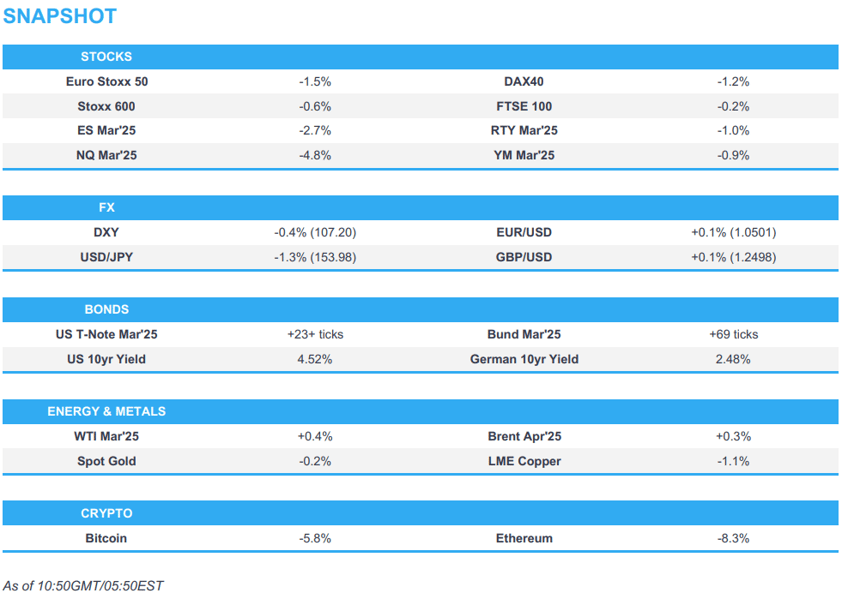

- Risk sentiment hit by DeepSeek threatening US AI dominance, NQ -4.8% & ES -2.7%; NVDA -13.5% in premarket trade

- European bourses are also mostly in the red, Tech lags with ASML -10.6% while Energy names are hit on this and numerous other factors

- Additionally, disappointing Chinese PMI data overnight, Trump's tariff announcement on Colombia and reports around MXN & CAD also weigh on the risk tone.

- DXY is at session lows with 107.00 coming into view, havens lead with USD/JPY probing 154.00 to the downside.

- Fixed benchmarks benefit from the above and partially on better-than-expected German Ifo; Central Banks coming into focus

- Crude is now modestly in the green, as the USD provides support and offsets initial bearish action on the above and Saudi/US discussing lower prices; Metals lower across the board

- Looking ahead, highlights include ECB President Lagarde & Supply from the US.

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 d

EUROPEAN TRADE

EQUITIES

- European bourses are almost entirely in the red while US futures are lower across the board amid the fallout from disappointing Chinese PMI data overnight, Trump's tariff announcement on Colombia, and with Chinese start-up DeepSeek threatening US dominance in the AI sector with a low-cost model on par with OpenAI’s o1.

- Euro Stoxx 50 -1.5%, with heavyweight tech and energy names in the region slumping on the DeepSeek update; ASML -10.6%, ASM -14.2% and Siemens Energy -21%.

- Sectors somewhat mixed with a clear defensive bias given broader market risk aversion, with Tech lagging on the above alongside Energy which is also hit on Trump and Chinese PMIs, factors which weigh on Basic Resources as well.

- Stateside, futures lower across the board, ES -2.7%, while the NQ -4.8% lags given significant NVDA pre-market pressure (-13.5%) after Chinese startup DeepSeek announced its low-cost model which matches or surpasses OpenAI's GPT-4 and Anthropic's Claude AI on many tasks, and with a fraction of the GPUs, with Microsoft (-6.1% pre-market) and peers also lower as US AI dominance is questioned.

- Tesla (TSLA) is taking the EU to court over tariffs it imposed on imports of electric vehicles from China, FT reports.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is lower on the session with the Dollar on the backfoot vs. safe-haven currencies such as JPY and CHF due to the risk-aversion on the AI-related updates. Index at a 107.21 low, matching the trough from Friday.

