- APAC stocks were mostly lower as the region failed to resume the momentum from last Friday's dovish post-NFP reaction, while the weekend macro news flow was light aside from the French election results.

- EUR/USD was mildly pressured after the French second-round election results pointed to a hung parliament in which the left-wing New Popular Front surprisingly won the most seats followed by Macron's centrists and with the far-right National Rally in third place.

- European equity futures indicate a flat open with Euro Stoxx 50 future unchanged after the cash market closed down by 0.2% on Friday.

- WSJ's Timiraos said on Friday that the June jobs report creates a more interesting series of risk management questions for the Fed and that officials have downplayed trade-offs so long as employment growth was running above expectations.

- Looking ahead, highlights include German Trade Balance, EZ Sentix, Comments from BoE’s Haskel & Earnings from Repsol.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

FRENCH ELECTION

- France's left-wing New Popular Front alliance surprisingly won the most seats (182 seats) in the second round of the French parliamentary election but fell short of an absolute majority, while President Macron’s centrist bloc won the second-most number of seats (163 seats) followed by the far-right National Rally in third place (143 seats) in a shock win for the left-wing coalition with France set for a hung parliament.

- French Presidency said Macron will respect the choice of the French people and will wait for the full picture to emerge in parliament before taking the necessary next decisions, while it added that Macron is currently analysing the latest parliament election results.

- French PM Attal said no absolute majority can be formed by extreme parties after the parliamentary elections and his political camp has no majority, while he will offer his resignation to President Macron.

- French left-wing leader Melenchon said the election score is the result of a magnificent mobilisation effort and the far-right is from a majority, while he added Macron’s defeat is clearly confirmed and PM Attal must go, according to Reuters.

- French far-right National Rally’s Le Pen said she sees the seed of tomorrow’s victory in today’s results and their victory has merely been delayed, while she added that French President Macron’s situation is untenable, according to Reuters.

US TRADE

EQUITIES

- US stocks finished mostly higher on Friday as participants digested a net dovish NFP report in which the headline came in above expectations at 206k (exp. 190k), although the prior saw a chunky revision lower to 218k from 272k, while the Unemployment Rate surprised to the upside at 4.1% (exp. 4.0%, prev. 4.0%) to surpass the Fed's median 2024 projection of 4.0% and earnings were in line with expectations but softened from the prior month. The downward revisions and rising unemployment rate sparked a dovish reaction with both stocks and bonds firmer on the session while the buck was hit.

- SPX +0.55% at 5,567, NDX +1.02% at 20,392, DJI +0.17% at 39,376, RUT -0.49% at 2,027.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Biden said he is convinced he is the most qualified person to beat Donald Trump and has done ten major events since the debate, while he pointed to his successes when asked if he was the same man as he was when he took office three years ago. Biden also stated he is still in good shape and that no one has said he needs neurological and cognitive tests.

- US Democrat Rep. Schiff said either Biden has to win overwhelmingly or he had to pass the torch and that Kamala Harris could win overwhelmingly but Biden needs to make a decision, according to Reuters.

- US Senator Mark Warner was reportedly seeking to assemble a group of Democratic senators to ask President Biden to exit the race, according to sources cited by the Washington Post on Friday.

- WSJ's Timiraos said on Friday that the June jobs report creates a more interesting series of risk management questions for the Fed and that officials have downplayed trade-offs so long as employment growth was running above expectations.

