- Newsflow was light whilst participants were also away on the US Labor Day holiday.

- US President Biden said they are still in the middle of ceasefire and hostage-deal negotiations, according to Reuters.

- Libya's NOC declared force majeure on El Feel oil field from 2nd September, according to Reuters.

- Highlights include New Zealand Import/Export Prices, South Korean CPI, UK BRC Retail Sales, 10-year JGB Auction.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

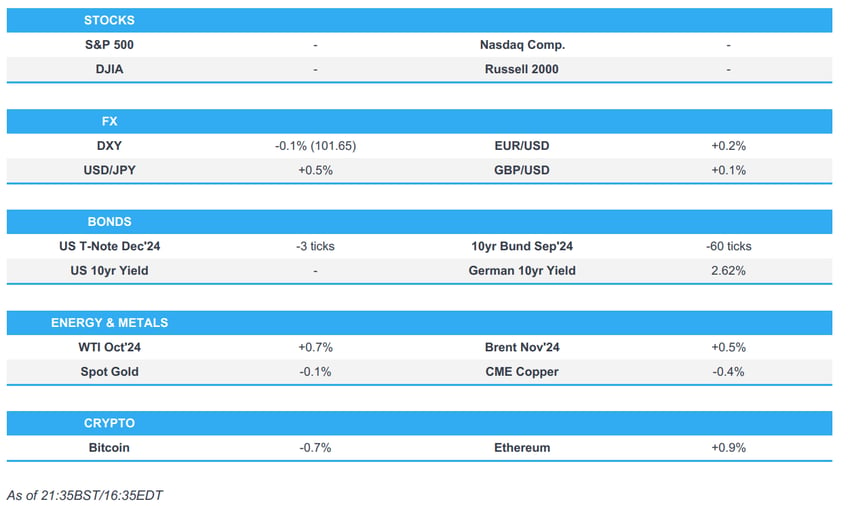

US TRADE - Closed for Labor Day

- No notable news.

COMMODITIES

- Libya's NOC declared force majeure on El Feel oil field from 2nd September, according to Reuters.

GEOPOLITICS

- US President Biden said they are still in the middle of ceasefire and hostage-deal negotiations, according to Reuters.

- Russian President Putin says they are advancing in the Donetsk region at a speed not seen in a long time, via Ria.

- Two oil tankers, one Saudi-flagged and the other Panama-flagged, were attacked on Monday in the Red Sea off Yemen, according to Reuters sources.

ASIA-PAC

NOTABLE HEADLINES

- A 4.7 mag earthquake was been felt in Taiwan's capital Taipei, according to witnesses cited by Reuters.

EU/UK

NOTABLE HEADLINES

- European Semiconductor industry group ESIA calls for EU "Chips Act 2.0"; should focus less on export restrictions, and more on support for existing strengths.

DATA

- UK S&P Global Manufacturing PMI (Aug) 52.5 (Prev. 52.5)

- EU HCOB Manufacturing Final PMI (Aug) 45.8 vs. Exp. 45.6 (Prev. 45.6); “The deflationary phase in the goods sector might be coming to an end."

- German HCOB Manufacturing PMI (Aug) 42.4 vs. Exp. 42.1 (Prev. 42.1); "In August, export orders in Germany dropped at a much faster pace than in previous months. This suggests that the export slump we've been seeing in recent months is probably going to stick around for a while"

- French HCOB Manufacturing PMI (Aug) 43.9 vs. Exp. 42.1 (Prev. 42.1); "Suppliers’ delivery times are lengthening again, partly due to disruption at the Red Sea"

- Spanish HCOB Manufacturing PMI (Aug) 50.5 vs. Exp. 51.5 (Prev. 51.0)

- Swedish PMI Manufacturing Sector (Aug) 52.7 (Prev. 49.2)

- Swiss Retail Sales YY (Jul) 2.7% (Prev. -2.2%, Rev. -2.6%)