Ever since day-one of the predictably disastrous and politically myopic insanity of weaponizing the world reserve currency against a major power like Russia, we warned that the USD had reached an historical turning point of slow demise and increasing de-dollarization.

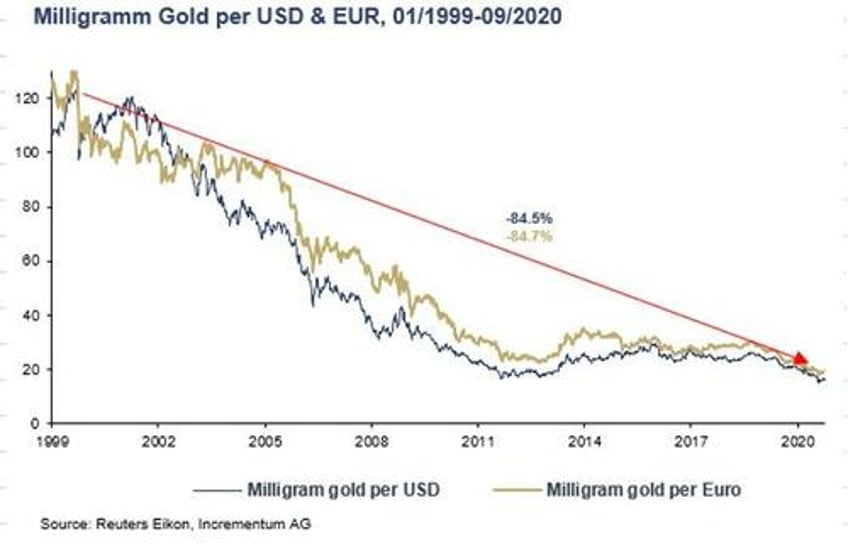

We also warned that this would be a gradual process rather than over-night headline, much like the slow but steady death of the USD’s purchasing power since Nixon left the gold standard in 1971:

But as we’ll discover below, this gyrating process is happening even faster than we could have imagined, and all of this bodes profoundly well for physical gold, yet not so well for the USD.

Bad Actors, Bad Policies & Predictable Patterns

Regardless of what the media-misled world thinks of Putin, weaponizing the USD was a foreseeable disaster which, naturally, none of DC’s worst-and-dimmest, could fully grasp.

This is because chest-puffing but math-illiterate neocons pushing policy from the Pentagon were pulling the increasingly visible strings of a Biden puppet at the White House.

In short, the dark state of which Mike Lofgren warned is not only dark, but dangerously dumb.

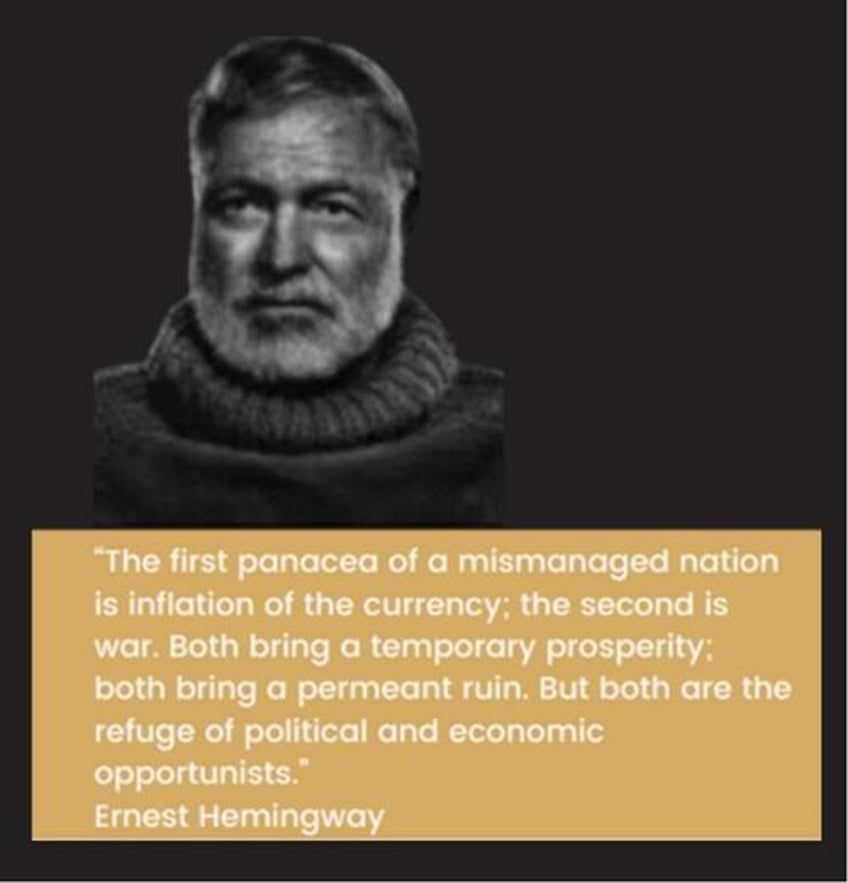

These political opportunists have forgotten that military power is not as wise as financial strength, which is why broke (and increasingly centralized nations) inevitably lead their country toward a state of permanent ruin preceded by cycles of war and currency-destroying inflation.

