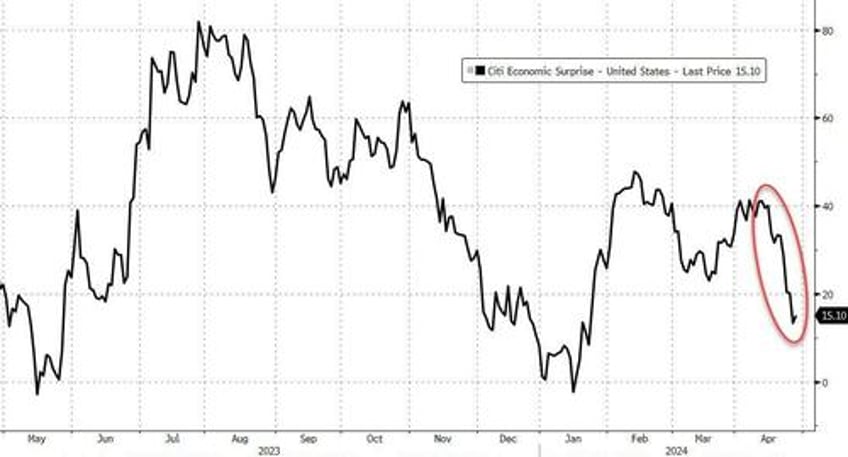

It was an ugly macro week...

Source: Bloomberg

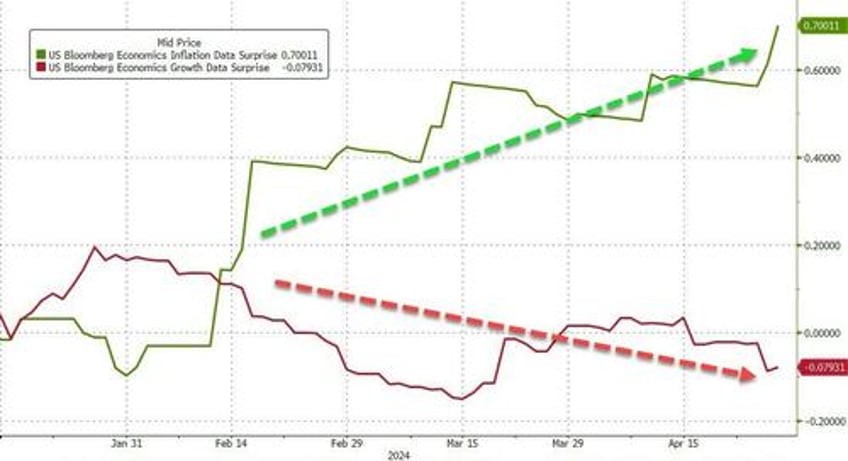

...and worse still, 'growth' surprises disappointed significantly while 'inflation' surprises surprised to the upside significantly...

Source: Bloomberg

Soaring inflation expectations sent rate-cut expectations to new cycle lows...

Source: Bloomberg

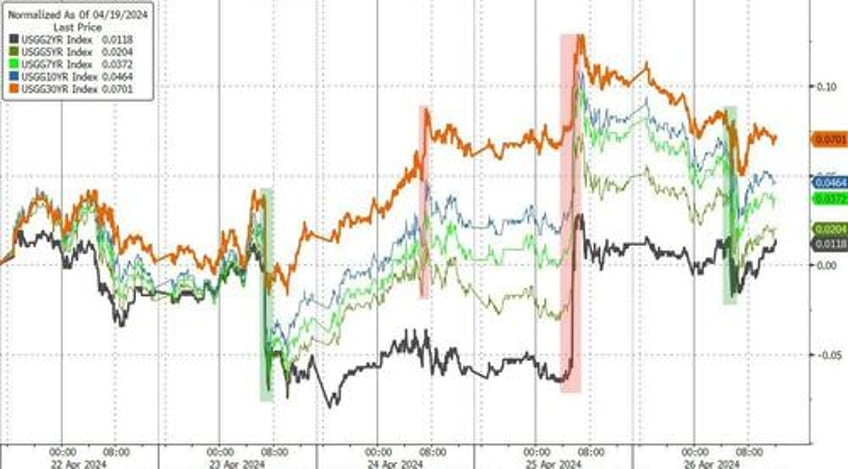

...pushing yields higher across the board (led by the long-end)...

