To set the scene for today's carnage, we give you POTUS...

Not so good news for folks 3 days later https://t.co/t5x3b49K7s

— zerohedge (@zerohedge) February 13, 2024

So, with that said, a hot CPI print was all it took to steal the jam from this melt-up-market's donut of exuberance.

The deer is back!

Small Caps collapsed - crashing almost 5% (worst day since June 2020). The S&P was down 2% - its worst day since Dec 2020 (worse than Feb 2023's SVB crisis drop). Some late-day profit-taking painted some lipstick on this pig of a day...

'Plot Twist' as Hugh Hendry said: "This is me hearing about today’s inflation print...My biggest takeaway from aujourd’hui is that we just made next month really blinking important. "

Plot Twist

— Hugh Hendry Eclectica (@hendry_hugh) February 13, 2024

This is me hearing about today’s inflation print 😂

The unpredictable path of the bumblebee - the economic data.

The first rule is: don’t panic. It’s a tough spot, but the market’s a fickle son of a bitch, and today’s drama can be tomorrow’s footnote.

Its not a… pic.twitter.com/Gf9068GxVK

"We were ripe for a pullback, right?" said a CNBC anchor, in some odd way trying to soothe investors.

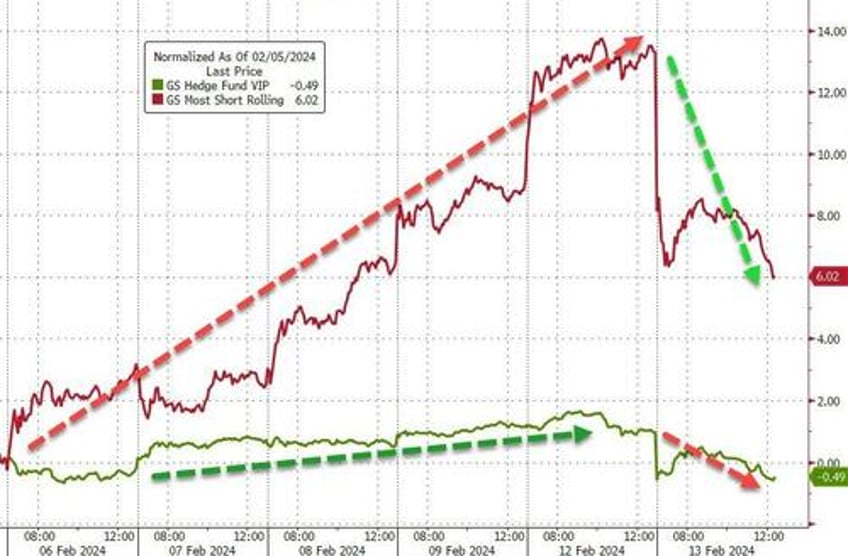

Some L/S hedge funds had a good day as their shorts crashed (but their longs were not happy, and it's been a bloodbath for them in the last week. However, we suspect this was as much about degrossing, closing longs and shorts, as any actual wins...

Source: Bloomberg

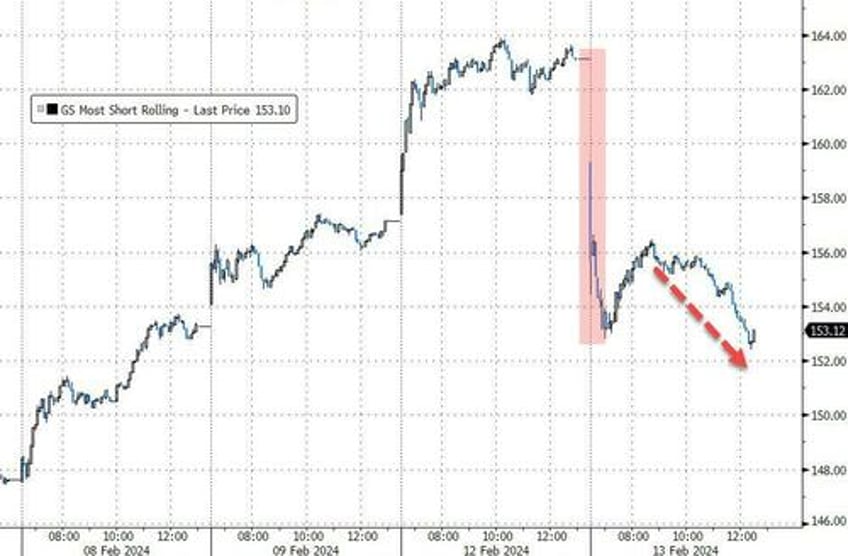

'Most Shorted' stocks plunged over 6% - the biggest decline since June 2022...

