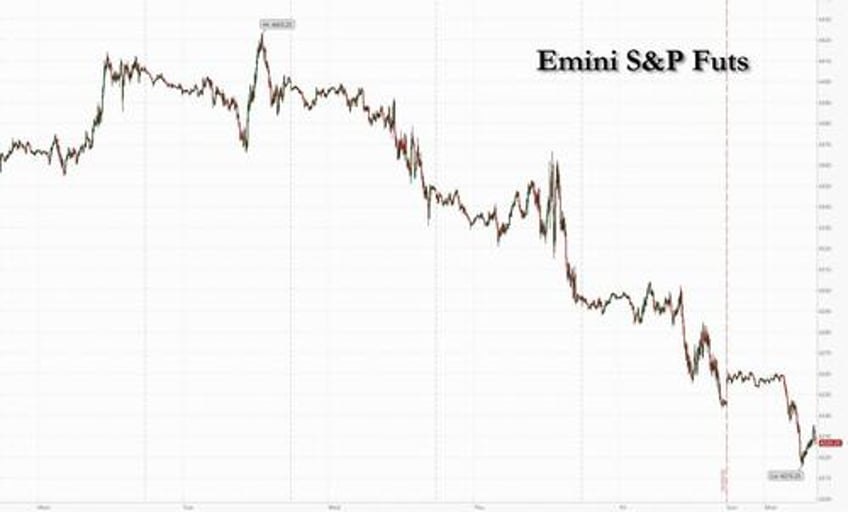

Global markets slumped and US equity futures started the new week deep in the red (if off the worst levels of the session) following losses on 5 of the past 7 weeks, after the 10-year Treasury yield finally topped 5%, fueling concern that soaring borrowing costs will erode economic growth. As of 8:00am ET, S&P futures were down 0.5% after sliding 0.7% earlier while Nasdaq 100 futures dropped 0.4%.

Europe’s Stoxx 600 index sank 0.7%, reaching the lowest intraday level since March. The catalyst for the selling was the 11bps surge in 10 year yields to 5.02%, the highest since 2007, before dipping modestly below 5.00%.

Copper, viewed as a benchmark for the global economy, tumbled to the lowest in nearly eleven months, offering fresh evidence that soaring borrowing costs and slower spending are beginning to bite in all corners of the industrial economy. WTI futures shed 0.7% as US and allies intensified efforts to stop the Israel-Hamas war from spreading. The USD is weaker pre-mkt, VIX higher, and commodities lower while the recent surge in bitcoin continued over the weekend, and pushed the crypto currency just shy of $31,000 before reversing.

Today the Fed enters its own blackout window after a flurry of Fedspeak the last 2 weeks, just as stocks exit their buyback blackout period. MegaCap Tech is the focus within earnings this week. Mega-energy M&A continues with CVX bidding for HES. Today's econ calendar is sparse: we get an update from the Chicago Fed ahead of tomorrow's flash PMIs.

In premarket trading, energy giant Chevron dropped 2% after it agreed to buy Hess Corp. for $53 billion, of $171 per share, a deal aimed at boosting production growth as the US oil industry bets on an enduring future for fossil fuels. Major technology and internet stocks such as Alphabet, Apple , Microsft and Nvidia, were among major technology and internet stocks that dropped, along with US equity futures as the 10-year Treasury yield crossed 5% for the first time in 16 years. Some other notable movers:

- Farfetch rose 2.5% as the European Commission unconditionally cleared the acquisition of a 47.5% stake in YOOX NET-A-PORTER (YNAP) from Richemont.

- Hess shares rose 2.4% after Chevron (CVX US) agreed to buy the energy company for $53 billion in the latest major US oil takeover as the industry bets on an enduring future for fossil fuels.

- Pinterest climbed 2.4% after Stifel raised its rating to buy from hold. The broker noted that there is a lot of room for growth outside the company’s domestic market.

- Textainer Group shares soared 42% after Stonepeak Partners agreed to buy the container leasing firm in a deal valued at around $7.4 billion.

- Walgreens Boots Alliance rose 3.5% as JPMorgan raised the drugstore chain rating to overweight from neutral. The broker notes that the company has an opportunity to remove several stock overhangs and improve performance.

The speed and severity of the bond selloff is capturing Wall Street’s attention, just as earnings season gets underway. With US data continuing to show a strong economy and Federal Reserve speakers reinforcing the need to keep interest rates high until inflation abates, many investors are turning more bearish on risk assets.

