And the hits just keep coming...

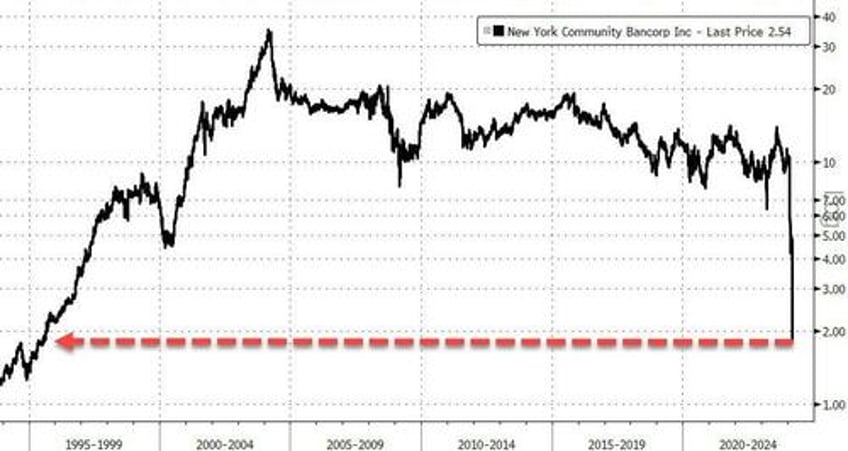

Once the darling of the small banking crisis comeback, New York Community Bancorp has crashed 45% to fresh 30 year lows after The Wall Street Journal reports the bank is seeking to raise equity capital in a bid to shore up confidence in the troubled regional lender.

According to people familiar with the matter, NYCB has dispatched bankers to gauge investors’ interest in buying stock in the company.

There’s no guarantee there will be a deal, or that one would succeed in addressing the bank’s challenges, which as of Wednesday morning had led to a roughly 80% decline in its stock price since January.

This is not a good picture for a bank... Would you hold your deposits there?

Last month, DiNello laid out a series of options the bank could explore to bolster its balance sheet, including selling assets from certain non-core businesses. The bank has also considered turning to newfangled financial instruments that would share the risks of those loans with outside investors, people familiar with the matter said.

As WSJ reports, finding takers for those assets, at least at prices that would make a deal worthwhile, has been challenging and U.S. officials have expressed reservations with banks pursuing credit-risk transfers that would shift the burden of potential losses to entities outside of the regulated banking system.

Finally, as a reminder, NYCB is not alone. The red line below shows 'small banks' are in trouble absent The Fed's BTFP facility...

And perhaps that's why the broad regional bank index is also getting hit today...