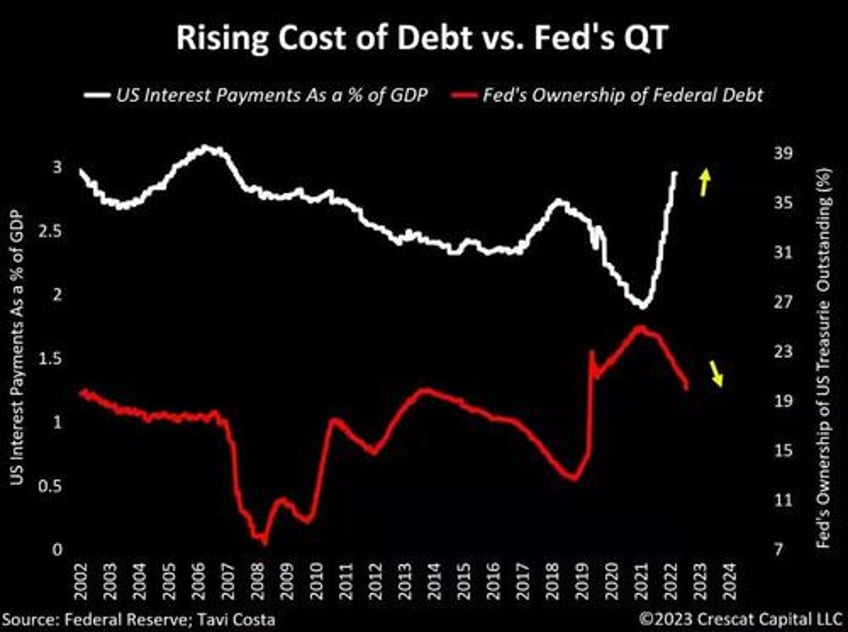

Monetary and fiscal authorities are currently running what we believe are unsustainably divergent policies. The simultaneous rise in the cost of debt by central banks and their deliberate reduction of balance sheet assets is entirely incongruous with the exponential growth in government debt.

Following the COVID era, we have entered a period of fiscal dominance among major developed economies. Hence, the escalating debt burden is already near historical levels and compounding at an alarming pace.

To sustain the current government spending deluge, we believe it is inevitable that the Fed and other monetary authorities reassume their fundamental role as the primary financiers of government debt.

Quantitative tightening policies are the central banks’ own version of an illusionary “debt ceiling”, a disciplinary measure that needs to be consistently reversed in practice.

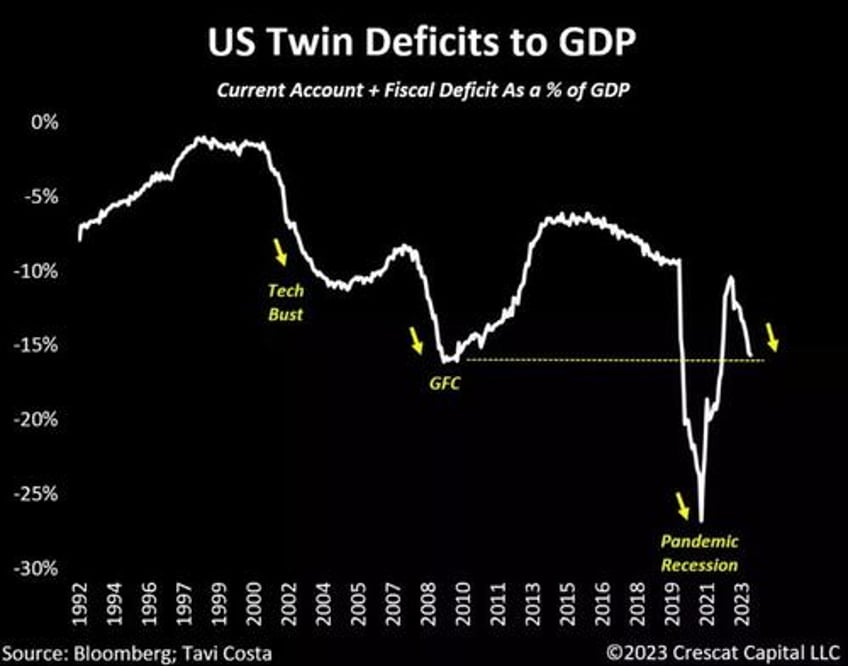

Twin Deficits at GFC Levels

The primary emphasis of our research will be centered on the United States, which is now running twin deficits that are as severe as those experienced during the worst parts of the Global Financial Crisis. This factor has contributed to the recent weakness in the US dollar. However, of even greater concern is the indication that this represents an ongoing structural issue that is still in the process of evolving.

Note that with each prior recession, this measurement has reached new lows. This further emphasizes the importance of owning hard assets in this environment.

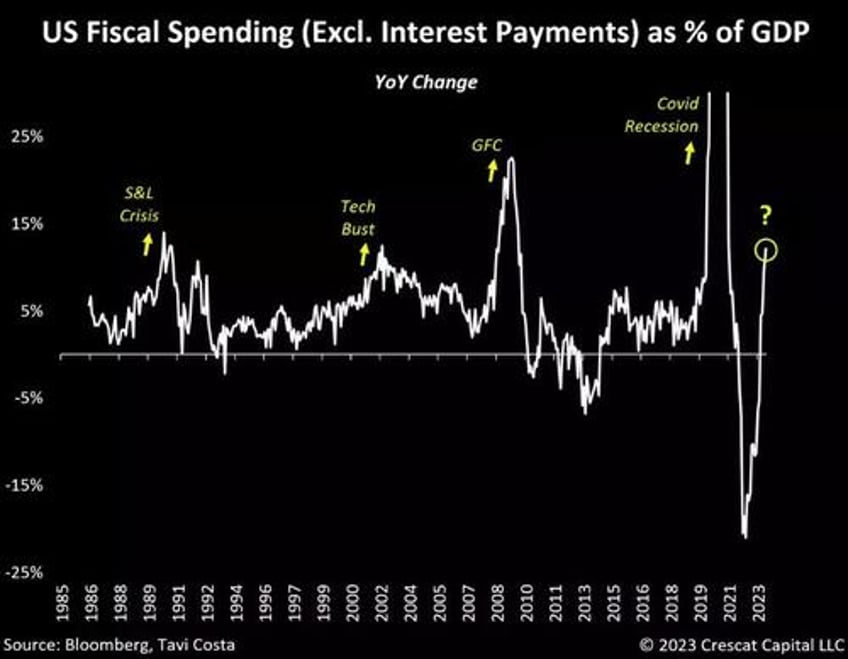

Fiscal Impulse Turning Up

The reality is that the fiscal agenda on a global scale has never been more expansive. While today’s severe inequality and wealth-gap issues have led to larger government social programs compared to historical norms, rising geopolitical tensions further exacerbate the issue. Countries acknowledge the significance of bolstering defense spending and the crucial need to reduce interdependence among trading partners by revitalizing domestic manufacturing capacities. Alongside this trend of reindustrialization, particularly among G-7 economies, governments persist in advocating for a substantial green-energy revolution, which necessitates a significant infrastructure overhaul.

