We'll do our preview of the week's main events shortly but first of all, a PSA from DB's Jim Reid who says to "standby for a manic Monday as the world tries to come to terms with the “shock” tariff announcements from Mr Trump’s administration on Saturday night." And even though he says "shock", all Trump did was follow through on exactly what he’s been saying he’s going to do since November, even though the market has refused to take that threat seriously, completely under-pricing the risks. So, this leaves the weekend news as a severe shock.

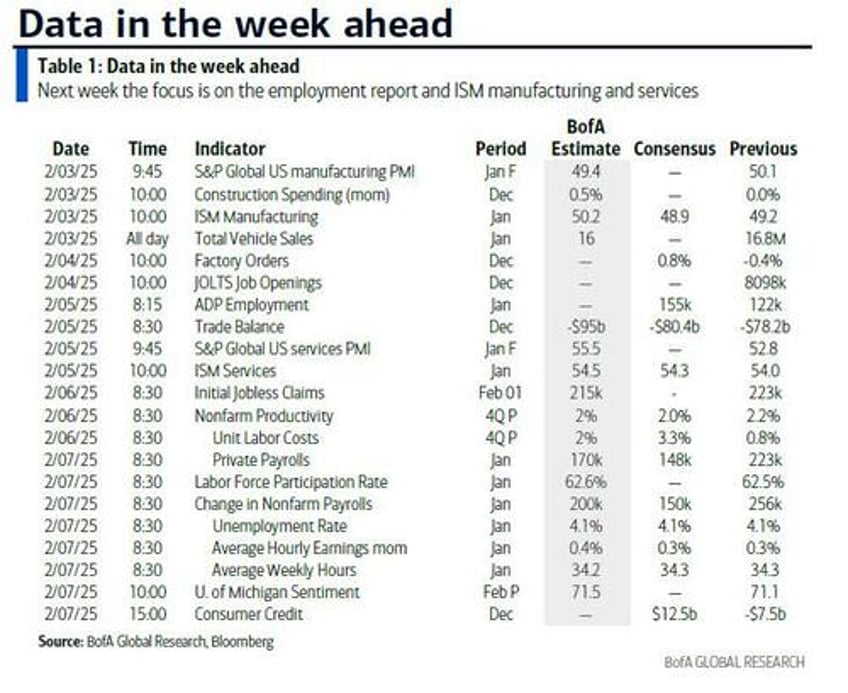

With that in mind, a preview of the week ahead feels a little parochial now given the weekend news but here it is anyway. In the US, we have the jobs report on Friday, and the ISM indices (today and Wednesday) leading the way. Elsewhere, the focus will be on the BoE decision in the UK (Thursday) and Alphabet (Tuesday) and Amazon (Thursday) earnings as part of 124 S&P 500 and 77 Stoxx 600 companies reporting.

Looking first at payrolls, DB's economists look for a moderation in the headline (175k vs. +256k previously) and private (150k vs. +223k) release but with higher uncertainty than usual around this. Firstly, the LA wildfires occurred during the survey week, which could reduce payrolls by -20k based on historical comparisons. Secondly, January's gains have been large over the last two years with the low layoff rates perhaps colliding with aggressively seasonal adjustments, although it could have been warm weather that was not prevalent this January. Thirdly, there are BLS benchmark revisions to deal with after last August's preliminary estimates. This could also influence the unemployment rate and make the data discreet from the December release which would now have a different population control to January's with the new revisions.

Staying in the US, other notable US data includes the University of Michigan's consumer sentiment on Friday (median forecast 72.0 vs 71.1) including the inflation expectations series which has seen some extreme partisan differences in expectations since the election. There will also be the US Treasury borrowing estimates and the quarterly refunding announcement (Wednesday). There are also lots of Fed speakers this week and this will give them their first chance to opine on possible policy implications of the Trump tariff news. We have a selection of these highlighted in the day-by-day week ahead calendar at the end.

For the Bank of England, our UK economist expects the MPC to deliver its third rate cut of the cycle, taking Bank Rate to 4.5% (75bps below its peak) with a 8-1 vote tally. There will also be new economic projections from the MPC as well as a supply projections update from the Bank. We’ll also see January CPI for the Eurozone today with the regional numbers already out. In China, notable releases feature the Caixin PMIs (services on Wednesday after manufacturing earlier today) after the official gauges released last week came in below forecasts. Remember China is on holiday until Wednesday.

