Bill Ackman, the billionaire CEO of Pershing Square Capital Management, wrote on X on Friday morning that his team has acquired a 30.3 million share position in Uber since early January.

"I have been a long-term customer and admirer of Uber beginning when Edward Norton showed me the app in its early days. I was also fortunate to be a day-one investor in the company through a small investment in a venture fund," Ackman wrote.

He continued: "While a great business, Uber suffered from erratic management. Since he joined the company in 2017, Dara Khosrowshahi CEO has done a superb job in transforming the company into a highly profitable and cash-generative growth machine."

Ackman said the ride-hailing app is "one of the best managed and highest quality businesses in the world," adding shares can "still be purchased at a massive discount to its intrinsic value."

Beginning in early January, we began acquiring a position in @Uber. Today, we own 30.3 million shares.

— Bill Ackman (@BillAckman) February 7, 2025

I have been a long-term customer and admirer of Uber beginning when Edward Norton showed me the app in its early days. I was also fortunate to be a day-one investor in the…

After Ackman's post, shares jumped as high as 7.5%. Bloomberg data showed volume for this time of day was about triple the average. Shares topped the $75 handle and were at their highest level since late October.

Earlier this week, Uber reported fourth-quarter results that beat analysts' expectations for revenue but underwhelmed on EPS and delivered softer guidance.

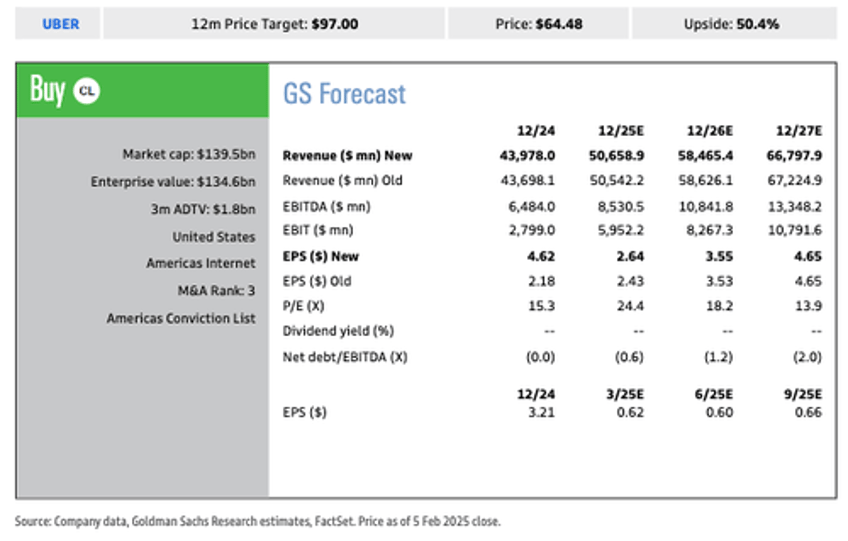

Goldman's Eric Sheridan, Ben Miller, and others provided clients with the positives and negatives from 4Q24 earnings:

Positives: a) Uber exhibited solid growth in Trips, Gross Bookings, and Adjusted EBITDA in Q4, with accelerating growth across MAPCs, Trips, and Gross Bookings, and shared expectations for 1H'25 Mobility GBs to grow 20%+ FXN and Delivery GBs FXN growth to remain relatively stable; b) Q4 was the seventh straight quarter of Delivery MAPC YoY growth accelerating with particular strength in the US, UK, Canada, and Mexico; c) Platform & new initiatives continue to be a tailwind to reach and penetration, including Uber One (30m+ members, up ~60% YoY), Uber Teen (now live in >50 countries), Uber Share (>$2bn annualized GBs), and taxi partnerships (up to 20k incremental vehicles in Japan); d) Progress on Autonomous Vehicle opportunity with recently announced Nvidia partnership, inaugural international AV launch with WeRide in Abu Dhabi, and deployment with Waymo in Austin expected to begin in March (Atlanta slated for this Summer); & e) Announced $1.5bn accelerated share repurchase in January against previous $7bn repurchase authorization ($4.25bn remains unused post-ASR).

&

Negatives: a) GBs guide for Q1'25 (mid-point of $42.75bn) came in below prior GSe/Street by 1-2%, albeit embedding a ~550bps FX headwind; b) Q4 incremental Adj. EBITDA margins of 8.4% (% GBs) was below mid-point implied in Q4 guidance (& step-down from Q3 level), with investors looking to better understand achievability of improving incremental margins in Q1 embedded in guidance; & c) Freight Revenue missed GSe/Street expectations, remaining ~flat YoY and down -3% QoQ, driven by a decrease in revenue per load as a result of the challenging freight market cycle, partially offset by an increase in volume.

The analysts maintained their "Buy" rating with a 12-month price target of $97.

Responding to Ackman's post, All-In Podcast's Jason Calacanis said, "And imagine what the world will look like when TSLA, AMZN, or Google buy $UBER for a modest 10-20% of their market caps."