- JPY and CHF the outperformers, with USD/JPY testing but yet to breach 154.00 to the downside vs overnight 156.25 peak.

- EUR near the unchanged mark, benefitting slightly from the German Ifo metrics though they provide only minimal relief given internal commentary while the Single Currency is very much focused on the ECB this week. EUR/USD in 1.0455-1.0502 band.

- GBP is faring slightly better and taking advantage of the USD's downside as it stands though Cable is yet to deviate significantly from the unchanged mark. EUR/GBP pressured and towards 0.8393 lows. Action which comes ahead of a speech from Chancellor Reeves on Wednesday, ahead of which press has been focussed on various growth initiatives from the gov't.

- Antipodeans softer given the risk tone and soft Chinese data, with the Yuan also hit on this.

- On tariffs, MXN and CAD are both softer this morning after reports suggesting that President Trump could slap pre-emptive tariffs on Canada and Mexico as soon as Saturday; action is much more pronounced in the MXN.

- PBoC set USD/CNY mid-point at 7.1698 vs exp. 7.2295 (prev. 7.1705).

- Mexican Central Bank said it will consider larger cuts to the benchmark interest rate early this year due to slowing inflation and warned balance of risks for inflation remains tilted to the upside mostly due to the persistence of core inflation.

- Barclays month-end model indicates "moderate USD selling against most majors"; signal for Cable is "borderline strong".

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- AI updates drive haven allure while Central Bank meetings move into focus; USTs post gains in excess of 20 ticks at a 109-07+ high into frontloaded supply on account of the FOMC this week.

- Bunds holding around the 132.00 mark having hit a 132.06 peak just after Ifo and the opening of the US pre-market, resistance at 132.15 and 132.22 from last Tuesday and Wednesday respectively.

- Further upside for the complex came from the German Ifo release which saw Business Climate and Current Conditions print firmer than expected, however Expectations slipped from the prior as expected and internal commentary points to stagflation.

- Gilts gapped higher by 41 ticks on the AI action to a 92.32 open before extending to a 92.60 peak post-Ifo and the US pre-market open. UK specifics not market moving thus far, lots of press attention on various initiatives the gov’t/Treasury is considering to drive growth ahead of a speech from Chancellor Reeves on Wednesday.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are modestly in the green. Having ground their way higher throughout the European morning and benefiting from the USD softness and ongoing geopolitical tensions; WTI and Brent at the top-end of USD 73.67-74.97/bbl and USD 76.57-77.88/bbl respective parameters.

- However, initial action was bearish given Trump's tariff rhetoric, lower energy demand from datacentres for AI purposes and soft Chinese data all on the demand side. Furthermore, on the supply side Trump spoke with Saudi Arabia’s Crown Prince and discussed bringing oil prices down.

- NatGas under marked pressure given the potential implications on energy demand from Chinese start-up DeepSeek announcing a model on par with OpenAI's advanced o1 model for a fraction of the costs. Elsewhere, EU to continue talks with Ukraine around gas supplies to Europe.

- Metals are lower across the board with XAU yet to find any haven allure from the above and losing out at the expense of haven-FX and Bonds. Though, XAU has lifted off lows and is towards the USD 2772/oz session high. Base peers lower given the risk tone and Chinese data, 3M LME Copper holding just above USD 9.1k/T.

- Russia's Nornickel (Q4): nickel output 59KT (prev. 55.8), palladium 606 (prev. 547), 2024 nickel output 205KT (prev. 209).

