This week's economic calendar is packed with important events, including potential US tariff actions as the White House weighs tariff actions on its largest trade partners. Recall that President Trump signaled that the Administration would implement 25% tariffs on Canada and Mexico as well as another 10ppts on China on Tuesday in response to those countries' failure to stem the flow of illegal drugs into the US. Barring any last minute negotiations, these tariffs are expected to come into effect; US commerce secretary Lutnick said on Fox yesterday that they will be implemented but that the level is still being decided. That could signal some room for the 25% on Canada and Mexico to be lower. On top of that Trump is set to address a joint session of Congress outlining his agenda tomorrow, his first such speech since his inauguration last month.

The fallout from an extraordinary televised row on Friday in the Oval Office between Trump and JD Vance on one hand and Zelenskiy on the other will also be a big talking point. Yesterday we had a large number of NATO countries’ leaders convene in London for an emergency (another!) summit on Ukraine. This was planned before Friday’s argument in the White House but it took on added importance after the clash. There was a lot of solidarity for Ukraine after the meeting but a lot still hinges on the US's involvement.

In Germany things are moving fast after the election and speculation has increased over special funds for defence and infrastructure being established while the existing parliament sits rather than wait for the new one where centrist policies won't have the two-thirds majority to reform the debt break on their own. Reuters reported yesterday that economists advising the talks have suggested the need for a EU400bn fund for defence and a EU400-500bn one for infrastructure. If this actually occurs before the new coalition is formed it will be a real positive "shock and awe" for Germany and Europe. Let's see what we hear on this in the coming days. Things continue to move at pace in Europe and after we paraphrased Lenin's famous "There are decades where nothing happens; and there are weeks where decades happen" quote two weeks ago, after the Munich Security Conference, the phrasing might need to be updated from weeks to days!

In terms of the data, the main focus will be on the US jobs report (Friday) and ISM indices in the US (today and Wednesday). Powell has a keynote economic speech on Friday to look forward to.

In Europe, the ECB will likely cut rates a further 25bps on Thursday, the same day as a special EU summit on defence and Ukraine is set to take place. It’s getting hard to keep up with all these summits and emergency meetings. MNI sources yesterday suggested that we will hear about a EU100bn common funding for defence at this meeting which is a mere drop in the ocean as to what Europe will likely need to spend on defence in the next several years.

In China we will get the annual session of 14th NPC starting on Wednesday where the government is expected to outline its plans for 2025 including targets for the fiscal deficit and government bond issuance (full preview to follow). In Japan, the release of the annual shunto wage hike demands by labor unions on Thursday is a key event.

As earnings season winds down after 485 of the S&P 500 and 310 of the Stoxx 600 have now reported, maybe keep an eye out for Broadcom's results on Thursday which is the next cab off the ranks in terms of the Mag-7 or a firm member of the BATMMAAN group of stocks. Their market cap briefly went above Tesla last week and is only just behind now.

Going through a couple of the main events this week in a little more detail now and all roads point to the tariff deadline tomorrow and payrolls on Friday. DB economists have previously said that 25% tariffs on Canada and Mexico, If sustained, would likely create a 0.4-0.7ppts drag on 2025’s US GDP and boost core PCE by 0.3-0.7ppts. It is possible that the revenues from the tariffs allow for larger US tax cuts which may help reduce the growth impact but we’re also starting to see some of the trade uncertainty hit confidence so there are a lot of moving parts. Overall, it’s hard to see China tariffs being negotiated lower but there’s still a chance that those on Mexico and Canada are lower than 25% as hinted by Lutnick yesterday. We will see today.

With regards to payrolls, our economists expect headline (160k forecast vs. 143k previously) and private (150k vs. 111k) payroll gains to rebound from weather-related and potential seasonal-factor related drags in the prior month. However there is a drag factored in from the start of federal government layoffs even if March may see a larger impact. DB think the unemployment rate will tick up a tenth to 4.1%. Today’s manufacturing ISM (DB at 51.8 vs. 50.9 last month) and Wednesday’s services ISM (DB at 52.1 vs. 52.8) will have employment components that along with Wednesday’s ADP report may sharpen the street’s forecasts as the week progresses.