“5% is purely a psychological level,” said Peter Chatwell, head of global macro strategies trading at Mizuho International. “All moves higher in yield pose the same difficulties for the markets — a higher ‘risk-free’ rate will encourage investors to reduce riskier asset holdings like equities, credit and emerging market assets, and allocate more into Treasuries.”

Inflation readings in Australia and Japan later this week as well as economic activity data in the US and Europe will offer more clues on the outlook for global interest rates. Fed Chairman Jerome Powell is due to give remarks and the European Central Bank will deliver a policy decision.

Europe's Stoxx 600 index sank 0.6%, reaching the lowest intraday level since March, with real estate and mining shares slumping the most, as US bond yields resumed their march toward 5%; autos and utilities also drop. Here are some of the most notable European movers:

- Getinge gains as much as 6.7%, the most since June and the biggest gainer on the Stoxx 600 Health Care subindex, after the Swedish medical technology group reported 3Q earnings described as robust by analysts

- Varta shares soar as much as 12% after CEO Markus Hackstein said in an interview with newspaper Augsburger Allgemeine that the German battery maker has resumed supplying a large client that had previously canceled orders

- VW shares fall as much as 3.3% to their lowest intraday value since April 2020 after reporting third-quarter Ebit below analyst expectations and again adjusting its full-year expectations after market on Friday

- Adevinta shares fall as much as 13%, the most since March 2020, after Bloomberg News reported over the weekend that a consortium backed by Permira and Blackstone is reconsidering its pursuit of the European online classifieds company

- Philips shares drop as much as 5.3%,, after reporting a drop in comparable order intake in the third quarter, offsetting an earnings beat and guidance increase. Analysts said potential pressures on sales growth lie ahead

- Vistry Group shares slip as much as 6.2%, after the builder reduced its full-year adjusted pretax profit guidance below estimates. The update is “bittersweet,” RBC analysts say, noting there is no sign of the usual early-autumn pickup

- Basic-Fit falls as much as 4.7% after two brokers lowered their price targets on the Dutch health and wellness gym chain’s shares because of the slower membership growth reported in the third quarter

- Piaggio drops as much as 7% in Milan trading after Kepler Cheuvreux analyst Niccolo Guido Storer (buy) cut the price target to €4 from €5 on the Italian motor vehicle maker, citing an increase in the cost of capital

- Mission Group shares drop as much as 62%, a record one-day plunge, after the marketing company issued a profit warning and started an operational review because trading has “rapidly become more challenging than previously anticipated” as clients cut spending, according to a statement

Earlier in the session, Asian stocks extended losses from last week, as sentiment remained fragile amid concerns from the Middle East conflict to Federal Reserve policy and China’s economy. The MSCI Asia Pacific Index fell as much as 0.6%, heading for a fourth-straight day of declines, with TSMC, BHP Group and Samsung among the biggest drags. Monday’s drop comes after stocks capped their worst week since August on Friday. Risk sentiment is waning as investors contemplate the possibility of a wider conflict in the Middle East that could spur global oil prices higher and further add to concerns over inflation and high interest rates. This week, traders will be parsing for clues on the outlook for global interest rates with inflation readings in Australia and Japan.

- A gauge of Chinese tech stocks fell to the lowest since its inception more than three years ago, as investor demand evaporates in the face of higher global rates. Confidence was rattled after Beijing launched a series of investigations into Apple supplier Foxconn, weighing on shares of its listed arm Hon Hai Precision in Taiwan. Hang Seng was closed due to a public holiday. In Taiwan, Apple-supplier Foxconn tumbled over 3% after Global Times sources suggested Chinese mainland tax and natural resource authorities have conducted inspections on key enterprises of Foxconn.

- Japan's Nikkei 225 was also weaker with the downside led by the Energy and Material names, while the index managed to stay afloat above 31k.

- Australia's ASX 200 fell at the open with the losses led by the Metals and mining sector as the sector caught up to the price action across base metals.

- Indian equities posted their steepest single day drop in three months as concerns over rising US Treasury yields and the ongoing Middle East conflict hurt risk assets globally. The S&P BSE Sensex Index fell 1.3% to 64,571.88 in Mumbai, its lowest close since June 28, while the NSE Nifty 50 Index slid by a similar measure. Both gauges have fallen for four straight days, paring their year-to-date gains to little over 6%. HDFC Bank contributed the most to the losses, falling 1.1%.