Indeed, in the US, the impact of such high levels of government expenditure is evident in the data. Excluding tax receipts, which have declined to levels comparable to those seen during recessions, fiscal spending alone represents a substantial 25.4% of nominal GDP in the US. That is higher than what we experienced after the global financial crisis or any other crisis in history outside of the Covid recession when the economy was in full lockdown.

While interest payments are growing exponentially, that still contributes to a relatively small percentage of the overall fiscal outlays. To be specific, it accounts for less than 10% of it. Interest payments used to be close to 15% of government spending in the 1980s and 1990s when interest rates were higher. This number is set to undergo a substantial increase and has the potential to create a larger problem soon.

Nonetheless, the US fiscal impulse has turned positive in a significant way recently, especially when calculating net of interest payments, which is now up 12% on a year-over-year basis.

In a healthy economic growth environment tax revenues typically increase while government spending tends to decline. However, today’s situation is a complete reversal of this trend.

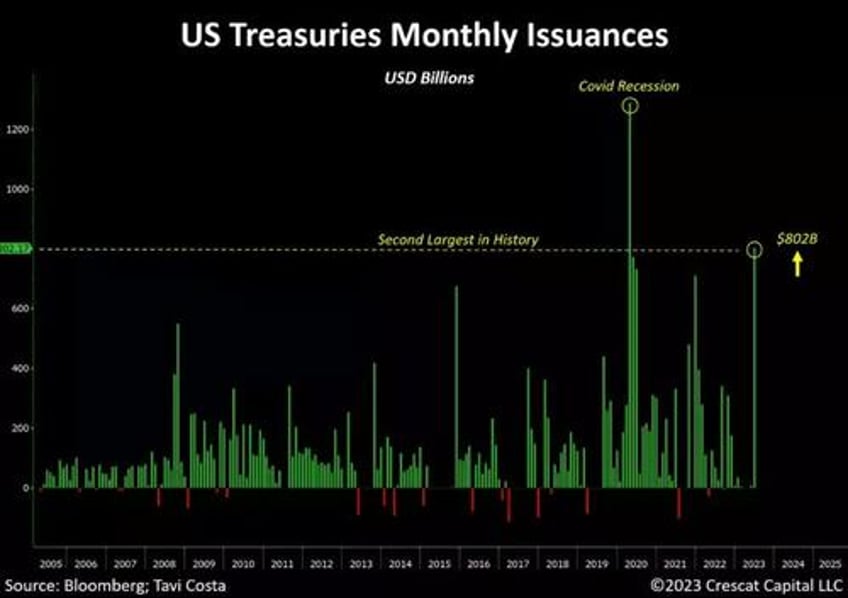

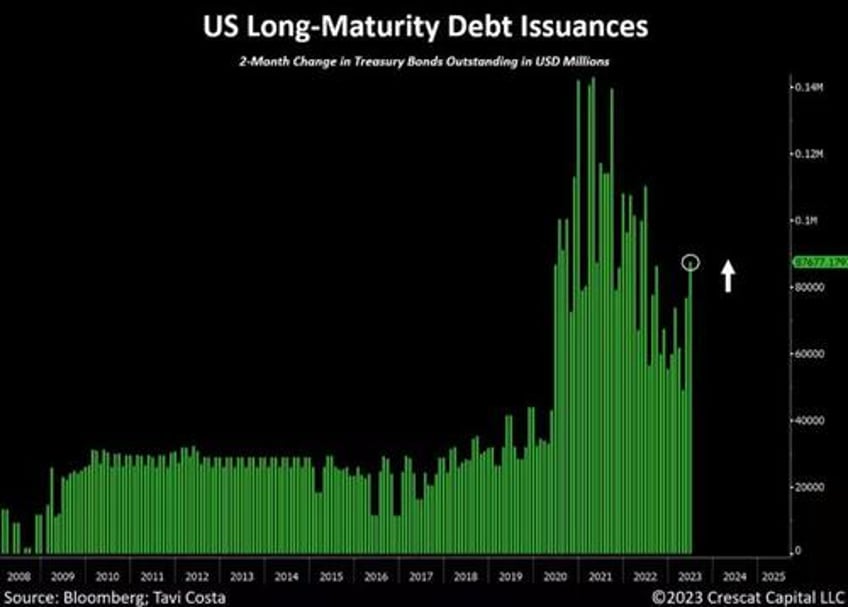

Second-Largest Issuance in History

The US is currently operating as if it were facing another pandemic lockdown from a fiscal spending and debt issuance perspective, yet there is one critical difference. Rather than the Fed financing over 50% of newly issued Treasuries, they are shrinking their balance sheet assets at the fastest pace in history.

It is important to consider that, unlike during the recovery from the global financial crisis, other central banks have not been buying these government bonds either. In fact, foreign holders currently own only approximately 20% of all outstanding Treasuries, marking the lowest level in nearly two decades.

Following the resolution of the debt ceiling agreement, the US government has already issued more than $1 trillion worth of US Treasuries. Notably, the month of June witnessed the second-largest issuance in history.

Not Only Short-Maturity Treasuries

As anticipated by the market, a significant portion of these issuances is comprised of T-Bills, which are short-term maturity instruments. However, what seems to be off the radar is the fact that there has also been a substantial issuance of longer-duration Treasuries in recent months.

The significant increase in the overall supply of these sovereign instruments is exerting additional pressure on long-term yields, contributing to their ongoing rise.

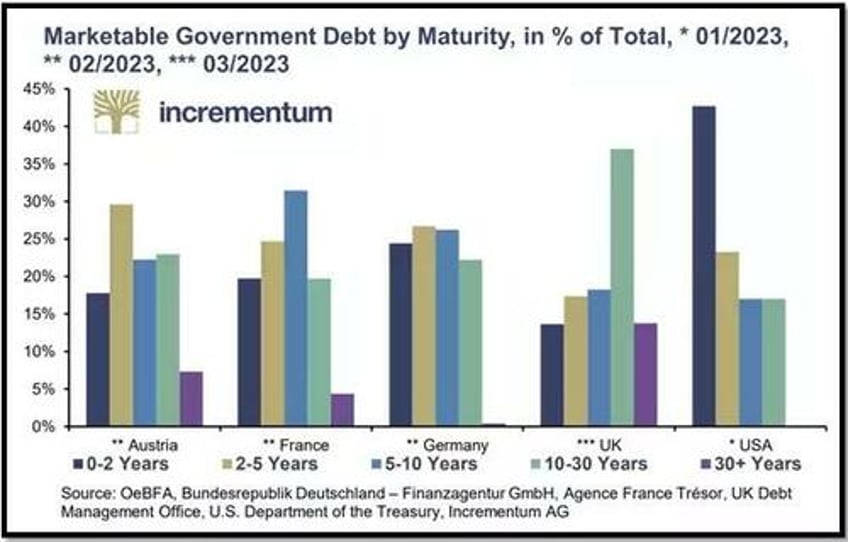

Nearly Half of the Federal Debt Matures in Two Years

To reiterate, although US interest payments represent less than 10% of the overall fiscal outlays, these obligations are likely to surge even further in the next couple of years. Here is one main reason for that:

The US will need to refinance almost half of its national debt in less than 2 years. As a reminder, interest rates were at 0% just 15 months ago.