APAC TRADE

EQUITIES

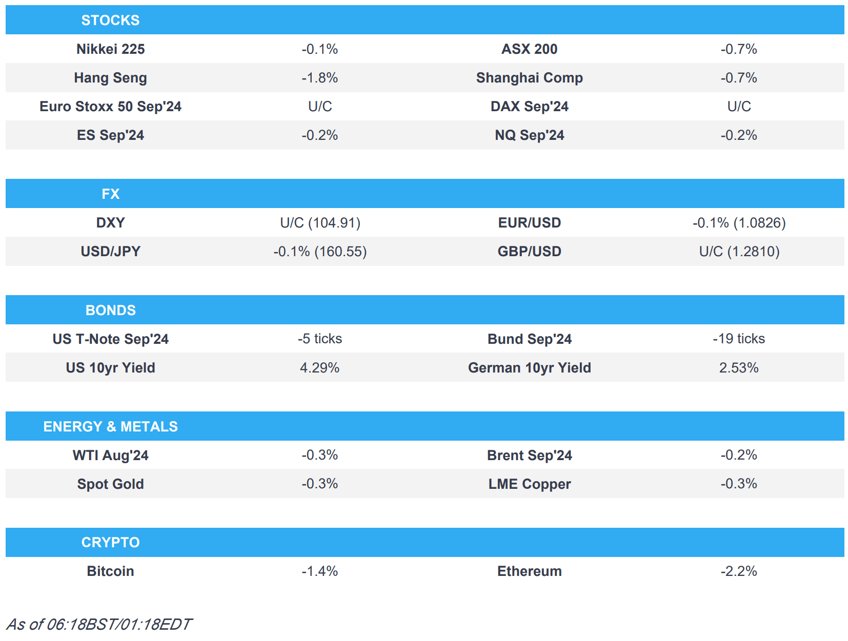

- APAC stocks were mostly lower as the region failed to resume the momentum from last Friday's dovish post-NFP reaction, while the weekend macro news flow was light aside from the French election results.

- ASX 200 was dragged lower by energy and mining stocks, while a surprise contraction in Home Loans added to the glum mood.

- Nikkei 225 faded after initially bucking the trend and hitting a fresh record high before reversing course, as participants digested mixed data.

- Hang Seng and Shanghai Comp. were pressured with underperformance in Hong Kong amid weakness in property stocks, while the mainland also lacked demand ahead of this week's key releases from China including CPI and the latest trade data.

- US equity futures were lacklustre overnight but held on to most of their post-NFP gains.

- European equity futures indicate a flat open with Euro Stoxx 50 future unchanged after the cash market closed down by 0.2% on Friday.

FX

- DXY remained subdued after the dovish reaction to last week's key US jobs report which dragged the DXY to below the 105.00 level, while the focus for the Dollar this week is on Fed Chair Powell's testimony in Congress from Tuesday and US CPI data on Thursday.

- EUR/USD was mildly pressured after the French second-round election results pointed to a hung parliament in which the left-wing New Popular Front surprisingly won the most seats followed by Macron's centrists and with the far-right National Rally in third place.

- GBP/USD traded little changed above the recently reclaimed 1.2800 level amid quiet pertinent newsflow.

- USD/JPY gradually retreated after somewhat mixed data from Japan but later rebounded off lows.

- Antipodeans lacked direction amid the subdued risk appetite and absence of tier-1 data releases.

- PBoC set USD/CNY mid-point at 7.1286 vs exp. 7.2640 (prev. 7.1289)

FIXED INCOME

- 10-year UST futures mildly pulled back from last week's peak after climbing on the back of the jobs data.

- Bund futures faded some of Friday's advances and reverted to below 131.00 ahead of German trade data.

- 10-year JGB futures conformed to the downward picture across global counterparts amid a lack of BoJ purchases and mixed data including softer-than-expected Labour Cash Earnings and larger-than-anticipated Current Account surplus.

COMMODITIES

- Crude futures were lacklustre amid Gaza truce hopes with Egypt to host Israeli and American delegations this week to discuss outstanding issues in Gaza and a ceasefire agreement, while it was also reported that several Texas ports were shut as Beryl approached.

- NHC said Beryl is forecast to strengthen to a hurricane again before landfall and a storm surge warning was extended along the Texas coast. NHC also announced that a hurricane warning is in effect for the Texas coast from Baffin Bay northward to San Luis Pass and Galveston Island, as well as for the south of Baffin Bay to the mouth of the Rio Grande River, according to Reuters. Furthermore, the NHC later confirmed that Beryl became a hurricane again.

- US Coast Guard shut the Port of Houston ahead of approaching Beryl, while ports of Texas, Freeport & Galveston were also shut by the Coast Guard, according to Reuters.

- Citgo began cutting production at its Corpus Christi, Texas refinery (165k bpd) ahead of Beryl but plans to keep the refinery running at minimum rates during the storm, according to sources cited by Reuters. It was later reported that the Port of Corpus Christi announced the port was closed due to Beryl.

- A fire broke out at a gas pipeline in Crimea due to an accident although there were no casualties, according to Russia-installed officials.

- Spot gold took a breather after ultimately rallying on Friday alongside the dovish reaction to the US jobs data.