In Argentina, investors were bracing for a selloff after Economy Minister Sergio Massa did better than forecast in Sunday’s presidential vote, dashing hopes for an outright win by a more market-friendly candidate. The country’s dollar bonds — already trading below 30 cents on the dollar — extended their losses on Monday, with five of them including the 2029 note figuring among the worst performers in emerging markets.

In FX, the Bloomberg Dollar Spot Index steady at 1273.23 after losing 0.2% in the past two days. Investors are waiting for the release of US data including the manufacturing PMI due Tuesday, third-quarter GDP Thursday and the Federal Reserve’s favored inflation gauge on Friday. USD/JPY briefly rose above 150 in early Asian trading before slipping back below. The euro is the best performer among the G-10’s, rising 0.2% versus the greenback.

“Data this week should confirm that the US economy continues to run hot and that the Fed has more work to do to cool it off,” Win Thin, global head of currency strategy at Brown Brothers Harriman & Co., wrote in a research note. “The dollar should play catchup and strengthen along with the higher yields”

In rates, the 10-year Treasury yield topped 5% for the first time since 2007 - rising 9bps to 5.01%, before retreating modestly. Treasuries were cheaper by 4bp-8bp across the curve, holding a bear-steepening move that saw 10-year yields breach 5% for the first time since 2007. Treasuries follow similar bear-steepening moves across core European rates amid an absence of escalation in Middle East tensions. US 10-year yields hover near 5% into early US session after topping close to 5.02%, underperforming bunds and gilts by 2bp and 3bp in the sector; long-end-led losses steepen 2s10s curve by ~4bp, 5s30s by ~1bp. 2s10s spread reached -11bp, least inverted since July 2022. The Dollar IG issuance slate is rather spares and includes BGK 5Y; around $20 billion in new bond sales are expected this week; among six biggest Wall Street banks, Bank of America, Citigroup and Morgan Stanley have yet to announce offerings. The Treasury auction cycle begins Tuesday with $51b 2-year note sale, followed by 5- and 7-year auctions Wednesday and Thursday.

In commodities, oil prices were lower but off their worst levels with WTI falling 0.2% to trade near $87.90. Fears softened over the weekend that the conflict in the Middle East would escalate as Israel held off on its ground offensive into Gaza amid efforts to secure the release of more hostages. Gold prices pared an earlier drop to trade little changed.

The US economic data slate is quiet to start the week and only includes the September Chicago Fed national activity index at 8:30am. Ahead this week are the October preliminary S&P Global PMIs, first estimate of 3Q GDP, and September personal income/spending.

Market Snapshot

- S&P 500 futures down 0.1% to 4,243.50

- STOXX Europe 600 down 0.3% to 432.22

- MXAP down 0.7% to 151.74

- MXAPJ down 0.7% to 475.19

- Nikkei down 0.8% to 30,999.55

- Topix down 0.7% to 2,238.81

- Hang Seng Index down 0.7% to 17,172.13

- Shanghai Composite down 1.5% to 2,939.29

- Sensex down 0.5% to 65,090.08

- Australia S&P/ASX 200 down 0.8% to 6,844.08

- Kospi down 0.8% to 2,357.02

- German 10Y yield little changed at 2.93%

- Euro little changed at $1.0601

- Brent Futures down 0.2% to $91.93/bbl

- Gold spot up 0.0% to $1,981.75

- U.S. Dollar Index little changed at 106.12

Top Overnight News

- BOJ emerging as a fresh source of macro anxiety as Ueda comes under pressure ahead of the 10/30-31 meeting to raise the YCC ceiling amid JPY weakness and upward yield pressure globally. RTRS / Nikkei

- Japanese Prime Minister Fumio Kishida pledged on Monday to compensate households for the rising cost of living with subsidies and payouts, stressing his government's resolve to pull the economy permanently out of stagnation (which is leading to some angst about Japan’s fiscal health). RTRS

- Apple supplier Hon Hai fell the most in three months after Chinese regulators reportedly launched a probe into parent Foxconn over taxes and land use. The move, alongside a series of arrests across industries, has rattled foreign firms. FT / BBG

- Brussels is weighing whether to prolong an emergency gas price cap introduced in February amid fears that the conflict in the Middle East and sabotage of a Baltic pipeline could push up prices again this winter. FT