If the government decides to reissue these maturing Treasuries in short-duration instruments, as it did recently after the debt ceiling agreement, these obligations will need to be rolled over at over 5% interest rates.

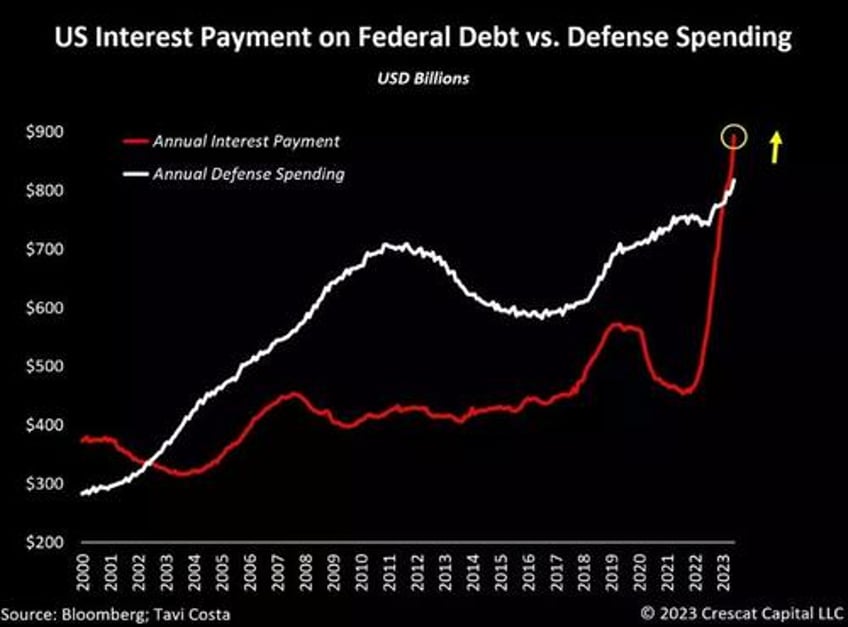

Surging Cost of Debt

While the US government is shifting focus to boost military expenditures from historically depressed levels, the current interest payments on the Federal debt have already exceeded annual defense spending.

This is likely the initial stages of a trend, and if no solutions are implemented, other components of the fiscal agenda may soon be constrained by the escalating cost of debt.

Yield Curve Control: A Matter of Time

The notion of an “improving” economy being linked to rising yields seems completely ludicrous in our view. The US debt problem is not only at staggering levels but is also compounding at almost 10% annually, while the Fed continues to shrink its Treasury holdings at a record pace. What gives?

Based on the rate-of-change analysis, there has been a 17% decline in the Fed’s holdings of US Treasuries. Interestingly, historical patterns suggest that similar balance sheet contractions have led the Fed to eventually reverse its policy.

Given the current magnitude of Treasury issuances flooding the market today, resulting in upward pressure on long-term yields, we believe that unspoken political pressure to implement “yield curve control” policies is already beginning to swell. The Fed’s inclination to implement such policies may only exist if the economy is in a recession, which we think is the path of least resistance today.

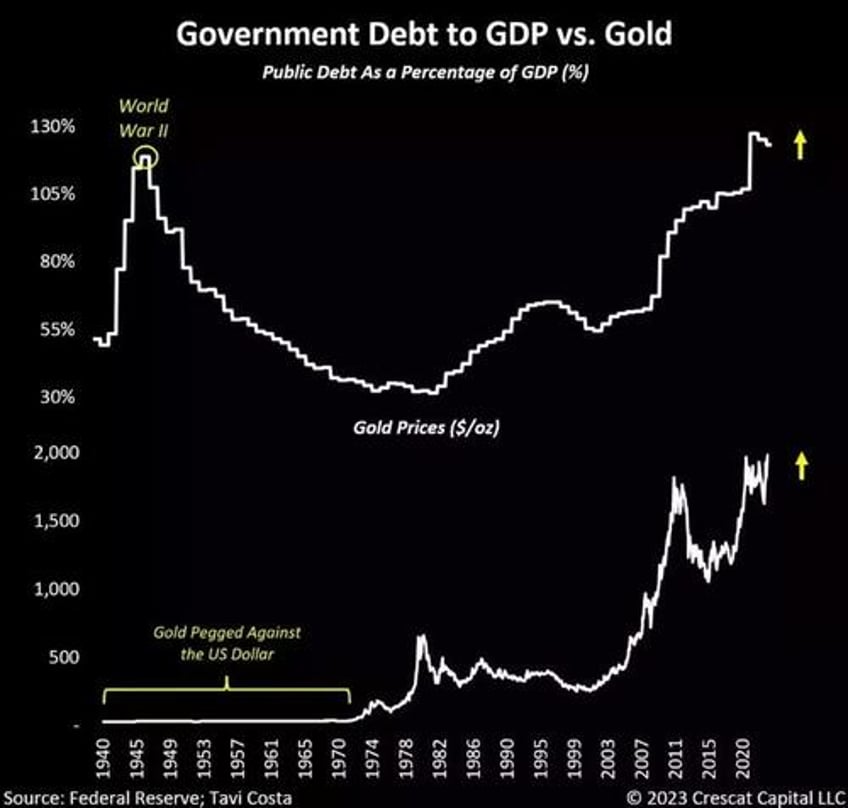

Gold: An Escape Valve

Investing in gold implies wagering on the notion that the debt problem will deteriorate further from its current state.

The 1940s period was a compelling historical analogy to today given the severity of the current debt problem. However, there is one major distinction that is often ignored. During that time, the US dollar was effectively tied to gold prices, making the metal an unfeasible investment alternative.

Today, with prices unpegged, it is highly probable that capital will divert away from US Treasuries and flow into gold. This becomes particularly crucial at a time when the government continues to issue a flood of debt instruments into the market after agreeing to extend the debt limit.

Today the metal is likely to serve as an escape valve for those seeking the ultimate form of protection during times of debt and monetary crises.

