Submitted by QTR's Fringe Finance

This week, I published the most recent letter from one of my good friends, hedge fund manager Lawrence Lepard. I believe Larry to truly be one of the muted voices that the investing community would be better off considering. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

His thoughts heading into Q4 are broken down into two parts which you can read here. Today, I wanted to slide in one more excerpt from Larry’s 30+ page writeup about the state of the economy and the “fiscal doom loop” we find ourselves in.

In his letter’s appendix, Larry emphasizes how Federal interest expensive is very sensitive to a rapidly growing short end yield. He issued 2 charts to show why he believes we are in a “debt doom loop”.

FROM LARRY’S Q3 2023 LETTER

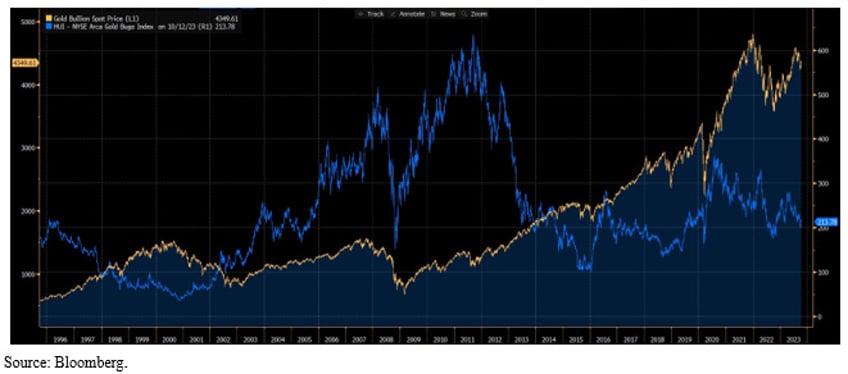

As we have shown in prior letters, the price of gold is hanging in there in spite of a very aggressive tightening campaign by the Federal Reserve. Real interest rates have gone up quite a bit. and yet gold has not reacted the way it has in the past. We think there is a message in this price behavior. We think that gold can see around the corner and anticipates the next round of debasement.

You can see this in the chart below showing the price of gold (yellow) and the HUI gold miner index (blue).

Notice in this chart below that the gold stocks (blue) have been left for dead. We believe this is because the consensus view is that the Fed will land the plane smoothly, and inflation will return to its prior level. Wall Street estimates for the price of gold 5 years out are $1,750 per ounce (well below it’s current $1,950). With the inflation which is taking place in the cost of mining, if the price of gold does not rise it will result in a severe margin squeeze. This is what the gold stock prices are reflecting. We think the market has it wrong and the price of gold will be much higher in 5 years and that gold mining profits will continue to be robust. As people come to realize that we are in an environment of secular inflation, they will begin to anticipate higher future gold prices and the multiples on the stocks will expand.

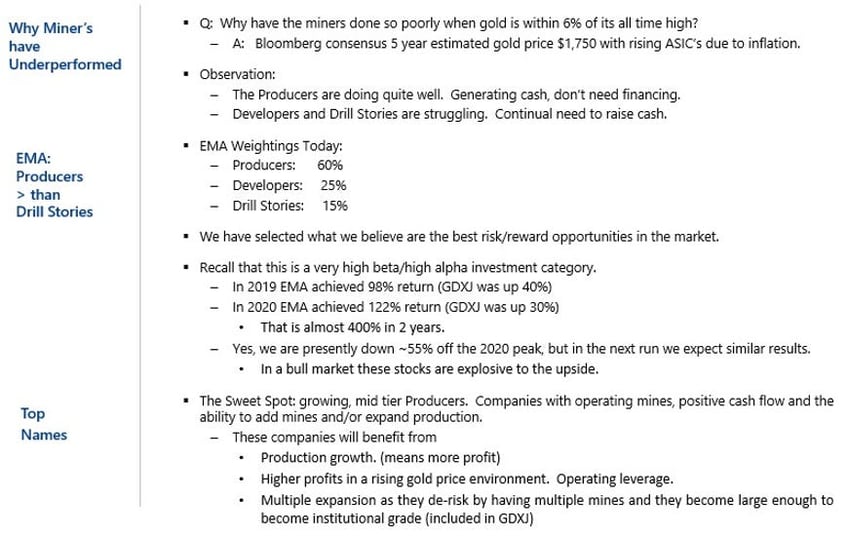

Below is a snapshot of comments on our current portfolio positioning:

The musical genius, Tom Petty was surely correct when he wrote the song “The Waiting Is The Hardest Part”. Some of the lyrics are genius: “every day you see one more card, you take it on faith, you take it to the heart” (Chorus).