- Throughout the Covid-19 pandemic and then Russia’s invasion of Ukraine, both the U.S. and Europe borrowed heavily. Now with those emergencies in the rear-view mirror, a divergence has emerged: Even as the U.S. continues to let deficits rip, Europe’s are on track to narrow significantly. WSJ

- Fears that the Israel-Hamas war could mushroom into wider Middle East conflict rose on Sunday with Washington warning of a significant risk to U.S. interests in the region as ally Israel pounded Gaza and clashes on its border with Lebanon intensified. RTRS

- Biden and senior US officials talked Netanyahu’s government out of launching a major strike against Hezbollah in Lebanon as the Pentagon feels Israel would struggle in a two-front war and that such a conflict would draw in outside parties, including Iran. NYT

- Nine House Republicans declared themselves for the Speaker race, with the party set to meet Monday evening to hear from the candidates before voting on Tuesday, although it’s not clear anyone can get the 217 votes needed to secure the gavel. Washington Post

- M&A Monday: Chevron will buy Hess in an all-stock transaction valued at $53 billion, the second oil megadeal this month. The price of $171 per share implies a 4.9% premium to Hess’s Friday close; Chevron stock slipped premarket. Roche agreed to buy irritable bowel drugmaker Telavant for $7.1 billion. Stonepeak will buy Textainer in a deal that gives the container lessor an enterprise value of about $7.4 billion. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with losses across the board following the downside seen on Wall Street on Friday, with participants citing mixed earnings and geopolitical angst. ASX 200 fell at the open with the losses led by the Metals and mining sector as the sector caught up to the price action across base metals. Nikkei 225 was also weaker with the downside led by the Energy and Material names, while the index managed to stay afloat above 31k. Hang Seng was closed due to a public holiday while Shanghai Comp conformed to regional losses. In Taiwan, Apple-supplier Foxconn tumbled over 3% after Global Times sources suggested Chinese mainland tax and natural resource authorities have conducted inspections on key enterprises of Foxconn.

Top Asian News

- The Chinese Commerce Minister said China seeks to encourage joint industrial collaboration with Gulf nations and wants to deepen the oil and gas cooperation model. The Commerce Minister added that China wants to promote the stability and smoothness of the industrial and supply chains, and seeks cooperation on potential new energy vehicles industries such as power batteries and smart charging, according to Reuters.

- PBoC Governor Gongsheng said prudent monetary policy will be more precise and forceful, and added that they will steer countercyclical and cross-cyclical adjustments and maintain appropriate money supply and credit with a steady pace. Gongsheng added that they will enhance the stability of financial support for the real economy, and effectively support the expansion of domestic demand. He added they will guide financial institutions to cut real lending rates and reduce the financing costs for enterprises and individuals. Gongsheng added they will implement policy measures to activate the capital market and boost investor confidence. He added the PBoC will prudently resolve the default risk of bonds and of large real estate firms while strengthening the monitoring, warning and prevention of Local Government Financing Vehicle (LGFV) bond risks. Gongsheng added they will prevent the risk of contagion in stock, bond and FX markets and ensure stable operation of financial markets, according to Reuters.

- PBoC injected CNY 808bln via 7-day reverse repos with the rate at 1.80% for a CNY 702bln net daily injection

- PBoC set USD/CNY mid-point at 7.1792 vs exp. 7.3109 (prev. 7.1793)

- Chinese mainland tax and natural resource authorities have conducted inspections on key enterprises of Apple-supplier (AAPL) Foxconn (2317 TT) in some cities in accordance with the law, according to Global Times "Experts said that while Taiwan-funded enterprises share the benefits of growth and achieve significant development in the mainland, they should also bear corresponding social responsibilities and play an active role in promoting the peaceful development of cross-Straits ties". Sources close to Foxconn (2317 TT) suggest reports on China's probe are unusual and believe Foxconn is possibly singled out for political reasons, according to Reuters

- China reportedly plans to hold a twice-a-decade financial work conference on October 30-31st to focus on resolving risks, according to Bloomberg sources.

- Chinese Agricultural Ministry says China's pig supply is still growing and they are not expecting a sharp rise in Q4; says hog market could see even larger losses after the Chinese New Year, according to Reuters.

