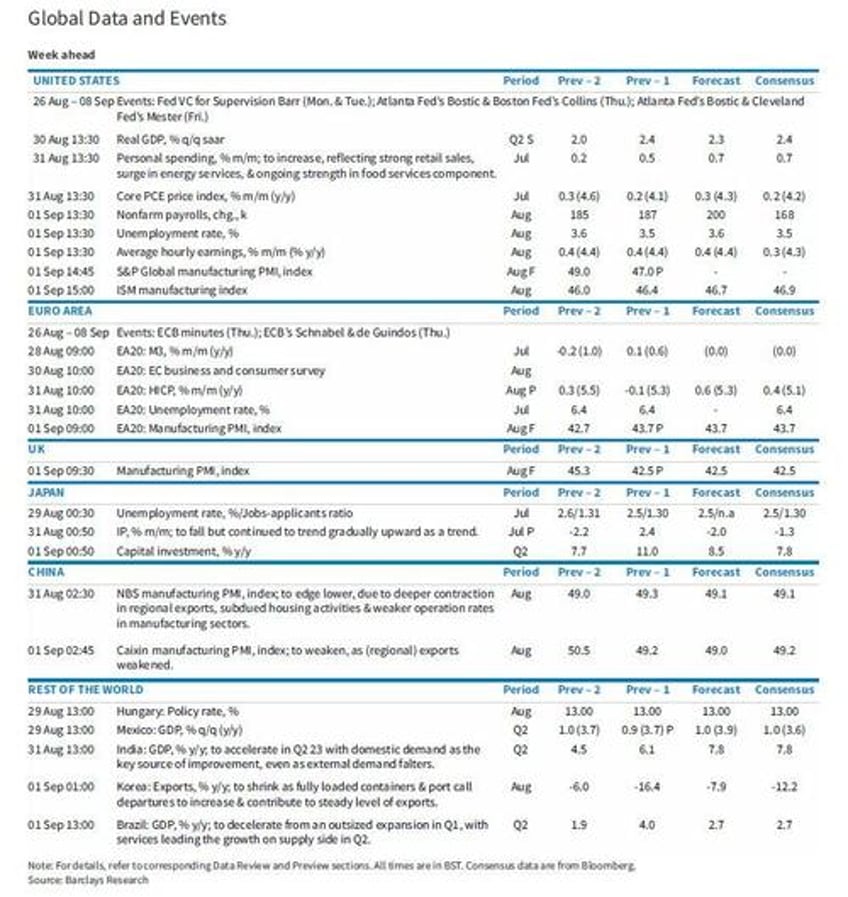

Thanks to a UK holiday, it's a quiet start to what is shaping up as a busy final week of August, and the summer. The main event this week is the August payrolls report on Friday; we also get JOLTS job openings on Tuesday, the Q2 GDP revision on Wednesday, core PCE on Thursday, and the ISM report on Friday. There are several speaking engagements from Fed officials this week, including remarks from presidents Bostic, Collins and Mester.

A day by day analysis of the global key events courtesy of Rabobank:

Monday: Aussie retail sales for July printed at 0.5%, much stronger than the 0.2% estimate of the Bloomberg survey. Might this be an indication that predictions of an end to the rate hiking cycle are premature? Later today we get the Dallas Fed’s manufacturing activity index, which is expected to be slightly less bad at -19 as well as a number of central bank speakers including Nagel and Holzmann from the ECB and Barr from the Fed.

Tuesday: Japanese labor market data is first up with the unemployment rate expected to hold at 2.5% in July and the job to applicant ratio also expected to hold at 1.3x. Following that, we have consumer confidence surveys out in Germany and France, July retail sales for Spain (6.7% YoY expected) and a climate-change related speech from current RBA Deputy (soon to be Supremo) Michele Bullock. The big-ticket items of the day will be the Conference Board survey and the JOLTS survey out of the USA. The Fed’s Barr will also be speaking on banking services.

Wednesday: NZ building permits for July gets the ball rolling ahead of similar data for Australia and the July monthly CPI inflation gauge from the ABS. We will get preliminary August CPI figures for Germany (6% expected) and Spain (expected to accelerate to 2.5% YoY) ahead of the second read of US 2nd quarter GDP.