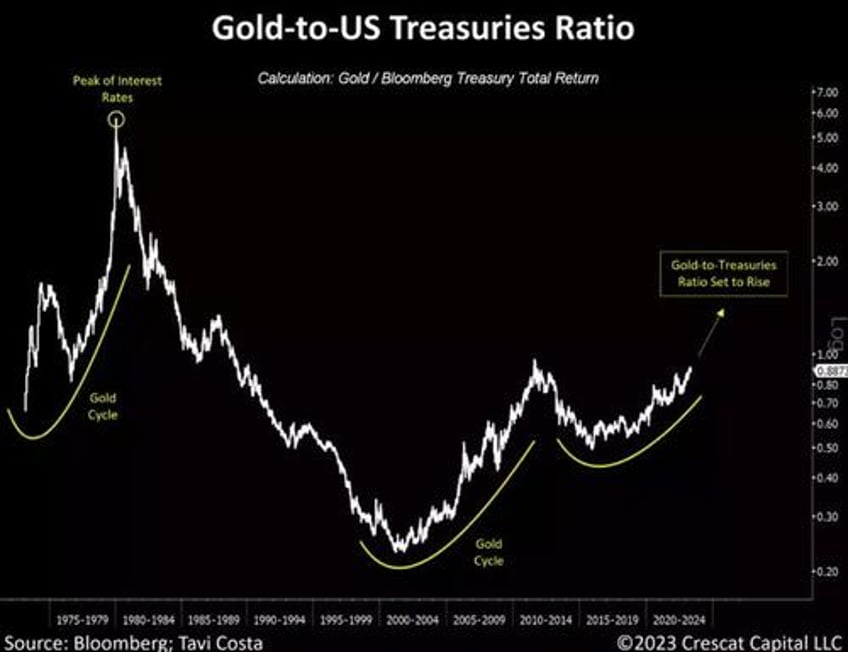

Gold > Treasuries

If the rationale for owning US Treasuries today is solely based on the premise that the system cannot endure substantially higher interest rates, then gold is a far superior choice.

It’s a neutral asset with no counterparty risk that also carries centuries of credible history as a haven and monetary alternative.

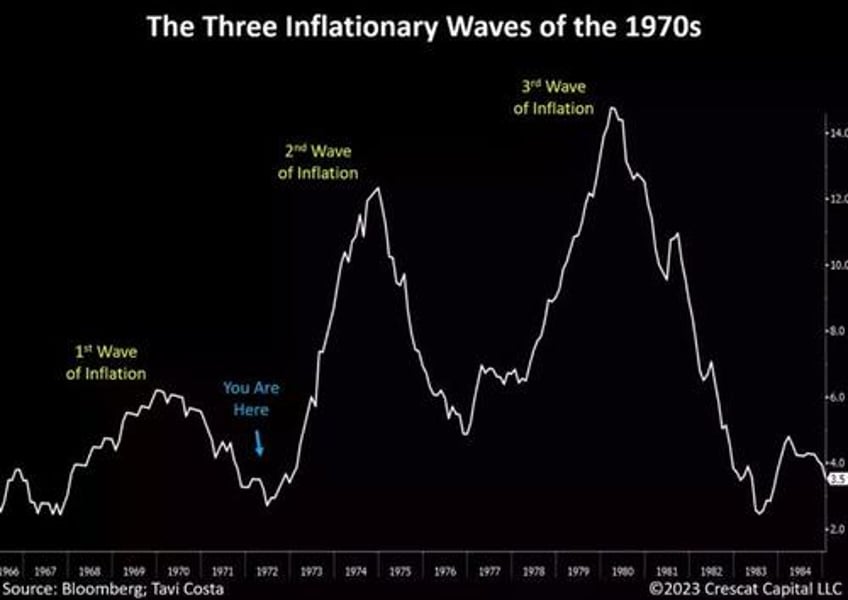

Inflation in a Bottoming Process

Just as base effects played a crucial role in reducing inflation rates, we anticipate that the opposite effect is on the horizon, with Consumer Price Index (CPI) likely to reach a bottom in the near future.

Last week’s CPI report marked a significant milestone as it is the first time in 102 years that we have witnessed twelve consecutive months of declining CPI on a YoY basis. The last time we experienced such a situation was in 1921 after the Spanish Flu pandemic, which marked the actual bottom for inflation rates at -15.8%. Today, after the same monthly sequence of falling CPI, the rate is still positive and above the Fed’s target.

The overwhelming focus on the recent slowdown in inflation appears to be rooted in backward-looking analysis. In fact, since last week’s CPI report, oil has broken out, gold rallied back above $2,000, silver surged, and agricultural commodities appreciated substantially.

While the macro environment today differs from that of the 1970s or 1940s, a lesson from history remains: inflation tends to develop in waves. We have recently witnessed the conclusion of the first wave and are likely in the process of reaching a bottom in the recent deceleration period, with a new upward trajectory underway. The primary reason for this is the persistence of underlying structural issues that continue to drive inflation rates higher:

Wage-price spiral, particularly driven by low-income segments of our society

Ongoing supply constraints due to chronic underinvestment in natural resource industries

Irresponsible levels of government spending

Escalating deglobalization trends, which necessitate the revitalization of manufacturing capabilities in economies.

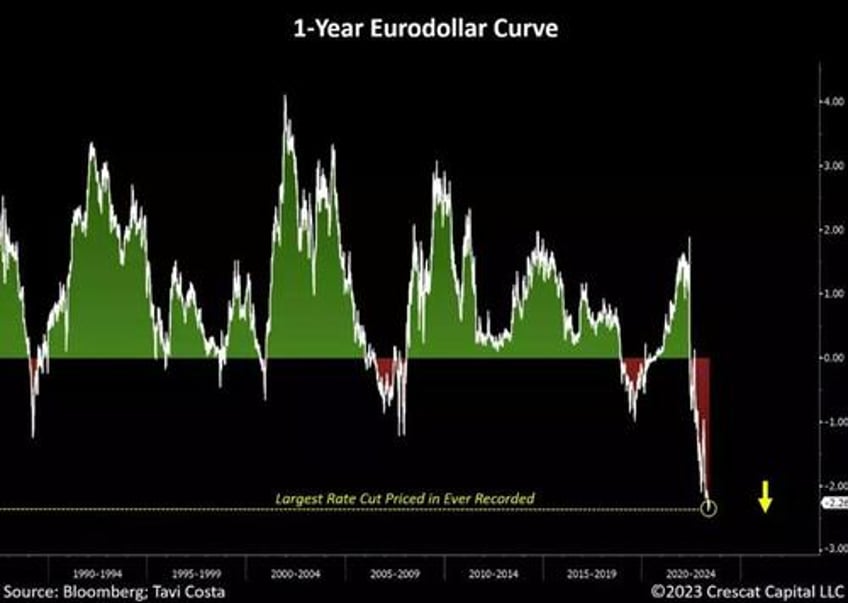

Interest Rate Cut Expectations: A Crowded Consensus

It is worth highlighting that, despite the strong potential for inflation rates to be in the process of bottoming out, the Eurodollar curve is currently pricing in the largest interest rate cuts in the history of the contract for the next year.