- BoJ officials are reportedly mulling tweaking the settings of YCC "because domestic long-term interest rates are also rising as US interest rates rise, and are approaching the de facto upper limit of 1% set in the July revision." The topic will be discussed at the next two-day meeting that ends on October 31st, "but there are differences of opinion within the Bank of Japan. Many say they want to carefully monitor trends in wage increases", according to Nikkei sources. Any decision to change its YCC will largely depend on how markets move leading up to the Oct. 30-31st policy meeting, according to Reuters sources; there is currently no consensus within the BoJ on whether an immediate change to YCC is necessary. Among ideas that could be discussed would be to raise the ceiling for the 10-year JGB yield beyond 1.0%, sources added.

- Japan's Fair Trade Commission is to inspect Google (GOOG) for possible breach of anti-monopoly law, according to Nikkei.

European bourses are in the red, Euro Stoxx 50 -0.7%, despite fleeting gains at the cash open with the negative APAC handover and broader market sentiment, geopolitical concerns and ongoing yield upside weighing on the space. Sectors are almost all in the red with Basic Resources lagging on the risk tone and benchmark pricing while Real Estate suffers from marked yield upside despite favourable broker action in the sector. Stateside, futures are in the red, ES -0.7%, throughout much of the European morning the magnitude of losses had been more limited than those seen in Europe. However, as yields continue to rise and the US 10yr eclipse 5.0% performance has deteriorated to be in-line with Europe ahead of a particularly quiet US schedule today before a very busy week. Chevron (CVX) is to purchase Hess (HES) in a deal valued at USD 53bln or USD 171 per share. In pre-market trade, Hess (HES) +1.6% with Chevron (CVX) -2.9%.

Top European News

- Philips Slides as Order Drop Raises Doubts Over Sales Growth

- European Gas Slumps as Mild Weather Counters Geopolitical Risk

- Adevinta Slumps as Buyout Firms Said to Reconsider Pursuit

- European Stocks Drop for Fifth Day as Yields Resume Their Climb

- VW Falls After Cutting Forecast on Hedging Loss, More Costs

- Nordic Semiconductor, Ocado, HelloFresh Short Sellers Active

FX

- Dollar and fellow safe havens lose some geopolitical risk premium, DXY drifts down from 106.330 to 106.040. However, having spent much of the morning in the red and nearer to the low, the USD is now managing to derive some incremental upside from the risk tone and yield action.

- Franc retreats from 0.8915 vs Buck to sub-0.8950 and Gold hovers within USD 1982-64/oz range after peaking within USD 3 of 2k on Friday.

- Euro and Pound initially firmer as the Greenback slips with EUR/USD probing 1.0600 and Cable above 1.2150; though, both GBP and EUR have retreated back through the levels as the USD firms up a touch.

- Yen only just afloat of 150.00 as yields rebound firmly and USD/JPY shrugs aside sources suggesting the BoJ may tweak YCC again.

- Indonesian Central Bank continues to intervene in the FX market, according to an official cited by Reuters.

Fixed Income

- Bond bears pounce as safety premium is unwound and curves steepen further.

- Bunds, Gilts and T-note all nearer the bottom of ranges spanning 127.33-83, 90.99-91.50 and 104-14/28 respectively.

- BTPs holding up a bit better between 108.18-77 parameters on technical grounds and relief that S&P maintained Italy's rating with a stable outlook irrespective of an expansive 2024 budget.

- Indian government is cautious amid the spike in yields, according to Reuters sources; could take "remedial action" if yields unexpectedly increase. Oil at USD 90/bbl is not a concern for the budget unless excise duty is tweaked.

Commodities

- Oil under pressure amid the broader tone in APAC hours and as Israel seemingly agrees to delay its ground invasion to allow for hostage negotiations.

- Currently, WTI & Brent Dec’23 are holding just shy of the USD 88.00/bbl and USD 92.00/bbl marks respectively, within USD 86.83-88.29/bbl and USD 91.08-92.45/bbl bounds.

- Spot gold is not really benefiting from the risk tone or USD weakness, with the yellow metal in a narrow range and yet to re-approach last week's USD 1997/oz peak.

- Base metals pressured by the risk tone and also unable to benefit from the softer USD, LME Copper pressured and down to the USD 7.9k/T mark and circa. USD 50/T down from Friday’s close.

- Russia's Gazprom is to supply an extra 600mln cubic meters of gas to China this year, exceeding its contractual obligations, according to Tass.

- Russia's Gazprom is to supply extra volumes of gas to Hungary this winter, according to Tass.

- The EU is reportedly mulling extending the emergency gas price cap introduced in February amid fears the Middle Eastern tensions and the sabotage of the Baltic pipeline could push gas prices higher this winter, according to the FT.

