Shares of Novo Nordisk A/S surged in European trading after the Danish pharmaceutical giant announced promising early-stage trial results for its next-generation obesity treatment called "amycretin," which demonstrated 22% weight loss. The positive data helped reverse negative sentiment surrounding Novo after disappointing trial results from another weightloss drug in December.

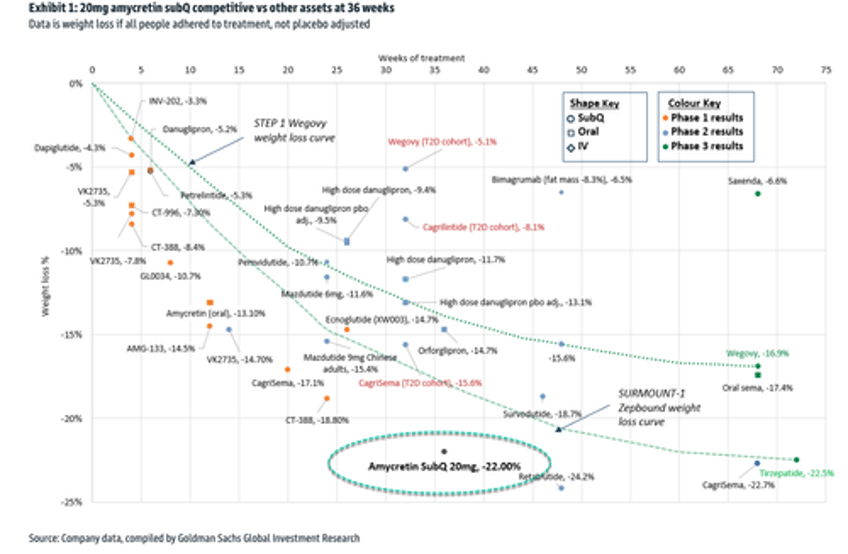

According to early-stage trial results published on Novo's website, the once-weekly amycretin obesity drug, administered via injection, helped patients lose 22% of their body weight over 36 weeks. In contrast, patients who received a placebo gained about 2% over the same timeframe.

"We are very encouraged by the subcutaneous phase 1b/2a results for amycretin in people living with overweight or obesity," Martin Lange, executive vice president for Development at Novo, wrote in a statement.

Lange said, "The results seen in the trial support the weight lowering potential of this novel unimolecular GLP-1 and amylin receptor agonist, amycretin, that we have previously seen with the oral formulation."

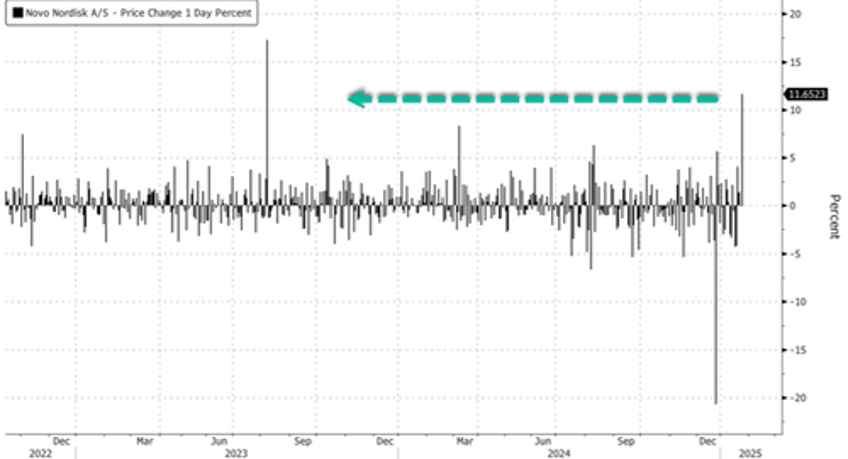

Shares of the pharmaceutical giant jumped as much as 14% in Copenhagen, the largest intra-day gain since August 8, 2023.

Shares have been nearly halved (-46%) since peaking around 1,000 Danish krone in June 2024.

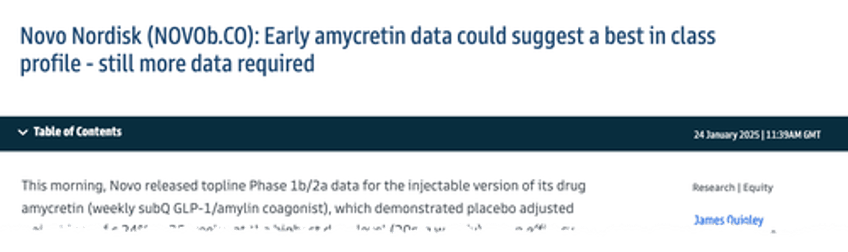

Novo super bull, Goldman's James Quigley, provided more color on amycretin's results.

