Earlier today we wrote an extensive preview of what to expect from Nvidia's Q3 earnings (here), but for those who missed it here is the summary: sky high expectations, which only go higher in 2025 and beyond when the full rollout of Blackwell is expected to hit the P&L, with everyone already long (Goldman desk positioning is 9 out of 10) and anything less than perfection will be punished by the market. The bull/bear case according to Goldman is as follows:

- Bulls playing for a ‘break-out’ trade on an expected beat/raise (with downside arguably cushioned by the upcoming Blackwell launch)

- Bears playing for a reset in the stock driven by a growing list of moving parts (Blackwell noise, scaling laws, custom ASICs/silicon, ROICs, etc) vs valuation back at ~15-mo highs.

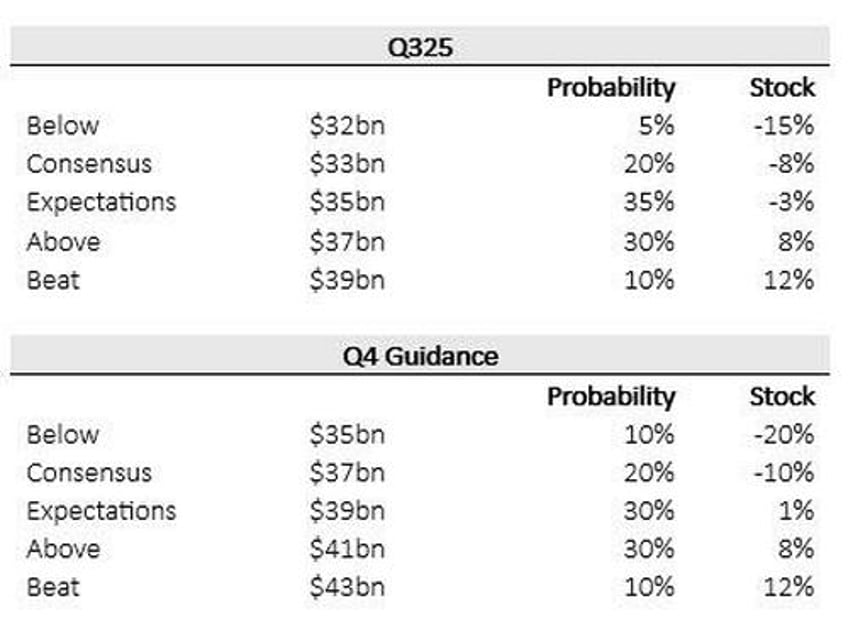

In terms of expectations, Q3 revenue is projected to come in at $33.25 billion, the average estimate of analysts; and the median Q4 revenue target is $37.1 billion. Keep in mind that that number has moved around a lot in the past few days as analysts have made last-minute tweaks to their models. While the current high sales estimate for the third quarter is $41.2 billion, but some investors have told me that the ‘whisper number’ may be above that

Beyond the headlines, JPM says that the key near-term bogeys are the following:

- The margin guide (with a few saying JPM's 73.8% buyside bar is too high),

- The possibility of hiccups in the Blackwell ramp which - given the steep ramp - could push revenues to the April quarter;

- Any guidance on F26 and beyond.

Other things to look out for when the company starts speaking will include how much supply it’s getting from its manufacturing partners. Like most chipmakers, Nvidia outsources production. Taiwan Semiconductor is the best in the business, and Nvidia’s pace of growth heavily depends on how well TSMC is able to provide Nvidia with the capacity it needs.

Amusingly, Nvidia shares actually closed down today, though far from session lows, ahead of the earnings report. Still, shares are up nearly 200% so far this year, and one of the best performers on the S&P 500 Index. Nvidia’s market cap north of $3.6 trillion makes it the biggest weighting in the S&P 500, meaning that any move in the stock could swing the entire market.

With that in mind, here is what NVDA reported moments ago:

