"That's a nice regional bank lender you got there... be a shame if anything happened to it..."

We have warned for months (here, here, and here most recently) - as regional bank shares soared back from SVB crisis lows - that this small bank balance sheet crisis was far from over... and worse still the 'big banks' have money to burn with excess reserves (to use, for example, to help the FDIC clean up some small bank issues)...

Last week we highlighted the dominoes had started falling in regionals, and the initial domino - New York Community Bancorp - is back in the cross-hairs as Bloomberg reports that, according to people with direct knowledge of the matter, mounting pressure from a top US watchdog led to the bank's surprise decision to slash its dividend and stockpile cash in case commercial real estate loans go bad.

The drastic actions - which prompted a collapse in the bank's shares - followed behind-the-scenes conversations with officials from the Office of the Comptroller of the Currency, the people said

Now, far be it from us to speculate but could a quiet call have been made to prompt regulators to suddenly pay attention?

Why now?

Everything was awesome, remember?

This all happened the week after The Fed officially killed its free-money 'arb' and confirmed the imminent death of its bank bailout facility... and as the Reverse Repo liquidity poll is draining fast.

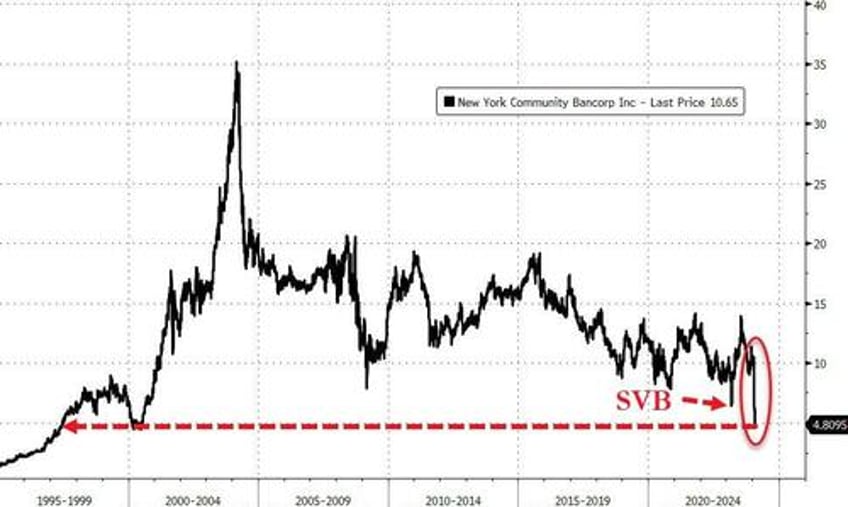

And that has sent NYCB shares down 14% this morning, after falling 11% yesterday...

Which leaves it near its lowest levels since 1997...

...well below the lows reached during the SVB crisis (down 65% from the post-SVB crisis highs).

The bank's chief risk officer Nicholas Munson and chief audit executive Meagan Belfinger both appear to have left the bank in recent months.

NYCB has said building reserves is part of its widely expected transition to more stringent capital rules after the lender swelled beyond $100 billion in assets while acquiring parts of Signature Bank last year.

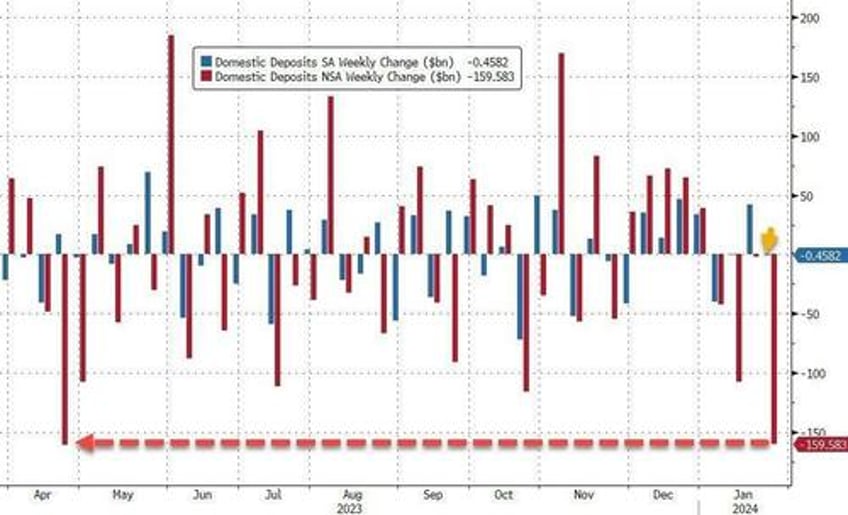

Well, given the massive drop in deposits last week (on a non-seasonally-adjusted basis) by domestic banks...

We wonder if SVB 2.0 is about to hit (and prompt those Fed rate-cuts to be brought forward)?

Bonds are bid this morning, gold and crypto are rallying, and rate-cut odds are on the rise again.