It’s hard to see what would drive a significant and sustained rally in bonds without a US recession. A downturn hinges on the services part of the economy, where the outlook is balanced.

Powell’s comments on Thursday gave fuel to hawks and doves. Bonds are oversold, but not yet at extremes, thus yields could easily climb higher in the absence of any flight-to-safety move.

But for anyone waiting to go long bonds, the best catalyst would be a US recession (even if yields would likely not fall as far as in a regular, non-inflationary downturn). However, that is looking less likely than not now, with US and global economies on the threshold of a cyclical upswing.

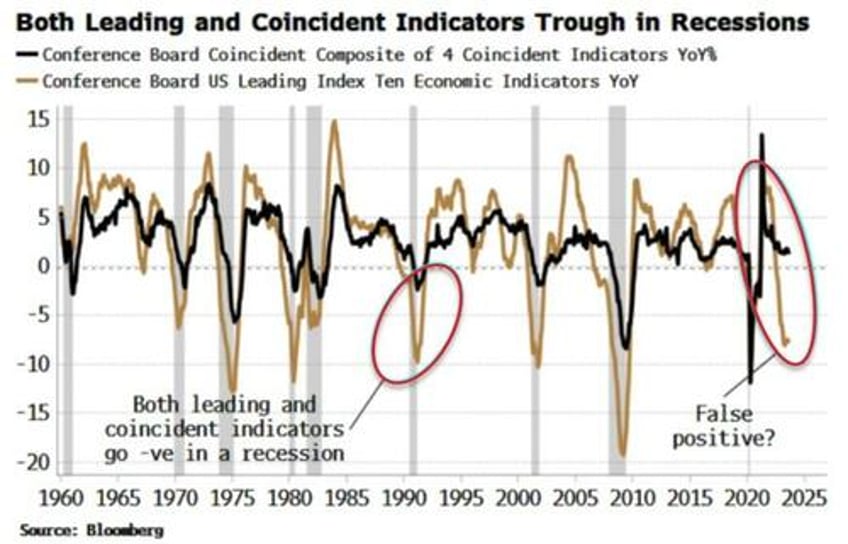

Leading indicators had been anticipating a recession earlier in the year. But that was not confirmed by coincident indicators. Both indicators have historically been contracting at the same time for there to be a recession.

There have been several false positives over the last 60 years where leading indicators have troughed but coincident ones have not (and only one where it was the other way around). The unique circumstances of the pandemic meant goods GDP was contracting from a high level – indicating recession – but services GDP was playing catch-up all the time. It’s looking like another false positive.

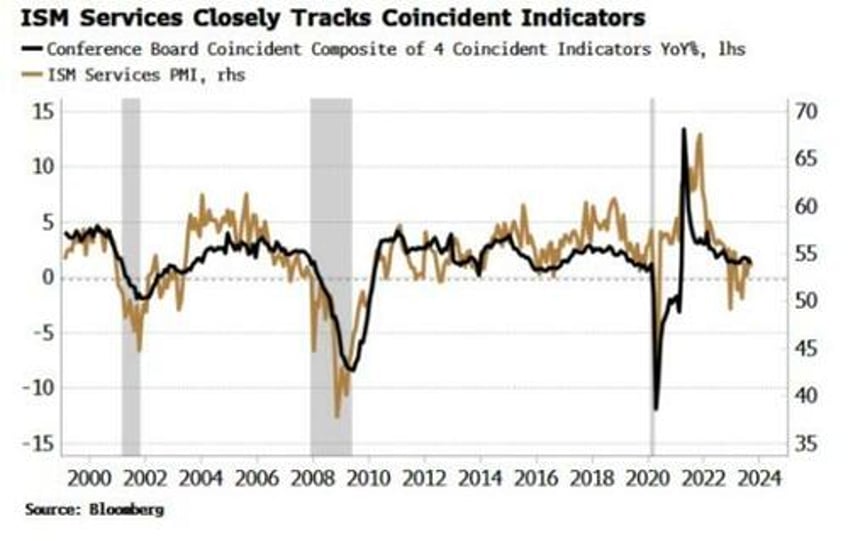

It hinges on services. The Conference Board’s Coincident Index is highly correlated to the services ISM.

The outlook for services is balanced. The ISM report is back above 50, but there is still some weakness in the S&P’s services PMI. However, the latter tends to revert to the ISM’s measure rather than the other way around. The strong retail sales report on Tuesday is another tentative sign the service economy is improving.

The US should avoid a recession as long as services does not worsen, as the highly cyclical manufacturing sector looks to have already turned the corner. Thus bonds are unlikely to experience any more than transient rallies, as the pull from rising nominal growth keeps yields elevated.