- APAC stocks were mixed amid holiday-thinned conditions on Chinese New Year's Eve and after the recent US tech sell-off.

- US President Trump said he wants universal tariffs much larger than a 2.5% monthly increase and has a tariff level in mind but has not set it yet.

- European equity futures indicate a marginally positive open with Euro Stoxx 50 futures up 0.1% after the cash market fell 0.6% on Monday.

- USD is firmer vs. peers following yesterday's selling, JPY lags, EUR/USD is back below 1.05.

- Looking ahead, highlights include US Durable Goods, Richmond Fed Index, ECB BLS (Q1), NBH Policy Announcement & US Senate Committee, ECB’s Cipollone & Lagarde, Supply from Netherlands, Italy, UK, Germany & US, Earnings from LVMH, Logitech, SAP, Boeing, GM, Lockheed Martin, Royal Caribbean, RTX Corporation, Kimberley Clark, Invesco, JetBlue & Starbucks.

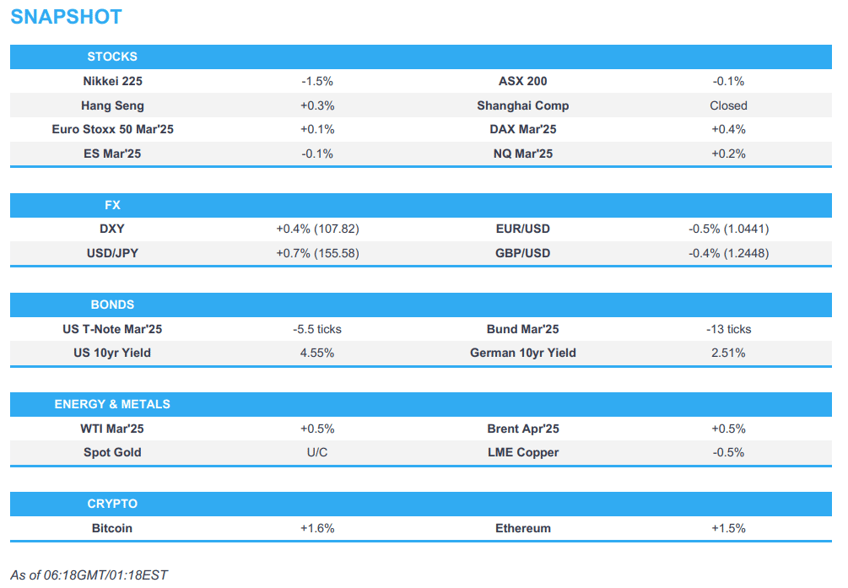

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were broadly hit on Monday with steep losses in AI and tech names leading the downside in which NVDA closed down around 17%. The weakness was observed with questions now hanging over the AI dominance in the US after China's DeepSeek (OpenAI rival) saw impressive performances at a fraction of the costs, bringing into question the need for extortionate CapEx from tech companies expanding their AI portfolios, while the sell-off sparked a flight to quality with T-notes higher across the curve and outperformance seen in haven currencies Yen and Swissy.

- SPX -1.46% at 6,012, NDX -2.97% at 21,127, DJIA +0.65% at 44,714, RUT -1.03% at 2,284.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Trump said he will work with Congress on a plan to secure the borders and that they need a massive increase in funding for border security, while he will work with Congress on tax cuts and must permanently extend tax cuts previously passed under the Trump administration. Trump reiterated "drill baby drill" and said he will give fast approval to anyone building a plant for electric generation. Trump also stated that tariffs will be placed on computer chips in the near future and he will place tariffs on producers of pharmaceuticals, while he added that steel and other industries will be considered for tariffs and tariffs will also be placed on aluminium and copper. Furthermore, he said if you want to stop placing the tariffs, companies need to build plants in the US and it is good that companies in China have come up with a faster method of artificial intelligence whereby Chinese startup DeepSeek should be a wake-up call.

- US President Trump said he wants universal tariffs much larger than 2.5% and has a tariff level in mind but had not set it yet, which followed an earlier report in FT that Treasury Secretary Bessent is pushing for a gradual 2.5% universal tariffs plan in which the 2.5% levy would move higher by the same amount each month.

- US Senate voted 68-29 to confirm Scott Bessent as Treasury Secretary.

- US President Trump's AI czar David Sacks posted on X that DeepSeek R1 shows that the AI race will be very competitive and that President Trump was right to rescind the Biden Executive Order that hamstrung American AI companies without asking whether China would do the same.

- Canada’s Foreign Minister said she will be talking to British, EU and Mexican counterparts soon in a bid to fend off US tariffs.

APAC TRADE

EQUITIES

- APAC stocks were mixed amid holiday-thinned conditions on Chinese New Year's Eve and after the recent US tech sell-off.

- ASX 200 traded rangebound on return from the long weekend as gains in the consumer, healthcare, telecoms and financial sectors offset the losses in real estate, utilities, tech and miners, while improved Business surveys did little to spur demand.

- Nikkei 225 extended on the recent selling but was off worst levels amid a weaker currency and softer Services PPI data.