Investors are highly likely to be caught off guard as CPI starts to accelerate again, leading the US monetary authorities to maintain higher Fed funds rates for longer and even engage in additional rate hikes in the short turn until its recessionary goals can be more clearly accomplished.

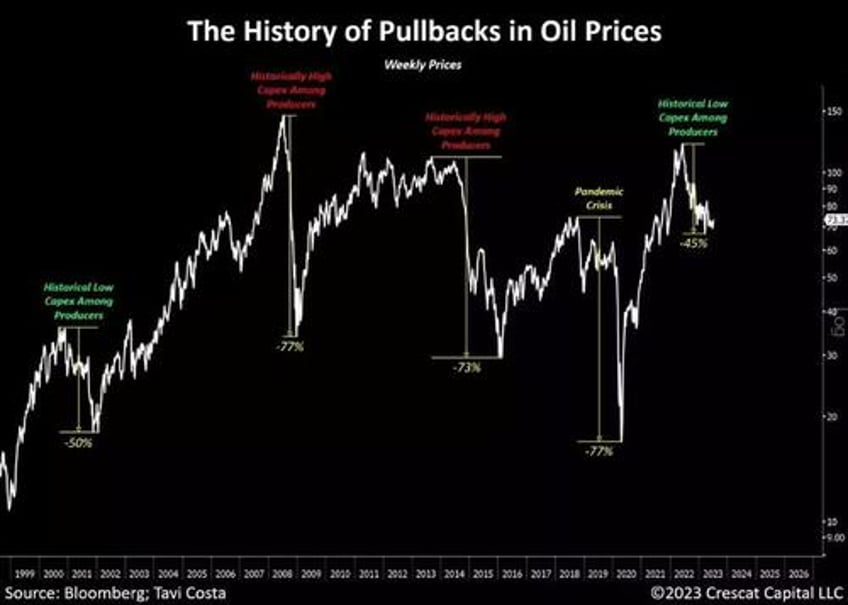

The Upside Case for Oil

After being down 45% from its recent highs, the risk/reward to buy oil today appears heavily skewed towards the upside. Excluding the outlier event of the pandemic crisis, we can observe two types of pullbacks in oil prices over the past few decades:

The GFC and the 2014 energy market meltdown resulted in an average decline of approximately 75% from peak to trough.

During the tech bust, the decline was close to 50%

In the current environment, we believe there are strong similarities to the early 2000s period, particularly in terms of historically depressed capital spending.

Despite the risk of a demand shock, which is already largely reflected in the current prices, in our view, oil supply remains incredibly tight with production still below pre-pandemic levels. Unlike a year or two ago, the government has already depleted its strategic petroleum reserves to levels not seen since the 1980s.

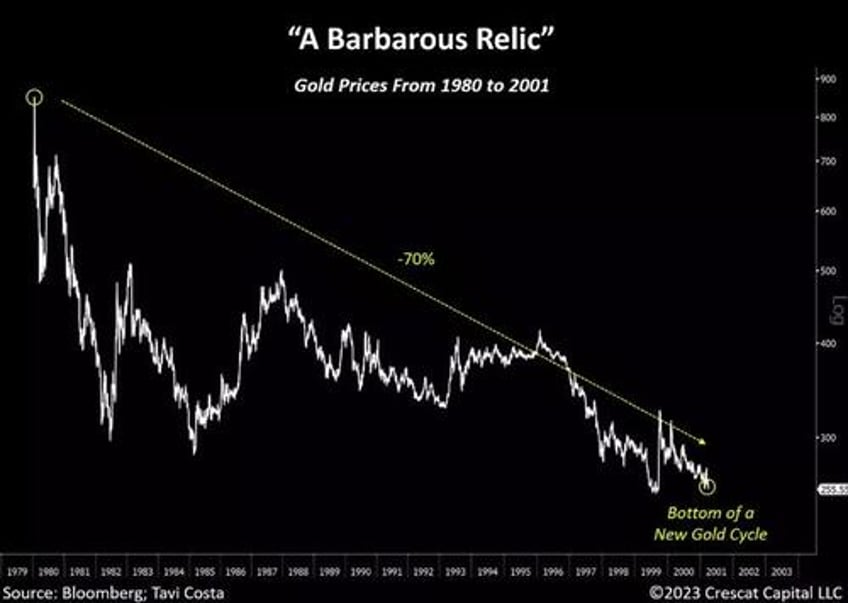

Gold: “A Barbarous Relic”

The current skepticism surrounding gold brings back memories of the late 1990s when equity markets soared due to the excitement surrounding the emergence of the Internet. During that time, gold prices experienced a significant decline of over 70% in 21 years, underperforming almost every other asset class (first chart below).

Some less experienced investors even labeled the metal as a barbarous relic.

However, markets often defy conventional expectations, and that period marked the bottom for gold prices, initiating a new long-term uptrend, propelling gold into a secular bull market that lasted over a decade.

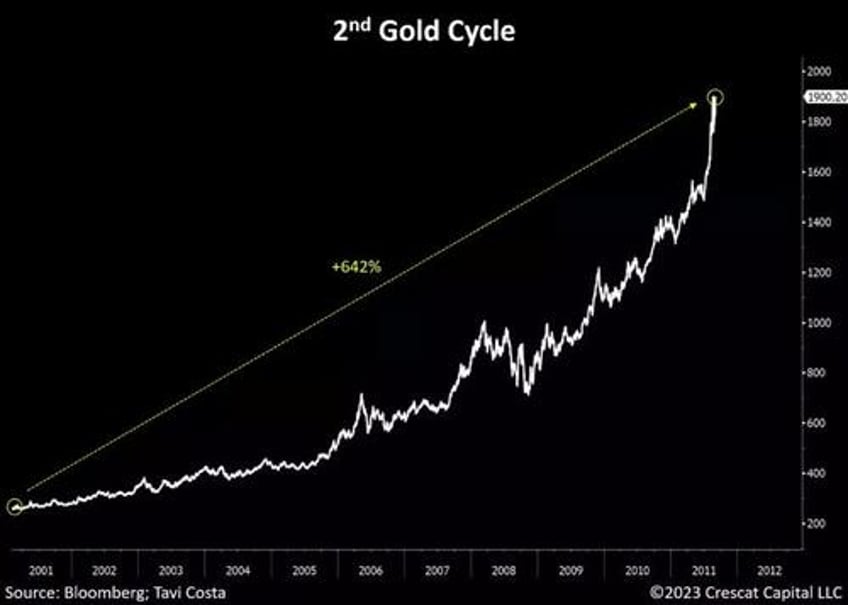

Following the mentioned period, gold prices embarked on a remarkable upward trajectory, delivering one of the most impressive performances in its history (see the second chart below).