Source: Bloomberg

The 'Magnificent 7' stocks puked at the open, dup-buyers stepped in (as they do), but were then clubbed like a baby seal. This was MAG7's 2nd worst day since October...

Source: Bloomberg

ARM was hammered...

But, of course, NVDA escaped with barely a fleshwound as panic-buyers stormed back in after the initial plunge...

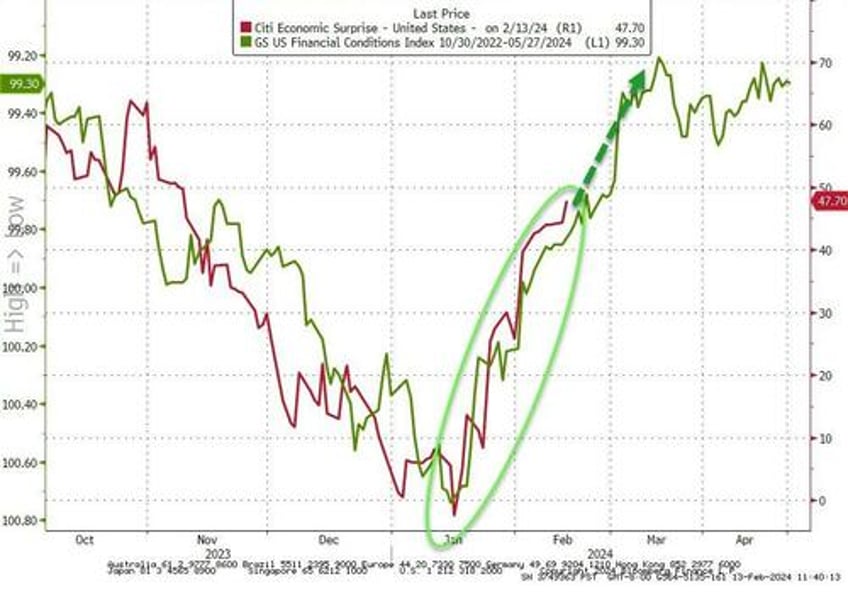

Who could have seen this resurgence in inflation coming?

Well, we've been warning about 'Animal Spirits 2.0' for weeks as the lagged impact of the massive loosening of financial conditions last year flows wondrously into the real economy and lifts all economic expectation boats...

Source: Bloomberg

CPI's hot, too damned hot! And being too hot, marked the death of hope for March rate cuts, forget May rate-cuts, at the moment the first cut is priced-in for June... and as of today's less than 4 rate-cuts for the whole of 2024 (in fact just a 50% chance of 4 cuts, conditioned on 3 cuts). As a reminder, in mid-January (a month ago), the market was pricing in 170bps of cuts in 2024, now its half that...

