"If you're an owner and need liquidity now, you pause on selling and instead borrow against your art, waiting for better market conditions," Adriano Picinati di Torcello, global art and finance coordinator for Deloitte, told Bloomberg, adding that's sparked growth across the art-lending market.

A rising number of affluent Americans with fine art collections have called their wealth advisors, asking about creative ways to unlock liquidity while keeping the multi-million-dollar Andy Warhol painting on the living room wall - for family and friends to appreciate over a glass of wine.

With art sales slowing and valuations sliding after decades of outperformance, wealth advisors are telling clients to reevaluate their options instead of sending the art to the Sotheby's auction block.

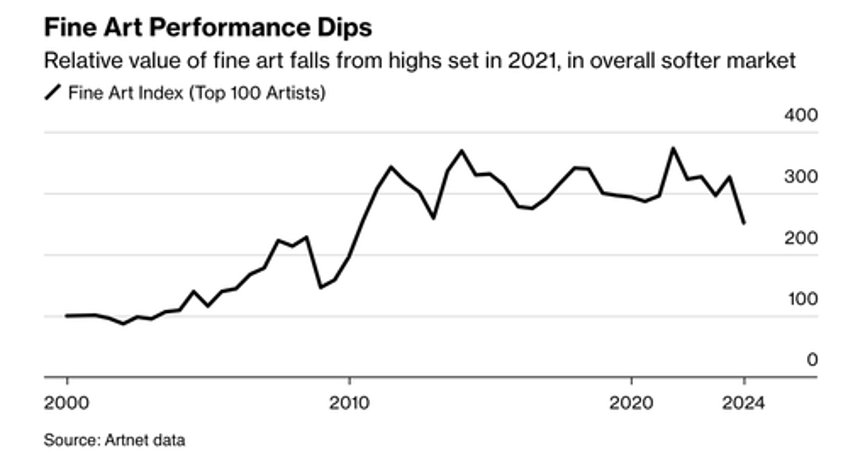

New data from Bloomberg shows the global art market has cooled significantly in a high-interest-rate environment. From its peak in mid-2021, the Fine Arts Index has slid 32%. In fact, the index has been levitating at a ceiling since 2011, following the run-up after the Dot Com bust.

Wealth advisors tell clients that art lending provides a significant advantage over borrowing against stocks and bonds: the valuation is updated just once a year, compared to the daily stock fluctuations that result in unexpected margin calls.

"We're not asking what the value of your Andy Warhol is every day," said Katy Lingle, US head of lending solutions at JPMorgan.

Bloomberg sheds more color on the expanding art-lending market for high net-worth Americans that's become a booming business for Wall Street banks:

As the market expands, Wall Street's biggest firms are growing their efforts by adding staff and marketing the service to new and existing clients. While the precise size of the market isn't certain, Deloitte estimates outstanding loans against art could surpass $36 billion in 2024, up from $29 billion to $34 billion last year. That also compares with $20.3 billion to $23.6 billion of such loans outstanding five years ago, according to Deloitte.

The largest US banks are looking to broaden their reach into the art market as a way to bring on and retain some of the world's wealthiest individuals and families. Catering to the affluent often means competing with rivals to offer more diverse products, fighting the constant threat that clients can move their money elsewhere.

* * *

Bank of America has seen new credit lines backed by art rise more than 14% compared to a year ago, according to Drew Watson, head of art services. Its book of art loans recently hit its highest on record. Within JPMorgan's asset and wealth management business, art lending is up 1% year-over-year, in-line with other loans in that business, according to a spokesperson.

Chadwick Chilcot, a high-net-worth wealth advisor at Wilmington Trust, explained that art lending among clients is certainly growing...

It's a steadily growing line of business for many of private banks that cater to high-net worth individuals. I tell my clients it's another tool in the toolbox that can help optimize their balance sheet and unlock some liquidity. Sometimes the art is just sitting on the wall but is a large part of the value of their balance sheet. Especially when you consider how much art has appreciated over the last 20 years. I tell them you might as well make it work for you just like any other asset.

If they have an "investment grade collection" with a qualified appraisal and that is properly insured we can easily lend off those assets. The last thing as a bank we want to do is come in and take those painting off the wall. Usually give them a line of credit with some sort of LTV. The assets are reappraised every 1-2 years and the line of credit goes up or down based on the appraisal. It's a very straightforward process.

Philip Hoffman, the founder of art advisory firm The Fine Art Group, explained, "There are margin calls, death, divorce and bankruptcy, so we have endless interest for lending."