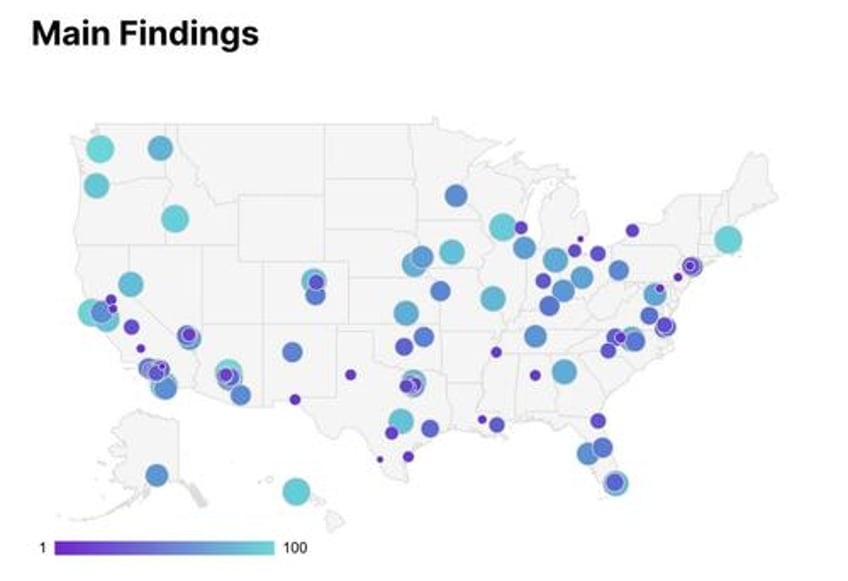

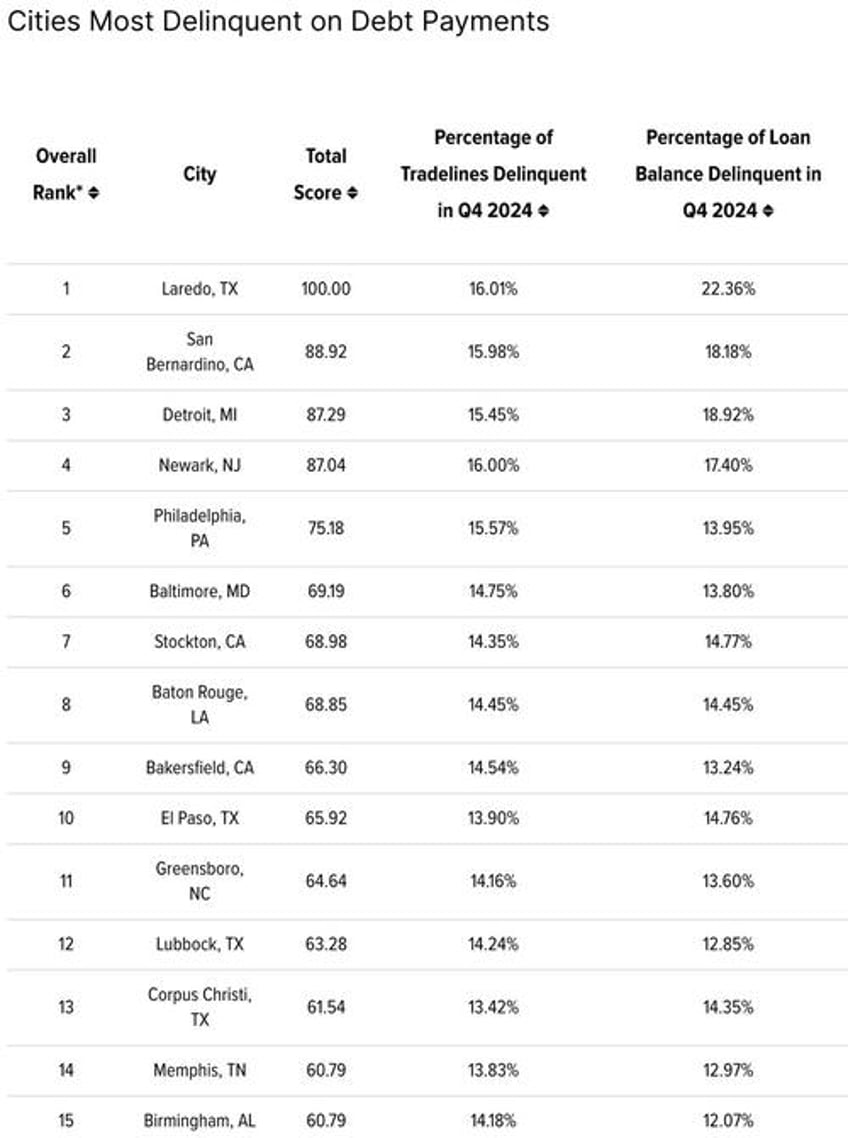

A new WalletHub study ranks the 100 largest U.S. cities by debt delinquency, using two key metrics: the percentage of delinquent credit tradelines and the percentage of total loan balances delinquent as of Q4 2024. Cities were scored and ranked based on both the number of delinquent accounts and the dollar value of unpaid debt. The findings spotlight regions where consumers are struggling most to keep up with payments, often reflecting deeper economic stressors in those communities.

Laredo, Texas tops the list as the most debt-delinquent city in America, according to WalletHub.

In Q4 2024, 16.01% of all tradelines in Laredo were delinquent—the highest in the country. Even more striking, residents were delinquent on 22.36% of their total loan balances, also the highest nationally. This combination places Laredo at the top of the list with a perfect delinquency score of 100.

The WalletHub study noted that San Bernardino, California ranks second, with 15.98% of its tradelines delinquent and 18.18% of total loan balances unpaid. While its tradeline delinquency rate is nearly identical to Laredo’s, the total debt amount past due is slightly lower, putting it behind Laredo overall. Still, these numbers make San Bernardino one of the most financially distressed cities in the country.

Detroit, Michigan follows closely in third place. About 15.45% of loans and credit lines in Detroit were delinquent, and 18.92% of the city's total debt was unpaid—the second-highest in terms of overall loan balance delinquency. Despite not being the worst on any single metric, Detroit's consistently high scores across both measures placed it third overall.

Newark, New Jersey and Philadelphia, Pennsylvania round out the top five. Newark had the second-highest tradeline delinquency rate at 16.00% but slightly lower total loan delinquency at 17.40%. Philadelphia, meanwhile, had a similar tradeline delinquency rate (15.57%) but lower unpaid balances (13.95%), ranking it fifth.

Overall, the most delinquent cities are often older, economically challenged urban centers—many of them in the Rust Belt or South—where residents face a mix of high costs and limited income growth. This study provides a snapshot of where debt stress is most acute, offering insight for policymakers and financial institutions focused on economic stability.

Analyst Chip Lupo commented: “Being delinquent on debt can significantly damage a person’s credit score and make it more difficult to get a credit card, rent apartments, or buy cars and homes in the future. People who miss a loan payment should try to get current as quickly as possible. The good news is that for many types of debt, borrowers have at least 30 days before delinquency gets reported to the credit bureaus."

"That allows people a little leeway to get the funds together and avoid credit score damage, though the issuer will still likely charge a late fee.”

Thanks for the tip...Chip.