Source: Bloomberg

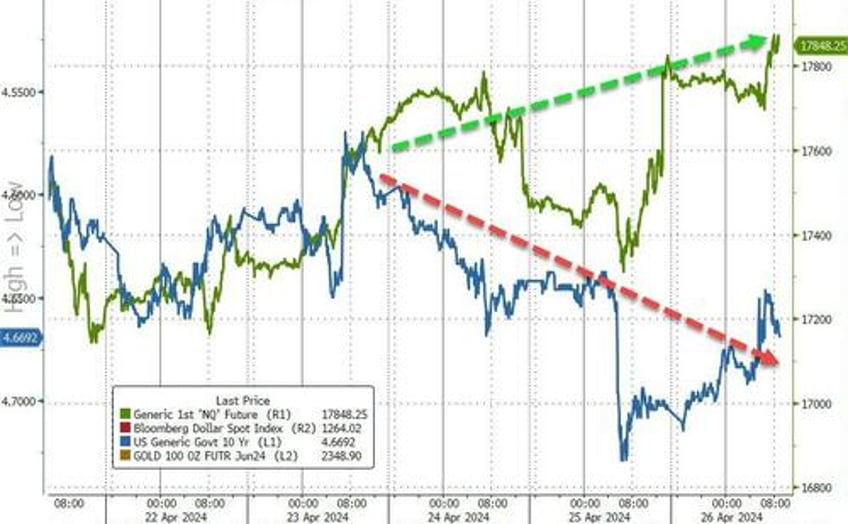

But, stocks didn't care about any of that because a handful of mega-cap tech stocks' earnings were awesome (except META) - and that's what matters (for now)...

Source: Bloomberg

Nasdaq outperformed, up 4% on the week (its best week since the start of Nov 2023). The Dow was the laggard on the week but all the majors had a decent week...

Not the best week for some observers...

Traders 1: Marko 0 https://t.co/T6PHjRSrMF

— zerohedge (@zerohedge) April 26, 2024

This week saw the biggest short-squeeze since the first week of March...

Source: Bloomberg

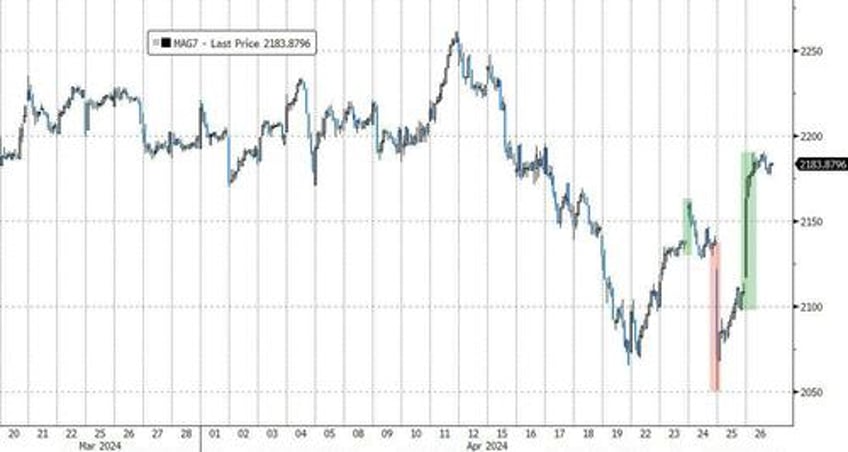

And the basket of Magnificent 7 stocks soared over 5% this week, its best week since the first week of November (Fed Pivot) - but it was noisy as TSLA surged, META tumbled, and then GOOGL/MSFT lifted the lid...

Source: Bloomberg

TSLA pushed back above $500BN market cap this week and Alphabet soared above $2TN market cap for the first time ever...

Source: Bloomberg

Tech and Discretionary outperformed on the week with Energy and Materials lagging (but all sectors ended the week green)...