Geopolitics: Israel-Hamas

- US and allies hold discussions on concerns that the Israel-Hamas war will spread, via Bloomberg.

- A second convoy of 17 aid trucks entered the Egyptian side of the Rafah crossing towards Gaza, according to security and humanitarian sources cited by Reuters. It was also reported that 14 trucks carrying aid for Gaza entered the region, according to Reuters.

- Blasts and sounds of ambulances were reportedly heard near the Rafah crossing between Egypt and Gaza, according to Reuters witnesses.

- The Israeli army told Gazans to move south or risk being seen as "terrorist organisation partners" if they stay put, according to Reuters citing Gaza residents.

- US Secretary of State Blinken said the US sees potential for escalation of the war in the Middle East due to actions of Iran's proxies and the US does not want escalation, according to NBC News. He added the US sees a prospect of a significant escalation of attacks on US troops and people throughout the region.

- US Defense Secretary Austin placed additional forces on prepare-to-deploy orders without offering a number. US Pentagon said the US is deploying THAAD batteries and additional battalions to the Middle East in response to the escalations in the region, according to Reuters.

- The Israeli Military said they have killed the Deputy Chief of Hamas with rocket force, according to Reuters.

- An Israeli raid was reported on the outskirts of the town of Aitaroun in southern Lebanon, according to Sky News Arabia citing National News Agency. The Israeli army said they have targeted Hezbollah military infrastructure in southern Lebanon, according to Al Arabiya.

- Israeli PM Netanyahu said if Hezbollah goes to war with Israel, it would bring unimaginable devastation upon it and Lebanon and added that he cannot yet say if Hezbollah will decide to fully enter the war, according to Reuters citing a statement from the PM's office.

- The Israeli President told Sky News that Hamas terrorists who broke into Israel were carrying instructions on how to make chemical weapons, according to Sky News.

- Israel gave Al-Quds Hospital in Gaza one hour to evacuate, according to Al Arabiya. Israel airstrikes targeted the surroundings of Al Shifa and Al Quds hospitals in Gaza, according to Palestinian press Wafa cited by Reuters.

- Israeli official said there will be 'no ceasefire' in Gaza, according to CNN and The Spectator Index.

- Israeli Defence Forces said an IDF tank accidentally fired and hit an Egyptian post adjacent to the border in the area of Kerem Shalom. The IDF said it expressed sorrow regarding the incident, according to a statement via Telegram. An Egyptian army spokesperson said border watchmen sustained minor injuries after being hit by fragments of a shell from an Israeli tank, according to a statement cited by Reuters.

- Israeli strikes reportedly hit and damaged both Damascus and Aleppo airports in Syria, according to AFP citing Syrian state media.

- A statement from the Department of National Defence and the Canadian armed forces on the recent strikes at Al-Ahli Hospital in Gaza on the 17th of October suggested the strikes were more likely caused by an errant rocket fired from Gaza, according to Reuters.

- Leaders of the US, Canada, France, Germany, Italy and the UK have reiterated support for Israel and its right to defend itself; joint statement calls for adherence to humanitarian law and protection of civilians, according to Reuters. Leaders committed to working with partners of the region to prevent the conflict from spreading.

- Israeli PM Netanyahu said French President Macron and Dutch PM Rutte are to visit Israel on Monday and Tuesday, according to Reuters.

- China's Middle East envoy, on the Israel-Hamas war, said China is willing to do whatever is conducive to the promotion of dialogue, ceasefire, and restoration of peace and promote implementation of the two-state solution; via Chinese state media.

- Palestinian Hamas leader and Iranian Foreign Minister discussed the Israeli "brutal crimes" in Gaza in a phone call, according to Reuters.

Geopolitics: Other

- A US official confirmed that the US is mulling measures to restrict China's access to US cloud and computing services, according to Nikkei.

- Clashes have reportedly erupted between the Iraqi army and Kurdish Peshmerga forces in Northern, with two fatalities, according to security sources cited by Reuters.

- Russian Foreign Minister Lavrov is to visit Iran on October 23rd, according to Ria.

- Rocket attacks have reportedly targeted Iraq's Ain Al-Asad airbase housing US forces; at least one blast was heard inside the army base, according to army sources cited by Reuters.