Sound familiar?

Despite no training in economics, Ernest Hemingway, who witnessed two world wars, saw this pattern clearly:

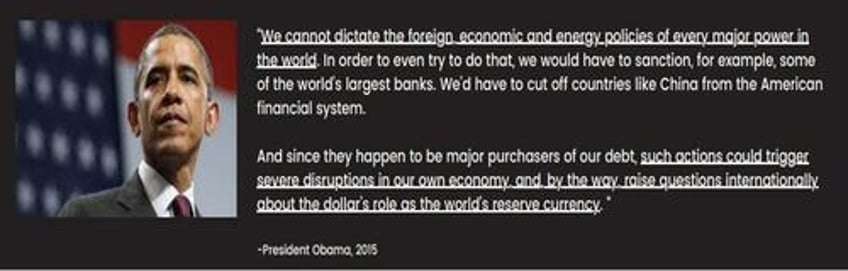

We also found “Biden’s” sanctions particularly comical, given that his former boss clearly understood the dangers of such a policy for the USD as far back as 2015:

The myopic (i.e., patently stupid) sanctions against Putin simply (and predicably) pushed Russia and China closer together while the BRICS+ nations increasingly began arbitraging gold for oil.

Or stated more bluntly, DC’s plan to weaken the Rubble has only served to put the USD at historical risk.

Does the Petrodollar Suck?

Throughout2022 and 2023, we warned of the weakening respect Saudi Arabia has for the allegedly Biden-“lead” US in general and its increasingly unloved UST and weaponized USD in particular.

Of course, we were specifically warning of the slow, gradual and yet again—inevitable—demise of the oh-so important Petrodollar which has been a critical “straw” of the milkshake theory’s faith in global demand for the USD.

But as the facts are now making increasingly clear, that “straw” is no longer sucking on a USD which much of the world now considers, well, a Dollar that sucks…

Three days after Christmas, the Wall Street Journal confessed what JP Morgan’s head of global commodities strategy had been tracking since 2015, namely that approximately 20% of the global oil bought and sold in 2023 was in currencies other than the USD.

Ouch.

That Dollar-straw appears to be losing its sucking-power, no?

Currently, this is because two nations all too familiar with American sanctions—i.e., Iran and Russia—just happen to have a lot of oil and have cranked up their oil selling in alternative currencies among willing buyers like China and India.

By the Way: This is All VERY Good for Gold

One, for example, can sell oil in London for gold, then transfer that gold to a Yuan trade hub where the gold is converted to CNY, and then use that CNY to buy oil outside of the USD.

Or stated more simply, gold will slowly be filling the delta in a BRICS+ oil trade once ruled by the USD, which mean’s gold’s price, hitherto controlled by NY and London, is about to return to actual fundamentals rather than OTC price fixing.

As gold traded on the Shanghai Exchange gathers greater and greater momentum (and premiums), the 200-day moving average of gold priced in USD will have to keep pace for the 200-day moving average in CNY…

Again, all of this was foreseeable but only now is the math finally making the headlines.

How Much Worse Can It Get for the USD?

Given the rapid pace and percentages of oil trading outside of the USD, the obvious next question is how much worse can it get?

The short answer: A lot worse.

Iran and Russia, for example, are playing hard-ball, but what happens if Saudi Arabia, which is now an official BRICS member (and more prone to fist-pumping Biden while shaking hands with Xi) decides to look more East than West in the coming years?

Saudi Arabia’s increasingly open relations with the Shanghai Cooperation Organization and BRICS New Development Bank suggest that unlike former nations who tried to sell oil outside of the USD (think Iraq and Libya), the Saudi Crown Prince appears far less afraid of meeting the same coincidental fate of say, Saddam Hussein or Muamar Gaddafi…