He outlined how the storm clouds over Novo could soon be lifting following "disappointments around CagriSema's" results last month:

Overall, we see the headline weight loss result as potentially best in class and although we need to see detailed data on weight loss curves, safety and tolerability, we believe further weight loss can likely be shown above 22% over a longer time period in a higher baseline BMI population assuming the Phase 3 trial does not contain similar flexible dosing protocol as in REDEFINE-1. Confirmation of a potential acceleration into phase 3 could improve sentiment for Novo and extend the obesity franchise value post sema patent expiry (2031 EU, 2032 US), following disappointments around CagriSema.

Quigley's chart showing amycretin's results and how it compares with competitors:

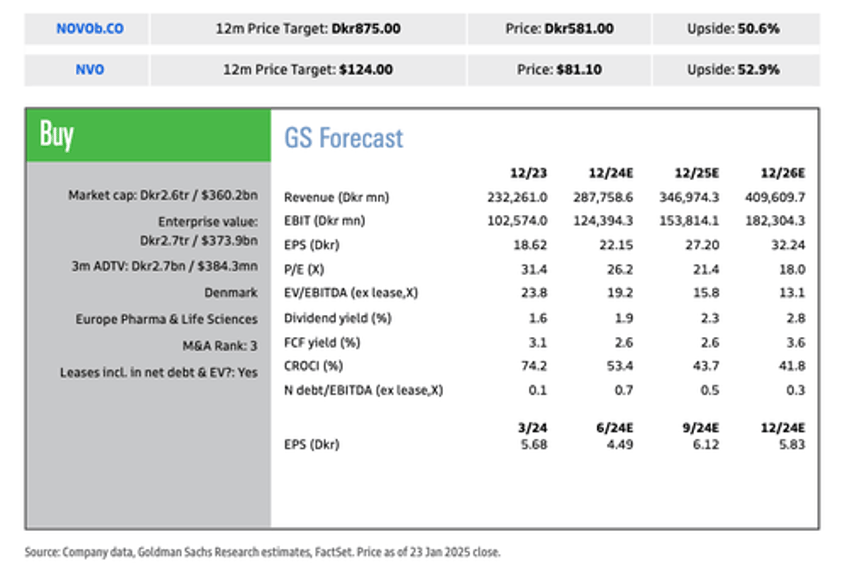

Quigley & his team maintained a "Buy" rating on Novo with an 875 Danish krone price target over the next 12 months.

As a result, our 12-month price target is DKK 875. Our ADR PT is set with reference to the Danish line, translated at the current FX rate, leading to an ADR PT of $124. Key risks to our view and price target include (1) clinical risks if CagriSema and/or Amycretin development was unsuccessful, (2) slower-than-expected scale up in manufacturing for Wegovy/Ozempic, slowing sales trajectory, (3) stronger-than-anticipated competitor obesity data, particularly oral small molecule GLP-1 based assets, and (4) deeper and sustained price pressure.

In a separate note, Barclays analyst Emily Field stated, "This news finally breaks the tide of negative sentiment" for Novo, adding that the data was "on par with the best" results achieved at this stage for weight loss drugs.

Unlike Novo's CagriSema, which fell short of Novo's analyst expectations last month ...

Novo Nordisk Crashes Most On Record After CagriSema GLP-1 Results Disappoint https://t.co/vn3LGUaJ7M

— zerohedge (@zerohedge) December 20, 2024

... Bloomberg noted, "amycretin combines two mechanisms for weight loss in a single molecule. It mimics both GLP-1 — the ingredient that powers Ozempic and Wegovy — and another gut hormone called amylin."

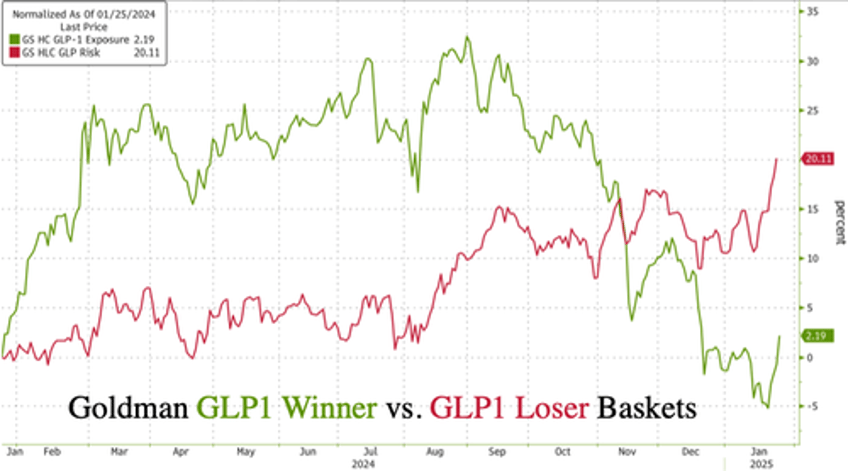

Meanwhile, Goldman's GLP-1 Winner Basket is underperforming its Loser Basket, reflecting the deflating obesity drug bubble. This shift comes ahead of Trump 2.0, with Robert F. Kennedy Jr. likely to head the Department of Health and Human Services.

Will amycretin re-excite Novo bulls?