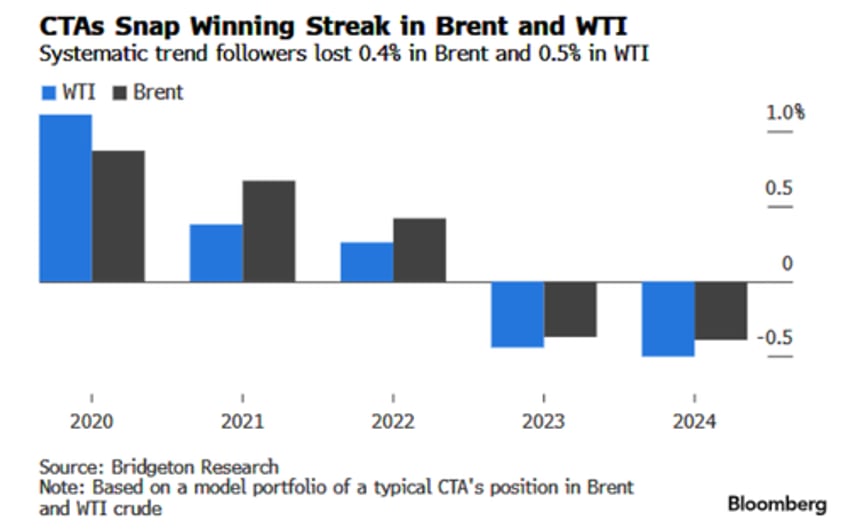

The also traders who have come to dominate the oil market are pulling back from the commodity after a second successive year of losses, according to Bloomberg's Maggie Eastland. So-called Commodity Trading Advisors, or CTAs — a class of algorithmic traders that trade entirely based on trends — posted consecutive annual losses for the first time in more than a decade last year, according to Bridgeton Research Group, which provides analytics on computer-generated trades.

With losses mounting, some of these firms are already reducing their exposure in crude oil, diminishing their impact on a market in which they had amassed a formidable presence in recent years, according to Eastland. This could help traders who focus more on supply and demand balances return to the driver’s seat and normalize daily price moves in the futures market.