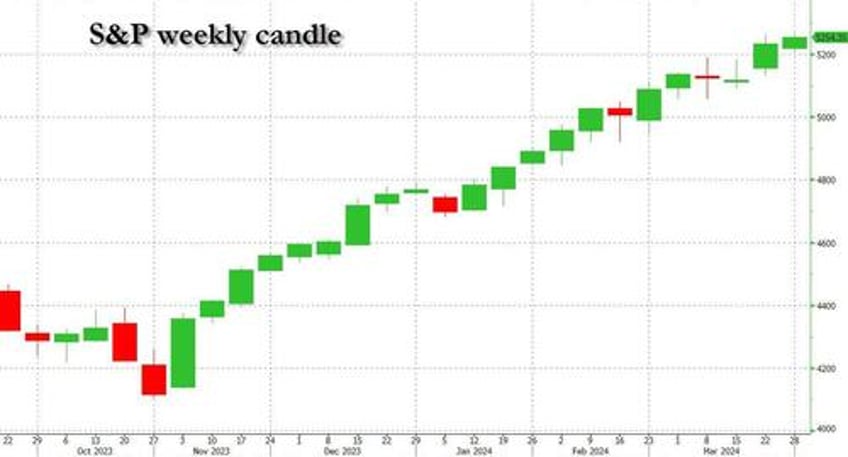

Since the October 2023 lows, we can count at least 19 green weekly candles in the S&P (vs just three red ones), and yet what is remarkable is that as the market has been relentlessly melting up to weekly and daily all-time highs, hedge funds have been just as relentlessly shorting single names for much of the historic meltup which culminated with the recent dovish presser by Fed chair Powell, and last week's core PCE print which came in fractionally below expectations, and which is sure to keep pushed spoos well over 5,300.

And while stocks just refuse to back down, we turn to the latest must read Weekly Rundown Report from Goldman, in which we read that "single stock short flow has increased for 7 consecutive weeks" and "saw the largest net selling since early January, driven entirely by short sales as long flows were fairly muted." with "7 of 11 US sectors were net sold on the week" even as Macro Products – index and ETF combined – were net bought for a 2nd straight week (4 of the last 5), driven by long buys outpacing short sales ~3 to 1. And so yet another bear trap sprung - as hedge fund short single names for 13 of the past 14 days - expect the meltup to continue until all bears have been steamrolled ahead of the November elections.