Source: Bloomberg

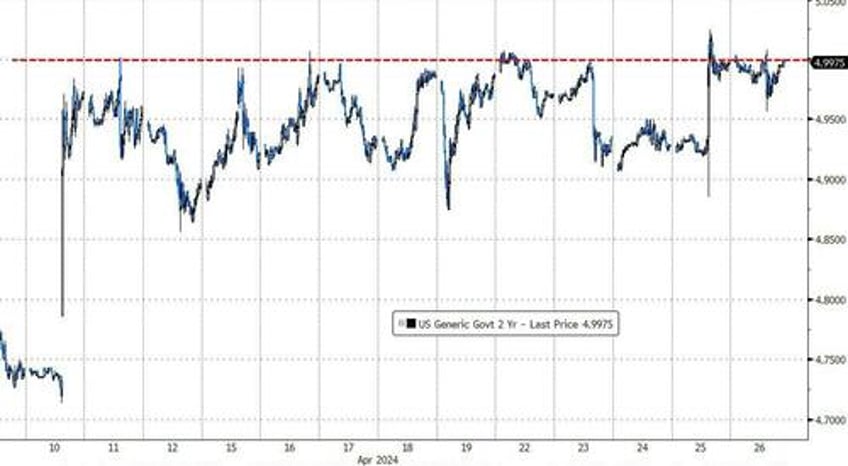

5.00% remains the Maginot Line for the 2Y Yield...

Source: Bloomberg

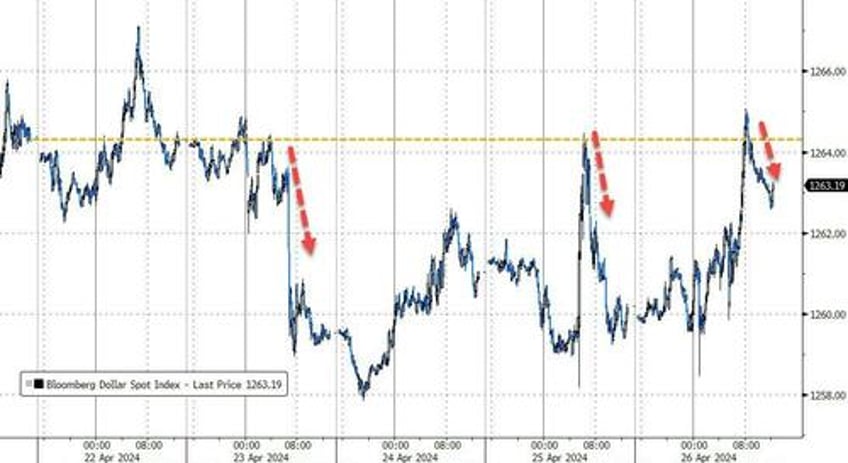

Interestingly, the dollar ended the week practically unchanged - despite a lot of noise...

Source: Bloomberg

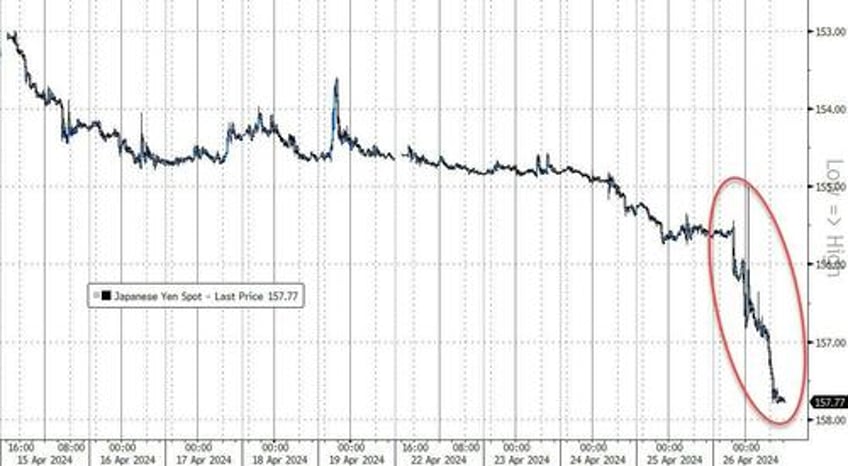

...despite the seventh straight week of declines in the yen vs the dollar as it appears the BoJ and MoF have given up...