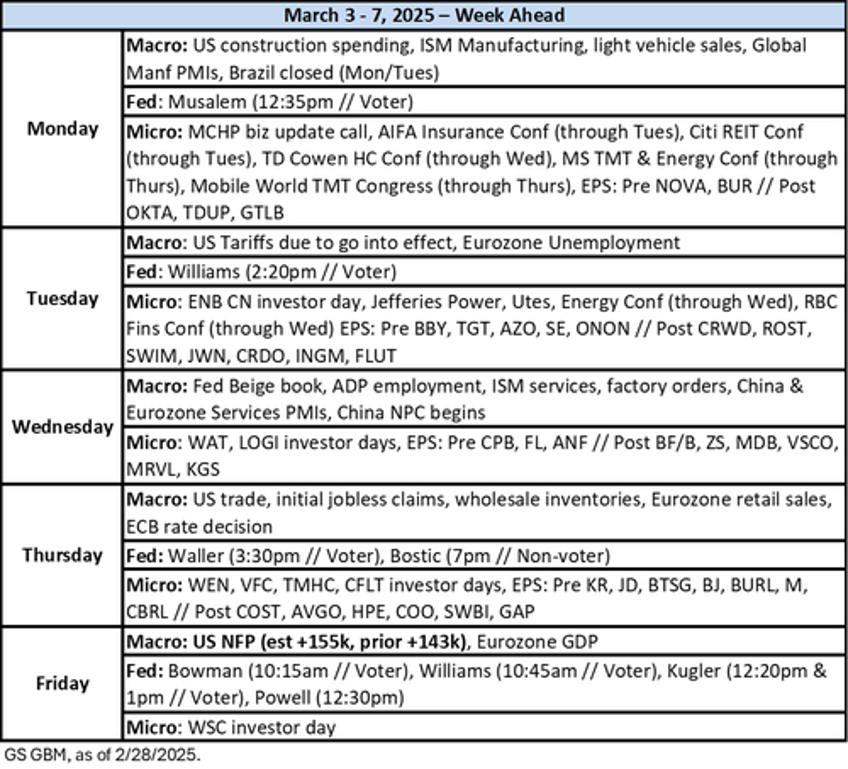

Courtesy of DB, here is a day-by-day calendar of events

Monday March 3

- Data: US February ISM index, total vehicle sales, January construction spending, China February Caixin manufacturing PMI, UK January net consumer credit, M4, Japan January jobless rate, job-to-applicant ratio, Q4 MoF survey, February monetary base, Italy February manufacturing PMI, new car registrations, budget balance, Eurozone February CPI, Canada February manufacturing PMI

- Central banks: Fed's Musalem speaks

- Earnings: Okta, AST SpaceMobile

Tuesday March 4

- Data: Japan February consumer confidence index, France January budget balance, Italy January unemployment rate, Eurozone January unemployment rate

- Central banks: Fed's Williams speaks

- Earnings: Crowdstrike, Sea, Flutter Entertainment, Thales, Ashtead, On Holding, Davide Campari-Milano

Wednesday March 5

- Data: US February ISM services, ADP report, January factory orders, China February Caixin services PMI, UK February new car registrations, official reserves changes, France January industrial production, Italy February services PMI, January retail sales, Eurozone January PPI, Canada Q4 labor productivity, Australia Q4 GDP, Switzerland February CPI

- Central banks: Fed's Beige Book, BoJ's Uchida speaks, BoE's Bailey, Pill, Greene and Taylor speak

- Earnings: Marvell, adidas, Zscaler, Bayer, Sandoz, Abercrombie & Fitch

Thursday March 6

- Data: US January trade balance, wholesale trade sales, initial jobless claims, UK February construction PMI, Germany February construction PMI, Eurozone January retail sales, Canada January international merchandise trade, Sweden February CPI