- The Philippines has accused China's coast guard of colliding with a Filipino supply boat in the South China Sea, according to the BBC. China said the Philippines "deliberately stirred up trouble". Philippines National Security Council said continued blocking by Chinese vessels may lead to disastrous results; concerned by escalation and provocations by Chinese vessels, according to Reuters.

- Six people have been killed and at least 14 injured in a Russian missile attack that hit a postal distribution centre in Kharkiv Ukraine, according to Ukrainian officials cited by Sky News.

- EU-US Summit Joint Statement: We have made progress toward a targeted critical minerals agreement for the purpose of expanding access to sustainable, secure, and diversified high-standard critical mineral and battery supply chains. We have made substantial progress in identifying the sources of non-market excess capacity of steel, according to the Commission statement.

- Several buildings have been evacuated following a bomb threat at German public broadcaster ZDF, via Bild.

US Event Calendar

- 08:30: Sept. Chicago Fed Nat Activity Index, est. -0.14, prior -0.16

DB's Jim Reid concludes the overnight wrap

Morning from the middle of a forest somewhere deep in a Center Parcs resort. Hopefully I won’t see another zip wire, quad bike or a tornado water slide until the next time I’m dragged here.

With the Fed on their media blackout ahead of next week's FOMC, things will be slightly quieter this week in terms of scheduled macro events after a hectic round of Fed speak last week. Those Fed speakers, including and especially Powell on Thursday, have been having a big impact on rates and the curve even if they haven't said much that adds to the debate as to whether the Fed is done and if so, how long they'll stay at these levels. US 2s10s and 2s30s both steepened more than 30bps last week (the most since post-SVB) even though 2yr yields were up +1.8bps. Although we are fully bought in to the steepener trade I’m struggling to explain why it moved so much last week. Perhaps the long end continues to be hit by supply, US fiscal fears (maybe including extra funding for Israel), and concerns over where the oil price might go whereas the front end is receiving the (relative) flight to quality trade that few want to put on at the long-end. Perhaps the recent back-end moves and the Middle-East tensions are also making the market more comfortable that central banks won’t move again at the front-end even as oil goes higher.

I continue to be concerned as to how markets will cope with such high yields at the back end of markets, especially those in the US. We spent 10-15 years with yields and rates low/zero/negative across the DM world, helped by QE as this was seen as the only way we could finance the enormous global debt load. If this synopsis is correct, then surely one of the biggest 2-3 year yield sell-offs in history risks causing a lot of pain beyond any seen so far. If yields stay elevated, the only way I think I’ll be wrong is if we actually didn’t need those levels of rates and yields in the 2010s, or if central banks and governments have taken on enough of the risk just in time to avoid pain from higher yields. That argument is harder to buy in to with QT and strong government supply combining at the moment. On the risk of accidents it was interesting that the US Regional Bank index fell -3.53% on Friday and is down around -20% since the local peak in August and is less than 10% away from the crisis lows in Q2 .

It isn't the busiest week for data but there are a few important signposts which we'll go through below but such is the way of the world it wouldn't be a surprise if the big-tech results have as much impact as the data. We have Microsoft and Alphabet tomorrow as well as Meta on Wednesday and Amazon on Thursday, which together make up over $6tn in market cap, and nearly 17% of the S&P 500. Note that the 7th largest in the index Tesla fell -15.58% last week which was a bit of a blow for the mega caps but AI related stocks like Microsoft may fair better.

The data highlight might be the latest US core PCE reading as part of Friday’s consumer income and spending data. In terms of macro events the ECB meeting on Thursday might be a little more dull than it has been for the last 15 months but there could be discussion as to how they will further reduce their balance sheet going forward (see our economists’ preview here). T omorrow sees the latest quarterly ECB bank lending survey where the recent reports have suggested very tight lending standards but with expectations that this should loosen in the subsequent quarter. This optimism has reduced the concerns over current conditions so we will see if that improvement has materialised and whether it’s expected to continue.

The global flash PMIs tomorrow will also be important, especially to see if manufacturing and Germany can pick up from what are very low levels historically.

Investors will also keep an eye on the preliminary Q3 GDP report in the US where our economists expect a 5.2% annualised number (vs. 2.1% in Q2) in what was a quarter that surprised almost everyone with its strength.

Elsewhere in the US we have durable goods orders (DB forecast -0.5% MoM vs +0.1% in August) and advance goods trade balance on Thursday, new home sales on Wednesday, and the final UoM consumer confidence numbers on Friday with the final inflation expectations reading. The Bank of Canada will also decide on rates on Wednesday with markets only pricing in around a 10% probability of a hike .

