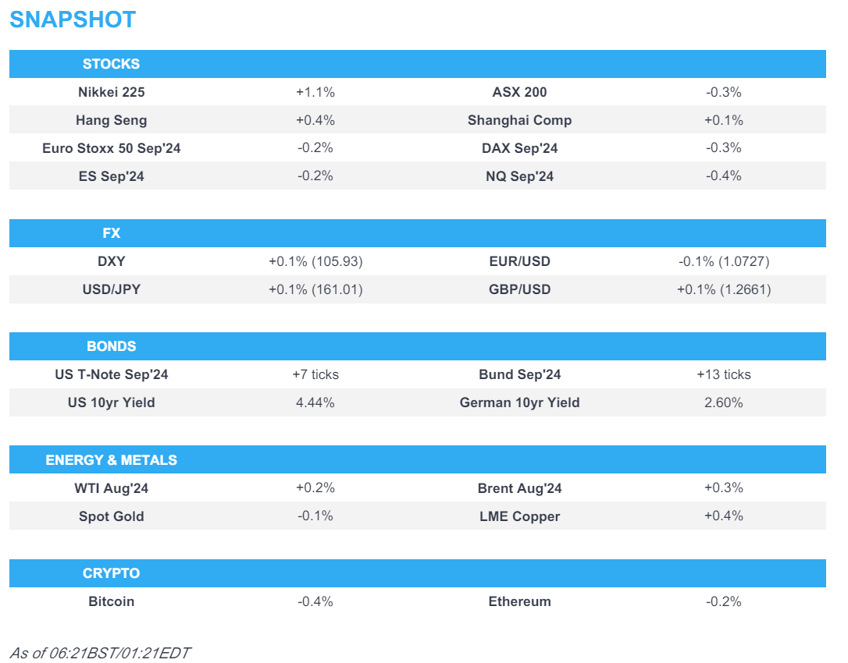

- APAC stocks were ultimately mixed amid the backdrop of rising global yields and recent soft US data.

- European equity futures indicate a slightly lower open with Euro Stoxx 50 future -0.2% after the cash market closed higher by 0.7% on Monday.

- DXY is steady and just below the 106 mark, USD/JPY printed another multi-decade high, antipodeans lag.

- Crude futures marginally extended on their best levels in more than two month, Bunds rebounded off the prior day's trough.

- Looking ahead, highlights include EZ Flash HICP, Canadian Manufacturing PMI, US JOLTS, Comments from Fed's Powell, ECB's Lagarde, Schnabel, de Guindos & Elderson, BCB's Neto, Supply from UK & Germany

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stock indices closed mostly higher albeit with the upside predominantly led by large caps in which tech and consumer discretionary outperformed while the majority of sectors were in the red and the Russell 2000 suffered losses. The gains in the major indices were contained amid a higher yield environment as bonds tumbled despite soft ISM Manufacturing PMI data with selling pressure in the Treasury complex exacerbated after SCOTUS gave Trump a partial win whereby it ruled that Trump has ‘absolute immunity’ for official acts.

- SPX +0.27% at 5,475, NDX +0.66% at 19,812, DJI +0.13% at 39,170, RUT -0.86% at 2,030.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Democrats are reportedly considering an early Biden nomination to squash the talk of a swap, while a July 21st meeting offers a potential date for the party to select Biden, according to Bloomberg.

- US President Biden said regarding the presidential immunity ruling that there are no kings in America and no one is above the law, while he added the decision means there are virtually no limits on what a president can do and it is a dangerous precedent. Biden said it is highly unlikely that a decision on Trump and January 6th will come before the election and the American people must decide whether Trump's assault on democracy makes him unfit to be president, as well as noted that Trump will be more emboldened to do what he wants to do. In relevant news, former President Trump moved to overturn his Manhattan conviction citing the Supreme Court immunity decision, according to NYT.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed amid the backdrop of rising global yields and recent soft US data.

- ASX 200 was subdued by weakness in real estate and miners, while RBA Minutes did little to shift the dial.

- Nikkei 225 recouped early losses and eventually reclaimed the 40,000 level for the first time since early April.

- KOSPI retreated after North Korea claimed it successfully test-fired a new tactical ballistic missile on Monday capable of carrying a super large warhead, while index heavyweight Samsung Electronics traded indecisively after its workers' union announced a 3-day strike.

- Hang Seng and Shanghai Comp. were marginally positive as the former gained on return from the long weekend in which property stocks briefly lifted the index to just shy of 18,000, while the mainland index was rangebound and attempted to reclaim the 3,000 status.

- US equity futures (ES -0.2%) head into the European open a touch softer after yesterday's upside wanes.

- European equity futures indicate a slightly lower open with Euro Stoxx 50 future -0.2% after the cash market closed higher by 0.7% on Monday.

FX

- DXY traded little changed beneath resistance at the 106.00 level amid recent upside in yields and soft ISM data.

