By Ven Ram, Bloomberg Markets Live reporter and strategist

The yen is perky this morning on suggestions that at least one member of the Bank of Japan may be willing to exit negative rates as soon as this month, but the currency has a long way to go before closing its valuation gap.

Overnight indexed swaps are assigning about a 50% chance of a 10-basis point hike this month and some 80% in April. Regardless of when the BOJ actually gets to the zero-bound on the policy rate, the yen has some significant heavy lifting to do.

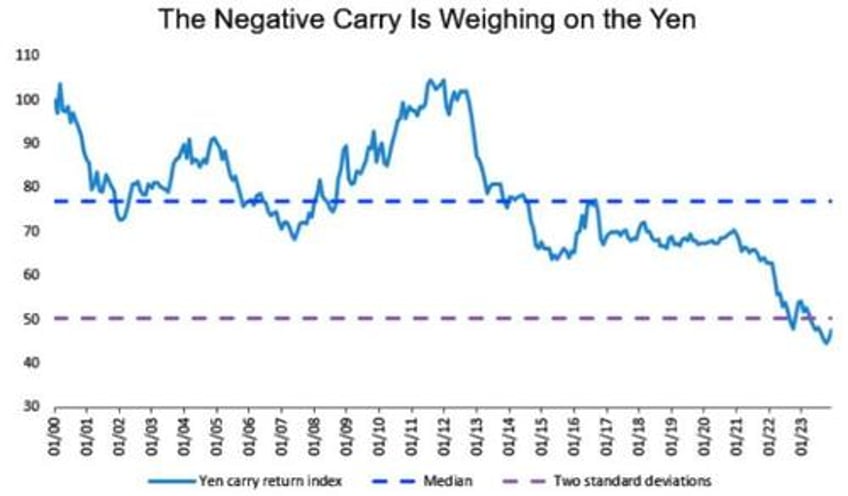

A key part of that is the currency’s negative carry. The carry bleed on portfolios that are long the yen against the dollar is significant. For instance, such an exposure since the start of the year would have led to about 6% in losses.

Which is why investors haven’t really flocked to the yen this year even though indication after every indication from the BOJ is that it will be done with negative rates in a matter of time. However, just getting to zero-bound won’t do the trick for the yen. With realized inflation still running above 2%, the BOJ’s policy rate needs to get a lot higher for inflation-adjusted rates to start biting — and for the yen to keep climbing from here.

Even so, the next 5% or so is the relatively easy part of the yen to climb against the dollar. But its potential goes far beyond — and a lot of that will come down how far the BOJ is willing to go.