Source: Bloomberg

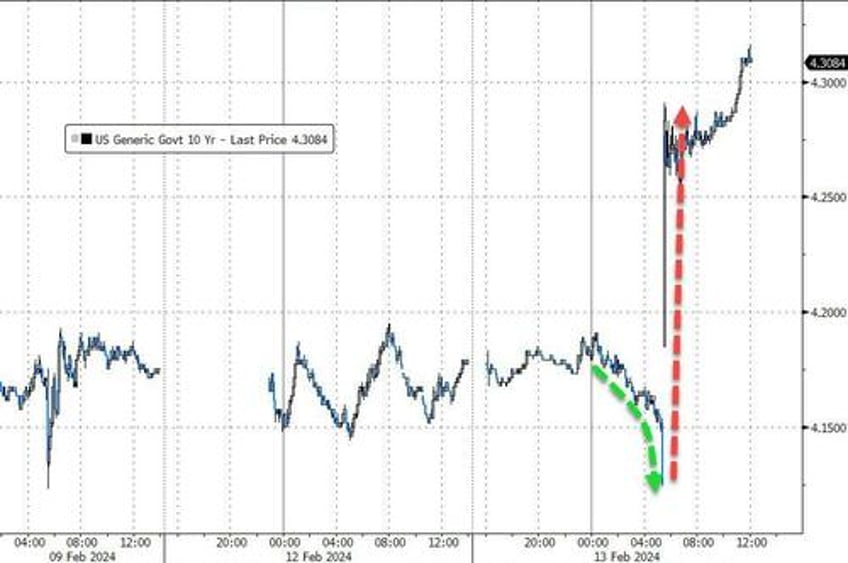

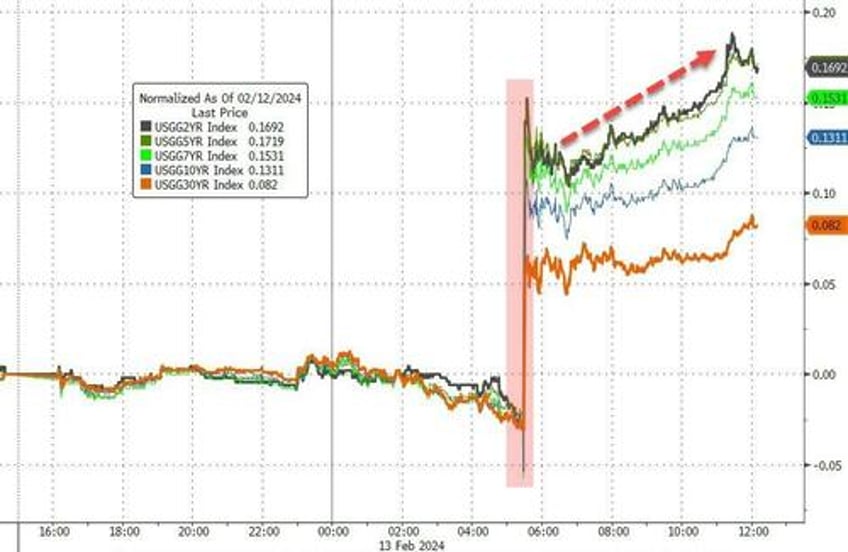

Treasury yields exploded higher after the CPI print (after bonds were aggressively bid into the print)...

Source: Bloomberg

...led by the short-end (2Y +17bps, 30Y +8bps) ...

Source: Bloomberg

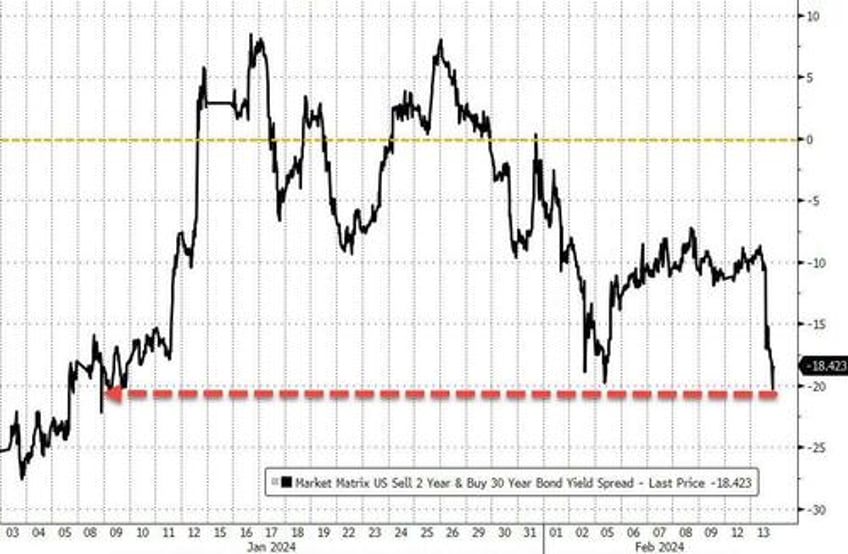

The yield curve bear-flattened dramatically (2s30s -8bps) to its most inverted in six weeks...

Source: Bloomberg

And as bond prices plunged, the dollar soared, breaking above its 100DMA to its highest since November...

Source: Bloomberg

Gold puked back below $2000, erasing all the gains since the December FOMC...

Source: Bloomberg

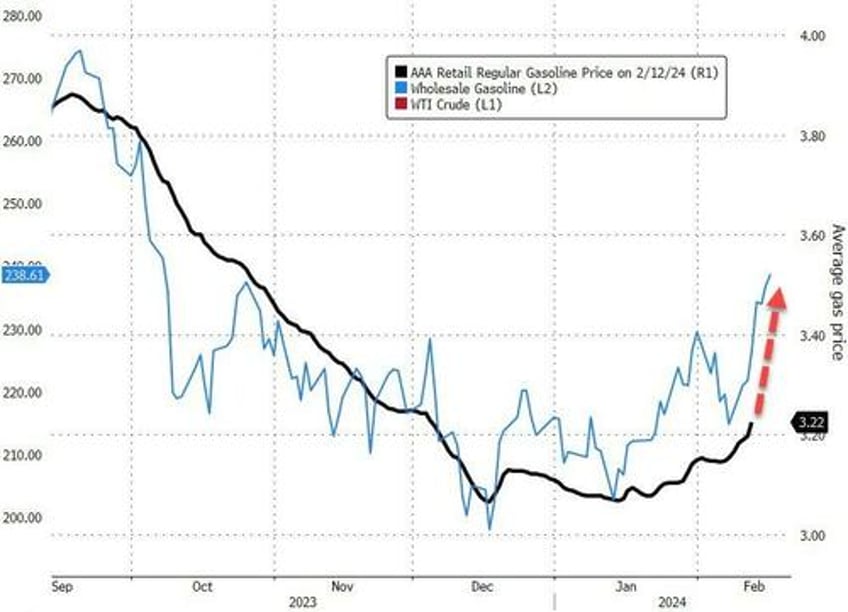

Oil prices rallied today, with WTI back above $78, breaking above its 100DMA and 200DMA (first time breaking above 100DMA since July 2023)...