- EUR/USD lacked direction after fading the post-first round French election momentum and as EZ CPI looms.

- GBP/USD remained uneventful with price action confined within a tight range around its 100DMA.

- USD/JPY eked slight gains after recently climbing to a fresh 38-year peak on the back of rising US yields.

- Antipodeans mildly underperformed against their major peers amid a lack of tier-1 data releases and the mixed risk appetite, while the RBA Minutes of the June 17th-18th meeting saw a muted reaction and were somewhat stale given the recent hot monthly inflation print.

- PBoC set USD/CNY mid-point at 7.1291 vs exp. 7.2774 (prev. 7.1265)

FIXED INCOME

- 10-year UST futures nursed some of the losses from yesterday's bear steepening and after selling was exacerbated by the Supreme Court immunity ruling which is seen to delay the Trump subversion trial till after the election and further raises the prospects of Trump 2.0.

- Bund futures rebounded off the prior day's trough but with the recovery limited ahead of EZ CPI data and German supply.

- 10-year JGB futures tracked recent losses in global peers with prices not helped by weaker demand at the 10-year JGB auction.

COMMODITIES

- Crude futures marginally extended on their best levels in more than two months after gaining yesterday amid expectations of summer demand and after record-breaking Beryl which has since strengthened to a Category 5 hurricane and is feared to be a signal of what could be in store during the hurricane season.

- OPEC June output is reportedly steady as some members exceeded limits, according to Bloomberg.

- Spot gold was lacklustre but remained north of the USD 2300/oz level amid an uneventful dollar.

- Copper futures were rangebound with price action restricted amid the mixed risk tone.

CRYPTO

- Bitcoin gradually edged higher and climbed back above the USD 63,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier He said China is willing to work with Switzerland to deepen and expand cooperation in economic and trade fields, while he added that China welcomes Japanese firms to further expand investment and cooperation in the country, according to Xinhua.

- RBA Minutes from the June meeting stated the Board judged the case for holding rates steady was stronger than for hiking, while they needed to be vigilant to upside risks in inflation and data suggested upside risk for May CPI. RBA stated that economic uncertainty meant it was difficult to rule in or out future changes in policy and recent data was not sufficient to change the outlook for inflation returning to target by 2026, as well as noted that inflation expectations are still anchored, but market premia had drifted higher. Furthermore, the RBA judged it is still possible to bring inflation to target while keeping employment gains but stated a hike might be needed if the Board judged policy was not "sufficiently restrictive" and that a material rise in inflation expectations could require significantly higher rates.

DATA RECAP

- South Korean CPI MM (Jun) -0.2% vs. Exp. 0.1% (Prev. 0.1%)

- South Korean CPI YY (Jun) 2.4% vs. Exp. 2.7% (Prev. 2.7%)

- New Zealand NZIER Business Confidence (Q2) -44.0% (Prev. -25.0%)

- New Zealand NZIER QSBO Capacity Utilisation (Q2) 88.7% (Prev. 90.2%)

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu said Israel is nearing the end of the phase of eliminating Hamas military capabilities and will continue to destroy the remnants of the Hamas military.

- Israel’s Army ordered a mass evacuation of Palestinians from part of Khan Younis in Gaza, according to Sky News.

- Yemen's Houthis said it conducted four military operations targeting four ships associated with the US, the UK and Israel.

OTHER

- NATO will station a senior civilian official in Kyiv as part of new measures designed to shore up long-term support for Ukraine which are expected to be announced at the summit in Washington next week, according to WSJ citing US officials.

- Russia reportedly sent the Kilo attack submarine towards the Irish Sea twice since the 2022 invasion of Ukraine, according to Bloomberg sources.

- North Korea said it successfully test-fired a new tactical ballistic missile on Monday that is capable of carrying a 4.5-ton super large warhead, according to KCNA.

EU/UK

NOTABLE HEADLINES

- ECB's Lagarde said it will take time to be certain that inflation is on track and that a strong labour market means the ECB has time to gather information. Lagarde added that a soft landing for the Eurozone economy is not guaranteed, as well as noted the work is not done and the ECB must remain vigilant.

- ECB's Simkus said two more cuts in 2024 are possible if the data is as expected and the ECB should not limit rate moves to projection meetings, while he added the case for a July interest rate cut has gone and he does not see disorderly moves in French bonds.

- ECB's Wunsch said the market pricing on the ECB rate path looks reasonable and the first two rate cuts are relatively easy, while he added the ECB would need convincing to cut more than twice this year and a July cut is an option in theory, but in practice, the ECB must be cautious. He later remarked that barring any major negative surprises, the ECB has space for a second rate reduction. Subsequent moves should only follow when the ECB has confidence that inflation is falling to target.

DATA RECAP

- UK BRC Shop Price Index YY (Jun) 0.2% (Prev. 0.6%)

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.