- EU Commission says it will continue talks with Ukraine on Natgas supplies to Europe, will include Hungary and Slovakia.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Ifo Business Climate New (Jan) 85.1 (Exp. 84.7, Prev. 84.7); Current Conditions New (Jan) 86.1 (Exp. 85.4, Prev. 85.1); Expectations New (Jan) 84.2 vs. Exp. 84.2 (Prev. 84.4)

- Ifo Chairman: Domestic economy is not moving; Economy is not benefitting from improved global developments; Trump is yet to play a role in the survey; Job concerns increasing imperative to save; Price pressures seen in services, inflation is not yet off the table.

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer spoke with US President Trump on Sunday and agreed to meet soon, according to the UK government.

- UK PM Starmer is expected to resist pressure from US President Trump to increase defence spending amid concerns surrounding public finances, according to The Times citing sources.

- UK Chancellor Reeves will call on sceptical Labour MPs on Monday to back her plans to boost the UK economy including the proposal to expand London’s Heathrow Airport, according to FT.

- UK Chancellor Reeves indicated the government would consider signing up to the Pan-Euro-Mediterranean Convention (PEM), a tariff-free trading scheme, according to The Telegraph.

- Fitch affirmed Netherlands at AAA; Outlook Stable.

NOTABLE US HEADLINES

- US President Trump announced the US will impose emergency 25% tariffs on all Colombian goods coming into the US which will be raised to 50% in one week after Colombia denied entry to two US deportation flights. Trump also announced a travel ban and visa revocations on Colombian government officials and said he will fully impose emergency treasury, banking and financial sanctions on Colombia, while he added that the measures on Colombia are just the beginning.

- Fox News reported that Colombian President Petro backtracked and offered his presidential plane to repatriate migrants coming back from the US, although Reuters reported that Petro threatened 50% tariffs on goods from the US in retaliation to measures announced by US President Trump. However, the White House later announced that Colombia has agreed to all of President Trump's terms including unrestricted acceptance of all illegal aliens from Colombia returned from the US, while fully drafted IEEPA tariffs and sanctions on Colombia will be held in reserve and not signed but visa sanctions issued and enhanced inspections will remain in effect until the first plane of Colombian deportees is returned.

- Mexico reportedly refused a US deportation flight, according to officials cited by Reuters. However, the White House denied reports of Mexico refusing migrant flights and stated that Mexico has accepted several flights in recent days.

- Momentum is growing among US President Trump’s advisers to place 25% tariffs on Mexico and Canada as soon as Saturday ahead of negotiations, according to WSJ.

- US President Trump said he is aiming to get Saudi investment of USD 1tln, up from USD 500bln-600bln.

- Pete Hegseth was confirmed by the US Senate as Secretary of Defense through a 51-50 vote in which US VP Vance cast the tie-breaking vote.

- Elon Musk reportedly explores blockchain use in the US government efficiency effort.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu confirmed three hostages are to be released by Hamas and that Israel will allow Palestinians to cross into northern Gaza from Monday morning. It was also reported that Hamas said it handed over to mediators the required information regarding the list of hostages to be released during the first phase of the Gaza agreement.

- Hamas said that Israel procrastinates in implementing ceasefire terms by preventing displaced Palestinians from returning to northern Gaza, while it holds Israel responsible for any delays in the implementation of the agreement and the repercussions in subsequent stages. It was separately reported that Hamas released a list of 200 Palestinian prisoners to be released by Israel, according to Reuters.

- Israeli fire killed a Lebanese soldier and injured another in southern Lebanon, while it was also reported that Israeli fire killed two people and injured 31 in southern Lebanon. It was later announced that the death toll from Israeli fire in southern Lebanon rose to eleven.

- White House said the ceasefire agreement between Israel and Lebanon will continue to be in effect until February 18th, while Lebanon, Israel and the US will also begin negotiations for the return of Lebanese prisoners captured after 7th October 2023.

- UN envoy in Lebanon and UNIFIL said conditions are not yet in place for the return of Lebanese citizens to the south, according to a statement cited by Reuters.

- US lifted the pause on delivery of 2,000-pound bombs to Israel, according to a source cited by Reuters.