Thursday: NZ business confidence is the first print of the day, followed by Aussie private sector credit and CAPEX figures. The major release of the Asian session will be Chinese PMI data for August, where the contraction in manufacturing is expected to worsen to 49.1 and services are seen slowing to 51.1. German July retail sales are expected to have grown by 0.3% MoM, while preliminary French CPI for August is seen accelerating to 4.6% YoY from 4.3% previously. We will also get German labour market data, where the unemployment rate is expected to lift one tick to 5.7%, and Italian preliminary CPI figures for August where price growth is expected to have slowed to 5.6% YoY. The major release of the day will be the US core PCE deflator for July. The Bloomberg survey suggests market expectations of inflation accelerating to 3.3% YoY in July.

Friday: NZ consumer confidence figures are the first release of the day ahead of Caixin manufacturing PMI data for China, Nationwide house prices for the UK and manufacturing PMIs for Europe, the UK, Canada and the USA. That data will likely be overshadowed slightly by the US non-farm payrolls report, which should be the highlight of the week. Payrolls are expected to have grown by 168k in August, while the unemployment rate holds steady at 3.5% and average hourly earnings tick lower to 4.3% YoY. Friday will also bring Q2 GDP data for Canada, where growth is seen slowing to 1.2% annualized, as well as the August ISM survey. Central bank speakers include Raphael Bostic and Loretta Mester from the Fed

And here is Goldman, focusing on just the US:

Monday, August 28

10:30 AM Dallas Fed manufacturing index, August (consensus -19.0, last -20.0)

01:30 PM Fed Vice Chair Michael Barr speaks about banking services: Fed Vice Chair for Supervision Michael S. Barr speaks in roundtable conversation with Confederated Salish and Kootenai Tribes Council. Q&A with moderator is expected.

Tuesday, August 29

09:00 AM S&P Case-Shiller 20-city home price index, June (GS +0.9%, consensus +0.80%, last +0.99%)

10:00am JOLTS job openings, July (GS 9400k, consensus 9450K, last 9582k)

10:00 AM Conference Board consumer confidence, August (GS 116.8, consensus 116.5, last 117.0): We estimate that the Conference Board consumer confidence index edged down to 116.8 in August.

10:30 AM Dallas Fed services index, August (consensus n.a., last -4.2)

03:00 PM Fed Vice Chair Michael Barr speaks about banking services: Fed Vice Chair for Supervision Michael S. Barr takes part in roundtable conversation with Blackfeet Business Council. Q&A with moderator is expected.

Wednesday, August 30

08:15 AM ADP employment change, August (GS 150k, consensus 198k, last 324k): We estimate a 150k rise in ADP payroll employment in August, reflecting solid but sequentially softer Big Data employment indicators. We also note that ADP employment growth has slowed in August in 6 of the last 7 years.

08:30 AM Advance goods trade balance, July (GS -$87.0bn, consensus -$90.0bn, last revised -$88.8bn)

08:30 AM GDP, Q2 second release (GS +2.6%, consensus +2.4%, last +2.4%): Personal consumption, Q2 second release (GS +1.8%, consensus +1.8%, last +1.6%): We estimate a 0.2pp upward revision to Q2 GDP growth to +2.6% (qoq ar), reflecting upward revisions to consumer spending, government spending, and business fixed investment—partially offset by downward revisions to inventory investment.

08:30 AM Wholesale inventories, July preliminary (consensus -0.3%, last -0.5%)

08:30 AM Retail inventories, July (consensus +0.5%, last +0.7%)

10:00 AM Pending home sales, July (GS +0.5%, consensus -1.0%, last +0.3%)

Thursday, August 31

03:15 AM Atlanta Fed President Bostic (FOMC non-voter) gives speech in South Africa: President Bostic will give a speech and participate in a panel discussion at the South African Reserve Bank's biennial research conference. Speech text will be made available. Q&A with audiences is expected. On August 1, Bostic said in a press briefing that “there has been significant progress in the battle.” and he doesn’t see need for a September hike.