Notably, silver significantly outperformed gold during this period, leading to a substantial decrease in the gold-to-silver ratio from 81 in 2003 to 31 in 2011.

Based on these historical trends, we maintain a strong conviction that we are on the brink of entering another enduring bull market for gold, with silver anticipated to spearhead the upward movement.

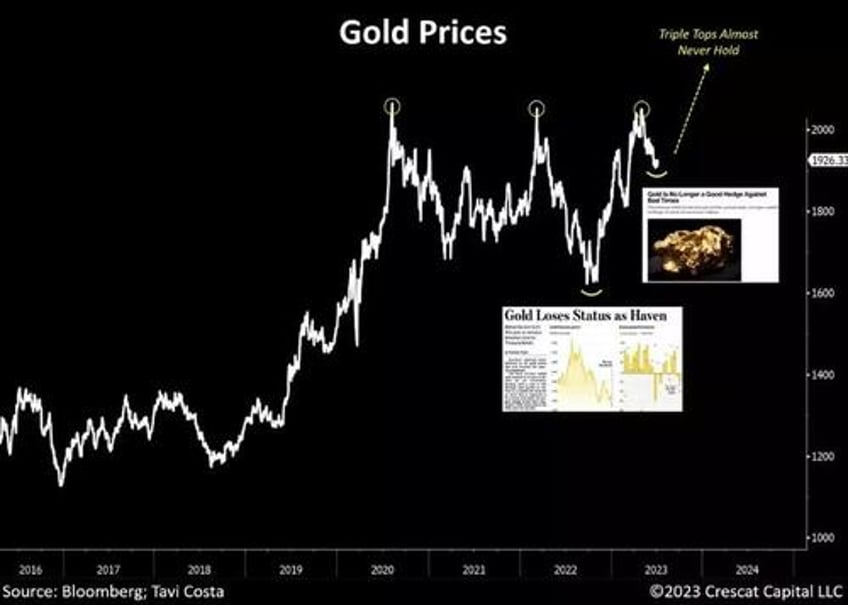

Precious Metals Primed for a Historical Breakout

Despite gold being within 5% of its all-time highs, skepticism towards the metal remains prevalent. A key turning point occurred in September 2022 when the Wall Street Journal published an article titled “Gold Loses Reserve Status” on its front page, leading to a short-term bottom in gold prices. Subsequently, precious metals experienced a strong rally and recently formed a triple top, testing previous highs from August 2020 and the peak during the Russia-Ukraine invasion.

In recent weeks, Bloomberg also published an article headlined “Gold Is No Longer a Good Hedge Against Bad Times,” at almost precisely the wrong time. Since then, precious metals have had another relevant move on the upside.

We believe that a potential breakout to new levels could attract substantial capital inflows to the mining industry, which has been starving for capital.

The Cheapest Metal on Earth

Silver looks ready to break through its decade-long resistance this month.

One thing is likely to be true, if this is indeed the onset of a new gold cycle, none of us own enough silver.

Key Signals of Stagflationary Times Ahead

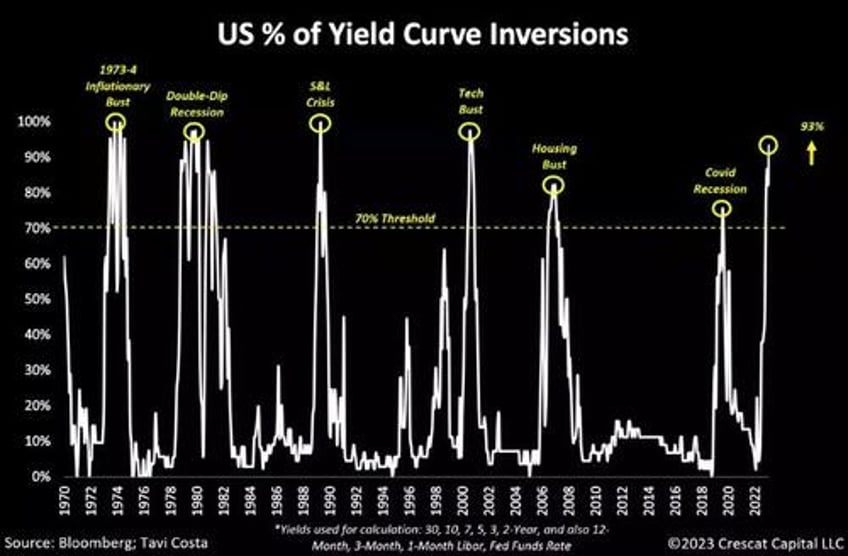

It is hard to be structurally bullish on the economy when almost the entire Treasury curve is inverted, despite the fact that yields across the board, short and long-term, have been increasing. The tech bust and the global financial crisis certainly didn’t unfold in this manner. During those times, it was the collapse of long-term yields that led to a surge in inversions.

Today’s issue in the Treasury curve resembles prior stagflationary times with yields across all durations continuing to move higher.

Overall equity market valuations are completely out of line with an environment where the cost of capital for businesses remains on the rise, accompanied by an increasing risk of a severe economic downturn. Let us not forget that monetary policy works with a lag, and the Fed has been tightening financial conditions for almost 16 months now.