- Central banks: ECB's decision, Fed's Waller speaks, BoE's DMP survey

- Earnings: Broadcom, Costco, JD.com, Merck KGaA, Universal Music Group, Reckitt Benckiser, Hewlett Packard Enterprise

Friday March 7

- Data: US February jobs report, January consumer credit, China February foreign reserves, trade balance, Germany January factory orders, France January trade balance, current account balance, Canada February jobs report, Q4 capacity utilisation rate

- Central banks: Fed's Powell, Kugler, Bostic, Bowman and Williams speak, ECB's Lagarde, Nagel, Knot, Panetta, Kazaks and Centeno speak, BoE's Mann speaks

Finally, looking at the just the US, the key economic data releases this week are the ISM manufacturing and services reports on Monday and Wednesday and the employment report on Friday. Tariffs on Mexico, Canada, and China are scheduled to take effect on Tuesday. There are several speaking engagements by Fed officials this week including Chair Powell and Governors Waller, Bowman, and Kugler.

Monday, March 3

- 09:45 AM S&P Global US manufacturing PMI, February final (consensus 51.6, last 51.6)

- 10:00 AM Construction spending, January (GS +0.1%, consensus -0.1%, last +0.5%)

- 10:00 AM ISM manufacturing index, February (GS 51.5, consensus 50.8, last 50.9): We estimate the ISM manufacturing index increased slightly in February (+0.6pt to 51.5), reflecting mixed manufacturing surveys so far for February but a tailwind from residual seasonality.

- 12:35 PM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will give a keynote luncheon speech at a National Association for Business Economics conference on the US economy and monetary policy. Speech text and Q&A are expected. On February 20, Musalem said, "I judge that monetary policy is modestly restrictive, and meaningfully less restrictive than it was six months ago. Monetary policy is well positioned to address risks to both sides of the Fed’s dual mandate."

- 05:00 PM Lightweight motor vehicle sales, February (GS 16.4mn, consensus 16.1mn, last 15.6mn)

Tuesday, March 4

- There are no major economic data releases scheduled.

- 02:20 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will be interviewed by Bloomberg's Michael McKee at the Bloomberg Invest Forum. On February 11, Williams said, "Monetary policy is well positioned to achieve maximum employment and price stability. The modestly restrictive stance of policy should support the return to 2 percent inflation while sustaining solid economic growth and labor market conditions."

Wednesday, March 5

- 08:15 AM ADP employment change, February (GS +125k, consensus +146k, last +183k)

- 09:45 AM S&P Global US services PMI, February final (consensus 49.7, last 49.7)

- 10:00 AM Factory orders, January (GS +1.7%, consensus +1.6%, last -0.9%); Factory orders ex-transportation, January (last +0.3%); Durable goods orders, January final (consensus +3.1%, last +3.1%); Durable goods orders ex-transportation, January final (last flat); Core capital goods orders, January final (last +0.8%); Core capital goods shipments, January final (last -0.3%);

- 10:00 AM ISM services index, February (GS 52.5, consensus 52.7, last 52.8): We estimate that the ISM services index edged down to 52.5 in February, reflecting sequential softening in our non-manufacturing survey tracker (-0.8pt to 53.2 in February) but a tailwind from residual seasonality.

- 02:00 PM Beige Book, March meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the January FOMC meeting period noted that economic activity and consumer spending increased slightly to moderately across all districts. Manufacturing activity decreased slightly on net and "a number of districts said manufacturers were stockpiling inventories in anticipation of higher tariffs." In this month’s Beige Book, we look for anecdotes related to the evolution of labor demand and firms’ expectations of activity growth for the remainder of the year.