- Hang Seng kept afloat but with upside capped amid the absence of mainland participants and Stock Connect flows, while markets in Hong Kong closed early ahead of Chinese New Year celebrations.

- US equity futures (ES U/C, NQ +0.2%) lacked firm direction following the recent AI-related tech sell-off on Wall St where Nvidia shares fell by 17% and suffered the largest daily market cap loss in history for a US company.

- European equity futures indicate a marginally positive open with Euro Stoxx 50 futures up 0.1% after the cash market fell 0.6% on Monday.

FX

- DXY mildly strengthened against its major counterparts after the latest tariff-related comments from President Trump who stated tariffs will be placed on computer chips in the near future and on producers of pharmaceuticals, aluminium and copper, while he also wants universal tariffs much larger than 2.5% and has a tariff level in mind but has not set it yet.

- EUR/USD was pressured and retreated further beneath the 1.0500 handle alongside US President Trump's tariff rhetoric.

- GBP/USD failed to sustain the 1.2500 status and gave up ground to the dollar, while the latest UK BRC shop price index showed a continued but slower-than-previous pace of deflation.

- USD/JPY continued its rebound to gain a firm footing above the 155.00 level as the greenback makes headway against major peers and with upside in the pair also facilitated by softer-than-expected Japanese Services PPI.

- Antipodeans retreated alongside their major FX peers and CNH owing to President Trump's tariff rhetoric and with price action also constrained amid the mixed risk appetite.

- SNB Chairman Schlegel said the SNB does not like negative interest rates but they cannot be excluded and they have worked in the past. Schlegel had also commented that Swiss inflation is to be relatively low this year and monthly inflation data may dip below zero.

FIXED INCOME

- 10yr UST futures slightly pulled back after recently gaining on a haven bid amid the US tech sell-off.

- Bund futures lacked demand after having failed to sustain a brief reclaim of the 132.00 level and with supply ahead.

- 10yr JGB futures benefitted from haven demand but are off the prior day's levels despite softer Japanese Services PPI data.

COMMODITIES

- Crude futures attempted to nurse some of the prior day's losses after prices were pressured alongside the broad risk aversion in the wake of Chinese start-up DeepSeek challenging US AI tech dominance.

- Saudi's Energy Minister met with Iraqi and Libyan counterparts and discussed efforts to support stability in energy markets, according to the Saudi state news agency.

- Oil traders expect OPEC+ to stick with its current supply policy at a review meeting next week, resisting pressure from US President Trump to open the taps and bring down crude prices, according to a survey by Bloomberg.

- Petrobras CEO told Brazilian President Lula that the company will readjust diesel prices with the readjustment expected to occur in the next weeks.

- Slovakian Foreign Minister said they welcome the European Commission statement on gas supplies through Ukraine and see Ukraine's willingness to discuss transit of non-Russian gas as a return to a solution they have proposed, such as Azeri gas.

- Spot gold traded rangebound after its recent choppy performance and as participants look ahead to this week's risk events.

- Copper futures marginally extended on yesterday's intraday rebound but with gains capped amid the mixed risk appetite and week-long absence of the red metal's largest buyer.

CRYPTO

- Bitcoin saw two-way price action but ultimately gained overnight to reclaim the USD 103k level.

NOTABLE ASIA-PAC HEADLINES

- US President Trump said they will have a lot of people bidding on TikTok and don't want China involved in TikTok, while he confirmed Microsoft (MSFT) is in talks on TikTok and said he would like a bidding war over TikTok.

- US federal maritime official said the US is not without options in addressing the growing presence of China and Chinese companies in Panama, while the US seeks to increase support for American companies in Panama and throughout the Americas, ensuring Chinese companies are not the sole bidders on contracts.

- Japan's government nominated Waseda University professor Junko Koeda as BoJ Board Member to replace Board Member Adachi whose term ends on 25th March 2025.

DATA RECAP

- Japanese Services PPI (Dec) 2.90% vs Exp. 3.20% (Prev. 3.00%)

- Australian NAB Business Confidence (Dec) -2.0 (Prev. -3.0)

- Australian NAB Business Conditions (Dec) 6.0 (Prev. 2.0)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu is to travel to Washington next week for a meeting at the White House with US President Trump, according to Axios.

- US Secretary of State Rubio had a call with Jordan's King Abdullah and discussed the implementation of a ceasefire in Gaza, the release of hostages and a pathway for stability in the region

- White House Envoy Steve Witkoff will travel on Tuesday to Saudi Arabia to meet Crown Prince Mohammed Bin Salman.

OTHER

- US President Trump to sign an order to begin the process of creating the next generation of missile defence, while the order will call for the creation of an 'Iron Dome' for the US.

- UK Foreign Secretary Lammy and US Secretary of State Rubio spoke on the phone and said the UK and US will work together in alignment to address the situation in the Middle East, Russia’s war in Ukraine and challenges posed by China.

EU/UK

DATA RECAP

- UK BRC Shop Price Index YY (Jan) -0.7% (Prev. -1.0%)