Submitted by QTR's Fringe Finance

It is once again that time of year where I lay out what I believe will be the broader themes in the market for the year to come and identify the names I’ll be watching in particular in the year to come.

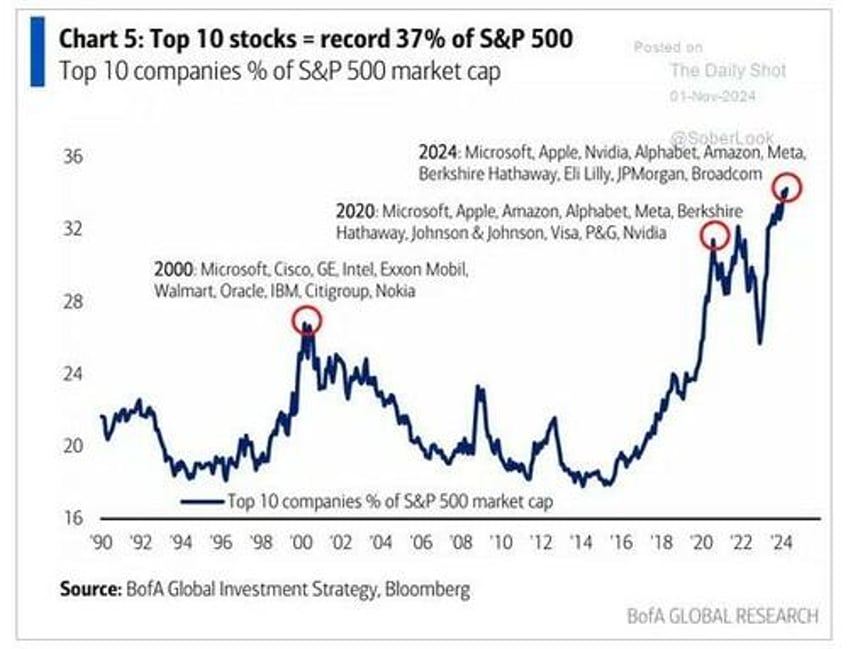

Once again, last year, my stocks to watch finished in the positive on an equal-weighted basis but failed to keep pace with the S&P 500, which is basically now made up of just the Magnificent Seven stocks. My 24 names I was watching for 2024 finished the year up 18.5% on an equal weighed basis versus 25.8% for the S&P 500, as of market close 12/27/2024. You can view these names here. (Disclaimer: I am terrible at math and didn’t double check these numbers at all.)

The three names I added in August, on an equal weighted basis, outperformed the S&P by 63.3% and were up on average 71% in a few short months.

The vibe going into 2025 is interesting. For those who have been paying attention, market breadth over the last two weeks has been awful, with decliners outpacing advancers for something like 10 or 11 days in a row. The top 10 S&P 500 names are the only stocks driving the market gains.

Thanks to our friends at Zero Hedge, we have Morgan Stanley equity strategist Michael Wilson’s take on breadth. He wrote last week:

One of the key technical factors I’ve used over time to gauge the health of equity markets is the breadth of participation by the underlying stocks.

Recently, we have fielded many questions from clients about breadth, as many have noted that December has exhibited some of the worst breadth in history while stock indices have remained near all-time highs. This anomaly is unusual, but some have concluded that breadth may not matter as much as in the past as a signal for price.

