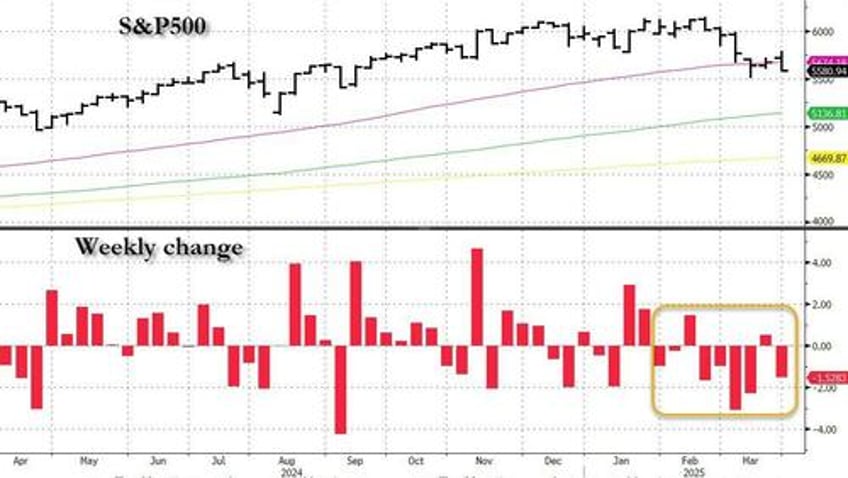

After a modest bounce the week prior, last week saw US equities resume their selloff for the 5th week in the past 7, and 2nd in the past 9, as a strong start to the week quickly gave way to more trade-related jitters and macro concerns. More importantly, the S&P closed back under the 200DMA (which, as Albert Edwards warns us, is a problem as "nothing good ever happens below the 200DMA".)

As Goldman's Share Sales trading desk writes in its Weekly Rundown note, on the week, SPX -1.5%, NDX -2.4%, RTY -1.9% with investors fatigued on lack of macro visibility and doses of downbeat updates. Yet despite the magnitude of the moves, large de-risking was mostly via macro products or rotational in nature within sectors. Goldman notes that from a flow perspective, Long Onlies and HFs have sold -$3b.5b and -$1.5b, respectively. Asset Manager sales are still present but now at a slower velocity and rotational in nature across sectors (GS saw defensive buy tickets across telcos, pharma, etc), while hedge funds remain 2 ways toggling short books. Largest Sell Skews: Tech & Comm Services / Largest Buy Skews: Discretionary (mostly covers).