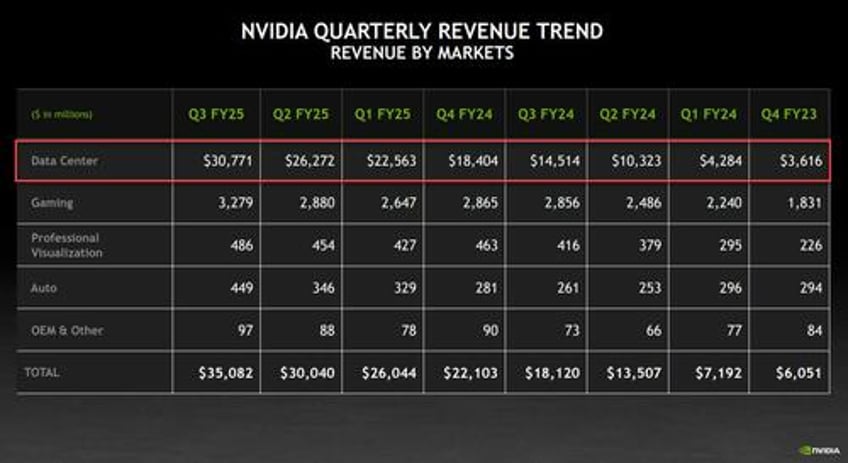

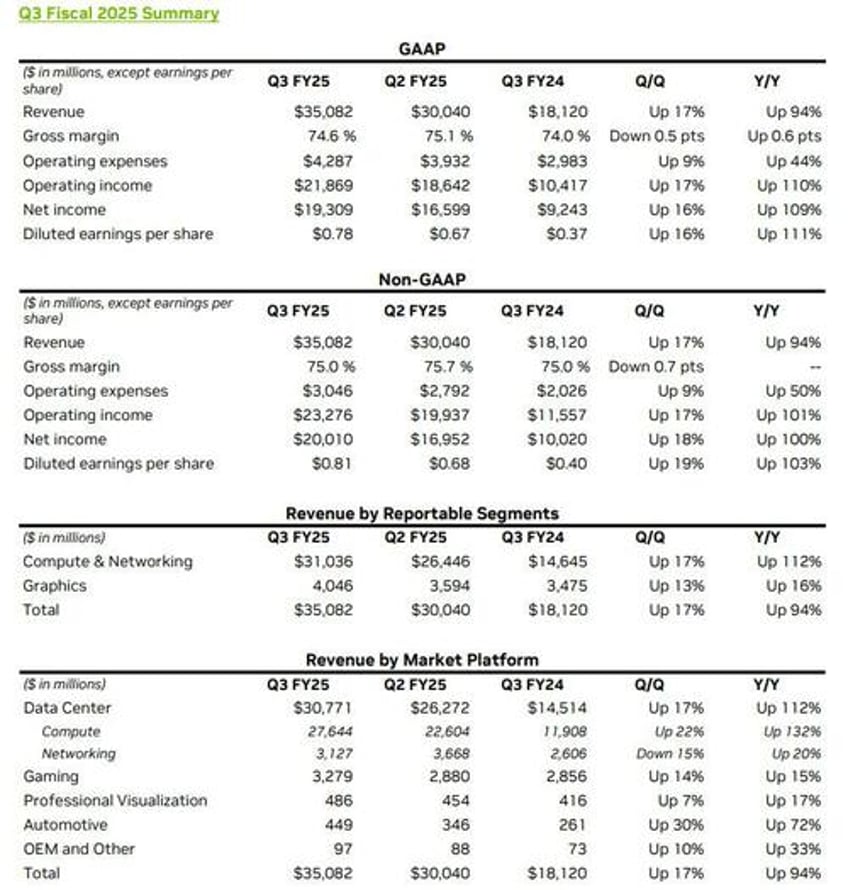

- Revenue $35.08 billion, up +94% y/y, beating the median estimate of $33.25 billion (but in line with Goldman's expectations of $35BN).

- Data center revenue $30.8 billion vs. $14.51 billion y/y, beating estimates of $29.14 billion

- Gaming revenue $3.3 billion, +15% y/y, beating estimates of $3.06 billion

- Professional Visualization revenue $486 million, +17% y/y, beating estimates of $477.7 million

- Automotive revenue $449 million, +72% y/y, beating estimates of $364.5 million

- Adjusted gross margin 75% vs. 75% y/y, and in line with estimates of 75%

- Adjusted operating expenses $3.05 billion, +50% y/y, beating estimates of $2.99 billion

- Adjusted operating income $23.28 billion vs. $11.56 billion y/y, beating estimates of $21.9 billion

- Adjusted EPS 81c, beating estimates 74c

The revenue trend, as expected, is impressive especially at the Data Center level where all the growth is.

Here is a full breakdown of recent results:

But while the Q3 results were stellar, the company's guidance came in on the weak side of the buyside expectations we discussed in our premium preview.

- Revenue is expected to be $37.5 billion, plus or minus 2%.

While this was above the median consensus of $37.1BN, it was well below the buyside expectations of $38.8BN. It was also well below Goldman's Q4 revenue expectations of $39BN and close to where the bank saw the stock dropping -10%. In fact, some estimates for Q4 revenue were as high as $41 billion!

The rest of the guidance was in line but far less important:

- Gross margins are expected to be 73.0% and 73.5%, respectively, plus or minus 50 basis points.

- Operating expenses are expected to be approximately $4.8 billion and $3.4 billion, respectively.

- Other income and expense are expected to be an income of approximately $400 million, excluding gains and losses from non-affiliated investments and publicly-held equity securities.

- Tax rates are expected to be 16.5%, plus or minus 1%, excluding any discrete items.

The muted outlook suggests that AI excitement may be getting ahead of reality according to Bloomberg. Nvidia investors had bid up the shares nearly 200% in 2024, turning it into the world’s most valuable company at $3.6 trillion in market cap. But the chipmaker has had trouble keeping up with demand for its products and struggled with production snags this year.

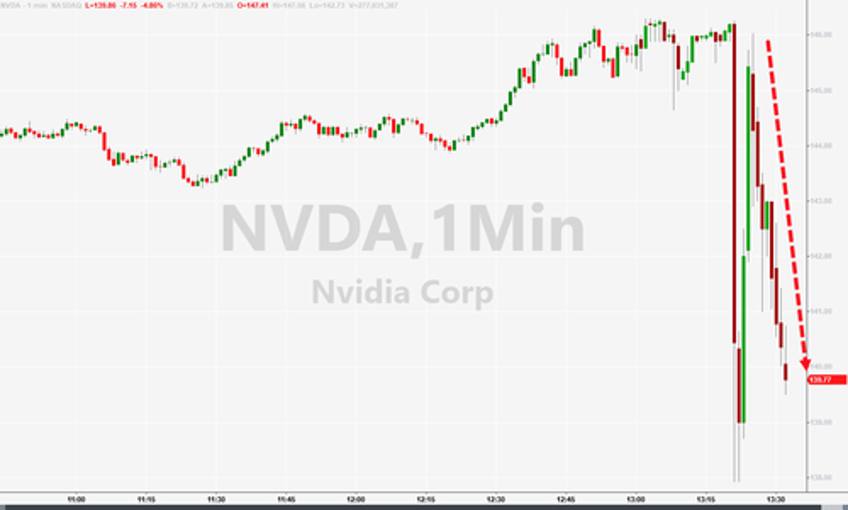

Shares of Nvidia fell as much as 5% in after hours trading following the announcement, before settling about 2% lower, far below the 8.8% straddle. They previously closed at $145.89 in New York.

Developing