Thursday, March 6

- 08:30 AM Trade Balance, January (GS -$129.2bn, consensus -$128.7bn, last -$98.4bn)

- 08:30 AM Nonfarm productivity, Q4 final (GS +1.3%, consensus +1.2%, last +1.2%); Unit labor costs, Q4 final (GS +2.3%, consensus +3.0%, last +3.0%)

- 08:30 AM Initial jobless claims, week ended March 1 (GS 230k, consensus 235k, last 242k); Continuing jobless claims, week ended February 22 (consensus 1,875k, last 1,862k)

- 08:45 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will speak on economic education. Speech text and Q&A are expected. On February 27, Harker said, "The policy rate remains restrictive enough to continue putting downward pressure on inflation over the longer term, as we need it to, while not negatively impacting the rest of the economy."

- 10:00 AM Wholesale inventories, January final (consensus +0.7%, last +0.7%)

- 03:30 PM Fed Governor Waller speaks: Federal Reserve Governor Christopher Waller will speak on the economic outlook with WSJ's Nick Timiraos. On February 18, Waller said, "I continue to believe that the current setting of monetary policy is restricting economic activity somewhat and putting downward pressure on inflation. If this winter-time lull in progress is temporary, as it was last year, then further policy easing will be appropriate. But until that is clear, I favor holding the policy rate steady."

- 07:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak to The Birmingham Business Journal about the economic outlook. Q&A is expected.

Friday, March 7

- 08:30 AM Nonfarm payroll employment, February (GS +170k, consensus +160k, last +143k); Private payroll employment, February (GS +150k, consensus +143k, last +111k); Average hourly earnings (MoM), February (GS +0.3%, consensus +0.3%, last +0.5%); Unemployment rate, February (GS 4.0%, consensus 4.0%, last 4.0%); Labor force participation rate, February (GS 62.6%, consensus 62.6%, last 62.6%): We estimate nonfarm payrolls rose 170k in February. On the positive side, big data indicators indicated a firm pace of job creation. Additionally, we expect continued above-trend (albeit moderating) contributions from catch-up hiring and the recent surge in immigration. On the negative side, we expect a limited drag—we assume 10k—from the combined reduction in force actions of the federal government, consisting of layoffs, a hiring freeze, and a deferred resignation program. Striking workers will be a 5k net drag, according to the strike report. We expect the net impact of the winter weather—an even colder-than-usual February than January but less snowfall on a seasonally adjusted basis—on job growth to be roughly neutral. We estimate that the unemployment rate was unchanged at 4.0% on a rounded basis and that the participation rate was unchanged at 62.6%. We estimate average hourly earnings rose 0.3% (month-over-month, seasonally adjusted), reflecting waning wage pressures but positive calendar effects.

- 10:15 AM Fed Governor Bowman speaks: Federal Reserve Governor Michelle Bowman will discuss the 2025 US Monetary Policy Forum report at a conference in New York. Speech text and Q&A are expected. On February 18, Bowman said, "Assuming the economy evolves as I expect, I think that inflation will slow further this year," but noted, " I continue to see greater risks to price stability, especially while the labor market remains strong." She later commented, "I would like to gain greater confidence that progress in lowering inflation will continue as we consider making further adjustments to the target range."

- 10:45 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will discuss the 2025 US Monetary Policy Forum report at a conference in New York. Speech text and Q&A are expected.

- 12:20 PM Fed Governor Kugler speaks: Federal Reserve Governor Adriana Kugler will give a speech on rebalancing labor markets around the world at the Bank of Portugal’s Conference on Monetary Policy Transmission and the Labor Market. Speech text and Q&A are expected.

- 12:30 PM Fed Chair Powell speaks: Federal Reserve Chair Jerome Powell will give the lunch keynote speech on the economic outlook at the 2025 US Monetary Policy Forum. Speech text and Q&A are expected.

- 01:00 PM Fed Governor Kugler speaks: Federal Reserve Governor Adriana Kugler will speak on monetary policy in a panel discussion at Bank of Portugal’s Conference on Monetary Policy Transmission and the Labor Market. Q&A is expected.

Source: DB, Goldman, BofA