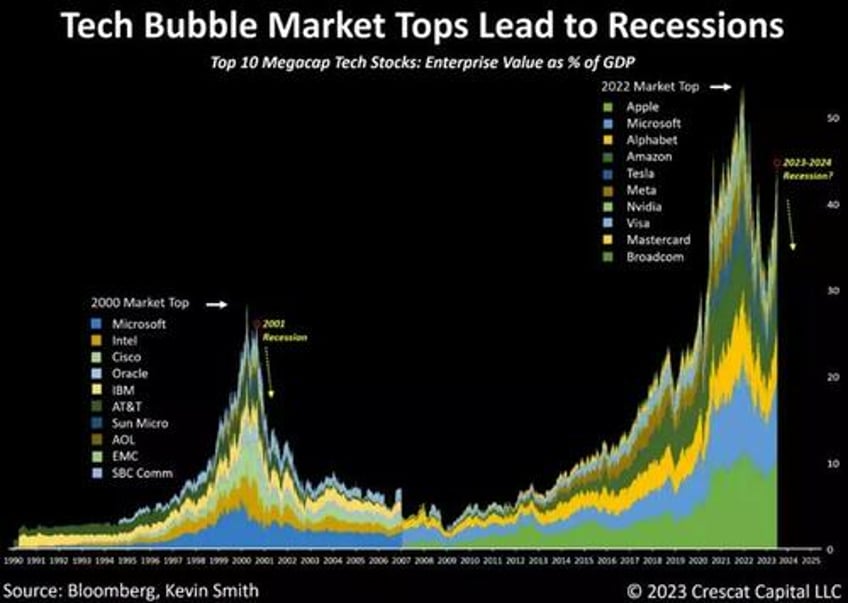

A Euphoria-Driven Rally in Equity Markets

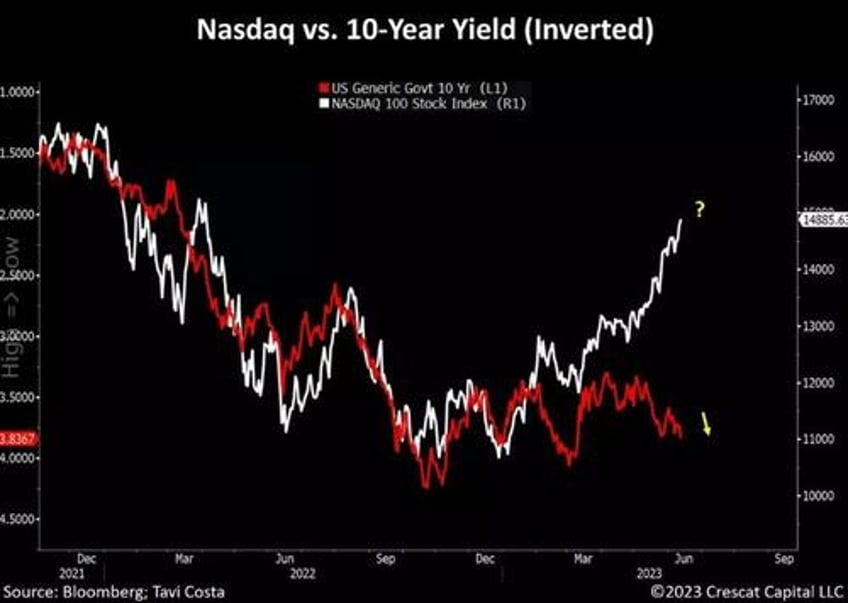

Meanwhile, the valuation of US equity markets continues to defy logic, with completely delusional fundamental multiples. Since the market peaked, Nasdaq has been significantly impacted by the increase in interest rates. Despite the continuous upward movement in 10-year yields, this correlation has been disrupted by the euphoria surrounding AI and consequently the surge in mega-cap tech companies. We believe the present value of long-duration businesses must soon start to better reflect the ongoing rise in discount rates with irrationally exuberant investors bearing the brunt of the punishment.

While these mispriced financial assets declined in 2022, they have only been reflated in 2023. We have yet to see the true bursting of financial asset bubbles that would correspond with the onset of a recession. From a valuation perspective, the excesses still rival those of 1929 and 2000.

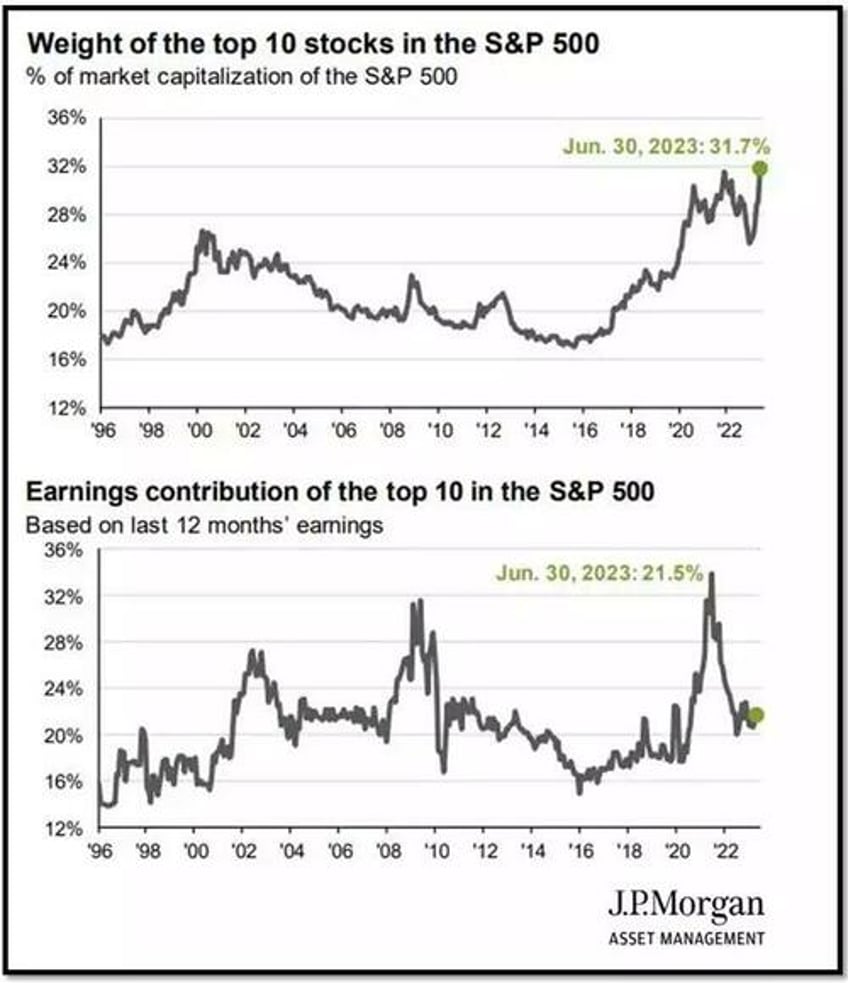

The “Magnificent” Top 10

Even though the combined market capitalization of the top 10 companies in the S&P 500 constitutes an unprecedented 31.7% of the index, their earnings contribution has been drastically declining and now stands at only 21.5%.

The dominance of megacaps in leadership is overwhelmingly unsustainable and cannot be justified by their current fundamentals.

