By Peter Tchir of Academy Securities

If the Fed’s wish was to push risk assets lower, then they got their wish!

This market faces a lot of problems, but I don’t think that the Fed is one of them.

Yes, we got a Fed meeting this week.

The statement at 2pm ET initially sounded quite hawkish. The SEP showed 50 bps more next year and the year after (“confirming” for many the higher for longer trade). However, I thought that the Powell presser was actually tilted towards the dovish side (he usually has to say hawkish things, but he barely accomplished that).

I remain convinced that we are in a position where the Fed wants to do NOTHING.

The 2-year yield closed Tuesday at 5.09% and ended at 5.11% - hardly alarming.

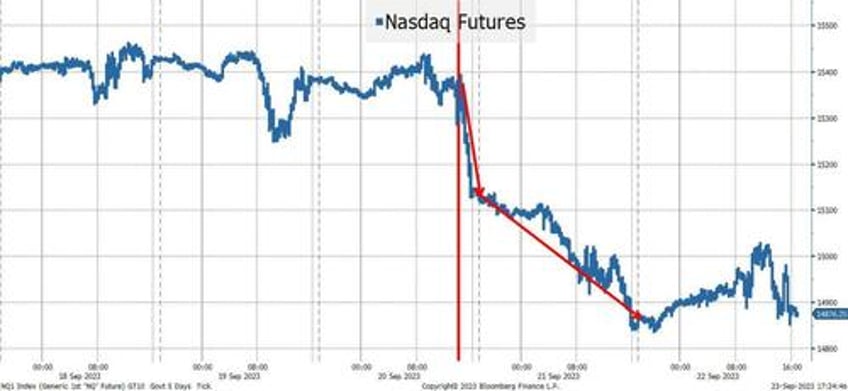

The 10-year was a bit worse, moving 10 bps on the week. Bad, but was it worth 3.6% on the week for the Nasdaq 100 (and 5% since last Thursday)?

Stocks seemed to fear the Fed more than the bond market did (at least by the end of the week). There is very little evidence of a “recession trade” as bond yields did inch higher and oil barely gave up any of its recent gains.

As discussed last weekend in 99 Problems, the economy and markets face several headwinds, but I do not believe that the Fed is one of them. If anything, I’m the most bullish that I have been on risk and rates since earlier this year when we were looking for a short squeeze.

Jinx

I’ve heard that markets don’t like how Powell answered questions about the likelihood of achieving a “soft landing”. I grew up playing sports and learned two things:

- You are not allowed to create your own nickname. Others have to do it for you (even Greenspan didn’t wake up one morning and start calling himself “the Maestro”).

- The minute you say good things about your performance is the moment that your performance starts to deteriorate. Who hasn’t said, “I’ve finally fixed my drive” only to shank one on your very next tee shot. Or “I might never miss an extra point again”, right before having one blocked. Okay, maybe only a few people have experienced that “jinx”, but trust me, it’s real.

So, what was Powell supposed to say?

- What he wanted to say? Which was probably something along the lines of: “Listen, for two years I said that I thought we could get a soft landing and you ignored me and made the idea seem silly, but now, suddenly, you want me to say that it is not just likely but it is also the base case?”

- What he had to say? “Yes, risks still exist and there are a lot of things that could prevent a soft landing. No, I cannot take a victory lap, nor can I say with certainly that we won’t have a recession.”

He had to go with the latter. He would be torn to shreds by the media if we hit a recession in a few months after claiming victory.

For those who say that he exhibited fear of a recession, it seems like they are taking his comments out of context and not considering that he cannot jinx himself or give his critics fodder if the recession hits. Recession remains a risk, which (paradoxically) is part of my bull thesis for now.

AI

We continue to focus on AI and discussed General (ret.) Groen’s take on the meetings in DC the prior week (he had an interesting seat at the table). We also discuss why we are searching for AI “success stories.” Not just stories about AI companies, but companies that have managed to harness/incorporate AI (or cutting-edge tech) into their products or processes to show outsized gains. Please see Thursday’s X Report – Intelligent Life in DC for more on these topics.

Bottom Line

I liked buying the post FOMC dip in stocks and rise in yields, and I am comfortable being almost max- long Treasuries, credit, and stocks here. I am also overweight risk and duration.

One of the best parts of my job is speaking with clients. While Zoom meetings are great, the travel schedule has been busy and gets hectic for the next 6 weeks. I cannot wait to sit down and speak with our clients! From corporations, to municipal entities, to asset managers of all stripes, it will be a great opportunity to exchange ideas and learn!

More people are asking if we can explain our “made by China” view in more detail as snippet after snippet of information comes out supporting that path for China (see TIC data & Merc). They want to discuss how they should be thinking about this for their businesses and investments.

India. I’m increasingly concerned that in 3 to 5 years, many of us will wonder why we weren’t discussing India in 2023 as much as we should have been. We are doing everything we can to rectify that as India’s potential (and figuring out how to profit/benefit from this) is high on my agenda!

Deion Sanders and Colorado are fun to watch! Please see last weekend’s piece and think about the “jinx” section from earlier in this report (and then don’t worry about Powell not sounding overly optimistic about a soft landing ).