As stocks continued to crash last week, money-market funds saw a second week of significant inflows (+$28.4BN) which together with the prior week's $52.7BN, pushed total MM assets under management to a new record high of $6.216 TN...

Source: Bloomberg

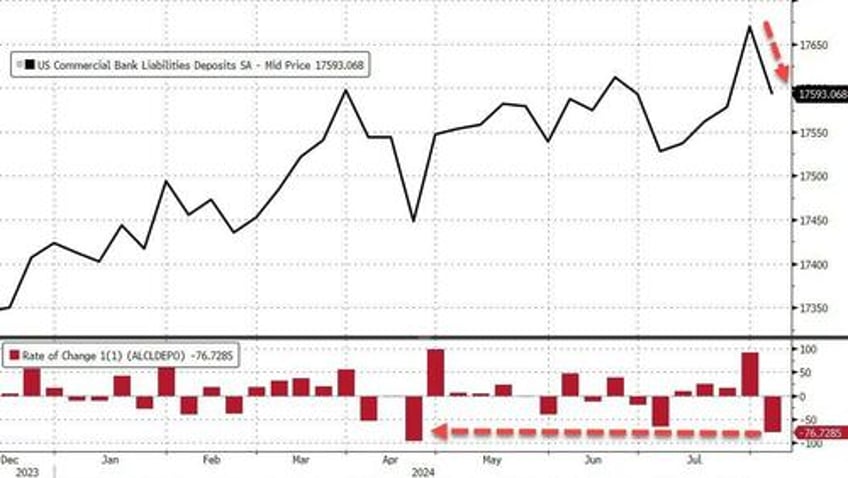

And while bank deposits also saw (huge) inflows the prior week, the week-ending 8/7 saw seasonally-adjusted (SA) US bank deposits plunge $77BN - the biggest weekly drop since Tax Day in April...

Source: Bloomberg

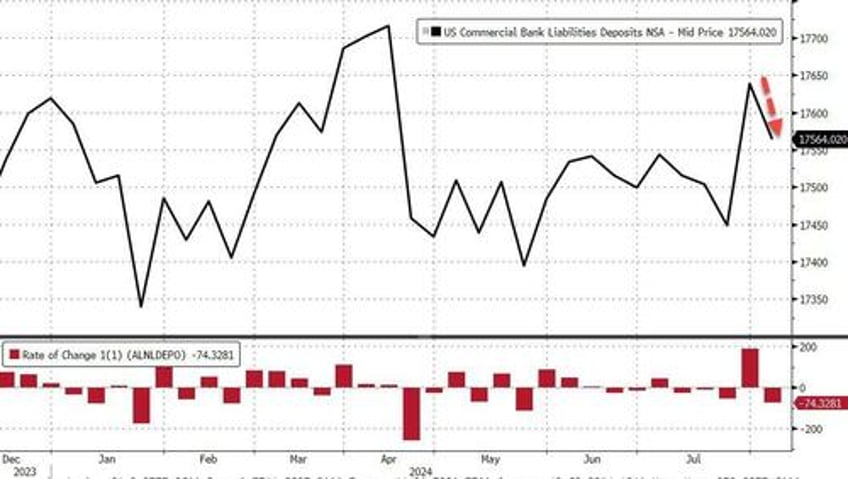

Non-seasonally-adjusted (NSA) deposits also tumbled (by $74BN)...

Source: Bloomberg

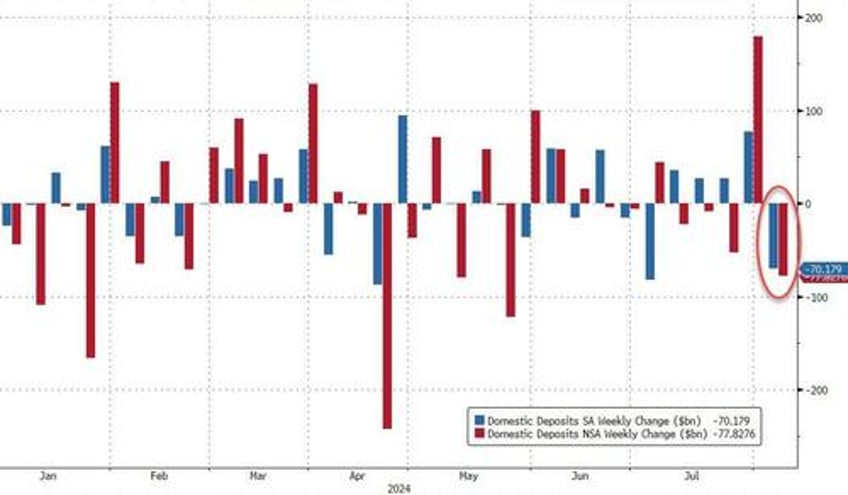

Excluding foreign deposits, US bank domestic deposits (SA and NSA) plunged as stocks tumbled (-$70BN and -$78BN respectively)...

Source: Bloomberg

On an SA basis, large banks saw $73.5BN of deposit outflows (the biggest since march 2023 - SVB!) and small banks $3.5BN on inflows. On an NSA basis, large banks suffered an $82BN deposits drawdown while small banks saw $4BN in inflows...

Source: Bloomberg

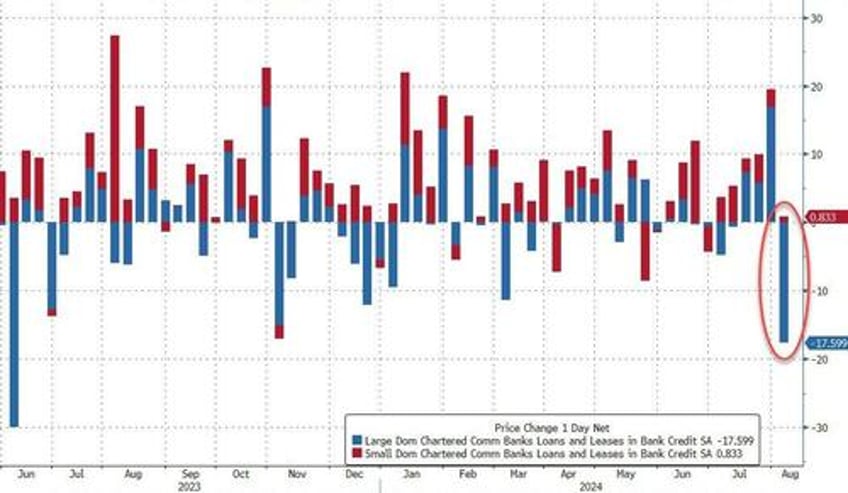

Fiittingly, on the other side of the ledger, bank loan volumes plunged last week (driven by a $17.6BN drop in loans at large banks offset very modestly by a $0.8BN increase in loan volumes at small banks)...

Source: Bloomberg

Finally, we note that US equity market cap rose this week while bank deposits at The Fed remained flat...

Source: Bloomberg

Will this historically-strong relationship ever re-couple?