Recent Rally Not Justified by Fundamentals

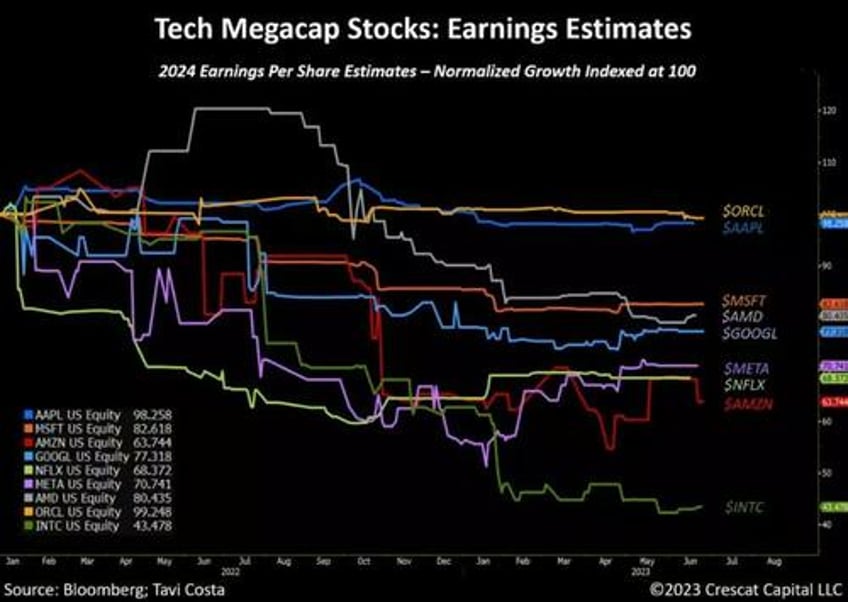

It is intriguing how the recent rise in tech megacap stocks has not been accompanied by a corresponding growth in projected earnings, despite the enthusiasm surrounding AI. In reality, we have seen the opposite of that in some cases. With the exception of $NVDA, tech megacap companies have either experienced stagnant growth in expected 2024 EPS (Earnings Per Share) or a substantial decline.

The persistently elevated cost of capital, coupled with the current excessive valuations and narrow market leadership, continues to be a cause for great concern. Considering the ongoing major Treasury issuances as the Fed shrinks its balance sheet, these stocks are clearly priced for perfection.

A Critical Divergence

The year-over-year change in the S&P 500 is now diverging from the ISM New Orders index.

Note that the last time this happened preceded the volatility event we had during the March 2020 crash and recession.

An Attractive Segment of the Market

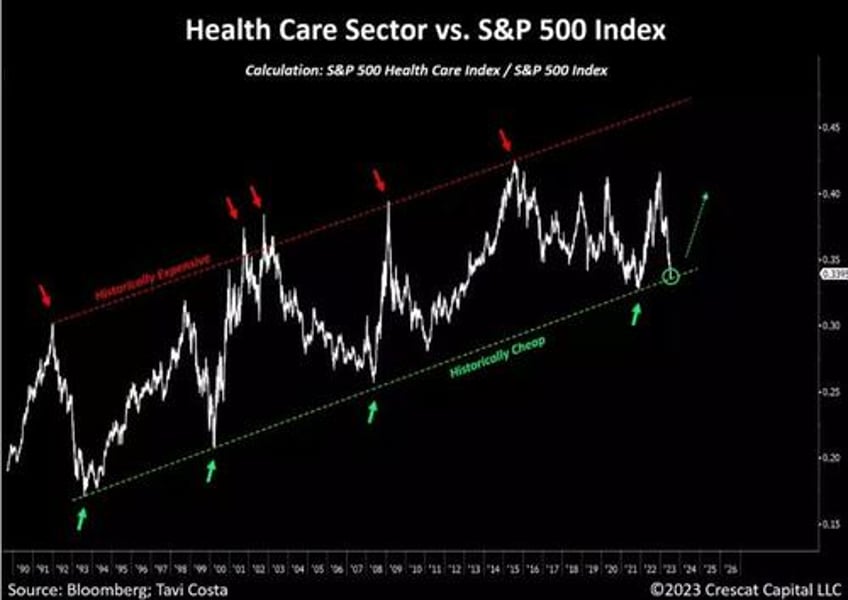

The healthcare sector is one area of the market outside of natural resource industries where we have become highly constructive on the long side given the recent price dislocation and valuation proposition, particularly biotechnology businesses. While the spotlight has been on historically expensive mega-cap technology companies fueled by AI developments, we believe strongly that healthcare stocks are poised to be among the primary beneficiaries of such technological advancements.

Over the past 30 years, the healthcare sector has demonstrated a consistent upward performance trend. Notably, these stocks tend to reach attractive valuations during market peaks and, more importantly, tend to outperform during economic crises.

The case for the Biotechnology industry is arguably even more compelling. Since 2015, these companies have drastically underperformed the S&P 500 and Nasdaq indices. The Nasdaq Biotechnology index, which includes larger and established businesses, currently has a price-to-sales multiple of approximately 5.5 times, down from nearly 13 times.

However, we find the development phase of the industry even more appealing. Several businesses on the cusp of breakthrough drug development are trading below their cash levels, with the potential to generate substantial cash flow over the next 3-5 years. To enhance our investment decision-making, we have recently hired Lars Thiel, Ph.D., as a research contractor. Dr. Theil seasoned scientist with over 30 years of experience in biomedical and drug discovery including 15 years with Amgen. Similar to our deep involvement in the mining and energy industries, we anticipate substantial growth in our exposure to the biotechnology industry in the coming years.

Brazil Liftoff

As an important way of capitalizing on a potential commodities-long thesis, we believe resource-rich economies are likely to perform exceptionally well. Rarely in history have Brazilian stocks been as cheap as they are today.

Given recent macroeconomic and political developments, it would be reasonable to assume that Brazil would have faced significant consequences. Firstly, the Fed implemented the steepest rate-hike cycle in history. Secondly, oil prices dropped by 45% from the recent peak. Additionally, the commodities equal-weighted index declined by 26%. And lastly, Lula assumed the presidency.

Interestingly and despite this sequence of facts, Brazilian stocks would have outperformed every developed market since 2022. In fact, Ibovespa continues to beat the S&P 500 year to date despite the AI euphoria. Today’s macro and fundamental reasons to own Brazilian equities are exceptional. In our view, this continues to be an incredible long-term buying opportunity.

Crescat Macro Positioning Summary

At Crescat, we have three overriding, high-conviction macro themes supported by our independent research and proprietary models that we believe are poised to unfold in rapid succession over the short and medium term:

1. We see highly overvalued long-duration financial assets as ripe for a major leg down due to the rising cost of capital and the deluge of US Treasury issuances now hitting the market. The Fed will ultimately need to accommodate the Federal debt but not before causing a financial asset meltdown and recession which we believe is its unspoken short-term objective. In our view, there is an abundance of timely and compelling short opportunities in the equity and fixed-income markets today.

2. We believe a powerful new demand wave for gold is coming in the short term from both institutional and retail investors. In aggregate, global central banks are already ahead of the curve as they have been accumulating the monetary metal recently as a reserve asset in preference over USTs. Gold is a haven asset that can provide an inflation hedge while also offering strong absolute and relative real return potential in the stagflationary hard-landing environment that our models are now forecasting.

3. From our perspective, we see a significant secular demand boom for commodities on the horizon fueled by fiscal stimulus from G7 economies. We believe the level of spending has the potential to rival and exceed China’s resource demand surge in the 2000s. In the US, three recently launched Congressional spending Acts stand ready to be expanded along with monetary policy support as soon as the recession becomes widely acknowledged to likely drive the entire next global economic expansion cycle.