Source: Bloomberg

Messrs Biden and Powell have a problem - pump prices are about to soar...

Source: Bloomberg

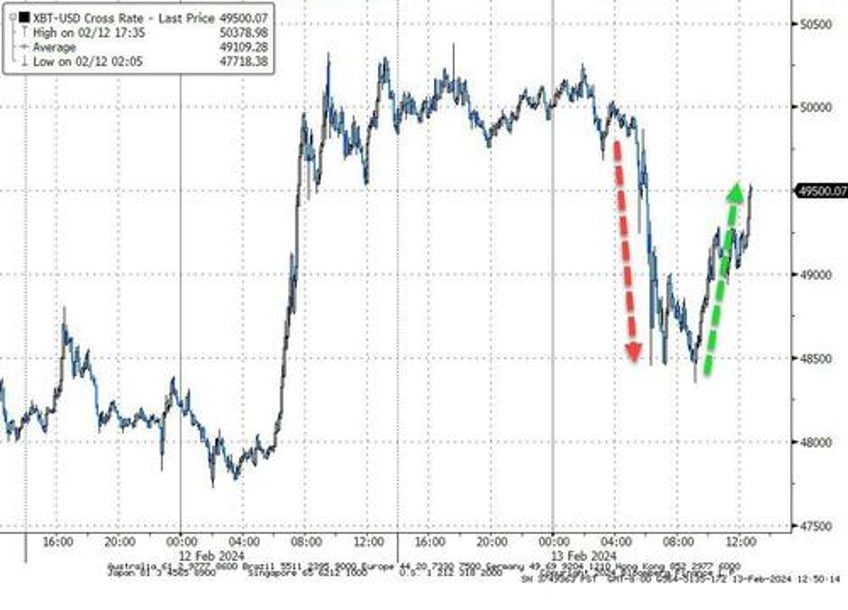

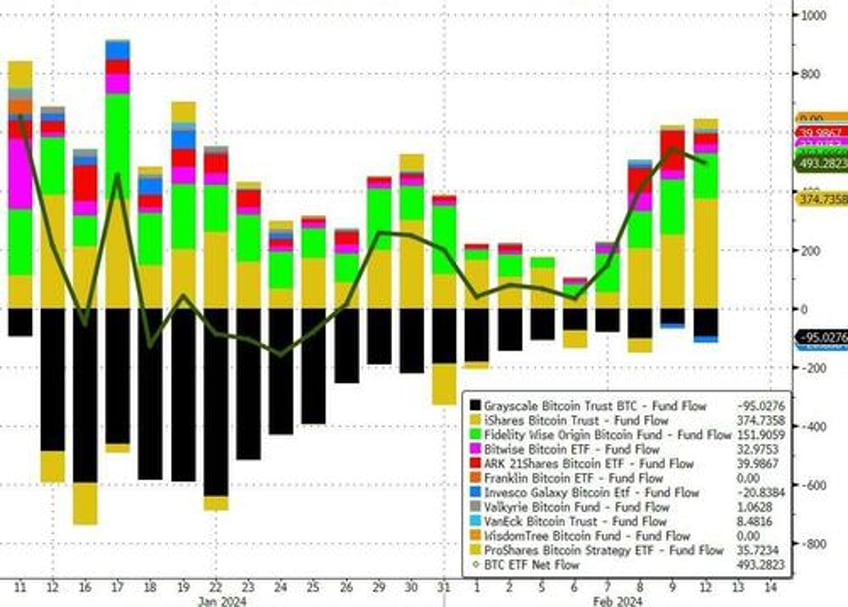

Bitcoin ended lower (after reaching $50k yesterday) but found serious support around $48,500 - quite impressive given the monkeyhammering that mega-cap tech got...

Source: Bloomberg

As Bitcoin ETF net inflows continue hot...

Source: Bloomberg

Finally, as a reminder, skews had collapsed to pre-volmageddon levels into this sudden narrative collapse...

Last time skew was this low was on Feb 5, 2018, a few hours before Volmageddon sent the VIX from 14 to 40 pic.twitter.com/gQEn8zpXny

— zerohedge (@zerohedge) February 11, 2024

VIX spiked up to almost 18 today...and 68% of Gamma is wiped away tomorrow in VIXperation.

Source: Bloomberg

That's a big 'unclench' from here.