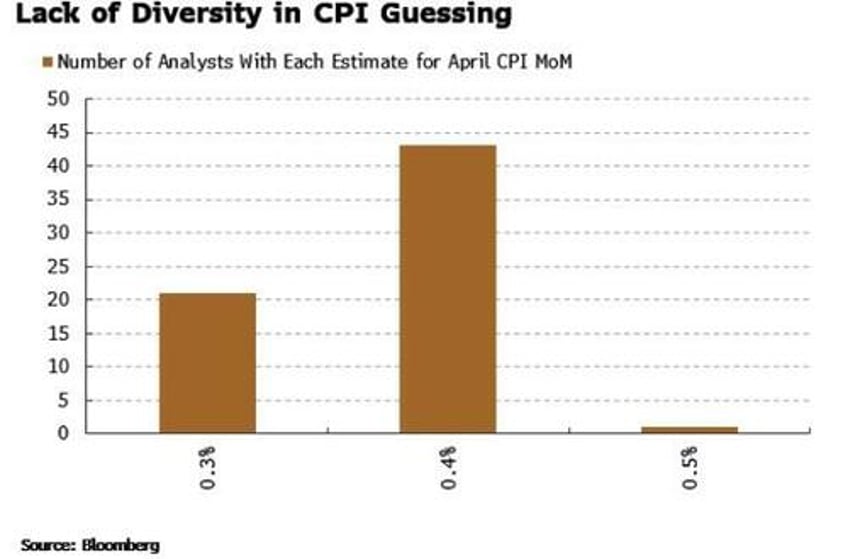

A simple model projects April’s month-on-month CPI to come in at 0.4%. Problem is most other estimates are 0.4%, leaving markets particularly exposed to a miss in either direction. The long gamma position in stocks could get unwound pretty quickly if the inflation outturn is big enough.

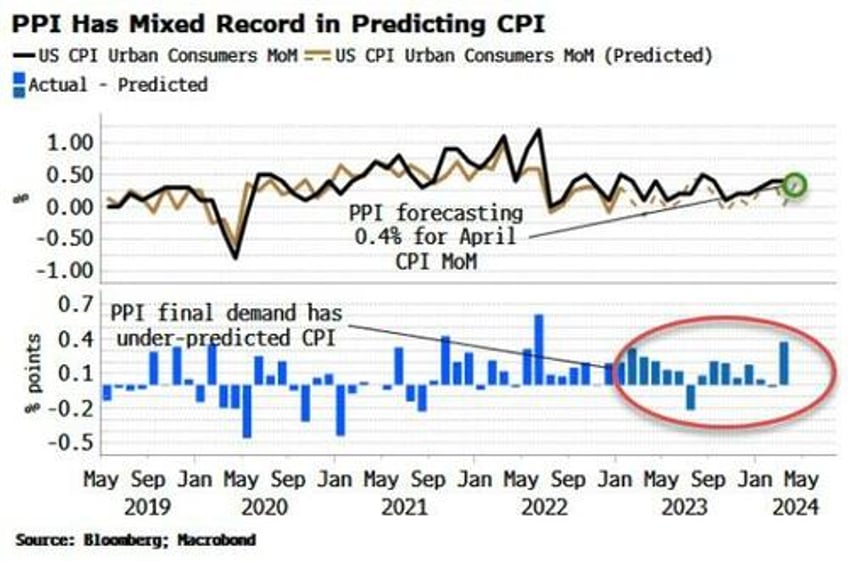

The chart below shows a simple regression of month-on-month CPI and PPI final demand (from 2009 to 2022, and running out of sample since then). As we can see the model seems to persistently underestimate CPI. For April’s CPI based on today’s latest final demand PPI data, it projects 0.36%, i.e. 0.4% rounded.

It suggests a lot of people are perhaps looking at it similarly. If we use the estimate for PPI final demand (0.3%) or the actual outturn (0.5%), we get 0.3% or 0.4% for April CPI. Just like everyone else.

Even if analysts aren’t using PPI to estimate CPI, there’s a remarkable lack of variance in these forecasts. A print lower than 0.3% or more than 0.4% could move markets quite significantly in either direction (revisions notwithstanding).