Late Monday, European aerospace giant Airbus delivered an alarming market update that sent shares in Europe tumbling on Tuesday. The company detailed how severe supply chain snarls would necessitate a downward revision of its earnings forecast and a reduction in aircraft delivery targets for the year.

"In commercial aircraft, Airbus is facing persistent specific supply chain issues mainly in engines, aerostructures, and cabin equipment," Airbus wrote in a 2024 guidance update.

According to Bloomberg, the parts shortage includes over a million items, such as engines, aerostructures, and cabin interiors.

Airbus now expects to deliver 770 commercial aircraft in 2024, down from the prior forecast of 800 at the beginning of the year. Adjusted earnings before interest and tax were forecasted to be around 5.5 billion euros this year, down from the goal of around 7 billion euros. It also slashed its outlook for free cash flow before customer financing to about 3.5 billion euros.

Here are the highlights from the update:

Charges of around € 0.9bn reported on certain telecommunications, navigation and observation space programmes

A320 ramp-up trajectory adjusted to reflect specific supply chain challenges in a degraded operating environment; around 770 commercial aircraft deliveries now expected in 2024; target production rate of 75 A320 Family aircraft a month maintained and now expected to be reached in 2027

Here the updated 2024 guidance (courtesy of Bloomberg):

Sees adjusted Ebit EU5.5 billion, saw EU6.5 billion to EU7.0 billion, estimate EU6.79 billion (Bloomberg Consensus)

Sees adjusted free cash flow about EU3.5 billion, saw about EU4.0 billion, estimate EU4.13 billion

Sees Commercial aircraft deliveries about 770 planes, saw about 800, estimate 804.37

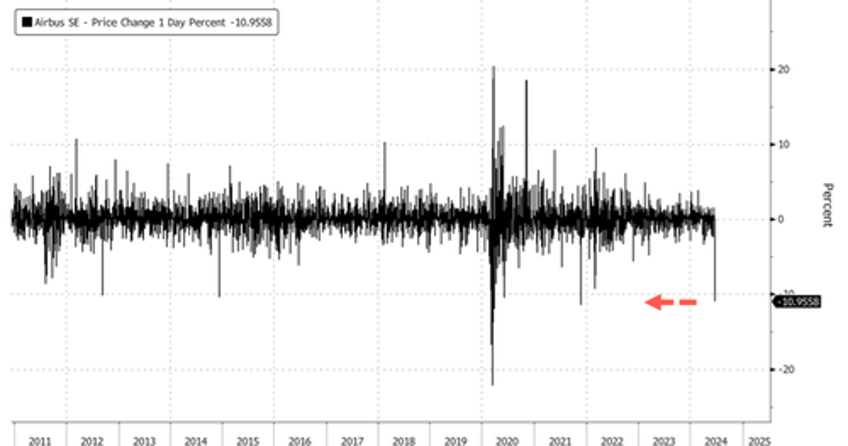

In markets, Airbus shares in Paris tumbled 11%, the largest intra-day decline since Nov. 11, 2021.

Shares are back below their 2019 peak.

The ripple effect of Airbus sent supplier shares tumbling, with Leonardo -4.3%, Rolls-Royce -4.3%, Safran -4.4%, and Sopra Steria -1.2%; other related stocks to decline include Melrose -6.8% and MTU Aero -7.9%.

Wall Street analysts were mostly shocked and stunned by the result:

Deutsche Bank (hold vs buy, PT to €155 vs €186)

- A "stunning" and "rather damaging" profit warning, according to analyst Christophe Menard

- Prompts cuts in Ebit and free cash flow estimates for 2024-26 of 13%-20%

- June deliveries "apparently sluggish" and certainly no guarantee that new delivery target can be reached

- Additionally, space systems is still underperforming following an already difficult 2023

RBC (outperform, PT to €180 vs €190)

- Analyst Ken Herbert says while commentary on supply chain not unexpected, will "remain a frustration for investors"

- Continues to see long-term free cash flow upside as attractive, but for now the stock "is in an execution penalty box"

- Many of the headwinds do seem to be already reflected in the stock

Citi (buy, PT €188 vs €190)

- Viewed as disappointing news, which prompts Citi analyst Charles Armitage to reduce 2024-27 estimates by 12-19%

- However, demand is still strong and says that when production catches up in 2028, estimates are essentially unchanged

- The company's space programs continue to be "problematic," noting €900m charge

Morgan Stanley (overweight)

- "Clearly a disappointing update," analyst Ross Law writes

- Notes that previous guidance had only been reiterated quite recently

"The dust needs to settle before we can turn positive again," Christophe Menard, an analyst at Deutsche Bank, told clients on Tuesday morning, adding, "June deliveries are apparently sluggish and there is no guarantee at this stage that the new delivery target will be easy to achieve by year-end."