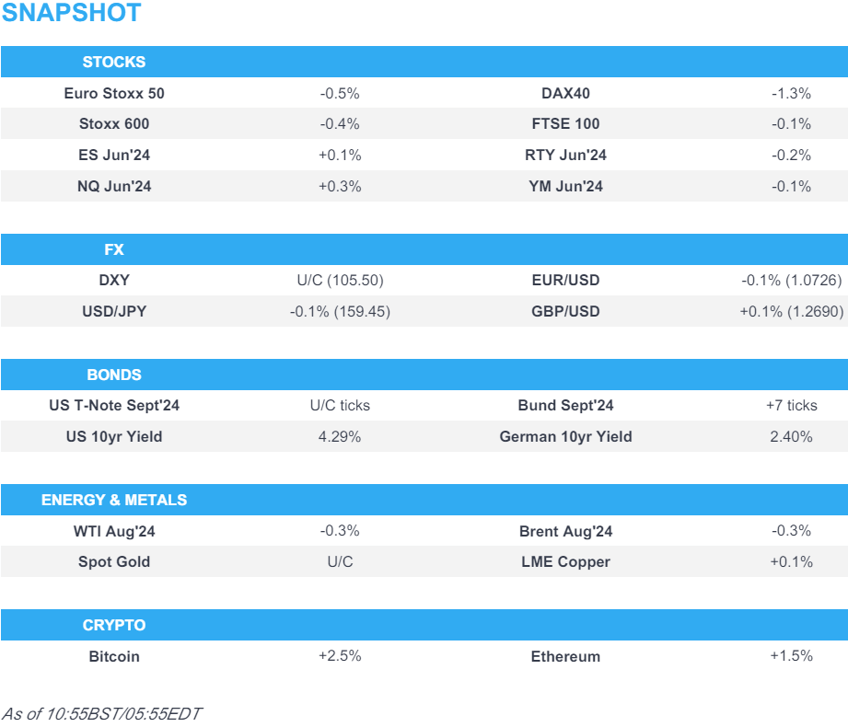

- European bourses are hit following updates from Airbus and Merck; US futures mixed, with the NQ leading as NVDA (+2.2%) finds its footing

- Dollar is flat, with G10 price action also lacklustre in catalyst-thin trade

- Bonds are contained awaiting impetus from US data and a 2yr auction

- Crude is modestly softer benefiting from Dollar price action, base metals are generally higher

- Looking ahead, US Philly Fed Nonmanufacturing Business Outlook Survey, US Richmond Fed Index, Canadian CPI, Comments from Fed’s Cook & Bowman, Supply from the US, Earnings from Carnival

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.3%) are almost entirely in the red, with sentiment hit following updates from Airbus (-9.8%) and Merck (-9.7%) (detailed in Notable European Headlines).

- European sectors are mixed; Industrials are the clear laggard after Airbus cut its 2024 delivery guidance, which has weighed on the entire sector. Tech is also towards the foot of the pile, with ASML (-2.2%) and ASM International (-2.1%) both suffering.

- US Equity Futures (ES +0.1%, NQ +0.3%, RTY +0.2%) are very modestly firmer, with mild outperformance in the NQ as Nvidia (+2.1% pre-market) finally edges higher after dropping around 11% over the past 5 days.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has been pivoting around the 105.50 mark after yesterday's selling brought it down from a 105.90 high. It can be noted that month-end models point towards USD selling vs. peers. Docket ahead includes Philly Fed Nonmanufacturing Business Outlook Survey, Richmond Fed Index and speak from Fed's Bowman and Cook.

- EUR is steady vs. the USD in quiet newsflow. Focus remains on French political risk, however, broader follow-through into the EUR is contained. For now, EUR/USD sits towards the top end of yesterday's 1.0683-1.0746 range.

- GBP a touch firmer vs. both USD and EUR in quiet newsflow with a lack of tier 1 highlights due this week and the BoE observing its quiet period ahead of next month's UK general election. Cable remains capped by resistance at 1.27. If breached, the 10DMA sits just above at 1.2704 with the 20th June high at 1.2724.