Source: Bloomberg

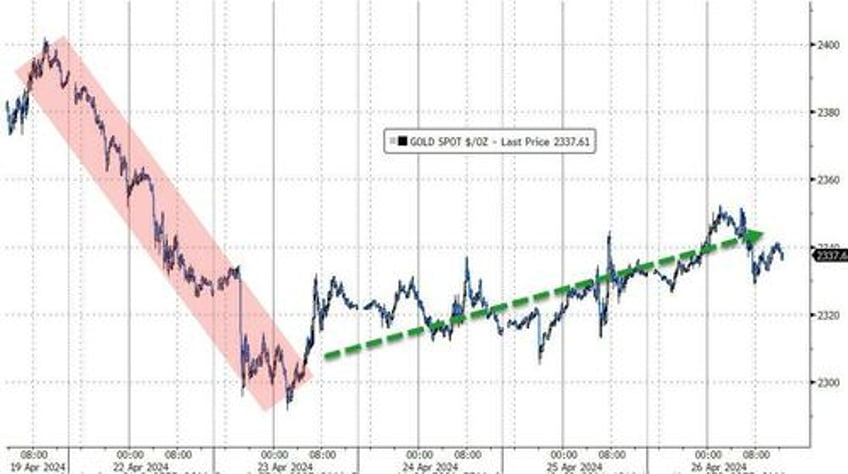

Gold was dumped this week - its worst week since the start of December 2023. Spot prices did find support at $2300 though...

Source: Bloomberg

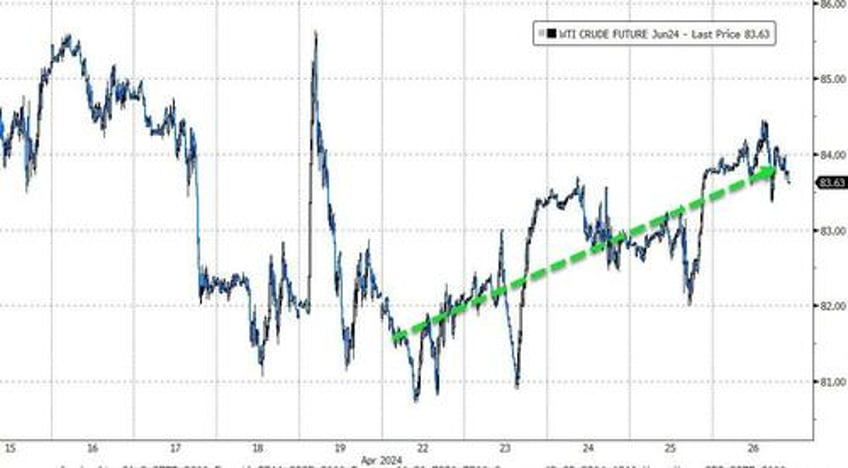

After two down weeks, oil prices rallied this week, with WTI back above $83...

Source: Bloomberg

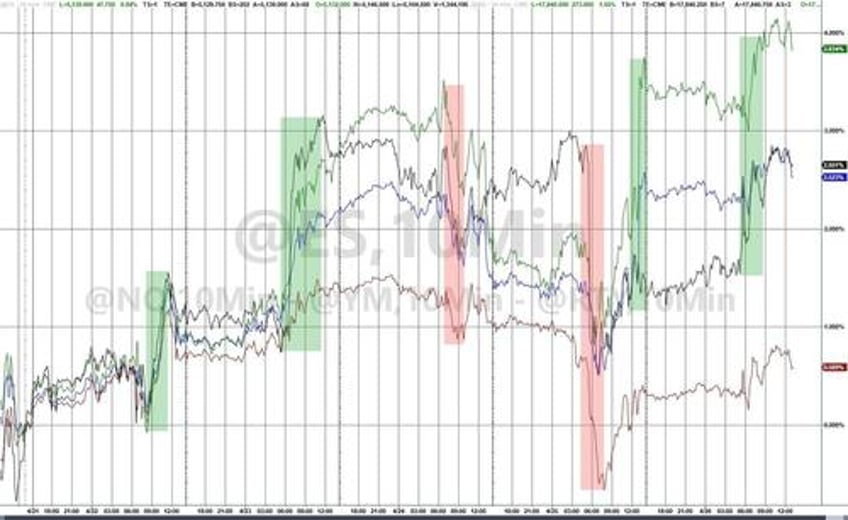

Finally, intraday volatility has picked up dramatically in the last couple of weeks...

Source: Bloomberg

...as the distribution of possible rate outcomes has picked up significantly. Don't forget next week's QRA and FOMC as Yellen and Powell get 'back to work'.