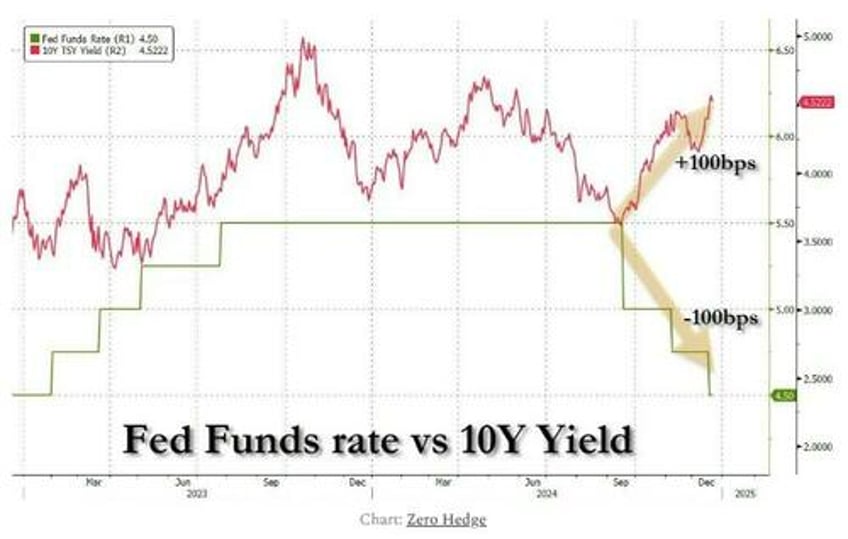

In my experience, ignoring breadth is usually a bad idea, and this past week suggests that breadth has anticipated what we learned on Wednesday – i.e., the Fed may not be able to deliver as much accommodation as markets were expecting.

Ergo, bonds are signaling something is “out of whack” in markets. Zero Hedge again notes that this is “the first time in history when 100bps of rate cuts raised 10Y yields by 100bps” (generally, the two move together directionally, as you can see in the chart).

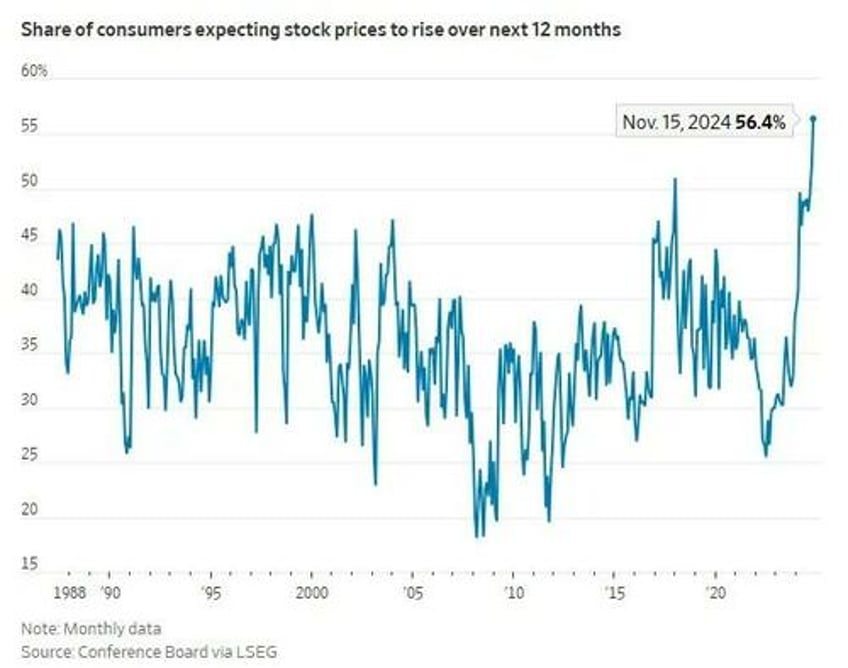

Meanwhile, in terms of quelling euphoria, fund managers are underweight cash and expectations have never been higher for markets:

To me, this bodes like a rocky year for the market. Heading into 2024, I felt pretty confident about what the geopolitical risks were and what the macro risks were heading into the year. 2025 could surprise some people, in my opinion. I think many people are automatically expecting another 30% upside year for the S&P 500 just because President Trump is in office, and he has guaranteed to deregulate and lower taxes. After all, this is what happened during Trump’s first term as President, up until COVID, so why would anybody expect differently?