- JPY is edging mild gains vs. the USD after topping out yesterday at 159.93. Commentary from Finance Minister Suzuki continued to attempt to talk up the JPY, but sparked little move in the pair. Currently USD/JPY holds around 159.50 with a notable OpEx at 160.00.

- Antipodeans are mixed vs. the USD with AUD the marginal outperformer across the majors. Newsflow for AUD has been light, however, AUD/USD has been able to build on the prior day's gains. NZD/USD is currently tucked within yesterday's 0.6104-40 range.

- PBoC set USD/CNY mid-point at 7.1225 vs exp. 7.2587 (prev. 7.1201).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are rangebound and essentially unchanged ahead of survey data, June's Consumer Confidence and then the beginning of the week's supply docket with a USD 69bln 2yr sale. USTs currently sits around 110-18.

- Bunds are contained with specific macro drivers sparse thus far though Bunds are at the lower-end of 132.42-65 parameters (132.47 is a 50% Fib of Monday's move).

- Gilt price action is in-fitting with peers with the docket once again sparse as we count down to the upcoming election. Holding in a very slim 14 tick range which is entirely within Monday's 98.38-98.76 bounds.

- UK sells GBP 1.5bln 0.75% 2033 I/L Gilt: b/c 2.89x (prev. 3.4x) and real yield 0.518% (prev. 0.440%)

- Italy sells EUR 2.5bln vs exp. EUR 2-2.5bln 3.20% 2026 Short Term BTP and EUR 2.25bln vs exp. EUR 1.25-2.25bln 0.40% 2030 & 2.40% 2039 BTPei

- Germany sells EUR 3.646bln vs exp. EUR 4.5bln 2.90% 2026 Schatz: b/c 2.4x (prev. 2.7x) & avg. yield 2.8% (prev. 3.01%) and retention 18.98%% (prev. 18.02%)

- Click for a detailed summary

COMMODITIES

- Crude is modestly softer on the session, having traded within a contained range for the majority of the European morning. Brent is holding just above USD 85.60/bbl.

- Precious metals are mixed, having spent much of the morning pressured; thereafter, spot gold climbed into the green, benefiting from the downbeat Dollar; the yellow metal currently sits above USD 2330/oz.

- Base metals are incrementally firmer, tracking US equity futures and the overall positive handover from the APAC session irrespective of downbeat European price action.

- Click for a detailed summary

NOTABLE DATA RECAP

- Spanish GDP YY (Q1) 2.5% vs. Exp. 2.4% (Prev. 2.4%); GDP Final QQ (Q1) 0.8% vs. Exp. 0.7% (Prev. 0.7%)

NOTABLE EUROPEAN HEADLINES

- Airbus (AIR FP) cuts 2024 delivery guidance: now targeting around 770 (prev. 800) commercial aircraft deliveries in 2024, the production rate of 75 A320 family aircraft a month is maintained but now expected to be reached in 2027 (prev. 2026); Targets adj. EBIT of around EUR 5.5bln in 2024 (prev. 6.5-7bln). Targets FCF of EUR 3.5bln (prev. 4bln) before customer financing. To record charges of around EUR 900mln in H1'24 accounts. Facing persistent specific supply chain issues mainly in engines, aerostructures, and cabin equipment. Elsewhere, reportedly has a backlog of several undelivered wide-bodied airliners without engines parked outside its Toulouse factory; jets are reportedly waiting for seats, engines and other parts, according to Reuters citing sources. CEO says Spirit AeroSystems (SPR) situation is difficult from an industrial standpoint. Says uncertain outlook for Spirit commitments contributed to the decision to cut Airbus output targets. Supply chain is improving but not in a uniform place. (Newswires/Reuters) Shares - 9.8% in European trade

- Merck (MRK GY) ceased the Phase III TrilynX study for xevinapant in unresected locally advanced squamous cell carcinoma of the head and neck due to unlikely efficacy in extending event-free survival, despite compatible safety data. Merck KHaA will review findings for publication. Shares - 9.9% in European trade

NOTABLE US HEADLINES

- Federal judges in Kansas and Missouri blocked parts of President Biden's student debt relief plan, while the White House later said that it strongly disagreed with the ruling on Biden's student loan plan, according to Reuters.