There will be more indicators of economic sentiment on the continent next week. This includes consumer confidence for the Eurozone today as well as a gauge for Germany (tomorrow) and France (Friday). Germany will also be in focus when it comes to business sentiment, with the Ifo survey due on Wednesday. In the UK, the focus will be on labour market data tomorrow with unemployment rate already 0.8pp above the lows, the most in the DM world. Moving on to Asia, key data releases in Japan include the Tokyo CPI on Friday and the services PPI on Thursday. This follows news from the Nikkei last night that the BoJ are looking at another tweak to its YCC policy. Our economist continues to believe they'll make changes at their meeting next week.

In terms of earnings, in addition to the US tech earnings mentioned at the top, we have a busy week with the key highlights mentioned in the day-by-day calendar at the end which also includes all the main data and other events.

Asian equity markets have started the week on a negative footing, mirroring Friday’s losses on Wall Street as reservation around risk-taking persists along with dollar strength. As I check my screens, the S&P/ASX 200 (-0.90%) is leading losses across the region closely followed by the Nikkei (-0.81%), the Shanghai Composite (-0.81%) and the CSI (-0.79%). Otherwise, the KOSPI (-0.46%) is also edging lower this morning while markets in Hong Kong are closed for a holiday.

In overnight trading, US stock futures are seeing a rebound with those on the S&P 500 (+0.21%) and NASDAQ 100 (+0.22%) moving higher ahead of the release of big tech earnings this week. Meanwhile, yields on the 10yrs USTs (+6.83bps) have again moved higher standing at 4.98%, within a whisker of 5% as we go to press. 2s10s curve is seeing further steepening in Asia session reaching -14.9bps, marking its highest level since July 2022.

We’re keeping an eye on Argentina which went to the polls over the weekend. With almost all the vote counted Sergio Massa, the Economy Minister, is in front on 37% while the libertarian economist Javier Milei coming in second with 30%. The two will now go to a run-off in November.

Now looking back on last week, the situation in the Middle East remained highly uncertain but playing out in an environment where investors are reluctant to buy duration as their safe haven play. Such a view may have been a big contributor to the large steepening seen as the front end held in much better.

Although US 10yr Treasury yields fell -7.5bps on Friday, 10yr yields rose +30.3bps to 4.92% on the week, in its largest up move since April 2022. The 30yr rose +32.2 bps. Both saw their highest weekly close since 2007. By contrast, the 2yr yield was near flat on the week (+1.8bps to 5.08%) after rallying -8.6bps on Friday. This contrast marked the sharpest weekly curve steepening since just after the collapse of SVB in March. The 2s30s slope returned to a zero level for the first time since last summer (it was -73bps a month earlier, on the day of the September FOMC). European bonds saw a more moderate sell off on the week, with 10yr bund yields up +15.3bps (and -4.1bps on Friday) with 2yr yields down -1.7bps (-8.1bps on Friday) .

US equity volatility jumped last week, as the VIX index rose +2.4 points to its highest level since March (and +0.3 points on Friday). Overall, equities closed the week down, with the S&P 500 down -2.39% (and -1.26% on Friday) to its lowest level since early June. Tech was not spared from the selloff, as the NASDAQ slipped -3.16% week-on-week (and -1.26% on Friday). Over in Europe, the STOXX 600 fell -3.44% last week, down to its lowest level since the first trading day of the year (and -1.36% on Friday).

The FANG+ index of megacap stocks also struggled last week after it fell -5.03% (and -1.93% on Friday), with Tesla down -15.58% in its worst week since last December (and -3.69% on Friday). Tesla’s retreat came on the back of Wednesday’s earnings and new restrictions by China on Friday on the export of natural graphite exports, critical for EV batteries, in reaction to new US limits on Nvidia’s AI chip exports. Read more on this development and impacts in Marion Laboure and Cassidy Ainsworth-Grace’s latest reports on graphite (here) and semiconductors (here)***

Finally, we turn to commodities. As Middle East tensions weigh on oil markets, Brent crude secured its second consecutive week of gains after gaining +1.40% to $92.16/bbl, although it retreated slightly on Friday (-0.24%). WTI crude followed suit, rising +1.21% week-on-week (-0.69% on Friday). Gold posted its strongest week of the year so far, climbing +2.51% to eye the $2,000 mark at $1,981/ounce (and +0.99% on Friday).