By Jan-Patrick Barnert, Bloomberg Markets Live reporter and strategist

At this stage of the market’s narrative you basically have three options:

Go with the flow and chase the rally with the risk of getting stung at the high,

bet against it and get caught covering your short faster then you can spell “bubble,” or...

wager on big moves in either direction.

This week once again showed how tricky it is to time the ins and outs of short-term positioning, as a weak macro print can be turned downside up within 48 hours. So the third option arguably offers the best risk-reward at this point.

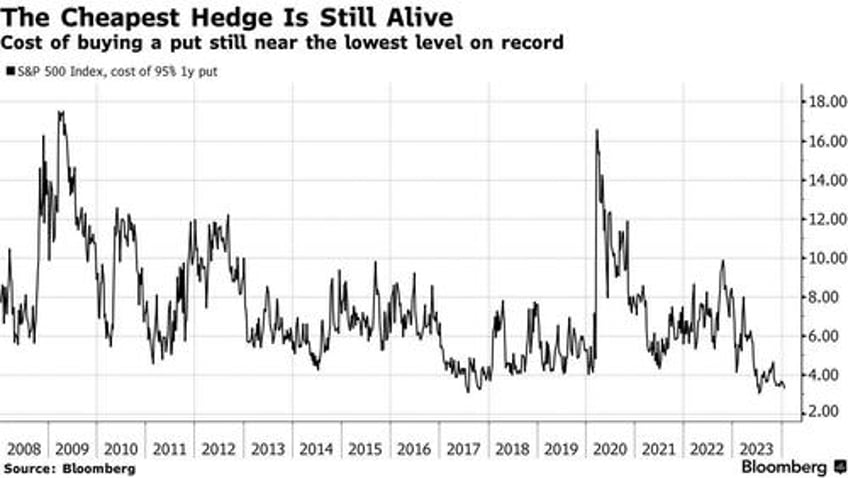

“Equity volatility remains priced for paralysis,” write Bank of America derivative strategists including Arjun Goyal and Vittoria Volta in a note published on Tuesday. So-called option straddles — in which you own both a put and a call — are “so inexpensive relative to the underlying market’s drift” that holding them would have made a profit 80% of the time over the past 12 months, they say. One-year straddles on the S&P 500 Index stand out with a 90% break-even probability.

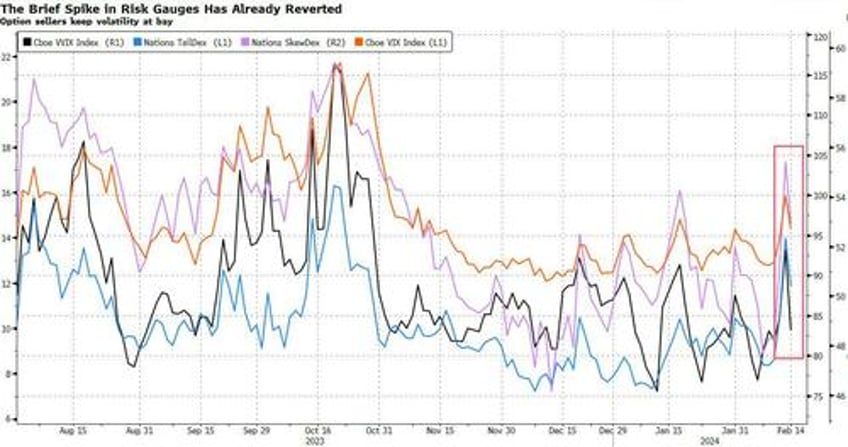

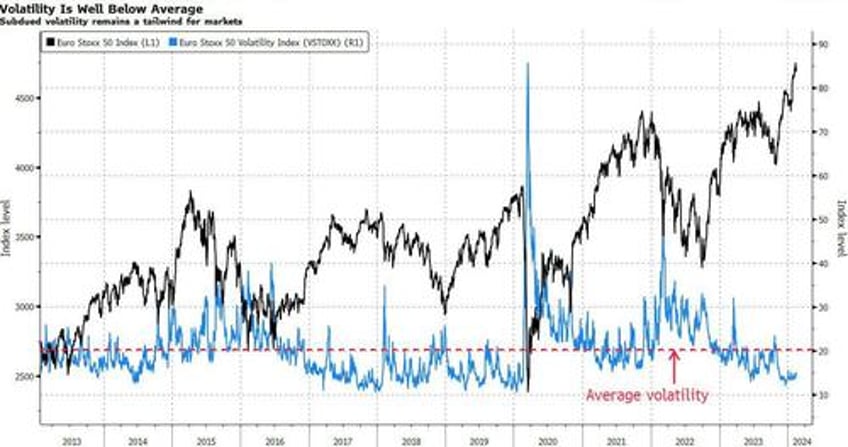

Market volatility has been depressed for some time now. A never-ending supply of option sellers combined with a very solid bull market have kept the VIX Index below 15 points since mid-November, and even the sharp spike back above on Tuesday was quickly reversed. Another measure of market risk, volatility skew, showed a similar pattern.

So why didn’t volatility blow up into a bigger move, as some had expected given how many are short the asset? There isn’t any forced end-of-day cover to volatility short positions, “meaning the current environment is nothing like we saw back during Volmageddon,” according to Nomura. Investors who use derivatives to generate income by selling options are not hedging dynamically, but rather mechanically reloading the monthly supply into volatility which now amounts to about $220 million, says Nomura’s Charlie McElligott.

Hence, just owning volatility might not offer much of a trade beyond one-day price action unless the market is being forced into a real and longer-lasting selloff, with skew and volatility moving consistently higher. Buying straddles seems more reasonable as they would generate delta when the market starts to move in one direction, even if volatility overall remains subdued.

Non-directional trades are often seen as a good alternative, especially if all the arguments of bulls and bears are about equally weighted, and determining market direction is more or less like a coin flip.

We may currently be at such a point. On the one hand, the economy is holding up well, corporate earnings are showing resilience, artificial intelligence holds the promise of improving efficiencies, and investor positioning is not overly bullish. Countering that are fears of a bubble in big tech, ever-higher market concentration and more money flowing into the riskier parts of the market, as well as geopolitics perils and some level of complacency.

And so while cash-market arguments are balancing each other out, maybe the options market is wrong in pricing the outcome. You’ll struggle to find support for the notion that stocks will not move at all from here. That leaves only the question of whether you should use this pricing to buy cheap hedges, or, if you can’t fully rule out more gains, play the non-directional game.

“We view the distribution implied by S&P options as too compressed,” the BofA strategists conclude. “Macro visibility remains extremely poor and the distribution of potential market outcomes over the next year seems particularly wide today, ranging from an asset bubble to a hard landing and everything in between.”