Mercedes-Benz shares in Germany tumbled on Friday after the luxury carmaker slashed its full-year profit outlook. The company warned that further deterioration of the macroeconomic environment, specifically in China, was the primary reason vehicle demand softened.

Mercedes has downgraded its outlook for the year, now forecasting earnings before interest and taxes (EBIT) to be "significantly below" last year's levels. The automaker also revised its adjusted return on sales forecast to 7.5% to 8.5%, a sharp drop from the prior forecast of 10% to 11%.

"This affected the overall sales volume in China, including sales in the Top-End segment. Overall, the sales mix in the second half of 2024 is expected to remain unchanged versus the first half, and therefore weaker than originally expected," Mercedes wrote in a statement.

Chief executive Ola Källenius informed analysts on a call that sliding vehicle demand stemmed "mainly [from] China" but noted slowdowns are materializing in other major markets, such as Europe. He said the carmaker is also being hit by "the [impact] of higher interest rates."

Shares fell as much as 8.4%—the largest intraday decline since June 2020 and a two-year low—after some analysts said the outlook revision was "not that surprising" given mounting pressures from China. Other analysts are concerned about the company's share buyback program.

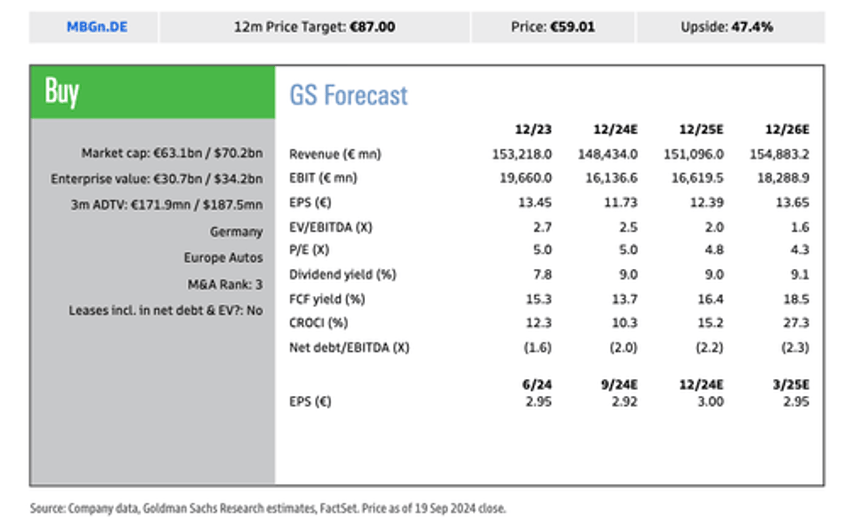

Goldman analysts George Galliers and Sian Keegan provided more color on Mercedes' substantial guidance cut for clients this morning. The analyst maintained a 'Buy' rating with a price target of 87 euros.

>20% cut to Cars adj. EBIT - Mercedes this evening (19th September) cut its FY2024 guidance, citing weak economic activity and consumption in China. The company negatively revised its Cars adj. EBIT margin target range from 10-11% to 7.5-8.5%. Within this is a c.100bps negative impact from valuation adjustments, with further insights into exactly what this encompasses to be provided during an investor call at 8am CET (7am UK) tomorrow morning. As a result of the cut to the Cars margin target, Mercedes now expects group EBIT to be significantly below (>15%) 2023's €19.7bn and industrial free cash flow also to be significantly below (>25%) last year's €11.3bn.

Group downgrades in the magnitude of €2.4bn or >=15% - Taking the mid-point of the new Cars margin target range and applying it to Visible Alpha Consensus Data revenues, all else equal, implies a downgrade to group EBIT in the magnitude of €2.4bn or >=15%. We would flag there is incremental risk to the c.15% from downgrades to the top-line, with Mercedes saying that it now expects top-end vehicle mix to be flat in 2H vs. 1H. Nevertheless, on flat mix and, potentially still, stronger volumes given constraints in 1Q, we believe the market will be left with many questions as to why the company looks set to see a c.365bps (c.175bps ex valuation adjustments) sequential decline in margin to c.6% (c.7.9%) in 2H.

Confidence waning in China - While valuation multiples suggest that investors are anticipating a deterioration in earnings across the European OEM space, we believe many will be surprised by the magnitude of Mercedes' cut with the company sounding reasonably assured at the end of July. Unlike warnings from BMW and Porsche, Mercedes is attributing the deterioration to the market evolution in China rather than supplier challenges. In our conversations with investors, we note increasing concerns that the China earnings for German OEMs are in a state of permanent decline and that local operations could eventually be loss making in the future.