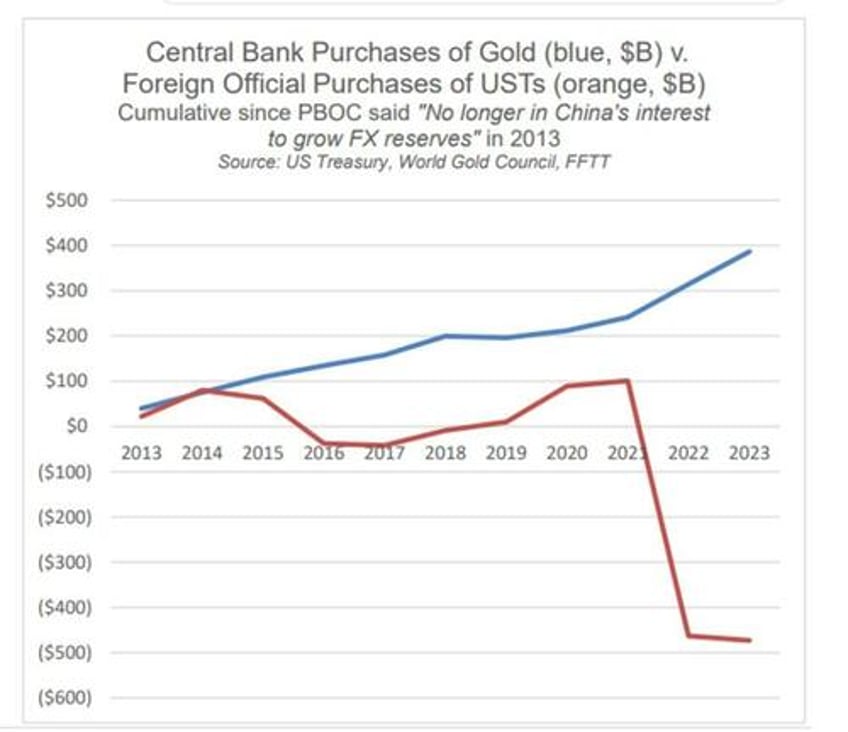

As we’ve warned numerous times, once the US weaponized the USD, there was no turning back, as nations both friendly or not-so-friendly to the US would never trust a non-neutral reserve currency in the same way they had in prior times.

Thanks to folks like Nixon and now Biden, we are a looonnnggg way from the Bretton Woods USD…

Stated simply, broken trust has made the once tolerated USD less tolerable, and like a genie that can never be put back in the bottle again, the USD will never be fully trusted again, which means demand for that Dollar will never be the same again.

But What About the UAE and Saudi Dollar Peg?

Defenders of the Petrodollar (and hence milkshake theory) will rightfully point out that both the Saudi riyal and UAE dirham are pegged to the USD, which might suggest that both of these mega oil powers have a vested interest in seeing a stronger rather than weaker role of the USD in their critical oil markets.

It’s also worth admitting that Russian oil enterprises are slamming into liquidity issues with Indian rupees and Chinese yuan, which are not nearly as liquid as the USD, which despite its weak legs and twisted back, is still the best horse in the global currency glue factory.

These are fair, very fair points.

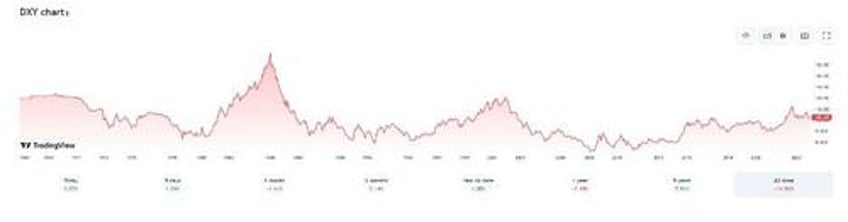

This is why we still maintain our belief that the USD’s supremacy, just like it’s post-1971 purchasing power, will die slowly by a thousand cuts rather than an overnight headline.

So yes, the riyal and dirham are both pegged to the USD, but as Luke Gromen recently observed, that’s only true “…for now.”

Gromen makes a compelling case that most investors are underestimating the ability by which both the UAE and Saudis have to de-peg their currencies from a weakening USD and re-peg “their energy to gold… while having their currencies APPRECIATE against the USD.”

Brent Johnson, who argues for a stronger USD, would counter such an argument by reminding us that OPEC considered cutting its link with the USD in 1975, and it never happened.

But like Gromen, I’d argue that we are not in 1975 (or Kansas) anymore.

Much has changed—including the distrust of that post-sanction USD, the subsequent rise of the BRICS+ nations, the aforementioned percentage of oil volumes trading outside the USD and the open decline of US monetary and foreign policy in recent years and headlines.

And like Gromen, I’d remind readers that even the hint of an OPEC link-cut in 1975 with the USD sent the gold price up by 5X in a period of less than five years.

This explains why the Fed of that same period hiked rates from 5.25% to over 18% to make the USD more attractive to OPEC.

BLACK Gold Colliding with Real Gold = A GREENback in the RED

But folks, with public US debt now racing past $34T, the current Fed has no ability to put such rate-hike lipstick on a high-debt pig of the current magnitude, which means Powell, unlike Volcker, simply can’t make the USD attractive to OPEC in 2024 like it could in the late 1970’s.

