Below we except from today's EOD note by Goldman TMT specialist Peter Bartlett describing what was one of the ugliest days for tech in years...

What happened?

AI Infrastructure stocks sold off violently (to put it mildly) after a cheap AI model from Chinese startup, DeepSeek, called into question the widespread market belief that the future of AI will require ever-increasing amounts of compute capacity, power, and energy to develop.

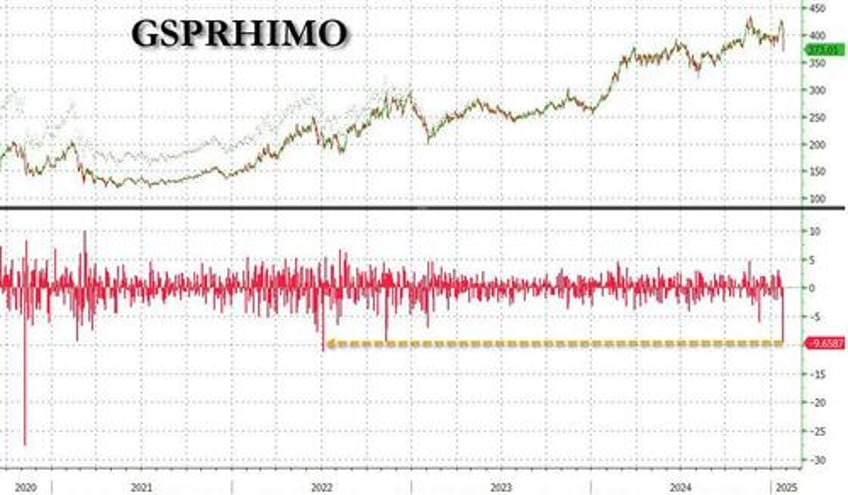

Semiconductors finished -10%, it’s single worst session since March 2020, led by NVDA -17% (which shed $600bn in market cap, the largest 1-day loss in market history), AVGO -17% (shed $200bn in mkt cap), and TSM -14% (-$155bn in cap). The damage, from a % move basis, was even more pronounced in the Industrial/Power complex, with VST finishing -28%, GEV -22%, and CEG -21%. Our Momentum Basket (GSPRHIMO Index), which measures performance of 12-month winners over 12-month losers, finished -10%, which was one of the worst single days for the basket in 5 years. Needless to say, it was a painful day for most.

What we saw from a flow perspective?

As you might imagine, the desk was overwhelmingly busy from a flow perspective wire to wire today. Below are the flow dynamics that stood out most to me:

1. Long Only Investors were Selling…While we didn’t get the sense today represented a wholesale thesis change for anyone, it was clear that LOs were “risk managing” today. Starting early in the premarket, we were extremely busy for a wide range of large Asset Managers (US + INTL) paring down positions across the AI infrastructure group, with the supply persisting for the entirety of today’s session. While tough to know how long this type of selling pressure will last, my gut is the "highest velocity" supply could’ve hit the market today (ie would expect a tail of supply this week, but likely smaller / less aggressive relative to what we saw come to the market today).

2. No one was Buying…We received a lot verbal “defense” of the broader AI infrastructure group from the investor community (particularly HFs), but virtually zero actual defending/buying on the way down. No one likes to catch a falling knife (particularly when most are busy playing defense), and our sense us real pools of capital would rather add on a move higher off the lows vs. step in too early at this point.

3. Levered ETFs likely exacerbated…The levered ETF space, which has seen significant growth in AUM and trading volumes in recent years, undoubtably played a role in move magnitudes today. SOXL (3x levered Semis) traded $5bn notional today (~$15bn worth of underliers), SOXS (3x Levered Semis short) traded $2.5bn ($7.5bn worth of underliers), and NVDL (2x levered NVDA long) traded $5bn today ($10bn in the underlier … and its largest value traded day ever by a wide margin). Short-dated options on all of these vehicles also traded huge volumes today. Seems reasonable to assume that trading in these securities, which all have huge imbedded leverage, contributed to outsized move magnitudes today.

4. Rotational Pressure was palpable…

As the day wore on, the desk noted increased out-of-Semis -> into-Software (+ AAPL) rotational flow. Zooming out even further, there were clear macro rotations into Defensives today (notably, 70% of S&P500 finished in the green today).

Where Sentiment stands now?

While most that we talk are still trying to make sense of this all (still several “unknowns” around the DeepSeek story + move magnitudes have many in a bit of shell shock), there is a view that growing AI adoption (which may now be at a lower cost, but potentially accelerated & more pervasive) still represents a significant tailwind for most of the companies hit hardest today and should keep the AI trade “intact.”

From Bartlett, we turn to his TMT colleague, Peter Callahan, who makes the following observations :