"We value Mercedes by applying a P/E multiple of 7.0x to our 2025E EPS to derive a 12-month price target of €87. We are Buy rated," the analysts said.

Here's what other Wall Street analysts are saying (list courtesy of Bloomberg):

RBC (outperform)

- Analyst Tom Narayan says the news is surprising given the size of the cut and the lack of cautionary commentary

- Says that while BMW's warning was due to a specific supplier issue, Mercedes is more ambiguous and calls out general macro weakness in China

UBS (buy)

- Analysts led by Patrick Hummel say expect meaningful 2025 consensus downgrades on the back of the news, potentially in the 20% range on group Ebit and EPS level

Jefferies (buy)

- Analysts Philippe Houchois and Michael Aspinall say the magnitude of the cut is surprising

- Say the 250 basis-point margin guidance cut to mid-point is largely due to China, "despite the expectation that the JV structure might soften the impact"

Oddo (underperform)

- Analyst Anthony Dick says China, primarily responsible for the profit warning, is "becoming a nightmare," and sees a potential structural crisis in the Asian nation, urges caution

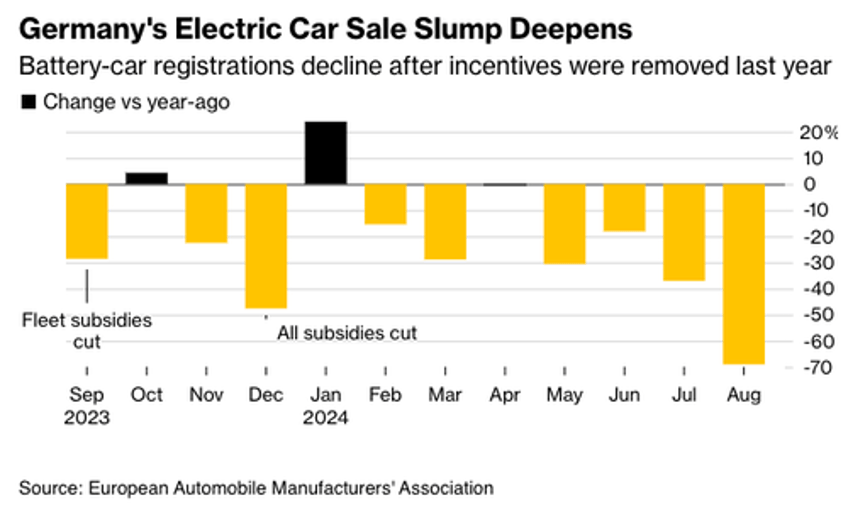

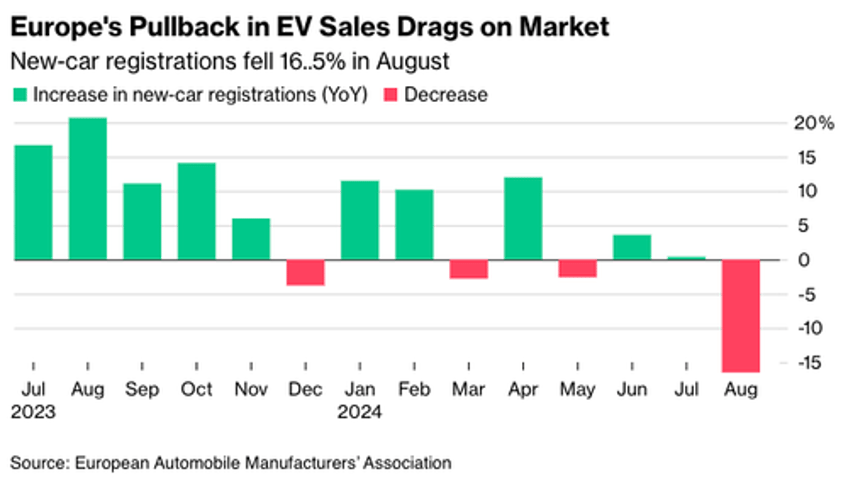

In August, Mercedes posted a 13% decline in new-car registration across the European Union. The report also showed that the demand for EVs in Germany crashed.

Across the continent, new car registrations tumbled 16.5% compared to a year ago.

Just last week, BMW slashed its full-year earnings guidance, blaming the downturn in China and sliding EV sales. Earlier this month, Volvo Cars offered a dismal outlook and no longer projected 100% all-electric vehicle sales by 2030.

Economy Minister Robert Habeck will host an industry summit in Berlin on Monday to discuss the downturn amid recession threats in Europe's largest economy.

Maybe the success of the German car industry should not be based on EVs.