Here is a day-by-day calendar of events

Monday February 3

- Data: US January ISM index, total vehicle sales, December construction spending, China January Caixin manufacturing PMI, Japan January monetary base, Italy January CPI, manufacturing PMI, new car registrations, budget balance, Eurozone January CPI, Canada January manufacturing PMI

- Central banks: Fed's Bostic and Musalem speak, ECB's Simkus speaks

- Earnings: Palantir, Mizuho, NXP Semiconductors

- Auctions: US Treasury borrowing estimates announcement

Tuesday February 4

- Data: US December JOLTS report, factory orders, Japan December labor cash earnings, France December budget balance

- Central banks: Fed's Bostic and Daly speak, ECB's Villeroy speaks

- Earnings: Alphabet, Merck & Co, PepsiCo, AMD, Pfizer, Amgen, Mitsubishi UFJ, KKR, UBS, Spotify, Apollo, PayPal, Ferrari, Chipotle Mexican Grill, Mondelez, Nintendo, Intesa Sanpaolo, TransDigm, Regeneron, BNP Paribas, Diageo, Dassault Systemes, DSV, Infineon, Mitsubishi Heavy Industries, Electronic Arts, Centene, Estee Lauder, Juniper Networks, Enphase Energy

Wednesday February 5

- Data: US January ADP report, ISM services, December trade balance, China January Caixin services PMI, UK January official reserves changes, new car registrations, France December industrial production, Italy January services PMI, December retail sales, Eurozone December PPI, Canada December international merchandise trade

- Central banks: Fed's Barkin, Jefferson, Bowman and Goolsbee speak, ECB's Lane speaks

- Earnings: Novo Nordisk, Toyota Motor, Walt Disney, Qualcomm, Arm, Boston Scientific, Uber, TotalEnergies, Fiserv, Santander, Emerson Electric, Equinor, GSK, Ares, Johnson Controls International, Credit Agricole, Ford Motor, Pandora, Vestas

- Auctions: US Treasury quarterly refunding announcement

Thursday February 6

- Data: US Q4 nonfarm productivity, unit labor costs, initial jobless claims, UK January construction PMI, Japan December household spending, Germany January construction PMI, December factory orders, Eurozone December retail sales, Sweden January CPI

- Central banks: BoE's decision, Fed's Jefferson and Waller speak, ECB's Nagel speaks, BoJ's Tamura speaks, BoE's DMP survey

- Earnings: Amazon, Eli Lilly, Linde, AstraZeneca, Philip Morris, L'Oreal, Honeywell, ConocoPhillips, Bristol-Myers Squibb, Intercontinental Exchange, Tokyo Electron, Fortinet, Vinci, Siemens Healthineers, Hilton, ING, Roblox, Kenvue, Blue Owl, IQVIA, Hershey, Monolithic Power Systems, Expedia, Societe Generale, AP Moller - Maersk, Illumina, ArcelorMittal, Affirm, Orsted

Friday February 7

- Data: US January jobs report, February University of Michigan survey, December wholesale trade sales, consumer credit, China January foreign reserves, Japan December leading index, coincident index, Germany December industrial production, trade balance, France December trade balance, current account balance, Q4 wages, Canada January jobs report

- Central banks: Fed's Bowman and Kugler speak, ECB's Guindos speaks, BoE's Pill speaks

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing and services reports on Monday and Wednesday and the employment report on Friday. Tariffs on Mexico, Canada, and China are set to take effect on Tuesday. The are many speaking engagements from Fed officials this week, including Vice Chair Jefferson on Tuesday and Governor Bowman on Wednesday.

Monday, February 3

- 09:45 AM S&P Global US manufacturing PMI, January final (consensus 50.1, last 50.1)

- 10:00 AM Construction spending, December (GS +0.4%, consensus +0.2%, last flat)

- 10:00 AM ISM manufacturing index, January (GS 49.5, consensus 49.9, last 49.2): We estimate the ISM manufacturing index edged slightly higher in January (+0.3pt to 49.5), reflecting general improvement in other manufacturing surveys but a slight headwind from residual seasonality.

- 12:30 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on the economic outlook at the Rotary Club of Atlanta. Q&A is expected.

- 05:00 PM Lightweight motor vehicle sales, January (GS 15.8mn, consensus 16.0mn, last 17.1mn)

- 06:30 PM St. Louis Fed President Musalem (FOMC voter) speaks

- St. Louis Fed President Alberto Musalem will give welcoming remarks at an event held at the St. Louis Fed.

Tuesday, February 4

- 10:00 AM JOLTS job openings, December (GS 7,800k, consensus 8,000k, last 8,098k): We estimate that JOLTS job openings declined slightly in December (-0.3mn to 7.8mn), reflecting convergence to the level suggested by online job postings.

- 10:00 AM Factory orders, December (GS -0.8%, consensus -0.7%, last -0.4%)

- 11:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will give a speech on housing at a National Housing Crisis Task Force meeting. Q&A is expected.