08:31 AM Initial jobless claims, August (GS 225k, consensus 235k, last 230k): Continuing claims, August (consensus 1705K, last 1702k)

08:30 AM Personal income, July (GS +0.5%, consensus +0.3%, last +0.3%); Personal spending, July (GS +0.7%, consensus +0.7%, last +0.5%); 08:30 AM PCE price index, July (GS +0.21%, consensus +0.2%, last +0.2%); Core PCE price index, July (GS +0.21%, consensus +0.2%, last +0.2%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.21% month-over-month in July, corresponding to a 4.24% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.21% in July, corresponding to a 3.28% increase from a year earlier. We expect that personal income increased by 0.5% and personal spending increased by 0.7% in July (mom sa).

09:45am Chicago PMI, August (GS 45.0, consensus 44.1, last 42.8): We estimate that the Chicago PMI rebounded by 2.2pt to 45.0 in August. Our GS manufacturing tracker rose by 1.4pt to 49.1.

09:00 AM Boston Fed President Collins (FOMC non-voter) speaks on community colleges: Federal Reserve Bank of Boston President Susan Collins to speak on the role community colleges play in the nation’s essential development of its people and workforce. Speech text will be made available. On July 11, Collins said in her Boston TV interview “my expectation is that we will need to hold rates at a level that will help us to slow demand and realign demand and supply for some time, and so my baseline is that we will need to hold at least through this year and that we’ll start bring rates down next year.”

Friday, September 1

06:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks on US monetary policy: Federal Reserve Bank of Atlanta President Raphael Bostic takes part in panel discussion with SARB governor Lesetja Kganyago, IMF first deputy managing director Gita Gopinath, and Huw Pill, chief economist and executive director for Monetary Analysis and Research at the Bank of England in Cape Town. The panel discussion will be livestreamed. Q&A with audiences is expected.

08:30 AM Nonfarm payroll employment, August (GS +149k, consensus +168k, last +187k); Private payroll employment, August (GS +124k, consensus +150k, last +172k); Average hourly earnings (mom), August (GS +0.20%, consensus +0.3%, last +0.4%); Average hourly earnings (yoy), August (GS +4.25%, consensus +4.3%, last +4.4%); Unemployment rate, August (GS 3.5%, consensus 3.5%, last 3.5%); Labor force participation rate, August (GS 62.6%, consensus 62.6%, last 62.6%): We estimate nonfarm payrolls rose by 149k in August (mom sa). Big Data indicators indicate solid but generally slowing job growth, and August payrolls has exhibited a consistent negative bias in the initial prints (subsequently revised higher in each of the last five years). Our forecast also embeds a 26k one-time drag from the combination of Hollywood worker strikes (-18k) and Yellow trucking layoffs (-8k). We estimate that the unemployment rate was unchanged at 3.5%, reflecting a modest rise in household employment and unchanged labor force participation (at 62.6%). We estimate a 0.20% increase in average hourly earnings (mom sa) that lowers the year-on-year rate to 4.25%, reflecting waning wage pressures and negative calendar effects (the latter worth -5bps, on our estimates).

09:45 AM S&P Global US manufacturing PMI, August final (consensus 47.0, last 47.0)

09:45 AM Cleveland Fed President Mester (FOMC non-voter) speaks on inflation: Federal Reserve Bank of Cleveland President Loretta Mester speaks at European Central Bank and Cleveland Fed's Center for Inflation Research conference - Inflation: Drivers and Dynamics Conference 2023. The talk will be livestreamed, and the text will be made available. Q&A with audiences is expected. On August 25, Cleveland President Mester said it’s quite possible the central bank will raise rates again and the key issue is to decide how restrictive monetary policy needs to be and how long it needs to stay at those levels.

10:00 AM Construction spending, July (consensus +0.5%, last +0.5%)

10:00 AM ISM manufacturing index, August (GS 47.0, consensus 47.0, last 46.4): We estimate that the ISM manufacturing index rebounded by 0.6pt 47.0 in August, reflecting the net pickup in US regional surveys but the mixed recovery in East Asian industrial activity. Our GS manufacturing tracker rose by 1.4pt to 49.1.

05:00 PM Lightweight motor vehicle sales, May (GS 15.3mn, consensus 15.5mn, last 15.7mn)

Source: Rabobank, Goldman