- US President Trump spoke with Jordan’s King Abdullah of Jordan about moving people out of ‘demolition site’ Gaza to neighbouring countries and said he will speak with Egypt’s President El Sisi, while it was separately reported that Egypt’s Foreign Ministry said Egypt rejects any attempt to move Palestinians out of their land.

- US Secretary of Defense Hegseth spoke with Israeli PM Netanyahu and stressed the US is fully committed to ensuring Israel has the capabilities it needs to defend itself.

- US Secretary of State Rubio said he is hearing the Taliban is holding more American hostages than has been reported, while he added that the US may place a very big bounty on Taliban’s top leaders. It was separately reported that Rubio spoke with Yemeni PM Ahmed Bin Mubarak and discussed cooperation to stop Houthi attacks.

- US President Trump’s Middle East envoy Witkoff will travel to Israel on Wednesday to oversee the Gaza ceasefire.

- Iran has launched AI-guided missiles during military manoeuvres in Gulf waters, according to Sky News Arabia citing Iranian press.

RUSSIA-UKRAINE

- Russia said its troops captured Zelene in eastern Ukraine, according to IFAX.

- Moldovan President Sandu arrived in Kyiv for talks with Ukrainian President Zelensky.

- Belarusian exit polls showed incumbent Lukashenko won the presidential election with 87.6% of votes.

- Radio Free Europe editor posts that the EU ambassadors meeting has concluded and a six month extension to Russian sanctions is likely to come later today.

OTHER

- Baltic Sea submarine fibre optic cable between Latvia and Sweden was damaged on Sunday morning which was caused by external influence, according to Latvian public broadcaster LSM citing the cable operator.

- North Korea tested a strategic cruise missile on Saturday, according to KCNA.

- China’s Coast Guard said two Philippine vessels entered waters near the reef in the Spratly islands on Saturday, while China’s Coast Guards intercepted the vessels and drove them away.

- Russia's Kremlin says there is still no signal from the US side about a Trump-Putin meeting.

CRYPTO

- Complex underpressure given the risk tone on factors relating to AI, Chinese PMIs and Trump tariffs. Action which saw Bitcoin lose the USD 100k handle to a 97.8k low, currently holding around USD 1k above that trough.

APAC TRADE

- APAC stocks traded mixed in a holiday-thinned start to the week as participants digested disappointing Chinese PMI data, Trump's tariff announcement on Colombia, and with Chinese start-up DeepSeek threatening US dominance in the AI sector with a low-cost model on par with OpenAI’s o1. Markets in Australia, South Korea and Taiwan were closed for holidays.

- Nikkei 225 reversed opening gains and dipped back beneath 40,000 amid headwinds from Trump tariffs and Chinese PMIs.

- Hang Seng and Shanghai Comp were kept afloat on the last trading day for the mainland before the Chinese New Year holiday despite the disappointing PMI data which showed headline Chinese Manufacturing PMI back in contraction territory. Nonetheless, there was notable strength seen in some AI-related stocks after Chinese tech start-up DeepSeek's low-cost AI model was reported to be on par with OpenAI's o1.

NOTABLE ASIA-PAC HEADLINES

- US President Trump said he is in talks with multiple people regarding buying TikTok and will likely have a decision on the app’s future in the next 30 days, while it was separately reported that the White House is working on a plan to have Oracle (ORCL) and an investor group takeover US TikTok.

- China’s Foreign Minister Wang is to visit the UK in February for talks with UK Foreign Secretary Lammy, according to The Guardian.

- China's President Xi says they will be preventing and resolving risks in key areas and external shocks, to promote a sustained economic recovery and improvement in 2025, via Xinhua.

DATA RECAP

- Chinese NBS Manufacturing PMI (Jan) 49.1 vs. Exp. 50.1 (Prev. 50.1); Services PMI (Jan) 50.2 vs. Exp. 52.1 (Prev. 52.2)

- Chinese Composite PMI (Jan) 50.1 (Prev. 52.2)