It seems like some of the bigger market moves in the past 6 months have occurred on Sunday nights. Always tough to get a good indicator from trading before the U.S. opens for the week, but so far, responses seem appropriate given our take on tariffs – please see Trump’s New Tariffs.

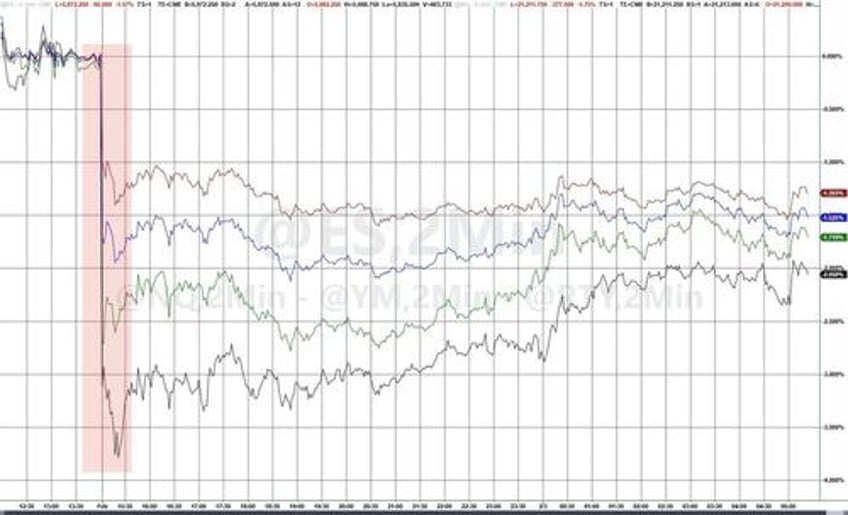

Major U.S. stock futures down between 1.5% and 2%. They were much lower earlier, which seemed a bit of a stretch. At these levels maybe be a touch defensive, but would be buying some risk. Also seems to make sense that the Russell 2000 is doing the worst (less ability to deal with tariffs) and the Nasdaq 100 is doing worse than the S&P 500 by a touch (presumably the strong dollar impacts profits on some of the most profitable companies more than others).

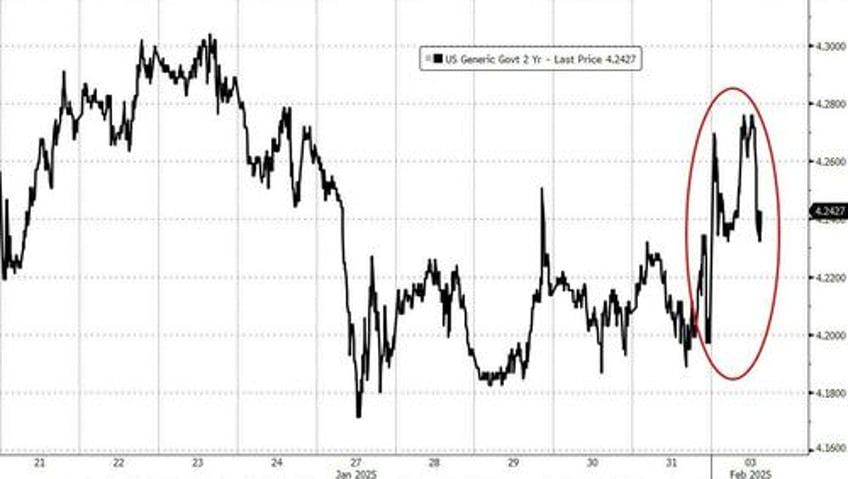

On rates, we see the front end of the yield curve with slightly higher yields. Makes sense as the uncertainty (and commodity inflation risks) keep the Fed on hold. The long end is rallying a bit. Presumably on the risk to future growth? Makes sense, though I’m less convinced about the move at the long end.

On the commodities side of things, energy is a sea of green, with NYMEX gasoline and heating oil leading the way. Fortunately, Canadian energy exports only got tagged with 10% instead of 25%, but I don’t see how this doesn’t hit the entire Atlantic Coast at the pump (see the report referenced above).

Credit, remains boring, as it should. High yield is at greater risk of underperformance here (I always equate HY to the Russell 2000 and IG to the S&P 500). Credit should remain open to new issues and has little risk of sever spread widening.

Currencies, are bearing much of the tariff load. Not just Canadian dollar, but the Euro too (in anticipation of tariffs?) If we get some sort of relief on tariffs, the currency markets seem most likely to experience violent reversals.

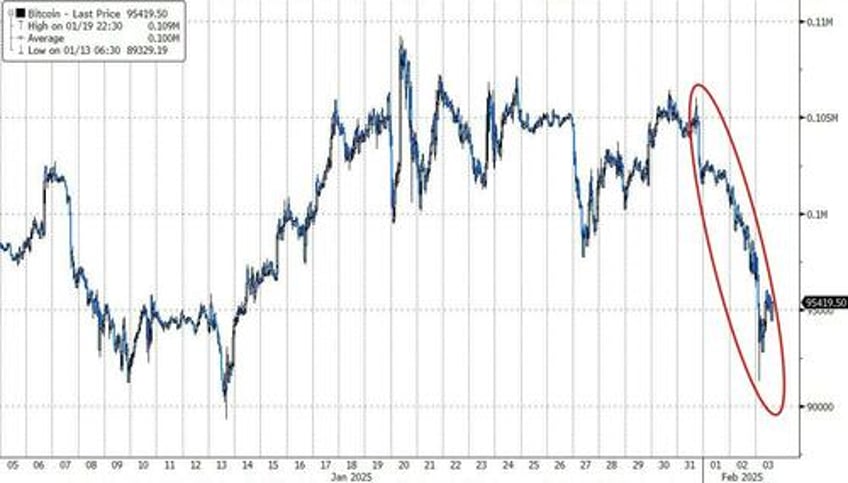

Bitcoin, caught me a bit by surprise.

More and more positive “chatter” about crypto and even potentially favorable tax treatment, but it lead the way lower, and caused, what can pretty much be described as a “rout” in the altcoin space. Maybe it was a function of being the only market open, but I don’t like the price action. What I really don’t like is that between the crypto ETFs and some companies, including some included in the indices, have become bitcoin proxies. That allows crypto to more directly impact equities than they have in the past. It is a concern of mine here.

What to Watch

Is this really all about fentanyl and will off-ramps be clarified? Will Canada (largely through treatment of precursors) and Mexico (largely by cracking down on the cartels) show a willingness to find the off-ramp? (I think China is more confusing as we are yet to see the National Security side of tariffs on China). If it is about fentanyl and Canada and Mexico “play nice” with President Trump, then these tariffs could be short lived, and we rally from here.

Does the administration decide they really like the increased revenues from tariffs, and decide to ramp up tariffs, and make the fentanyl claims, a red herring?

We should learn a lot in the coming days. If there is no clarity that there is an achievable way out, markets will be under a lot more pressure, but for now, I’m in the “off ramp” camp.

If this wasn’t difficult enough to navigate, who knows what unexpected items will pop up this week?