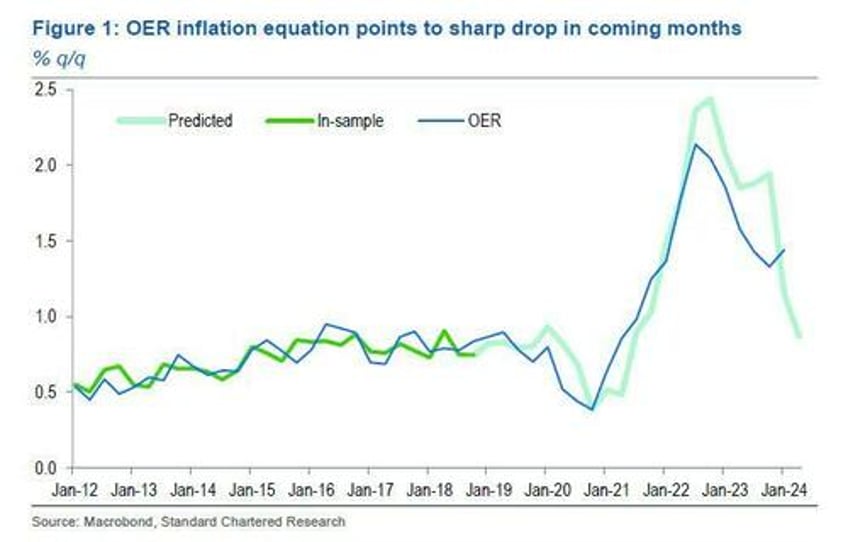

Last week, and ahead of this week's most important data point the Wednesday CPI report, we explained why the CPI number "Will Be A Big Miss" - the TL/DR is that the OER component of the CPI basket is now badly lagging the (already lagged) drop in current rents, and as a result, there will be one or more months of rapid catch downs as core CPI "unexpectedly" is a huge miss.

And while we explained why our bet is on this week, it turns out that Morgan Stanley largely agrees: as the bank's chief economist Seth Carpenter writes in the bank's Sunday Start note (available to pro subs in the usual place), "most folks in markets know that the BLS takes current rents and essentially spreads those price changes over a couple of quarters. Current readings on rents have been very weak, so a continued fall in the official statistics for the rest of the year seems clear. Indeed, despite the surge in immigration over last year and this, multifamily vacancies are approaching historical highs. In housing inflation lies the clearest signal for the path of inflation – and that path is lower."