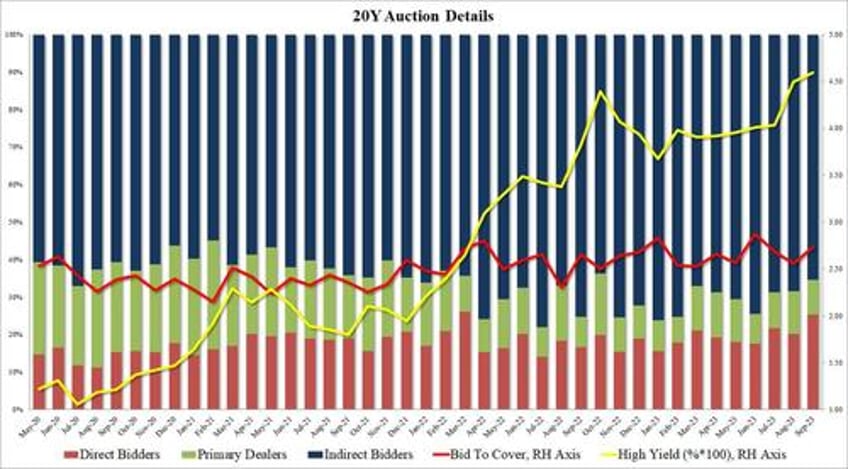

With auction after auction printing at the highest yields in decades, today's sale of $13BN in 20Y notes was no different, only today's high yield of 4.592% was the highest on record (or at least since the auction was reintroduced after it was phased out in 1986). Naturally, it was higher than last month's 4.499% but signaling overall bond market strength, perhaps as a result of the dump in stocks, stopped through the 4.595% When Issued by 0.3bps, the first non-tailing 20Y auction since June.

The bid to cover of 2.74 was also solid, coming above the six-auction average of 2.64 and was the highest since June's 2.87.

The internals were a bit softer, with Indirects taking down 65.4%, below last month's 68.4% and below the recent average of 69.7%. And with Directs taking down 25.4%, or the most since March 2022, Dealers were awarded 9.3%, the lowest since June.

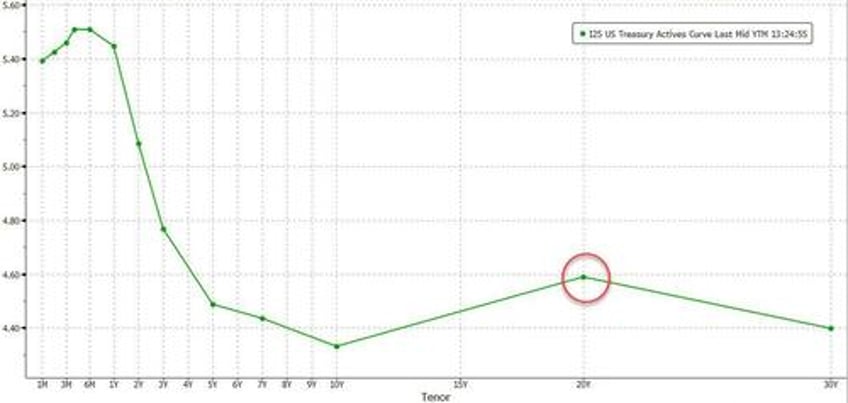

Overall, this was a good, if not great 20Y auction, one which did little to fix the kink in the curve that has the 20Y yield printing well above both the 10Y and the 30Y.