- 02:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will speak in a moderated panel hosted by the Commonwealth Club World Affairs of California. Q&A is expected.

- 07:30 PM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will give a speech on the US economic outlook and monetary policy at Lafayette College in Easton, Pennsylvania. Q&A is expected.

Wednesday, February 5

- 08:15 AM ADP employment change, January (GS +160k, consensus +150k, last +122k)

- 08:30 AM Trade balance, December (GS -$95.0bn, consensus -$96.8bn, last -$78.2bn)

- 09:00 AM Richmond Fed Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will participate in a fireside chat hosted by the Conference Board. Q&A is expected.

- 09:45 AM S&P Global US services PMI, January final (consensus 52.8, last 52.8)

- 10:00 AM ISM services index, January (GS 53.5, consensus 54.1, last 54.0): We estimate that the ISM services index declined 0.5pt to 53.5 in January, reflecting sequential softening in our non-manufacturing survey tracker (-1.5pt to 54.2 in January) and a headwind from residual seasonality.

- 02:30 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will give remarks at the Automotive Insights Symposium in Detroit. Speech text is expected.

- 03:00 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will give a brief economic update and speak on bank regulation at a Kansas Bankers Association conference. Speech text is expected.

- 07:30 PM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will give a lecture called "Do Non-Inflationary Economic Expansions Promote Shared Prosperity?" at Swarthmore College. Speech text and Q&A are expected.

Thursday, February 6

- 08:30 AM Initial jobless claims, week ended February 1 (GS 205k, consensus 213k, last 207k): Continuing jobless claims, week ended January 25 (consensus 1,875k, last 1,858k)

- 08:30 AM Nonfarm productivity, Q4 preliminary (GS +1.2%, consensus +1.4%, last +2.2%): Unit labor costs, Q4 preliminary (GS +3.4%, consensus +3.4%, last +0.8%)

- 02:30 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will participate in a fireside chat hosted by the Atlantic Council. The event will cover topics related to the global financial ecosystem, rise of digital assets, dollar-backed stablecoins, and development of new domestic and cross-border payment systems. Q&A is expected.

- 05:10 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will give a speech on the “Future Challenges for Monetary Policy in the Americas" at an event in Mexico City. Speech text is expected.

Friday, February 7

- 08:30 AM Nonfarm payroll employment, January (GS +190k, consensus +170k, last +256k); Private payroll employment, January (GS +160k, consensus +140k, last +223k); Average hourly earnings (MoM), January (GS +0.3%, consensus +0.3%, last +0.2%); Unemployment rate, January (GS 4.1%, consensus 4.1%, last 4.1%); Labor force participation rate, January (GS 62.6%, consensus 62.5%, last 62.5%): We estimate nonfarm payrolls rose 190k in January. On the positive side, big data indicators indicated a healthy pace of job creation and the pace of layoffs—a particularly important determinant of net job growth in January—remained subdued. Additionally, we expect continued above-trend (albeit moderating) contributions from the recent surge in immigration and catch-up hiring. On the negative side, we assume that the Los Angeles wildfires and colder-than-usual weather will each subtract 20k from January job growth. We assume the weather headwind will disproportionately impact the construction, leisure and hospitality, and other services categories. The report will be accompanied by the annual benchmark revision to nonfarm payrolls. The Bureau of Labor Statistics’ preliminary estimate of the benchmark indicated that cumulative payroll growth between April 2023 and March 2024 would be revised 818k lower, though we see the revision as partly misleading, as it will likely exclude 300-500k immigrants who were not authorized to work but were correctly picked up in payrolls initially.

- We estimate that the unemployment rate was unchanged at 4.1% on a rounded basis and that the participation rate increased by 0.1pp to 62.6%. The report will be accompanied by updated population controls, which we expect to lead to the largest upward revisions on record to the level of the population (+3.5mn), the labor force (+2.5mn), and household employment (+2.3mn). On net, we expect these revisions to put modest upward pressure on the participation (+0.11pp) and unemployment (+0.04pp) rates via a composition effect.

- We estimate average hourly earnings rose 0.3% (month-over-month, seasonally adjusted), reflecting negative calendar effects but a modest boost from the tail end of start-of-the-year wage increases.

- 09:25 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will give a brief economic update and speak on bank regulation at a conference hosted by the Wisconsin Bankers Association. Speech text is expected.

- 10:00 AM University of Michigan consumer sentiment, February preliminary (GS 71.1, consensus 72.0, last 71.1); University of Michigan 5-10-year inflation expectations, February preliminary (GS 3.2%, consensus 3.1%, last 3.2%)

- 12:00 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will give a speech on entrepreneurship and aggregate productivity at the 2025 Miami Economic Forum. Speech text is expected.

Source: DB, Goldman