- Copper futures were subdued amid the mostly downbeat risk tone in Asia including in its largest buyer China.

CRYPTO

- Bitcoin was pressured overnight but off worst levels after rebounding from an early slump beneath the USD 55,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC said it will conduct a temporary repo or reverse repo based on market conditions effective from July 8th and the tenor of the temp repo or reverse repo will be overnight loans, while it added the move is to maintain banking system liquidity reasonably ample and to increase the accuracy and efficiency of open market operations.

- China's MOFCOM said China's Vice Premier will co-chair the fifth meeting of the Sino-Russian intergovernmental cooperation committee in Russia on July 9th, according to Reuters.

- China’s auto manufacturers association is strongly dissatisfied with the EU Commission’s anti-subsidy tax rate, according to Reuters.

- Tokyo Governor Koike won re-election for a third term, according to exit polls cited by Reuters.

- Japan's government says regular pay rose 2.5% Y/Y, which was the fastest pace of increase since January 1993.

DATA RECAP

- China FX Reserves (USD)(Jun) 3.222tln (Prev. 3.232tln)

- China Gold Reserves (USD)(Jun) 169.7bln (Prev. 171.0bln)

- Japanese Labour Cash Earnings YY (May) 1.9% vs Exp. 2.1% (Prev. 2.1%)

- Japanese Current Account NSA JPY (May) 2849.9B vs. Exp. 2453.9B (Prev. 2050.5B)

- Japanese Bank Lending YY (Jun) 3.2% (Prev. 3.0%, Rev. 2.9%)

- Australian Home Loans MM (May) -1.7% vs Exp. 1.8% (Prev. 4.8%)

- Australian Owner-Occupied Housing Finance MM (May) -2.0% vs Exp. 2.0% (Prev. 4.3%)

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu said any Gaza deal must allow Israel to continue fighting until all war objectives are met and the deal must not allow weapon smuggling to Hamas via the Gaza-Egypt border. Netanyahu added that thousands of armed militants cannot return to northern Gaza under the deal and that the proposal to which Israel agreed allows the return of hostages without compromising war objectives, according to Reuters.

- A revised proposal on a Hamas-Israel deal stated talks on the release of Israeli hostages including soldiers will start in a 16-day period after the first phase and an agreement on a hostage release deal is to be concluded before the end of the fifth week of the second phase, according to a senior Hamas source. Furthermore, the revised proposal involves mediators to guarantee a temporary ceasefire, aid delivery, and the withdrawal of Israeli troops as long as indirect talks continue to implement the second phase, according to Reuters.

- Egypt is to host Israeli and American delegations to discuss outstanding issues in Gaza and a ceasefire agreement, according to senior sources cited by Al Qahera News TV. It was also reported that CIA Director Burns is expected to visit Cairo this week for Gaza ceasefire talks.

- An Israeli air strike on a school sheltering displaced Palestinians in Gaza’s Al-Nuseirat killed at least 13 people, while the Israeli military said its airstrike targeted militants in an area near a Gaza school. It was also reported that senior Hamas government official Ehab Al-Ghussein was killed by Israel’s air strike in Gaza City, according to Reuters.

- Lebanon's Hezbollah said it launched its “largest” air operation, sending explosive drones at a mountaintop Israeli military intelligence base in the annexed Golan Heights, according to SCMP.

- Moderate Pezeshkian beat his hard-line rival in the Iranian presidential race runoff, according to the interior ministry, while the vote is unlikely to result in a shift of policies but may shape the succession for Iran’s Supreme Leader Khamenei, according to Reuters.

OTHER

- Ukrainian security source said Ukrainian forces hit a Russian munitions depot in the Voronezh region using drones, while a state of emergency was introduced in some parts of the Voronezh region following the drone attack.

- North Korean leader Kim's sister said South Korea's recent drills near the border are inexcusable and explicit provocation, while she added that if North Korea's sovereignty is violated, North Korea's armed forces will immediately carry out their mission and duty according to the constitution.

- China is developing a new stealth aircraft which will be a fifth-generation fighter jet with stealth function and is likely to be deployed on China’s third aircraft carrier the Fujian, according to Nikkei.

- Philippines President's Office announced the Philippines and Japan signed a reciprocal access agreement