We will say this. We like the cards we see. We wish the game was moving a little faster, but we remain highly confident that our thesis is correct and that we will do the job you entrusted us with over the next few years. It is hard to be patient, we know. It has not worked as we expected. But there are very few things in finance and investing that are highly likely, and we strongly believe that given the system of Governments and Central Banks that we live under that “monetary debasement” is highly likely. That is the good news. The bad news is getting the timing right is tough, but when it does happen, we are not talking about small upside. The upside is very outsized.

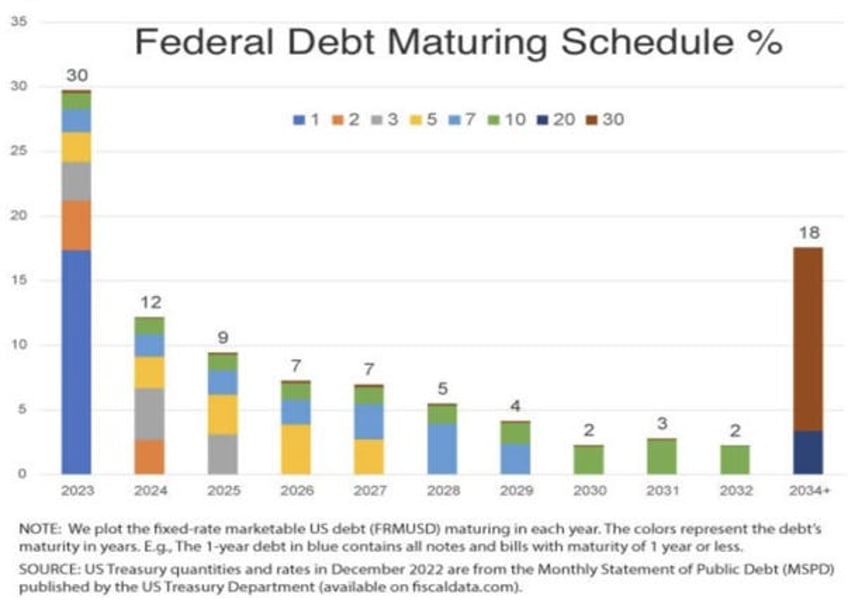

We think that it is important to understand how front end weighted the US Federal Debt has become. This means that the Federal interest expense is very sensitive to the short term interest rate. The next two charts help us to understand this more clearly.

First, see the chart below. Note how half of the debt will need to be rolled over within the next 3 years.

Most of this debt was issued with interest rates that are way below today’s level.

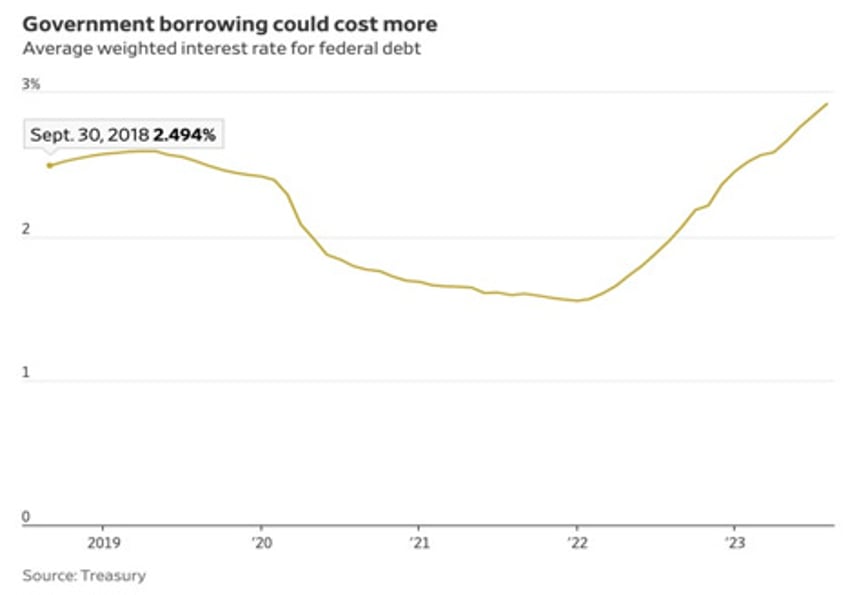

Then consider the following chart which shows that presently the US Federal Government is paying 2.49% on average on its debt burden. Consider that US Federal Interest expense is running at a $970B annual rate (see Parts 1 and 2 of this letter).

Further, consider that US Bond interest rates now range between 4.6% and 5.4%, or nearly twice the average that is being paid now. As the bonds above mature they will need to be rolled over at higher rates. Total US Federal Debt is $35.5T but it is growing at $2-3T per year (conservatively).

Let’s say the average interest rate becomes 4.6% over the next few years and deficits run at $2.5T per year. This means that in two years US Federal interest expense will be $1.9T, or more than double today’s run rate. All else equal we would add another $1 Trillion to the deficit. This helps to explain why we are in a debt doom loop.

You can read Larry’s full 30+ page Q3 letter here.

Please read Larry and QTR's full disclaimer here.