By Jane Foley, Senior FX strategist at Rabobank

Since the release of the softer than expected June US CPI inflation report on July 12, the market has been increasingly hopeful that the narrative of a soft landing for the US economy will stick. Oil prices recorded a strong month in July as expectations of more Saudi supply cuts coincided with hopes that demand may stay resilient. Also, US stock market indices continued to probe the upside. The S&P 500 gained 3.1% in July, its fifth consecutive monthly gain. While the upside in US stocks earlier in the year was largely driven by the AI boom in the seven megacap tech stocks, since May there is evidence that the gains have become more broad-based.

That said, niggling worries about economic headwinds remain. We maintain that there is risk that the US economy will enter a mild recession before the end of this year and the US economic data releases due over the coming days could be decisive in underpinning or testing this view. Despite the strong stock market performance in July, equity futures are mostly lower this morning suggestive of some fatigue in the market and growing concerns about the outlook for the world’s second largest economy.

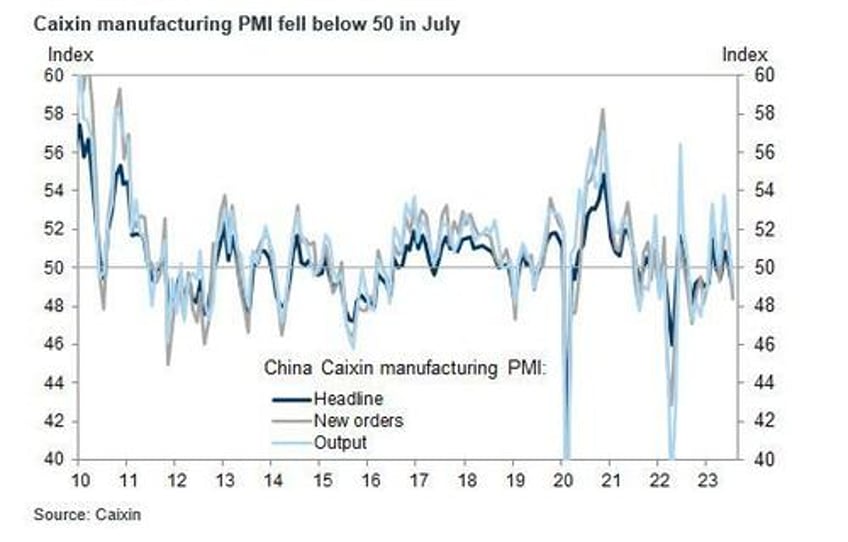

There is no denying the pressures that are facing China. The Caixin manufacturing PMI swung back below the 50 level in July, for the first time since April. At below 50, the index is reflecting contraction in the sector, in line with the official PMI released yesterday. Worryingly, new orders recorded the quickest fall since December, with weakness stemming from the producers of consumer and intermediate goods. A sharp drop in the new export orders sub-index raises questions about the buoyancy of global demand.

In addition, Chinese consumer demand remains soft. Youth unemployment is at elevated levels in China and falling house prices have injected a negative wealth effect. The market has remained broadly optimistic that further support measures will be forthcoming from the authorities, but so far policies have been aimed at the supply side and not the consumer. Data released overnight suggested that home prices in China dropped by the most in a year in July. According to data from China Real Estate Information Corp., the value of new home sales by the 100 biggest developers plunged 33.1% y/y. The news will undoubtedly stir fears of potential defaults in the sector. Last week the Politburo pledged to optimise policies for the property sector.

In contrast to the situation in China, house prices have been rebounding in Australia where a lack of property has overwhelmed the impact of rising mortgage costs in the sector. A little reprieve to mortgage holders was offered by the decision by the RBA this morning to leave policy unchanged for a second consecutive month. The Board is concerned that “many households are experiencing a painful squeeze on their finances” on the back of the 400 bps of RBA rate hikes that have been announced since May 2022. That said, it also recognized that others are “benefiting from rising housing prices, substantial savings buffers and higher interest income”. The RBA maintained the guidance that some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe. Australian CPI inflation in Q2 dropped to 6% y/y, still well above the RBA’s 2-3% goal. The AUD is the worst performing G10 currency this morning on the back of the RBA’s announcement.

Yesterday, Eurozone July CPI inflation data recorded a little further moderation in the headline figure, which eased to 5.3% from 5.5% the previous month. However, the core number stood firm at 5.5%. Q2 GDP data registered a better than expected 0.3% q/q rise, led by activity in countries such as Ireland and France. The GDP data, however, have not eased fears surrounding stagnation risks for the bloc. Energy concerns for the region remain on the agenda.

According to my colleague Mike Every, “the recent coup in Niger might seem irrelevant to markets. However, besides adding to a growing list of geopolitical troublespots, the new junta immediately declared it would cease exporting uranium, of which it is a key supplier, to France, whose electricity generation relies on it. The West African Union has already imposed sanctions and threatened military intervention if the previous government is not reinstalled; Niger claims France is set to join those military efforts. More importantly, take what’s happening with uranium here and apply it to many ‘green’ minerals the EU doesn’t control the supply chain of but needs on a vast scale; add Russian and Chinese on the ground influence in Africa etc; and start to see that this kind of geopolitical event might become more frequent and will matter for markets and inflation”.