Or stated more simply, the USD, like the cornered US Fed, is running out of both credibility and options.

And This Again, Is Good for Gold

The implications and ripple effects of a now weaponized Greenback are nothing short of extraordinary as gold slowly rises to the status of an oil currency for the first time since Nixon welched on the gold standard in 1971.

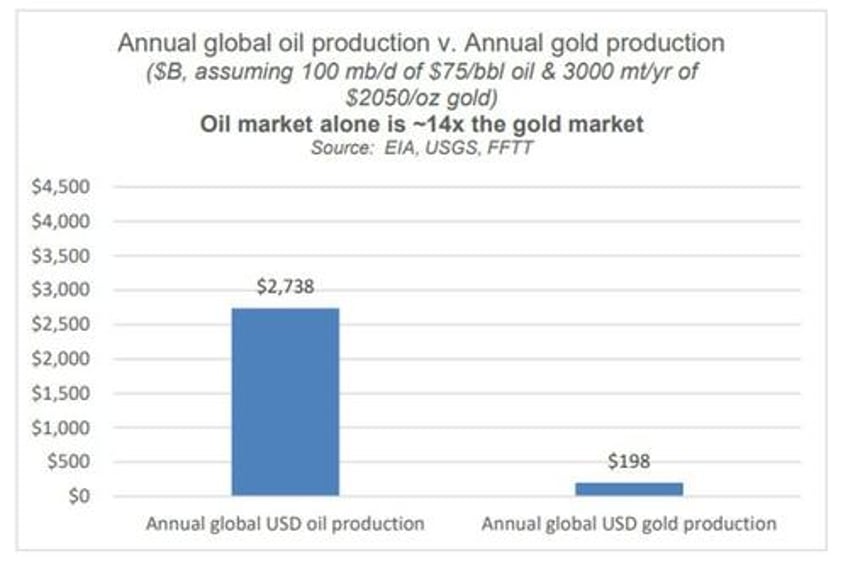

And given the disconnect between current USD oil production (massive) and USD gold production (tiny), the potential for an historically significant repricing of gold is as powerful (and predictable) as good ol’ fashioned supply and demand.

After all, when a golden asset of infinite duration yet finite supply collides with spiking demand, the price of that asset skyrockets.

By contrast, when an unloved asset of finite duration yet infinite supply—like a UST—collides with tanking demand, the price of that asset sinks to the ocean floor…

Don’t Get Too Comfortable with Lower Rates and Defeated Inflation…

Thus, despite recent and openly desperate attempts by the FOMC to project reduced rates while declaring victory over inflation (after having engineered a deflationary, yet unreported and rate-hike-driven recession), we foresee a longer-term scenario of tanking USTs and hence rising yields, which means rising interest rates.

Such bond-market-determined (rather than Fed-set) rate hikes will also be colliding with a US Congressional Budget Office forecasting another $20T of UST issuance in the next 10 years.

This will be a perfect storm of more IOU issuance colliding with even higher rates and hence higher costs, which will in turn only be payable if the Fed prints even more trillions of USDs out of thin air to pay Uncle Sam’s bar tab.

Needless to say, such inevitable synthetic liquidity (i.e., QE to the moon) will lead to further rather than less debasement of an already debased USD (very good for gold…), proving that Hemingway’s predictions above make him a far more deserving recipient of the Nobel Prize in Economics than Bernanke.

Ah, the ironies, they do abound…

Bernanke’s thesis of solving a debt crisis with more debt is far more deserving of a prize in fiction than math, but as per above, it was Papa Hemingway, the novelist, who understood history and math far better than this falsely idolized central banker…

All Signs Point to Gold

In 2023, we saw gold reaching record highs in all currencies including the USD despite a year marked by a relatively strong USD, positive real rates and spiking yields—all traditional headwinds for USD-priced gold.

This disconnect from traditional metrics is based upon the USA’s disconnect from sound monetary and foreign policies, all of which have left the USD, UST and US Government looking more like the island of misfit toys rather than a trusted land of the reserve currency.

Gold will continue to diverge from traditional metrics as its role as a net trade settlement among the growing BRICS+ nations makes the issue of positive or negative US real rates less relevant in a world turning away from, well…the US and its broken/dis-trusted currency.

These hard facts, combined with the inevitable return to mega QE to monetize massive and projected UST issuance (and hence debt) in the coming years, will further debase the USD to support the UST market.

Ludwig von Mises, Ernest Hemingway, and David Hume understood the philosophy of debt long before the first central banker was spawned. They warned that all debt-soaked and failing nations have and will sacrifice their currency to save their rotten “system.”

They were and are correct.

In blunt yet historically and math-confirmed terms, gold, priced in USDs, will continue to rise much higher for the simple reason that the USD, despite its powerful reserve status, will continue to debase itself in real terms.