- EU says that Microsoft's (MSFT) unbundling of Teams from some products is insufficient to deal with competition concerns and as such more changes are needed, regulators charge Co. with abusive bundling of Teams with Office package

GEOPOLITICS

MIDDLE EAST

- Israeli media reported news about the killing of the sister of the head of Hamas' political bureau, Ismail Haniyeh, in an Israeli bombardment that targeted the beach camp west of Gaza which killed 13 people, according to Sky News Arabia.

- US Secretary of State Blinken emphasised to Israel's Defence Minister Gallant the need to take additional steps to protect humanitarian workers in Gaza and deliver assistance in coordination with the UN, while Blinken underscored the importance of avoiding escalation and reaching a diplomatic resolution that allows both Israeli and Lebanese families to return home, according to the State Department.

- There were initial rumours on social media that something of note occurred in the Black Sea and that a US drone had been shot down although there was no confirmation, according to Faytuks News via social media platform X. However, social media reports later noted that a US defence official said no incident involving a US surveillance drone occurred today over the Black Sea, despite claims earlier by several Russian sources

OTHER

- Ukraine will start EU accession talks on Tuesday and will meet with EU ministers in Luxembourg to officially begin a process that is set to take years but which represents a symbolic moment, according to FT.

- Russian President Putin said in a message to North Korean leader Kim that his recent visit to North Korea raised ties to an unprecedentedly high level of partnership, while he added that Kim is an honoured guest Russia waits for, according to KCNA.

- South Korean President Yoon criticised North Korea's balloon sending and vowed a strong response to North Korean provocation, according to Yonhap.

CRYPTO

- Bitcoin is back on a firmer footing and climbs above USD 60k, after briefly dipping below USD 59k in the prior day.

APAC TRADE

- APAC stocks were mostly positive but with some of the gains capped following the mixed lead from Wall St where tech underperformed amid Nvidia's continued retreat from last week's record high into correction territory.

- ASX 200 outperformed with energy and real estate leading the advances amid broad optimism across sectors.

- Nikkei 225 shrugged off the initial indecision and gradually reverted to above the psychological 39,000 level.

- Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark advanced as strength in consumer and property stocks atoned for the slack seen in some tech names, while the mainland lagged despite the PBoC's liquidity boost with headwinds from US-China frictions as the Biden administration probes Chinese telcos. Furthermore, Premier Li flagged weak global economic momentum during his WEF address in Dalian.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li called for facing up to the difficulty of global economic growth and said that weak global economic growth momentum was hit by Covid, high inflation and increasing debt, while he added that economic growth is becoming more difficult to achieve and noted that decoupling and protectionism will only raise economic costs for the world. Furthermore, he said they should seize the new opportunities of the tech revolution and industrial transformation and they are confident and capable of achieving the full-year growth target of around 5%, as well as noted that the Chinese economy is expected to continue to show steady improvement in Q2.

- US President Biden’s administration is investigating China Telecom (728 HK), China Mobile (941 HK) and China Unicom (762 HK) with the probe focused on potential national security risks from their US cloud and internet infrastructure, according to Reuters sources

- Japan is to revise January-March GDP to reflect corrected data on construction orders from the Land Ministry with the revised figure to be released on July 1st 00:50BST, according to the Cabinet Office.

- Japanese Finance Minister Suzuki says shared serious concerns over weakness of JPY and KRW with the South Korean Finance Minister. Will continue to respond appropriately to excessive FX moves; desirable for FX to move stably.

DATA RECAP

- Japanese Services PPI (May) 2.50% vs. Exp. 3.00% (Prev. 2.80%)

- Australian Consumer Sentiment MM (Jun) 1.7% (Prev. -0.3%)

- Australian Westpac Consumer Confidence Index (Jun) 83.6 (Prev. 82.2)