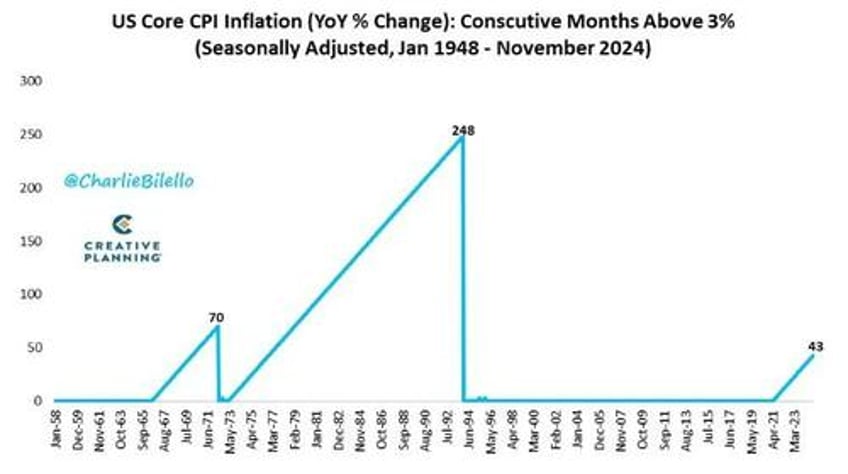

But this year, the Trump tailwind is going to have to face off with several headwinds rooted in reality. The first of those headwinds is that the Fed has not solved the inflation problem—something I laid out and talked about in this article last week. One of my favorite analysts, Charlie Bilello, notes that “US Core CPI has been above 3% for 43 straight month[s], the longest period of elevated inflation in the US since the early 1990s.”

(Charts from Charlie Bilello on X — a great follow for financial & macro charts).

At this point, it still looks like there’s two options: the Fed is going to have to surrender to higher inflation rates or allow an deflationary depression to take place.

I think a little bit of both will happen. Put simply, I think we’re going to see a significant amount of volatility this year in markets at some point, and then I think Trump will urge the Fed to cut rates rapidly, which they will do, at which point inflation will once again start to move higher, causing the Fed to capitulate to the fact that 2% is no longer going to be the inflation target. This is a series of events I predicted a couple of years ago when the first Fed started hiking during an appearance on Palisades Gold Radio.

The main risk I see heading into the new year is nothing more than just math. We simply can’t continue to have positive real rates until further notice without there being a larger shock to the financial system at some point. It is true that we have survived this long with rates at high levels when compared to recent rates, but this will not—and cannot—last, in my opinion.

As you read this heading into 2025, the gears of the economy continue to slow, with unemployment numbers slowly ticking higher, delinquencies in all types of credit still rising, and personal savings getting zapped as Americans continue to borrow to fund discretionary purchases.

BLS Unemployment Rate

There is no doubt in my mind that as long as interest rates stay on this path, we are going to run into a very large iceberg at some point, triggering a change in market psychology that will begin a nationwide deleveraging.

Sure, there was a lot of talk about a “soft landing” this year, but can it really be considered a soft landing when inflation is still at 2.7%?

We all thought a soft landing was 2.0% inflation, not 2.7% inflation, with the economy then returning to normal.

Anything but has happened. The economy is slowing, but inflation is staying persistently high. This is a bona fide prescription to wind up between a monetary policy rock and an economic reality hard place in the upcoming year. Remember, the market is extremely overvalued, in my opinion.

As I pointed out (for the millionth time) last week, the Buffett Indicator (market cap/GDP) is nearing all time highs.

The good news for the upcoming year is that I see geopolitical tensions cooling off a little. With Trump at the helm, I believe there will be a rejiggering of diplomacy globally, and that a lot of the geopolitical risk we saw with Joe Biden in office — and that I highlighted as key risk heading into 2024 — will start to cool heading into the new year.

This may act as a tailwind for the broader market, but I’m generally focused on it as it relates to the same defense stocks I liked for 2024, which I am not as excited about heading into the new year. Between geopolitical tensions cooling and this government supposedly looking for ways to cut spending, I can’t envision defense stocks having as great of a year as they had last year—so you won’t see them on my list this year.

As I said last week, this market is so overvalued and hyperextended that I would be watching cryptocurrencies as the first canary in the coal mine for a potential pullback. In my opinion, they will lead the way.

Keeping these macro trends in mind, it wasn't as easy to find ideas I'd like to watch for the upcoming year. But, as I always do, I gave it my best...(CLICK HERE TO READ ALL 25 NAMES I'M WATCHING FOR 2025).

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.