By Michael Msika, Bloomberg Markets Live reporter and strategist

Investors are counting on China to shake European equities out of a lull, but strategists warn that officials’ measures to bolster the world’s second-biggest economy may fall short of expectations.

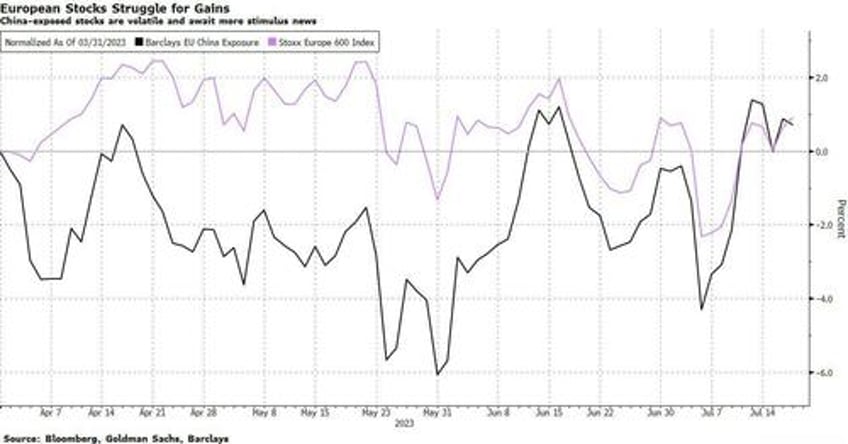

Most of the Stoxx 600’s gains this year came in the first quarter, with the benchmark mostly moving sideways since then as investors priced in shifting monetary-policy expectations. Given European stocks’ strong reliance on China, all eyes are on the Politburo meeting later this month after officials vowed on Wednesday to boost the private economy.

“Slowing growth in China has taken some wind out of the sails for European equities in recent months,” says HSBC strategist Max Kettner, who maintains a cautious stance on Europe. While some easing has helped markets, policymakers are more cautious than before, “so a return to the post-2008 stimulus mix is unlikely,” he adds.

The latest reports out of China, showing weaker-than-expected economic growth and a contraction in real estate, have weighed on for European sectors particularly exposed to the economy — cyclicals like miners, industrials and autos, as well as luxury stocks.

Kettner says any Chinese stimulus news will likely boost the broader consumer discretionary sector in Europe, but warns that cyclicals on aggregate have already rallied strongly. “In terms of what is priced in currently, there’s already quite some hope for a growth recovery in the price.”

Miners have borne the brunt of China’s disappointing reopening. They are the worst performers in Europe this year, down 12%. The sector suffered another blow this week after Rio Tinto, the biggest constituent on the Stoxx 600 basic resources gauge, warned that the country’s faltering recovery continues to weigh on demand for metals.

“Structural downtrends” in the Chinese property sector, a major consumer of metals, are likely to continue weighing on European mining stocks, say JPMorgan strategists led by Mislav Matejka. Moreover, potential steel production cuts in China would be bearish for iron ore demand, meaning “lower metal prices could keep the sector’s earnings under pressure,” they add.

The strategists are negative on European stocks generally, seeing cyclical shares losing momentum in the second half, a trend that could worsen if expectations on China disappoint. They recommend investors “keep fading stimulus news,” adding that the region is sliding back into deflation and the property market will likely need “a much more aggressive policy support to rebound sustainably.”

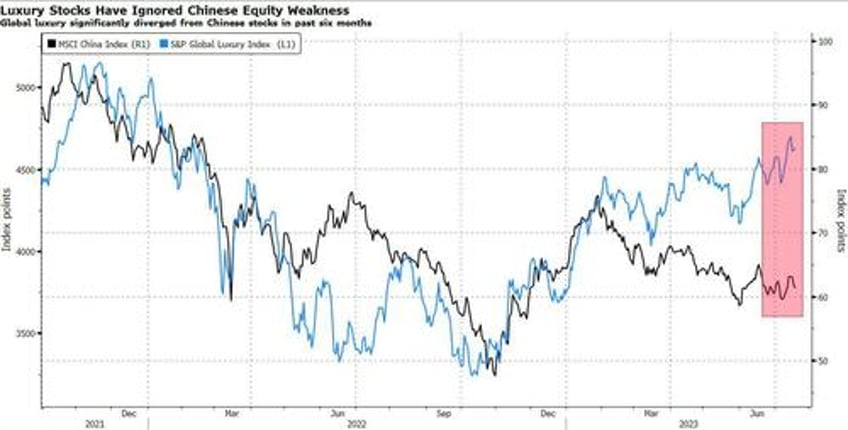

For luxury stocks, which have been a strong driver of gains in Europe this year, a continued recovery in China will be necessary to support their strong performance. The sector has diverged from Chinese stocks, which have been dragged by disappointing data.

“It’s definitely more mixed than it was at the start of the year,” says Karim Chedid, head of EMEA iShares investment strategy, pointing out that the first leg of the China reopening has already played out, while domestic demand has been more sluggish than expected. As Chinese tourists start to travel again, there is a possibility for another tailwind for the sector, he says.

“As it stands, we believe that a brighter outlook for global growth is required for the euro to move sustainably higher and European equities to outperform again,” says Barclays strategist Emmanuel Cau. “And a lot has to do with China, which doesn’t look good at the moment.”